1/

Get a cup of coffee.

In this thread, I'll walk you through the basics of Tax Deferred Compounding.

This will show you a few simple ways to factor taxes into your decision making -- so you can better optimize your *after tax* investment returns.

Get a cup of coffee.

In this thread, I'll walk you through the basics of Tax Deferred Compounding.

This will show you a few simple ways to factor taxes into your decision making -- so you can better optimize your *after tax* investment returns.

2/

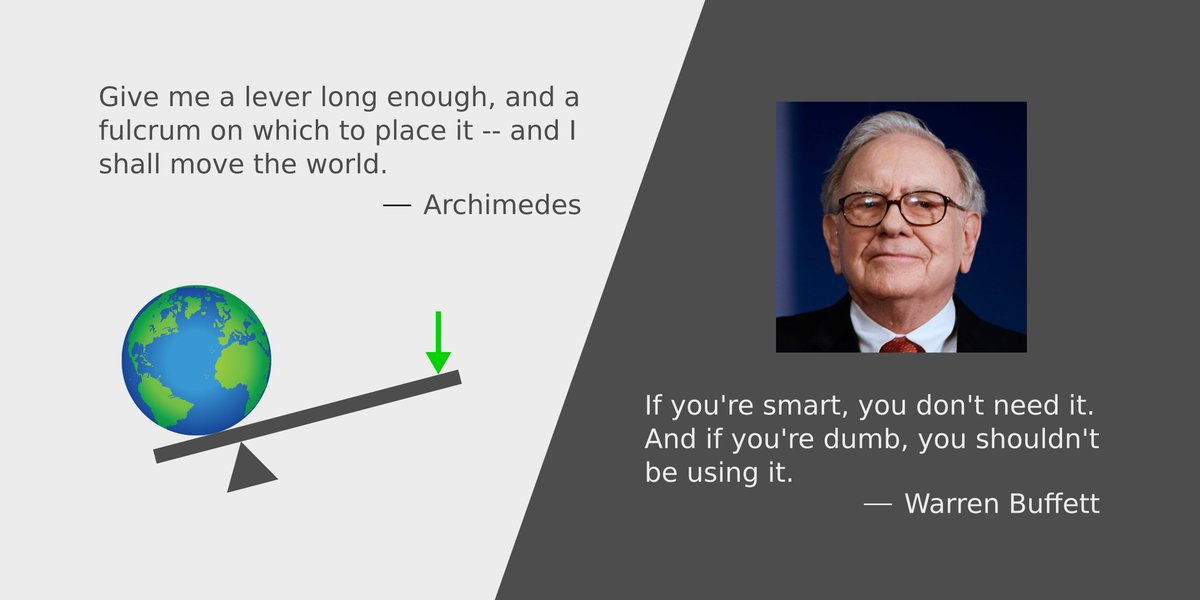

In his 1989 letter to Berkshire shareholders, Warren Buffett shared a very insightful calculation:

In his 1989 letter to Berkshire shareholders, Warren Buffett shared a very insightful calculation:

3/

This calculation highlights a key fact:

When our portfolio turnover is high, our *after tax* results can be much worse than our *pre-tax* results.

It's because: every time we sell a stock (at a profit) to buy another, we incur a tax charge. Over time, these charges add up.

This calculation highlights a key fact:

When our portfolio turnover is high, our *after tax* results can be much worse than our *pre-tax* results.

It's because: every time we sell a stock (at a profit) to buy another, we incur a tax charge. Over time, these charges add up.

4/

Let's work through the math in Buffett's example.

The example has 2 scenarios: A and B.

In A, we start with $1.

We invest this $1 into a stock -- say, S1.

We hold S1 for 1 year. In this time, S1 doubles.

So, our investment becomes worth $2.

Let's work through the math in Buffett's example.

The example has 2 scenarios: A and B.

In A, we start with $1.

We invest this $1 into a stock -- say, S1.

We hold S1 for 1 year. In this time, S1 doubles.

So, our investment becomes worth $2.

5/

We now sell S1 for $2.

But all of this $2 is not ours to keep.

We have to pay a 34% tax on the $1 of capital gains we realized. That's $0.34.

After paying the $0.34 tax, we're left with $2 - $0.34 = $1.66.

We now invest this $1.66 into a second stock, S2.

We now sell S1 for $2.

But all of this $2 is not ours to keep.

We have to pay a 34% tax on the $1 of capital gains we realized. That's $0.34.

After paying the $0.34 tax, we're left with $2 - $0.34 = $1.66.

We now invest this $1.66 into a second stock, S2.

6/

We hold S2 for 1 year. In this time, S2 doubles.

We again sell, and again pay the 34% tax.

And so on -- for 20 years.

Here's a quick picture:

We hold S2 for 1 year. In this time, S2 doubles.

We again sell, and again pay the 34% tax.

And so on -- for 20 years.

Here's a quick picture:

7/

The question is: how much money will we have at the end of Year 20?

Well, suppose we start a particular year with $X.

During this year, our stock will double to $2X. We'll pay $0.34X in taxes on capital gains of $X.

So, we'll end the year with $2X - $0.34X = $1.66X.

The question is: how much money will we have at the end of Year 20?

Well, suppose we start a particular year with $X.

During this year, our stock will double to $2X. We'll pay $0.34X in taxes on capital gains of $X.

So, we'll end the year with $2X - $0.34X = $1.66X.

8/

So, each year, we start with $X and end with $1.66X.

Year 1: start with $1, end with $1.66

Year 2: start with $1.66, end with $1.66^2

Year 3: start with $1.66^2, end with $1.66^3

...

Year 20: start with $1.66^19, end with $1.66^20.

That's the pattern.

So, each year, we start with $X and end with $1.66X.

Year 1: start with $1, end with $1.66

Year 2: start with $1.66, end with $1.66^2

Year 3: start with $1.66^2, end with $1.66^3

...

Year 20: start with $1.66^19, end with $1.66^20.

That's the pattern.

9/

So, we end Year 20 with $1.66^20 = ~$25244, exactly as Buffett said.

Thus, in scenario A, we hold 20 stocks for 1 year each.

And in the process, we turn our $1 into ~$25K.

So, we end Year 20 with $1.66^20 = ~$25244, exactly as Buffett said.

Thus, in scenario A, we hold 20 stocks for 1 year each.

And in the process, we turn our $1 into ~$25K.

10/

Scenario B is much simpler: we hold *1* stock for *20* years.

And that stock -- let's call it SB -- doubles each year, just like our Scenario A stocks.

But we don't sell SB until the end of Year 20.

So, we *defer* paying capital gains taxes until the very end.

Scenario B is much simpler: we hold *1* stock for *20* years.

And that stock -- let's call it SB -- doubles each year, just like our Scenario A stocks.

But we don't sell SB until the end of Year 20.

So, we *defer* paying capital gains taxes until the very end.

11/

So, how much money do we end up with in Scenario B?

Here's the pattern:

Year 1: start with $1, end with $2

Year 2: start with $2, end with $4

Year 3: start with $4, end with $8

...

Year 20: start with $2^19, end with $2^20.

So, how much money do we end up with in Scenario B?

Here's the pattern:

Year 1: start with $1, end with $2

Year 2: start with $2, end with $4

Year 3: start with $4, end with $8

...

Year 20: start with $2^19, end with $2^20.

12/

So, when we finally sell SB at the end of Year 20, we'll get $2^20 = $1,048,576.

As with Scenario A, we pay a 34% tax on our capital gains of $1,048,575. That's a $356,515.50 tax bill.

After the tax, we'll be left with $1,048,576 - $356,515.50 = $692,060.50.

So, when we finally sell SB at the end of Year 20, we'll get $2^20 = $1,048,576.

As with Scenario A, we pay a 34% tax on our capital gains of $1,048,575. That's a $356,515.50 tax bill.

After the tax, we'll be left with $1,048,576 - $356,515.50 = $692,060.50.

13/

So, here's the summary:

Scenario A. Hold 20 stocks for 1 year each. *Pay* tax each year. Turn $1 into ~$25K.

Scenario B. Hold 1 stock for 20 years. *Defer* tax until the end. Turn $1 into ~$692K.

That's the power of *deferring* taxes.

That's what Buffett was driving at.

So, here's the summary:

Scenario A. Hold 20 stocks for 1 year each. *Pay* tax each year. Turn $1 into ~$25K.

Scenario B. Hold 1 stock for 20 years. *Defer* tax until the end. Turn $1 into ~$692K.

That's the power of *deferring* taxes.

That's what Buffett was driving at.

14/

But of course, this is an exaggerated example.

Ordinary investors don't double their money (even pre-tax) every year.

So, let's make it more realistic.

We'll start with $100K in both scenarios, score a 10% pre-tax return each year, and pay capital gains tax at a 25% rate.

But of course, this is an exaggerated example.

Ordinary investors don't double their money (even pre-tax) every year.

So, let's make it more realistic.

We'll start with $100K in both scenarios, score a 10% pre-tax return each year, and pay capital gains tax at a 25% rate.

15/

Using similar reasoning, here's what we'll end up with at the end of Year 20.

Scenario A. Hold 20 stocks for 1 year each. *Pay* tax each year. Turn $100K into ~$425K.

Scenario B. Hold 1 stock for 20 years. *Defer* tax until the end. Turn $100K into ~$530K.

Calculations:

Using similar reasoning, here's what we'll end up with at the end of Year 20.

Scenario A. Hold 20 stocks for 1 year each. *Pay* tax each year. Turn $100K into ~$425K.

Scenario B. Hold 1 stock for 20 years. *Defer* tax until the end. Turn $100K into ~$530K.

Calculations:

16/

So, even with more realistic numbers, there's a material difference between *paying* the tax each year and *deferring* it until the end.

In this case, *deferring* nets us about $105K -- or ~25% -- more money than *paying*.

That's serious money for most of us.

So, even with more realistic numbers, there's a material difference between *paying* the tax each year and *deferring* it until the end.

In this case, *deferring* nets us about $105K -- or ~25% -- more money than *paying*.

That's serious money for most of us.

17/

*Deferred* taxes are like "float" -- an interest free loan from the government that we've invested in a particular stock.

We share the benefits of this investment with the government.

And we don't have to pay the government until we sell the stock.

As Buffett puts it:

*Deferred* taxes are like "float" -- an interest free loan from the government that we've invested in a particular stock.

We share the benefits of this investment with the government.

And we don't have to pay the government until we sell the stock.

As Buffett puts it:

18/

The longer we hold the stock, the longer we get to defer our taxes -- and the more we benefit from this "float".

Over 20 years, as we saw, this benefit can add up to hundreds of thousands of dollars!

This is partly why Buffett's favorite holding period is forever.

The longer we hold the stock, the longer we get to defer our taxes -- and the more we benefit from this "float".

Over 20 years, as we saw, this benefit can add up to hundreds of thousands of dollars!

This is partly why Buffett's favorite holding period is forever.

19/

But of course, we shouldn't hold on to a stock just because selling it would trigger a tax.

That would be letting the tax tail wag the investment dog.

Long holding periods work great -- but only for wonderful businesses. "Cigar butts", for example, don't meet this test.

But of course, we shouldn't hold on to a stock just because selling it would trigger a tax.

That would be letting the tax tail wag the investment dog.

Long holding periods work great -- but only for wonderful businesses. "Cigar butts", for example, don't meet this test.

20/

Also, it's a good idea to remember that *passive* investment strategies -- which tend to have lower portfolio turnover -- tend to benefit more from Tax Deferred Compounding than *active* investment strategies.

Also, it's a good idea to remember that *passive* investment strategies -- which tend to have lower portfolio turnover -- tend to benefit more from Tax Deferred Compounding than *active* investment strategies.

21/

For example, let's imagine 2 investors: Pam and Aaron.

Pam is a passive investor. Every year, she saves $50K and puts it into a low-cost S&P 500 index fund.

The fund returns 7% per year (tax deferred), plus 2% in dividends (tax paid at 25%, and the rest reinvested).

For example, let's imagine 2 investors: Pam and Aaron.

Pam is a passive investor. Every year, she saves $50K and puts it into a low-cost S&P 500 index fund.

The fund returns 7% per year (tax deferred), plus 2% in dividends (tax paid at 25%, and the rest reinvested).

22/

If Pam continues her passive investing style for 30 years, and then finally pays her deferred taxes, she will be left with $5.24M:

If Pam continues her passive investing style for 30 years, and then finally pays her deferred taxes, she will be left with $5.24M:

23/

Aaron, on the other hand, is an active investor.

He also saves $50K per year. But he picks individual stocks. He holds these stocks for a year before selling them, paying taxes, and reinvesting the rest into the next batch of stocks.

Aaron, on the other hand, is an active investor.

He also saves $50K per year. But he picks individual stocks. He holds these stocks for a year before selling them, paying taxes, and reinvesting the rest into the next batch of stocks.

24/

Not surprisingly, Aaron doesn't benefit from Tax Deferred Compounding to the same extent that Pam does.

So, if Aaron gets the same "7% pre-tax appreciation plus 2% dividends", he will end up under-performing Pam:

Not surprisingly, Aaron doesn't benefit from Tax Deferred Compounding to the same extent that Pam does.

So, if Aaron gets the same "7% pre-tax appreciation plus 2% dividends", he will end up under-performing Pam:

25/

To get the *same* result as Pam, Aaron has to generate an *excess* annual return of about 1.1% (ie, 8.1% pre-tax appreciation + 2% dividends).

This excess return is a kind of "phantom" alpha. It may boost Aaron's pre-tax results, but it vanishes post-tax.

To get the *same* result as Pam, Aaron has to generate an *excess* annual return of about 1.1% (ie, 8.1% pre-tax appreciation + 2% dividends).

This excess return is a kind of "phantom" alpha. It may boost Aaron's pre-tax results, but it vanishes post-tax.

26/

Thus, active investors with shorter holding periods are at a fundamental disadvantage.

Because they don't benefit as much from deferred taxes, they have to generate *excess* pre-tax returns simply to level with their passive counterparts' post-tax results.

Thus, active investors with shorter holding periods are at a fundamental disadvantage.

Because they don't benefit as much from deferred taxes, they have to generate *excess* pre-tax returns simply to level with their passive counterparts' post-tax results.

27/

If you're still with me, thank you very much!

Taxes are a fundamental consideration in investing. I hope the calculations in this thread convinced you of the power of deferring taxes while compounding money.

Please stay safe. Enjoy your weekend!

/End

If you're still with me, thank you very much!

Taxes are a fundamental consideration in investing. I hope the calculations in this thread convinced you of the power of deferring taxes while compounding money.

Please stay safe. Enjoy your weekend!

/End

• • •

Missing some Tweet in this thread? You can try to

force a refresh