1/9 Thread: No Slam Dunk in Investing

I was recently speaking with someone and we both somewhat lamented how Buffett did not bet big on Google.

Google IPOed in 2004; it may not be clear then that they would win search. But surely by 2014, Buffett should have known it, right?

I was recently speaking with someone and we both somewhat lamented how Buffett did not bet big on Google.

Google IPOed in 2004; it may not be clear then that they would win search. But surely by 2014, Buffett should have known it, right?

2/9 Following our conversation, we both explored a bit whether it really was that obvious that Google was an easy buy in 2014 when it was trading at ~$500.

Let me share two quotes.

Let me share two quotes.

3/9 "The growth rate in Internet penetration is set to peak in 2016. Were Google’s revenue and profit continues to track Internet penetration, then those metrics would peak as well"

4/9 "A great number of Internet users today were not raised with computers; it’s fair to question how many of those clicking on Google ads falls in this group. As a new generation comes online, will ads continue to be effective at the scale Google needs them to be?"

5/9 Those two quotes are by Ben Thompson from a piece in 2014.

How about Wall Street? Allow me to share a quote from a SS initiation.

stratechery.com/2014/googles-n…

How about Wall Street? Allow me to share a quote from a SS initiation.

stratechery.com/2014/googles-n…

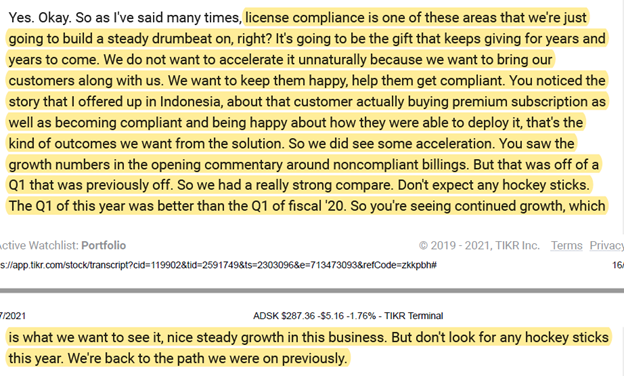

6/9 "We initiate at EW with a $600 PT as Google fends

off a “law of large numbers” issue in core search

by ramping investment spend. Google is a LT

secular winner, but estimates appear high and

diversification is proving expensive."- MS initiation (Nov 03, 2014)

off a “law of large numbers” issue in core search

by ramping investment spend. Google is a LT

secular winner, but estimates appear high and

diversification is proving expensive."- MS initiation (Nov 03, 2014)

7/9 In ~2015, there were concerns around whether the rise of apps would seriously drive browser traffic down hurting search growth.

In 2016, Google added 4th mobile ad unit in its search result which would increase revenue in ST, but LT growth sustainability was a question mark

In 2016, Google added 4th mobile ad unit in its search result which would increase revenue in ST, but LT growth sustainability was a question mark

8/9 To be clear, I'm certainly NOT mocking anyone. I can only imagine how many of my current takes will turn out be downright terrible in 5 years.

But the fact that even Google wasn't quite a slam dunk 5 years ago should give us a pause just how difficult long-term investing is.

But the fact that even Google wasn't quite a slam dunk 5 years ago should give us a pause just how difficult long-term investing is.

9/9 The people who live and breathe tech had plenty of reasons to worry, so it doesn't feel quite right to lament about Buffett missing out on Google.

Well, at least he got Apple right. Thankfully, we just need to be really, really right on few things to forget other "mistakes"

Well, at least he got Apple right. Thankfully, we just need to be really, really right on few things to forget other "mistakes"

• • •

Missing some Tweet in this thread? You can try to

force a refresh