1/ Thread on Galaxy Digital (TSX: $GLXY)

We believe Galaxy Digital is a diversified bet on the success of crypto.

Galaxy aims to encompass all facets of the digital asset market, providing various avenues of service & infrastructure for both retail and institutional clients.

We believe Galaxy Digital is a diversified bet on the success of crypto.

Galaxy aims to encompass all facets of the digital asset market, providing various avenues of service & infrastructure for both retail and institutional clients.

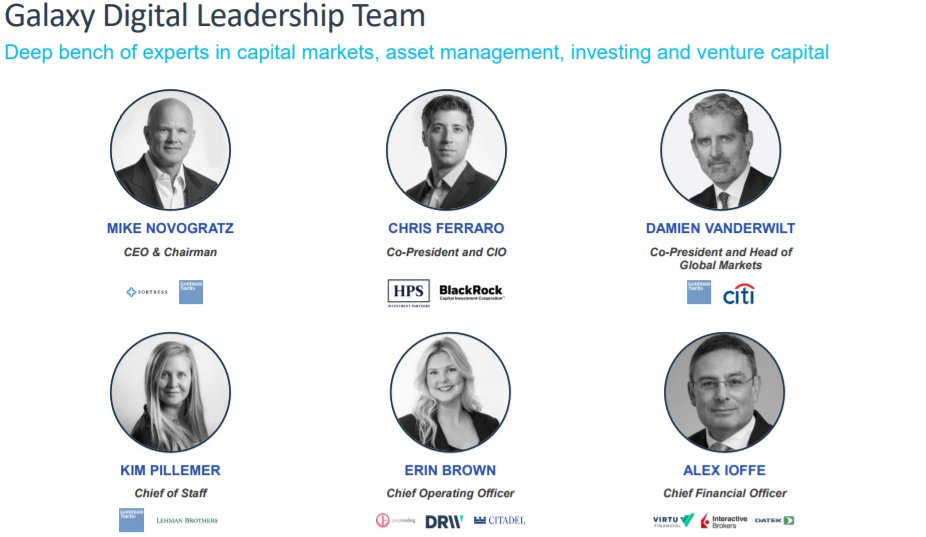

2/@novogratz is the CEO, he has taken his experience from Goldman and Fortress to create an institutional bridge into crypto.

All stats in this thread are in USD and based on $GLXY Q1 2021 numbers.

Let's go through Galaxy's 5 main business lines!

All stats in this thread are in USD and based on $GLXY Q1 2021 numbers.

Let's go through Galaxy's 5 main business lines!

3/ #1 Asset Management

Galaxy has ~$1.6bn AUM across BTC & ETH ETFs in Canada + private funds focusing on DeFi, Web 3, NFT’s, and Gaming.

Galaxy provides exposure beyond BTC and ETH, offering institutions a full range of products covering the entire crypto space.

Galaxy has ~$1.6bn AUM across BTC & ETH ETFs in Canada + private funds focusing on DeFi, Web 3, NFT’s, and Gaming.

Galaxy provides exposure beyond BTC and ETH, offering institutions a full range of products covering the entire crypto space.

4/ #2 Principal Investments

Galaxy holds ~$2bn worth of crypto on their balance sheet alongside ~$350mm of private investments across companies in the space (below).

Galaxy has diversified holdings of both tokens and equity investments providing crypto infrastructure.

Galaxy holds ~$2bn worth of crypto on their balance sheet alongside ~$350mm of private investments across companies in the space (below).

Galaxy has diversified holdings of both tokens and equity investments providing crypto infrastructure.

5/ This ~$2bn worth of crypto includes large portions of BTC & ETH alongside investments like $LUNA.

As an investment Galaxy provides great exposure across the spectrum of crypto ranging from native DeFi & NFT tokens all the way to crypto equities such as BlockFi.

As an investment Galaxy provides great exposure across the spectrum of crypto ranging from native DeFi & NFT tokens all the way to crypto equities such as BlockFi.

6/ #3 Trading

Galaxy is currently making markets in over 90 tokens and is one of the biggest OTC traders in the US.

They provide loans, derivatives, and structured products allowing clients to access customized strategies and hedge positions.

Galaxy is currently making markets in over 90 tokens and is one of the biggest OTC traders in the US.

They provide loans, derivatives, and structured products allowing clients to access customized strategies and hedge positions.

7/ As one of the leading crypto trading desks in the US, Galaxy has positioned itself to offer a suite of products to any customer.

Ranging from miner’s looking to hedge their BTC position or a family office looking to get exposure to more esoteric DeFi tokens.

Ranging from miner’s looking to hedge their BTC position or a family office looking to get exposure to more esoteric DeFi tokens.

8/ #4 Mining

Galaxy launched their Bitcoin mining services in 2021 helping both miners finance equipment along with doing their own in-house BTC mining.

Galaxy is mining Bitcoin sub $12,000 and plans to scale their proprietary operations significantly into 2022.

Galaxy launched their Bitcoin mining services in 2021 helping both miners finance equipment along with doing their own in-house BTC mining.

Galaxy is mining Bitcoin sub $12,000 and plans to scale their proprietary operations significantly into 2022.

9/ Galaxy has created tailor made products to help miners: hedging products for BTC & hash rate exposure, along with financing + sourcing new mining equipment.

This has positioned Galaxy as the go to financial infrastructure for bitcoin miners in North America.

This has positioned Galaxy as the go to financial infrastructure for bitcoin miners in North America.

10/ #5 Investment Banking

Galaxy sits in a unique position given its deep knowledge of crypto assets and businesses.

This has allowed them scale their IB business helping with financing, M&A and general corporate advisory across a growing list of crypto companies.

Recently:

Galaxy sits in a unique position given its deep knowledge of crypto assets and businesses.

This has allowed them scale their IB business helping with financing, M&A and general corporate advisory across a growing list of crypto companies.

Recently:

11/ This keeps Galaxy at frontier of innovation in the space, constantly looking at deals and evaluation companies.

It allows them to build relationships, serve as advisors and take part in financings with top crypto related businesses.

It allows them to build relationships, serve as advisors and take part in financings with top crypto related businesses.

12/ Galaxy’s IB arm has also allowed them to streamline their own in-house acquisitions. Recently Galaxy has acquired Drawbridge Lending, Blue Fire Capital, Vision Hill Group and BitGo.

These acquisitions have widely expanded the scope of Galaxy’s operation specifically BitGo.

These acquisitions have widely expanded the scope of Galaxy’s operation specifically BitGo.

13/ Galaxy announced the acquisition of custodian BitGo for roughly ~$1.2bn in cash and stock on May 5th.

This is key infrastructure that completes Galaxy’s offerings into a full-service custodian and prime brokerage for crypto assets.

This is key infrastructure that completes Galaxy’s offerings into a full-service custodian and prime brokerage for crypto assets.

14/ BitGo currently custodies over $40bn in assets generating recurring revenues and expands Galaxy's footprint to an additional 400 institutional clients located in over 50 countries.

This provides massive synergies and cross selling opportunities across all business lines.

This provides massive synergies and cross selling opportunities across all business lines.

15/ When BitGo is fully onboarded, Galaxy starts to become a true competitor to Coinbase.

96% of Coinbase’s revenue comes from transaction fees, a large portion of these are attributable to their very high retail fee structure.

96% of Coinbase’s revenue comes from transaction fees, a large portion of these are attributable to their very high retail fee structure.

16/ As a crypto equity Galaxy seems to have a wider scope of business lines and investment exposure. $COIN is likely to see aggressive fee compression as competition increases.

Long term we believe $GLXY has potential to close the gap on $COIN being valued at ~$6.5bn vs ~$50bn.

Long term we believe $GLXY has potential to close the gap on $COIN being valued at ~$6.5bn vs ~$50bn.

17/ This is not to say that $COIN cannot pivot or perform well, but the gravy train of 4% fees on crypto purchases won’t be around forever.

At this point we would rather own $GLXY over $COIN, especially with the upcoming up-listing of $GLXY in H2 2021.

At this point we would rather own $GLXY over $COIN, especially with the upcoming up-listing of $GLXY in H2 2021.

18/ We also believe Galaxy will gain significant market share with US institutions.

Every executive has worked at a well-respected bank or asset manager; they know how to speak their language and bridge the gap from traditional finance into crypto.

Every executive has worked at a well-respected bank or asset manager; they know how to speak their language and bridge the gap from traditional finance into crypto.

19/ You can see this in real time as Galaxy has partnered with traditional asset managers; CI and Morgan Stanley to offer Bitcoin and Ethereum to their clients.

We see connections with traditional finance being a huge growth avenue for Galaxy in the future.

We see connections with traditional finance being a huge growth avenue for Galaxy in the future.

20/ A recent Fidelity survey of 800 institutional investors, shows 91% of respondents plan on having an allocation to digital assets over the next five years.

Due to management and these partnerships, it makes Galaxy an obvious first choice for new investors.

Due to management and these partnerships, it makes Galaxy an obvious first choice for new investors.

21/ $GLXY is currently listed on the TSX and has a US up listing planned in H2 of 2021.

Key Stats (USD):

Stock Price: ~$19.00

Shares Outstanding: 342.2mm

Market Cap: ~$6,549mm

Net Income 2020A = ~$539mm

Net Income Q1 2021 = ~$1,109mm

Key Stats (USD):

Stock Price: ~$19.00

Shares Outstanding: 342.2mm

Market Cap: ~$6,549mm

Net Income 2020A = ~$539mm

Net Income Q1 2021 = ~$1,109mm

22/ Galaxy's Net Income has been driven by appreciation on its Digital Assets and Principal Investments.

To be clear this is not likely re-occurring revenue but dependent on crypto returns. Yet it has allowed Galaxy to make strategic investments and scale their business lines.

To be clear this is not likely re-occurring revenue but dependent on crypto returns. Yet it has allowed Galaxy to make strategic investments and scale their business lines.

23/ We can start to see the long-term thesis behind a company like Galaxy. They will not only facilitate capital inflows from traditional finance, but they also have exposure to ~$2.4bn worth of these digital assets and businesses.

24/ We view Galaxy as an excellent way to play out a broader crypto/digital thesis over the coming years.

Exposure to the actual underlying digital assets and businesses alongside their own diversified product offerings means Galaxy provides exposure to everything crypto.

Exposure to the actual underlying digital assets and businesses alongside their own diversified product offerings means Galaxy provides exposure to everything crypto.

25/ Thanks for reading!

*Not Financial Advice, DYOR*

*We are long $GLXY*

*Not Financial Advice, DYOR*

*We are long $GLXY*

• • •

Missing some Tweet in this thread? You can try to

force a refresh