Housing your investments and doing business the most efficient way.

How do the rich do it?

Let’s learn some secrets.

• Individuals

• Companies

• Trusts

(Thread)👇🏽

How do the rich do it?

Let’s learn some secrets.

• Individuals

• Companies

• Trusts

(Thread)👇🏽

• Introduction

I want to start by saying this; the system isn’t designed for you to win this game if you operate as a sole proprietor.

You’re eventually going to reach all your thresholds and it won’t be tax efficient anymore.

The rich know this, this is how they do it 👇🏽

I want to start by saying this; the system isn’t designed for you to win this game if you operate as a sole proprietor.

You’re eventually going to reach all your thresholds and it won’t be tax efficient anymore.

The rich know this, this is how they do it 👇🏽

• Individuals

• Easy to set up

• One man capital

• Single entity

• Risks are yours

(unlimited liabilities)

Sole Proprietor = alone

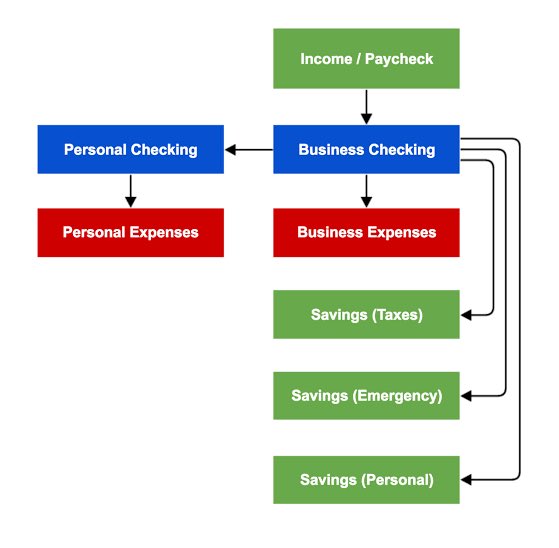

It could look like this. 👇🏽

(Pty Structures look similar)

A S/P doesn’t need a business set up, there’s no tax benefits.

• Easy to set up

• One man capital

• Single entity

• Risks are yours

(unlimited liabilities)

Sole Proprietor = alone

It could look like this. 👇🏽

(Pty Structures look similar)

A S/P doesn’t need a business set up, there’s no tax benefits.

-You should move through different structures as you grow your asset base/cash flow.

You need a business set up if you plan to scale - unlock tax benefits. The rich know NOT to keep all their assets in their personal name

Check out @AndreBothmaTax thread about “one man shows”

You need a business set up if you plan to scale - unlock tax benefits. The rich know NOT to keep all their assets in their personal name

Check out @AndreBothmaTax thread about “one man shows”

https://twitter.com/AndreBothmaTax/status/1402231638805917698

• Companies (Pty Ltd)

•Limited liability

•Separate entity

•Lower tax rates

•Costly to maintain

•Lifespan is perpetual

•Easier to raise capital.

•Tax payer in its own right

•Consists of shareholders

•Personal asset protection

•Transfer of ownership is easy

•Limited liability

•Separate entity

•Lower tax rates

•Costly to maintain

•Lifespan is perpetual

•Easier to raise capital.

•Tax payer in its own right

•Consists of shareholders

•Personal asset protection

•Transfer of ownership is easy

- The graph depicts the benefit of using the system to separate personal liabilities.

If you are a S/P with assets, you’ll be at risk - (unlimited liability)

The rich know this, it’s how they scale, separate assets + get tax breaks.

It’s set up to incentivize this behavior.

If you are a S/P with assets, you’ll be at risk - (unlimited liability)

The rich know this, it’s how they scale, separate assets + get tax breaks.

It’s set up to incentivize this behavior.

- Pty Ltd’s

Check @IvynSambo thread of how to set up a small business. (company)

You can register with @BizPortalGovZa to set up a South African business.

Check @IvynSambo thread of how to set up a small business. (company)

You can register with @BizPortalGovZa to set up a South African business.

https://twitter.com/IvynSambo/status/1273828646625718272

• Trusts

•Do not die-no estate duty

•Income is still distributed

•Offers tax efficiency

•Protection of assets

•Creditor protection

Most people set up trusts once they already have several companies and a large asset base.

•Do not die-no estate duty

•Income is still distributed

•Offers tax efficiency

•Protection of assets

•Creditor protection

Most people set up trusts once they already have several companies and a large asset base.

- Trusts

You won’t just go and set up a trust, unless you need to;

Firstly,

cause its costly to maintain. It needs to be worth the amount saved in tax to make it viable,

and this comes when you have a high net-worth. The idea of trusts is to reduce tax liabilities.

You won’t just go and set up a trust, unless you need to;

Firstly,

cause its costly to maintain. It needs to be worth the amount saved in tax to make it viable,

and this comes when you have a high net-worth. The idea of trusts is to reduce tax liabilities.

- Trusts continued,

Secondly,

tax is steep in a trust (45%)

The wealthy use it as a tool to mitigate tax liabilities.

They probably have several companies already that are beneficiaries of their trusts. (Conduit principle)

Again, @AndreBothmaTax will explain it best

Secondly,

tax is steep in a trust (45%)

The wealthy use it as a tool to mitigate tax liabilities.

They probably have several companies already that are beneficiaries of their trusts. (Conduit principle)

Again, @AndreBothmaTax will explain it best

https://twitter.com/AndreBothmaTax/status/1318505078458896385

•How do the rich do it?

They use a combination of all three.

•They separate liabilities from their personal name

• They hide assets in complicated company structures.

• Own companies through companies and trusts.

You won’t win at the game if you don’t know how to play.

They use a combination of all three.

•They separate liabilities from their personal name

• They hide assets in complicated company structures.

• Own companies through companies and trusts.

You won’t win at the game if you don’t know how to play.

- My company, FundUp, set up our structure like this.👇🏽

We started as a stokvel, and have slowly progressed to this.

We loan capital to the business and issue shares.

We’ll eventually open recruitment to the public where we’ll try use access to cheaper capital to leverage

We started as a stokvel, and have slowly progressed to this.

We loan capital to the business and issue shares.

We’ll eventually open recruitment to the public where we’ll try use access to cheaper capital to leverage

• How we started

It’s a long process to get to where you want to be, but start.

Build your own capital, then use bank financing to leverage, then reduce costs by recruiting members and offering them return on their capital, lower than it would cost you to borrow from bank.

It’s a long process to get to where you want to be, but start.

Build your own capital, then use bank financing to leverage, then reduce costs by recruiting members and offering them return on their capital, lower than it would cost you to borrow from bank.

https://twitter.com/talkcentss/status/1334512575497842688

These are the wealthy’s secrets

Learn to structure your affairs, take advantage of the system to play the game.

Property can be structured like this too, Learn it all.

Start by buying knowledge.

I have a SPECIAL price for YOU.

35% off

Code: freedom

gum.co/twice

Learn to structure your affairs, take advantage of the system to play the game.

Property can be structured like this too, Learn it all.

Start by buying knowledge.

I have a SPECIAL price for YOU.

35% off

Code: freedom

gum.co/twice

• Bundle deal

Two quality ebooks that you want.

Get yours today and start building a better relationship with your money.

Discount: 20%

Code: bundle

gum.co/twice

Two quality ebooks that you want.

Get yours today and start building a better relationship with your money.

Discount: 20%

Code: bundle

gum.co/twice

Final thoughts:

I’ll be having three FREE seminars, and registration will close tomorrow morning.

If you would like to join, register below ⬇️

docs.google.com/forms/d/e/1FAI…

I’ll be having three FREE seminars, and registration will close tomorrow morning.

If you would like to join, register below ⬇️

docs.google.com/forms/d/e/1FAI…

• • •

Missing some Tweet in this thread? You can try to

force a refresh