We have started taking a bullish position on ITC aiming at the results tomorrow. Trade is through an options strategy with zero or minimal loss and large profits if correct. Would you like to see the trade ?

OK, here is the position. Be aware that we are already in the position and are running at a small profit

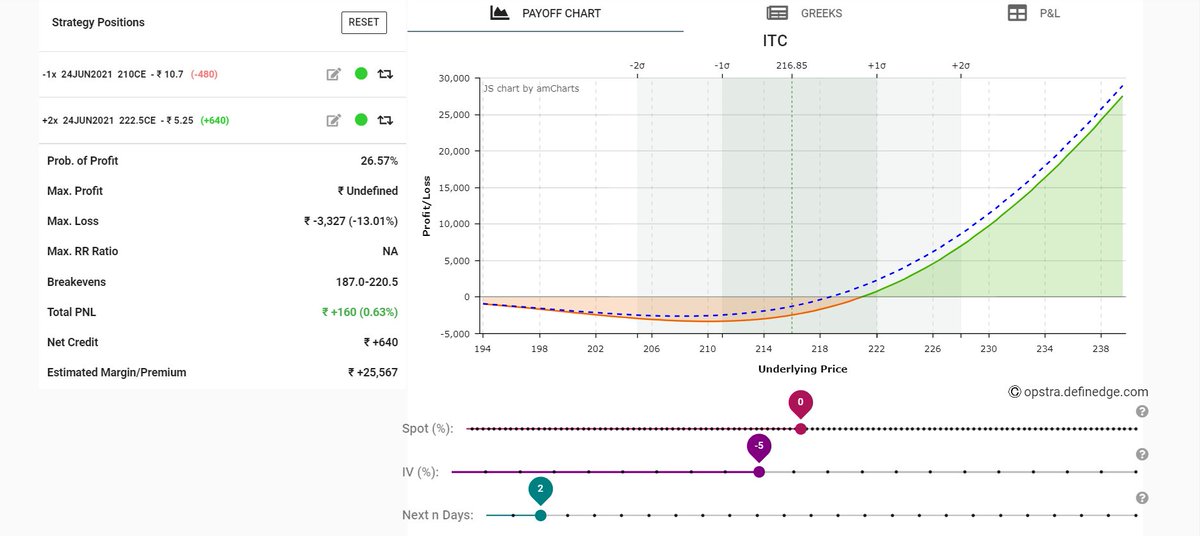

Sell 1*210CE and buy 2*222.5CE June

Call Backspread

Sell 1*210CE and buy 2*222.5CE June

Call Backspread

Be aware that we can at best make a guess at the results ( which we are making from data analysis). We can be wrong and are ready to bear the loss, so follow us if you understand the same. I seriously don't want idiotic " he he, you were wrong" comments post results

The question is not of right or wrong , I can be 50% of the time or more wrong on the results. The question is how much I lose when wrong and how much I win when right. This trade has a risk-reward ratio of 1:2 to 1:4 depending on how ITC performs

As usual, I have my skin in the game. Aim to increase positions till closing tomorrow based upon certain conditions. Assume 150% of the max loss shown per lot in worst case scenario and use position mgmt

I strongly suggest one goes thru the zerodha notes and play with any option payoff graph to understand. I have used opstra.definedge.com .

Keep the days at T+2

Keep the days at T+2

• • •

Missing some Tweet in this thread? You can try to

force a refresh