1/

Get a cup of coffee.

Let's talk about dividends.

From an investor's standpoint, dividends are key determinants of "intrinsic value".

From a company's standpoint, dividends are key capital allocation tools.

This thread will help you appreciate *both* these perspectives.

Get a cup of coffee.

Let's talk about dividends.

From an investor's standpoint, dividends are key determinants of "intrinsic value".

From a company's standpoint, dividends are key capital allocation tools.

This thread will help you appreciate *both* these perspectives.

2/

Let's do a thought experiment.

Suppose a rich uncle gives us $1M.

We're allowed to invest this $1M for our own benefit.

But there are 2 conditions:

1. Within a week, we must put the entire $1M into a *single* stock. And,

2. We can *never* sell any shares.

Let's do a thought experiment.

Suppose a rich uncle gives us $1M.

We're allowed to invest this $1M for our own benefit.

But there are 2 conditions:

1. Within a week, we must put the entire $1M into a *single* stock. And,

2. We can *never* sell any shares.

3/

This is a "buy and hold forever" scenario.

Whichever stock we choose, we must buy $1M worth of its shares within a week.

And after that, there are no more decisions.

We must simply hold our shares *forever*.

The question is: how do we decide which stock to buy?

This is a "buy and hold forever" scenario.

Whichever stock we choose, we must buy $1M worth of its shares within a week.

And after that, there are no more decisions.

We must simply hold our shares *forever*.

The question is: how do we decide which stock to buy?

4/

One way to approach this decision:

From the universe of all available stocks, which one will give us the *highest* return on our $1M investment?

That's the stock we should buy.

After all, who doesn't like a high return, right?

One way to approach this decision:

From the universe of all available stocks, which one will give us the *highest* return on our $1M investment?

That's the stock we should buy.

After all, who doesn't like a high return, right?

5/

So, how do we measure this return?

An "IRR calculation" is one way to do it.

IRR stands for Internal Rate of Return. The logic behind it can be boiled down to 4 points:

Point 1 (Cash Outflow). At the outset, we put up $1M to buy shares. This $1M is our *cash outflow*.

So, how do we measure this return?

An "IRR calculation" is one way to do it.

IRR stands for Internal Rate of Return. The logic behind it can be boiled down to 4 points:

Point 1 (Cash Outflow). At the outset, we put up $1M to buy shares. This $1M is our *cash outflow*.

6/

Point 2 (Cash Inflows). Over time, our shares will return cash back to us -- in the form of dividends.

These "dividends spread out over time" are our *cash inflows*.

Our return (ie, our IRR) will depend on both the *size* and the *timing* of these cash inflows.

Point 2 (Cash Inflows). Over time, our shares will return cash back to us -- in the form of dividends.

These "dividends spread out over time" are our *cash inflows*.

Our return (ie, our IRR) will depend on both the *size* and the *timing* of these cash inflows.

7/

Point 3 (Dividend Size). The bigger our dividend checks, the higher our IRR.

For example, other things being equal, a $35K dividend check naturally translates to a higher IRR than a $25K dividend check.

Point 3 (Dividend Size). The bigger our dividend checks, the higher our IRR.

For example, other things being equal, a $35K dividend check naturally translates to a higher IRR than a $25K dividend check.

8/

Point 4 (Dividend Timing). All things being equal, it's better to receive our dividends *sooner* rather than later.

For example, a stock that returns $2M back to us over 10 years will get us a higher IRR than a stock that returns the same $2M back to us, but over 20 years.

Point 4 (Dividend Timing). All things being equal, it's better to receive our dividends *sooner* rather than later.

For example, a stock that returns $2M back to us over 10 years will get us a higher IRR than a stock that returns the same $2M back to us, but over 20 years.

9/

Here's a quick picture.

The red bar shows our *cash outflow* -- ie, our $1M investment at the outset (at time t = 0).

The green bars show our subsequent *cash inflows* -- ie, the dividends we receive over time ($d1 at time t1, $d2 at time t2, etc.).

Here's a quick picture.

The red bar shows our *cash outflow* -- ie, our $1M investment at the outset (at time t = 0).

The green bars show our subsequent *cash inflows* -- ie, the dividends we receive over time ($d1 at time t1, $d2 at time t2, etc.).

10/

And here's the "IRR equation", which decides our IRR based on the sizes and timings of our dividends.

When we solve this equation, we get our IRR.

For more on this equation and how to solve it:

And here's the "IRR equation", which decides our IRR based on the sizes and timings of our dividends.

When we solve this equation, we get our IRR.

For more on this equation and how to solve it:

https://twitter.com/10kdiver/status/1284536987861446657

11/

The IRR equation is a *fundamental* way to look at *any* investment.

After all, fundamentally speaking, what is investing?

It is the act of putting up *some* cash now, in order to receive *more* cash later.

The IRR equation is a *fundamental* way to look at *any* investment.

After all, fundamentally speaking, what is investing?

It is the act of putting up *some* cash now, in order to receive *more* cash later.

12/

And that's what the IRR equation reflects.

How much cash do we need to *put in*? And once we do that, how much cash can we *take out* over time? Simple. Fundamental.

The *more* cash we can take out, and the *sooner* we can take it out, the higher our return (IRR).

And that's what the IRR equation reflects.

How much cash do we need to *put in*? And once we do that, how much cash can we *take out* over time? Simple. Fundamental.

The *more* cash we can take out, and the *sooner* we can take it out, the higher our return (IRR).

13/

For a "buy and hold forever" stock investment, the *only* way to "take cash out" is via a dividend -- as selling stock is not allowed.

So, fundamentally, *only* 2 factors drive our returns: 1) our initial purchase price, and 2) the dividends we receive over time.

For a "buy and hold forever" stock investment, the *only* way to "take cash out" is via a dividend -- as selling stock is not allowed.

So, fundamentally, *only* 2 factors drive our returns: 1) our initial purchase price, and 2) the dividends we receive over time.

14/

This is a key point.

For a "buy and hold forever" fundamental investor, *dividends* are what matter.

Not revenues. Not earnings. Not free cash flow.

Not the market price of the stock.

*Only* dividends.

This is a key point.

For a "buy and hold forever" fundamental investor, *dividends* are what matter.

Not revenues. Not earnings. Not free cash flow.

Not the market price of the stock.

*Only* dividends.

15/

This may seem strange and counter-intuitive at first.

But it makes sense when we chew on it a bit.

After all, if we're *never* allowed to sell our stock, its market price should be completely irrelevant to us, right?

This may seem strange and counter-intuitive at first.

But it makes sense when we chew on it a bit.

After all, if we're *never* allowed to sell our stock, its market price should be completely irrelevant to us, right?

16/

And what about all those other factors -- revenues, earnings, free cash flow?

Well, they're important. But not because they affect the market price of the stock.

They're important *only* insofar as they increase our *dividends*, or bring our dividends forward in time.

And what about all those other factors -- revenues, earnings, free cash flow?

Well, they're important. But not because they affect the market price of the stock.

They're important *only* insofar as they increase our *dividends*, or bring our dividends forward in time.

17/

In fact, this is the key distinction between *investing* and *speculation*, as Ben Graham and Warren Buffett view it.

To such folks, *investing* is based on fundamentals.

An *investor* wouldn't mind if the market closed, never to reopen, the day after he bought a stock.

In fact, this is the key distinction between *investing* and *speculation*, as Ben Graham and Warren Buffett view it.

To such folks, *investing* is based on fundamentals.

An *investor* wouldn't mind if the market closed, never to reopen, the day after he bought a stock.

18/

That's because, when buying a stock, a true *investor* makes no assumptions about its future market price.

The investor's thesis is simply that future *dividends* from the stock will more than compensate for the *purchase price*.

Cash In, Cash Out. Simple. Fundamental.

That's because, when buying a stock, a true *investor* makes no assumptions about its future market price.

The investor's thesis is simply that future *dividends* from the stock will more than compensate for the *purchase price*.

Cash In, Cash Out. Simple. Fundamental.

19/

But a pure *speculator* would be devastated if the market closed the day after he bought a stock.

That's because the speculator's rationale for buying the stock is that *someone else* will pay a higher price for it in the future.

And that requires the market to be open.

But a pure *speculator* would be devastated if the market closed the day after he bought a stock.

That's because the speculator's rationale for buying the stock is that *someone else* will pay a higher price for it in the future.

And that requires the market to be open.

20/

For example, when Buffett buys a stock (or an entire business) for Berkshire, he thinks like a true "buy and hold forever" investor.

His "acid test" is: will the dividends to Berkshire over time comfortably exceed the price paid and generate an adequate IRR?

For example, when Buffett buys a stock (or an entire business) for Berkshire, he thinks like a true "buy and hold forever" investor.

His "acid test" is: will the dividends to Berkshire over time comfortably exceed the price paid and generate an adequate IRR?

21/

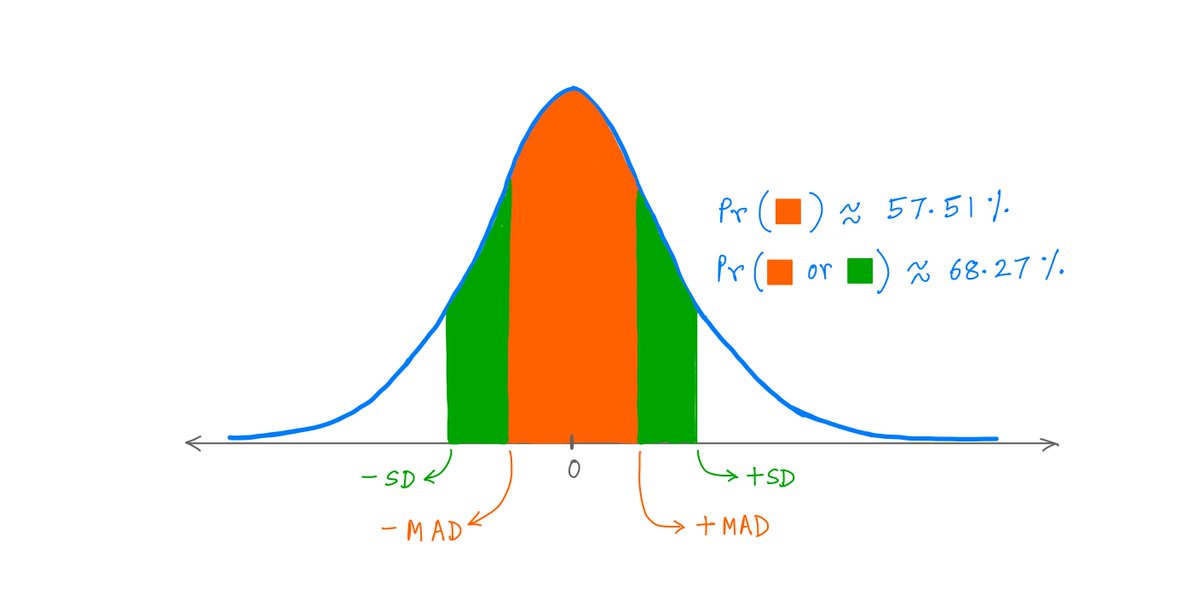

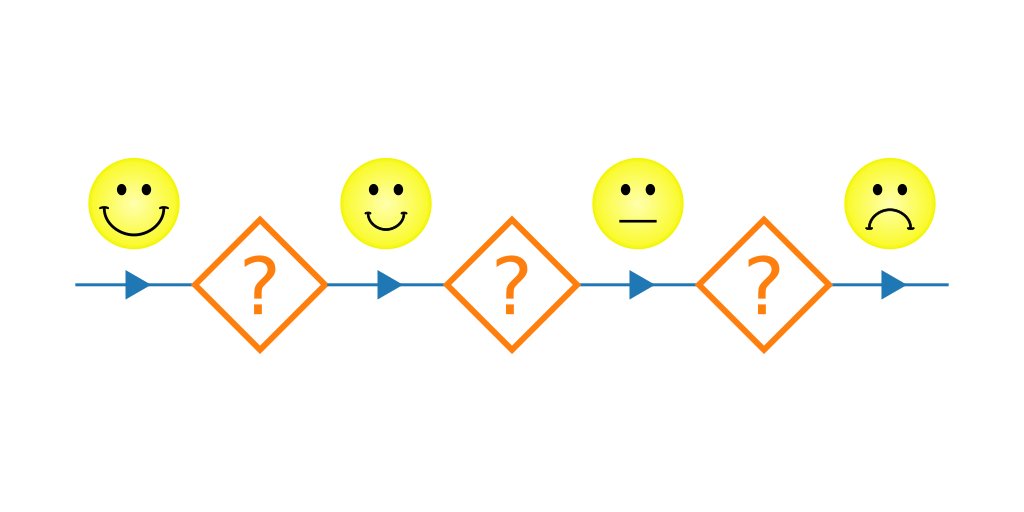

Of course, this "pure fundamentals-driven investor" vs "pure market-driven speculator" distinction may be a bit theoretical.

I like to think of "investing vs speculation" as a spectrum -- with most of us falling somewhere in the middle between these two extremes.

Of course, this "pure fundamentals-driven investor" vs "pure market-driven speculator" distinction may be a bit theoretical.

I like to think of "investing vs speculation" as a spectrum -- with most of us falling somewhere in the middle between these two extremes.

22/

Still, as the saying goes: all models are wrong, but some are useful.

One such useful model is the pure, fundamentals-driven, "buy and hold forever" investor.

Still, as the saying goes: all models are wrong, but some are useful.

One such useful model is the pure, fundamentals-driven, "buy and hold forever" investor.

23/

To such an investor, a business would be worth the present value of all future *dividends*, discounted at the IRR the investor wants.

That's the "intrinsic value" of the business to this investor -- and what the investor would pay for it.

For more:

To such an investor, a business would be worth the present value of all future *dividends*, discounted at the IRR the investor wants.

That's the "intrinsic value" of the business to this investor -- and what the investor would pay for it.

For more:

https://twitter.com/10kdiver/status/1292130833273257984

24/

Thus, *dividends* are a key determinant of a business's intrinsic value.

And the IRR equation above gives us a way to tie these concepts together -- relating a business's future dividends to its intrinsic value and the IRR a "buy and hold forever" investor can expect.

Thus, *dividends* are a key determinant of a business's intrinsic value.

And the IRR equation above gives us a way to tie these concepts together -- relating a business's future dividends to its intrinsic value and the IRR a "buy and hold forever" investor can expect.

25/

So, let's work through the IRR equation for a couple simple businesses.

To concretize things, let's say each share of our business is at $100 at the time we buy it.

So, our $1M would get us $1M/($100 per share) = 10,000 shares of the business.

So, let's work through the IRR equation for a couple simple businesses.

To concretize things, let's say each share of our business is at $100 at the time we buy it.

So, our $1M would get us $1M/($100 per share) = 10,000 shares of the business.

26/

Suppose the business trades at 20x trailing P/E at the time we buy it.

So, in the year before we buy it, the business would have earned ($100 per share)/(20 P/E) = $5 per share.

Suppose the business trades at 20x trailing P/E at the time we buy it.

So, in the year before we buy it, the business would have earned ($100 per share)/(20 P/E) = $5 per share.

27/

The simplest business to analyze is the "Steady" business. Let's call it "S" for short.

This is a business that's stable and mature. It earns pretty much the same amount each year. And all earnings are distributed as dividends -- as they cannot be meaningfully re-invested.

The simplest business to analyze is the "Steady" business. Let's call it "S" for short.

This is a business that's stable and mature. It earns pretty much the same amount each year. And all earnings are distributed as dividends -- as they cannot be meaningfully re-invested.

28/

If our business were of type S, we'd expect $5 per share in dividends every year.

These dividends wouldn't grow over time.

Against our $100/share purchase price, that's a 5% IRR.

Thus, for a Type S business, our IRR is the same as our dividend yield.

If our business were of type S, we'd expect $5 per share in dividends every year.

These dividends wouldn't grow over time.

Against our $100/share purchase price, that's a 5% IRR.

Thus, for a Type S business, our IRR is the same as our dividend yield.

29/

The second type of business is Type G -- a Growing business.

Here, a portion of the business's earnings are retained and re-invested back into the business each year.

Only the non-retained earnings are distributed as dividends.

The second type of business is Type G -- a Growing business.

Here, a portion of the business's earnings are retained and re-invested back into the business each year.

Only the non-retained earnings are distributed as dividends.

30/

For example, let's say 40% of earnings are retained and re-invested at a 15% per year return (ROIIC).

And the other 60% of earnings are dividended out.

This means the business will initially return only $3/share in dividends.

But the dividends will *grow* at 6% per year.

For example, let's say 40% of earnings are retained and re-invested at a 15% per year return (ROIIC).

And the other 60% of earnings are dividended out.

This means the business will initially return only $3/share in dividends.

But the dividends will *grow* at 6% per year.

31/

For Type G businesses, there's a simple IRR formula.

Our IRR will be equal to the business's growth rate plus the initial dividend yield.

For example, with our 6% growth rate and $3/share in initial dividends (ie, 3% yield), our IRR will be 9% per year.

For Type G businesses, there's a simple IRR formula.

Our IRR will be equal to the business's growth rate plus the initial dividend yield.

For example, with our 6% growth rate and $3/share in initial dividends (ie, 3% yield), our IRR will be 9% per year.

32/

Thus, for growing businesses, ROIIC (the rate of return the business can get on retained earnings) is crucial.

ROIIC determines the business's growth rate -- a key component of IRR.

Thus, for growing businesses, ROIIC (the rate of return the business can get on retained earnings) is crucial.

ROIIC determines the business's growth rate -- a key component of IRR.

33/

For example, if our Type G business only had a 4% ROIIC instead of 15%, it would only grow at 1.6% per year instead of 6%.

In that case, our "buy and hold forever" IRR would only be 4.6% -- which is *lower* than the 5% we can get from the Type S (steady) business.

For example, if our Type G business only had a 4% ROIIC instead of 15%, it would only grow at 1.6% per year instead of 6%.

In that case, our "buy and hold forever" IRR would only be 4.6% -- which is *lower* than the 5% we can get from the Type S (steady) business.

34/

This is another key point.

Not all growth benefits investors.

There's a "minimum ROIIC" threshold. Below the threshold, growth actually hurts IRRs.

Investors would be better off with a dividend -- instead of the company re-investing earnings at such low ROIICs.

This is another key point.

Not all growth benefits investors.

There's a "minimum ROIIC" threshold. Below the threshold, growth actually hurts IRRs.

Investors would be better off with a dividend -- instead of the company re-investing earnings at such low ROIICs.

35/

For example, many tech companies today (eg, Facebook and Google) are retaining billions of dollars of earnings each year.

In many cases, these earnings are simply piling up as cash on the balance sheet -- earning close to 0% ROIIC.

For example, many tech companies today (eg, Facebook and Google) are retaining billions of dollars of earnings each year.

In many cases, these earnings are simply piling up as cash on the balance sheet -- earning close to 0% ROIIC.

36/

This cash may yet be invested at attractive ROIICs (eg, via sensible acquisitions, transformative new technologies like self-driving cars, etc.).

But every year that passes without such investment actually ends up hurting long term shareholders.

This cash may yet be invested at attractive ROIICs (eg, via sensible acquisitions, transformative new technologies like self-driving cars, etc.).

But every year that passes without such investment actually ends up hurting long term shareholders.

37/

At some point, the cash build up may become so large that investing it all at high returns is practically impossible.

In such cases, shareholders would be well-served if the company initiated a dividend.

At some point, the cash build up may become so large that investing it all at high returns is practically impossible.

In such cases, shareholders would be well-served if the company initiated a dividend.

38/

For example, I think Tim Cook deserves special praise for capital allocation at Apple.

When Steve Jobs was running things, cash was simply piling up on the balance sheet, earning low returns.

But under Cook, much of this cash is being returned to shareholders as dividends.

For example, I think Tim Cook deserves special praise for capital allocation at Apple.

When Steve Jobs was running things, cash was simply piling up on the balance sheet, earning low returns.

But under Cook, much of this cash is being returned to shareholders as dividends.

39/

When great managers allocate capital, they always weigh dividends against ROIICs from re-investments and potential acquisitions, against share buybacks, and against the *opportunity costs* of letting cash pile up on the balance sheet until an attractive opportunity emerges.

When great managers allocate capital, they always weigh dividends against ROIICs from re-investments and potential acquisitions, against share buybacks, and against the *opportunity costs* of letting cash pile up on the balance sheet until an attractive opportunity emerges.

40/

Also, inflation is important when discussing dividends and capital allocation.

A company may retain $1 today, grow it, and return it as a $2 future dividend.

But if, due to inflation, that $2 buys less than what $1 buys today, then shareholders are actually worse off.

Also, inflation is important when discussing dividends and capital allocation.

A company may retain $1 today, grow it, and return it as a $2 future dividend.

But if, due to inflation, that $2 buys less than what $1 buys today, then shareholders are actually worse off.

41/

Finally, many of us pay *taxes* on dividends.

In the US, though, dividends can be pretty tax-efficient.

For example, in 2020, a US couple could have earned $104,800 in qualified dividends and paid *zero* Federal income tax (h/t @DividendGrowth):

Finally, many of us pay *taxes* on dividends.

In the US, though, dividends can be pretty tax-efficient.

For example, in 2020, a US couple could have earned $104,800 in qualified dividends and paid *zero* Federal income tax (h/t @DividendGrowth):

https://twitter.com/10kdiver/status/1396783036348370947?s=20

42/

Still, capital allocators at large companies tend to own a lot of stock, which tends to put them well above the $104,800 bar.

So, management's interests and tax incentives may not be the same as ours. This may bias them towards buybacks over dividends, for example.

Still, capital allocators at large companies tend to own a lot of stock, which tends to put them well above the $104,800 bar.

So, management's interests and tax incentives may not be the same as ours. This may bias them towards buybacks over dividends, for example.

43/

If you're still with me, thank you very much!

Dividends are a fundamental concept in investing. I hope this thread was able to guide you through the various ways we can understand and analyze dividends.

Happy bagging great IRRs and pocketing rich dividends!

/End

If you're still with me, thank you very much!

Dividends are a fundamental concept in investing. I hope this thread was able to guide you through the various ways we can understand and analyze dividends.

Happy bagging great IRRs and pocketing rich dividends!

/End

• • •

Missing some Tweet in this thread? You can try to

force a refresh