Will take this ON 😀 Straddle and strangle selling has higher POP, true. But if that method has that small risk of a single event blowing up your capital, you will blow up at one point of time unless you manage position size conservatively

https://twitter.com/arun_tankha/status/1405889606176821249

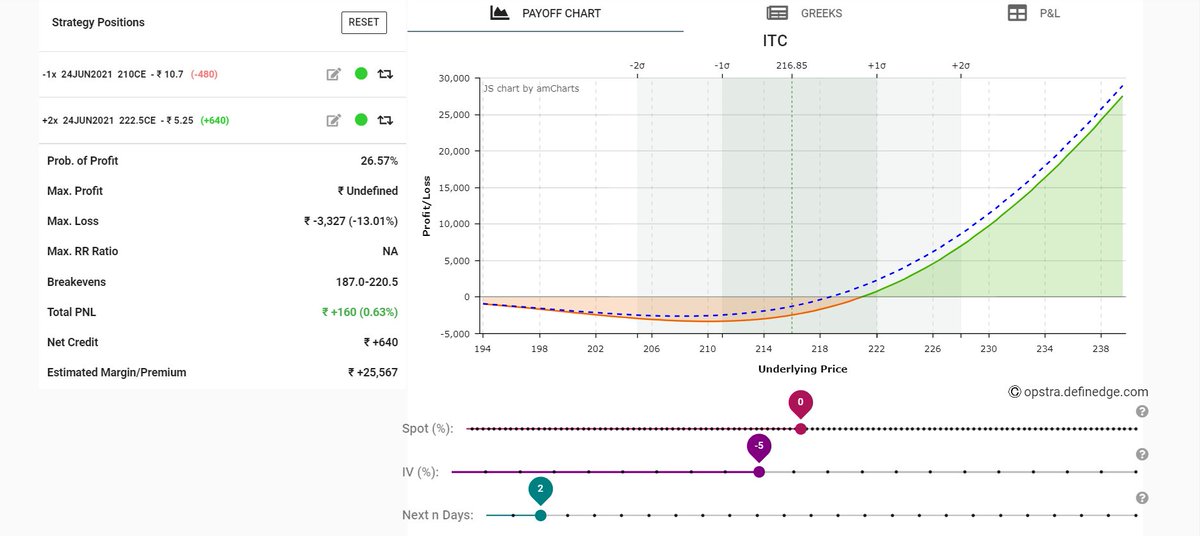

1. Vol when it goes up will cover the time decay

2. Volatility is mean reverting,yes. But how does one know other than guessing that it will mean revert from here ? high vols are no guraantee for mean reversion

2. Volatility is mean reverting,yes. But how does one know other than guessing that it will mean revert from here ? high vols are no guraantee for mean reversion

2a. At low IVs, the probability of long options succeeding increases exponentially. Why would I sell ?

The point is, there is a time for selling and a time for buying. Being fixated on one and assuming that to be the better solution is not a good strategy

• • •

Missing some Tweet in this thread? You can try to

force a refresh