1/

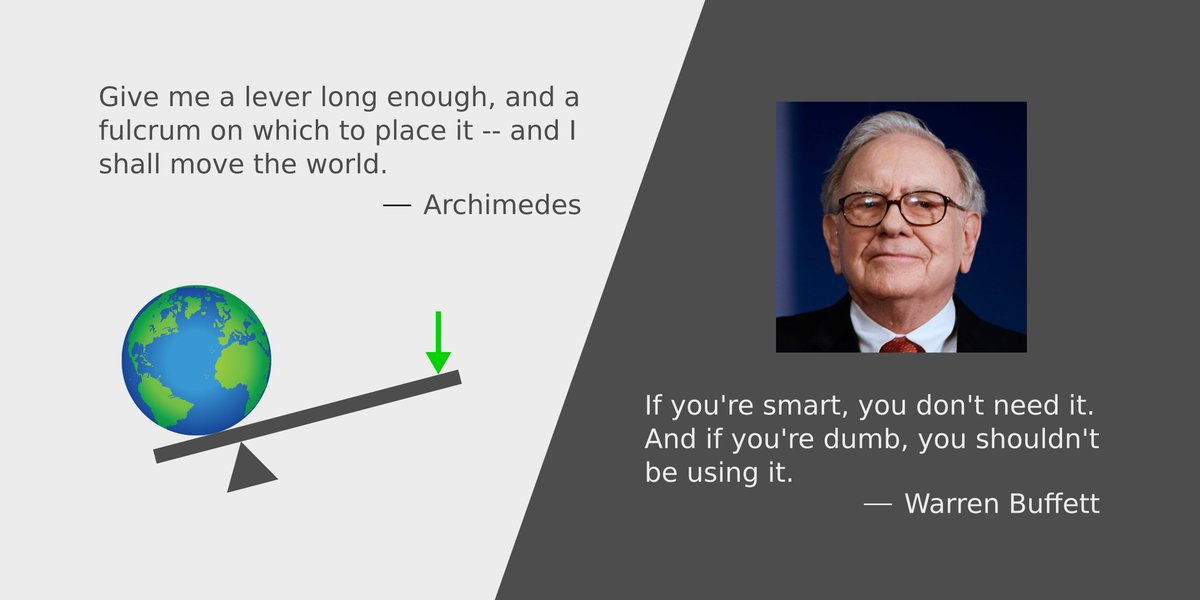

Reductio Ad Absurdum, or Proof By Contradiction, is a powerful mathematical technique.

It embodies the spirit of Charlie Munger's favorite mantra -- Invert, Always Invert!

Here's G. H. Hardy, a renowned British mathematician, comparing the technique to a chess gambit:

Reductio Ad Absurdum, or Proof By Contradiction, is a powerful mathematical technique.

It embodies the spirit of Charlie Munger's favorite mantra -- Invert, Always Invert!

Here's G. H. Hardy, a renowned British mathematician, comparing the technique to a chess gambit:

2/

Reductio Ad Absurdum works like this:

We want to prove a statement S.

We start by assuming that S is *false*. We then show that this leads to an absurd conclusion -- like 1 = 2.

So, S can't possibly be false.

It has to be true!

And that's the proof.

Reductio Ad Absurdum works like this:

We want to prove a statement S.

We start by assuming that S is *false*. We then show that this leads to an absurd conclusion -- like 1 = 2.

So, S can't possibly be false.

It has to be true!

And that's the proof.

3/

Here are 2 examples of Reductio Ad Absurdum from G. H. Hardy's book, A Mathematician's apology:

a) Euclid's proof that there are infinitely many prime numbers, and

b) Pythogoras's proof that the square root of 2 is irrational (ie, not the ratio of 2 integers).

Here are 2 examples of Reductio Ad Absurdum from G. H. Hardy's book, A Mathematician's apology:

a) Euclid's proof that there are infinitely many prime numbers, and

b) Pythogoras's proof that the square root of 2 is irrational (ie, not the ratio of 2 integers).

4/

Here's a link to the book on Amazon.

It's a great read! It gives you a real taste of how pure mathematicians work. And you don't have to know much math to read it.

/End

amazon.com/Mathematicians…

Here's a link to the book on Amazon.

It's a great read! It gives you a real taste of how pure mathematicians work. And you don't have to know much math to read it.

/End

amazon.com/Mathematicians…

• • •

Missing some Tweet in this thread? You can try to

force a refresh