1/

Get a cup of coffee.

In this thread, I'll walk you through the basics of Decision Fatigue.

Understanding this can help us improve the quality of our "high value" decisions, while reducing the number of "low value" decisions we need to make.

Get a cup of coffee.

In this thread, I'll walk you through the basics of Decision Fatigue.

Understanding this can help us improve the quality of our "high value" decisions, while reducing the number of "low value" decisions we need to make.

2/

Every day, from the minute we wake up, we have a number of decisions to make.

Some are "low value" decisions. A few months or a year from now, we probably won't care much about them or even remember them.

For example, do we wear the red shirt or the blue shirt today?

Every day, from the minute we wake up, we have a number of decisions to make.

Some are "low value" decisions. A few months or a year from now, we probably won't care much about them or even remember them.

For example, do we wear the red shirt or the blue shirt today?

3/

And some are "high value" decisions.

A year or more from now, they're likely to still be impacting us.

For example, do we get an Apple or an Android device? Do we invest this month's savings into Stock A or Stock B?

And some are "high value" decisions.

A year or more from now, they're likely to still be impacting us.

For example, do we get an Apple or an Android device? Do we invest this month's savings into Stock A or Stock B?

4/

And some decisions are "low value" when viewed as one-time, but "high value" when viewed together.

For example, on any one day, it probably doesn't matter whether we eat cereal or eggs for breakfast.

But repeated over many years, all that sugar from the cereal may harm us.

And some decisions are "low value" when viewed as one-time, but "high value" when viewed together.

For example, on any one day, it probably doesn't matter whether we eat cereal or eggs for breakfast.

But repeated over many years, all that sugar from the cereal may harm us.

5/

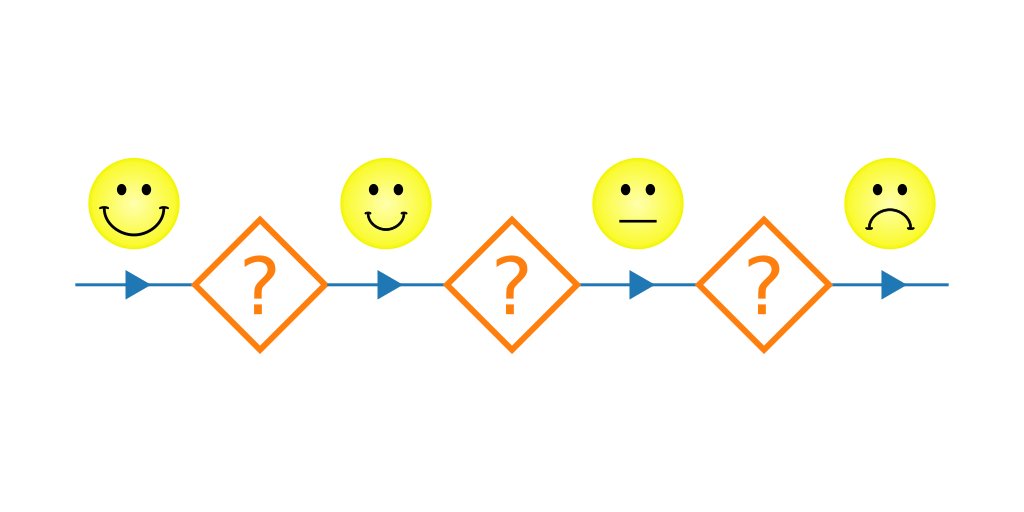

Finally, with some decisions, it's hard to tell in advance whether they're high or low value.

For example, do we accept that dinner invitation or not?

It may be "high value". We may run into someone who changes the course of our life forever.

Or it may be a waste of time.

Finally, with some decisions, it's hard to tell in advance whether they're high or low value.

For example, do we accept that dinner invitation or not?

It may be "high value". We may run into someone who changes the course of our life forever.

Or it may be a waste of time.

6/

Decision Fatigue means: as we keep making decisions one after another, we become more and more stressed, and therefore more and more likely to make poor quality decisions.

In other words, with each successive decision, our ability to make the next decision gets worse.

Decision Fatigue means: as we keep making decisions one after another, we become more and more stressed, and therefore more and more likely to make poor quality decisions.

In other words, with each successive decision, our ability to make the next decision gets worse.

7/

As with most psychological concepts, there's no mathematical proof or anything like that behind this claim.

But there's quite a bit of empirical evidence, gathered from many academic experiments, to support the idea.

As with most psychological concepts, there's no mathematical proof or anything like that behind this claim.

But there's quite a bit of empirical evidence, gathered from many academic experiments, to support the idea.

8/

Plus, my personal experience is that Decision Fatigue is real.

As a computer scientist, I write a lot of programs.

And programming is basically a series of decisions one after the other -- how to name variables, what data structures to use, which functions to optimize, etc.

Plus, my personal experience is that Decision Fatigue is real.

As a computer scientist, I write a lot of programs.

And programming is basically a series of decisions one after the other -- how to name variables, what data structures to use, which functions to optimize, etc.

9/

I think "stress build up" is a big reason for Decision Fatigue.

Almost all our decisions are made with only imperfect information.

So, almost always, there's a chance that our decision is the wrong one.

This kind of uncertainty/doubt creates stress.

I think "stress build up" is a big reason for Decision Fatigue.

Almost all our decisions are made with only imperfect information.

So, almost always, there's a chance that our decision is the wrong one.

This kind of uncertainty/doubt creates stress.

10/

So, each successive decision contributes a bit of stress, and all this stress adds to the "cognitive load" we carry in our minds.

And as our cognitive load gets heavier, our ability to make good decisions gets reduced.

So, each successive decision contributes a bit of stress, and all this stress adds to the "cognitive load" we carry in our minds.

And as our cognitive load gets heavier, our ability to make good decisions gets reduced.

11/

For example, supermarkets have a lot of success selling "impulse items" like candy bars placed near the checkout.

After making a series of decisions about which milk to buy and so forth, shoppers suffering from Decision Fatigue tend to be less able to resist the candy bar.

For example, supermarkets have a lot of success selling "impulse items" like candy bars placed near the checkout.

After making a series of decisions about which milk to buy and so forth, shoppers suffering from Decision Fatigue tend to be less able to resist the candy bar.

12/

In business and investing, we need to make a lot of decisions.

So, we need to overcome Decision Fatigue -- or at least, reduce its impact on our key "high value" decisions.

How do we do this?

I have 5 tips that I've found useful.

In business and investing, we need to make a lot of decisions.

So, we need to overcome Decision Fatigue -- or at least, reduce its impact on our key "high value" decisions.

How do we do this?

I have 5 tips that I've found useful.

13/

Tip 1. Make "high value" decisions early in the day.

During the course of our day, we know Decision Fatigue is likely to creep up on us.

So, if important decisions are to be made, it's better to make them early in the day -- when our "cognitive load" is low.

Tip 1. Make "high value" decisions early in the day.

During the course of our day, we know Decision Fatigue is likely to creep up on us.

So, if important decisions are to be made, it's better to make them early in the day -- when our "cognitive load" is low.

14/

Tip 2. Make "low value" decisions O(1).

What is O(1)? It's a term from computational complexity theory (a branch of computer science) that indicates how much time is needed to make a decision.

For example, suppose we're deciding what to wear for the day.

Tip 2. Make "low value" decisions O(1).

What is O(1)? It's a term from computational complexity theory (a branch of computer science) that indicates how much time is needed to make a decision.

For example, suppose we're deciding what to wear for the day.

15/

Most people approach this by first looking up and down their closet -- to get a sense of the available options.

They weigh these options for a few seconds.

And then make their choice.

Most people approach this by first looking up and down their closet -- to get a sense of the available options.

They weigh these options for a few seconds.

And then make their choice.

16/

In complexity theory terms, this is an O(N) decision process.

Why? Because it involves making a pass through all available choices before picking one.

If we have N shirts hanging in the closet, the time we'll take to reach our decision is proportional to N. So, O(N).

In complexity theory terms, this is an O(N) decision process.

Why? Because it involves making a pass through all available choices before picking one.

If we have N shirts hanging in the closet, the time we'll take to reach our decision is proportional to N. So, O(N).

17/

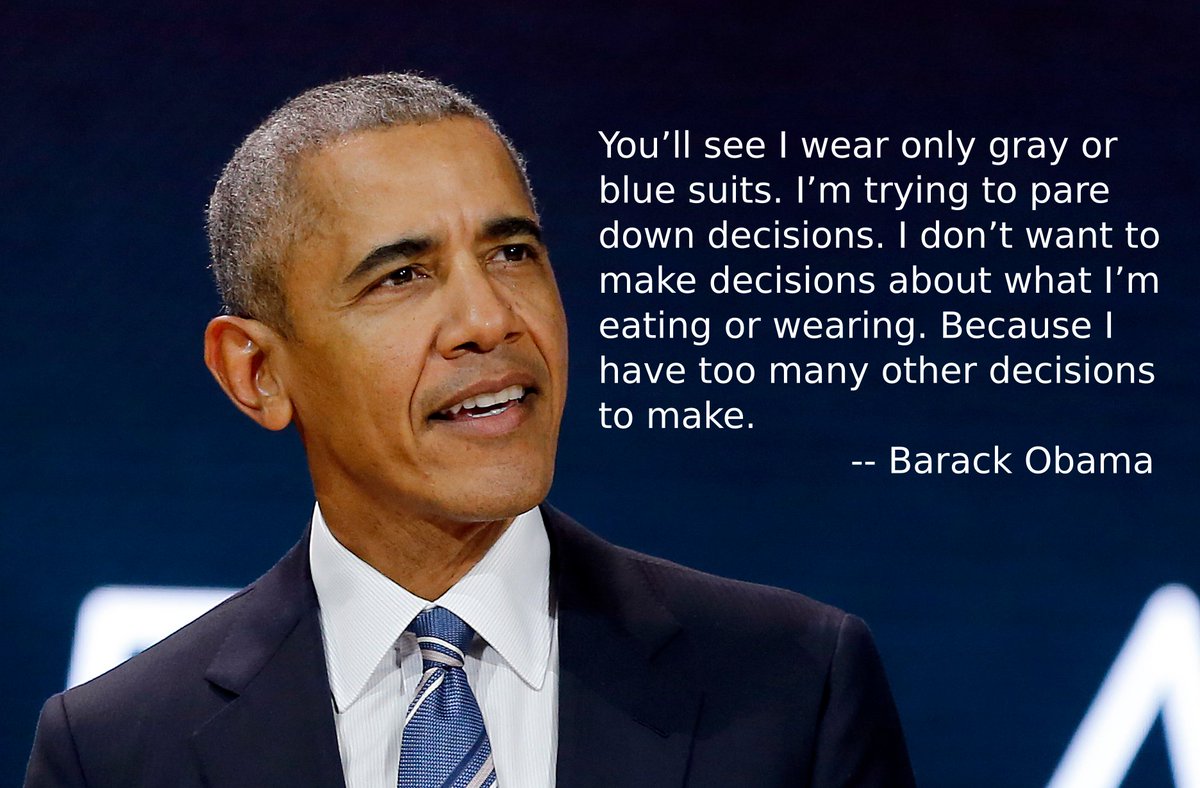

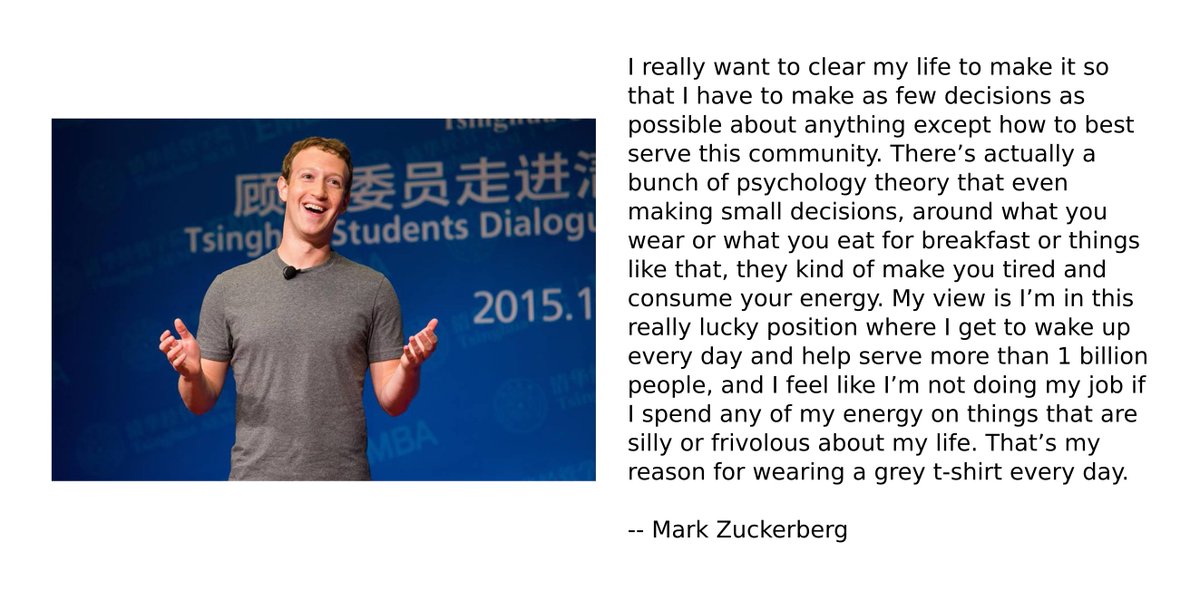

But people like Barack Obama and Mark Zuckerberg -- who have a lot of "high value" decisions to make -- don't want to spend all this time on the relatively "low value" decision of what to wear.

So, what do they do?

They have only 1 or 2 kinds of clothing in their wardrobe.

But people like Barack Obama and Mark Zuckerberg -- who have a lot of "high value" decisions to make -- don't want to spend all this time on the relatively "low value" decision of what to wear.

So, what do they do?

They have only 1 or 2 kinds of clothing in their wardrobe.

18/

This makes their "what to wear" decision O(1).

It doesn't matter whether their wardrobe contains 100 or 1000 articles of clothing. They're all the same.

The *decision* takes constant time -- independent of the number of clothes they have. That's O(1).

This makes their "what to wear" decision O(1).

It doesn't matter whether their wardrobe contains 100 or 1000 articles of clothing. They're all the same.

The *decision* takes constant time -- independent of the number of clothes they have. That's O(1).

19/

But how can *we* implement this O(1) idea -- without getting rid of our entire wardrobe?

That's easy.

We don't go through all available options every day.

We just pick whichever option is in front, and wear that. That's O(1).

But how can *we* implement this O(1) idea -- without getting rid of our entire wardrobe?

That's easy.

We don't go through all available options every day.

We just pick whichever option is in front, and wear that. That's O(1).

20/

This "round robin" strategy not only reduces Decision Fatigue. It also ensures that we'll wear all our clothes with roughly the same frequency -- which achieves great "load balancing", and thus minimizes "wear and tear" on our set of clothes.

Win win.

This "round robin" strategy not only reduces Decision Fatigue. It also ensures that we'll wear all our clothes with roughly the same frequency -- which achieves great "load balancing", and thus minimizes "wear and tear" on our set of clothes.

Win win.

21/

Tip 3. Empower and Delegate.

Here, we reduce Decision Fatigue by simply making fewer decisions.

That is, we delegate some decisions to others, and we empower them to take these decisions on their own without micro-management from us.

Tip 3. Empower and Delegate.

Here, we reduce Decision Fatigue by simply making fewer decisions.

That is, we delegate some decisions to others, and we empower them to take these decisions on their own without micro-management from us.

22/

Of course, finding the right people to empower and delegate to, and communicating our expectations to them clearly, can be a challenge!

Of course, finding the right people to empower and delegate to, and communicating our expectations to them clearly, can be a challenge!

23/

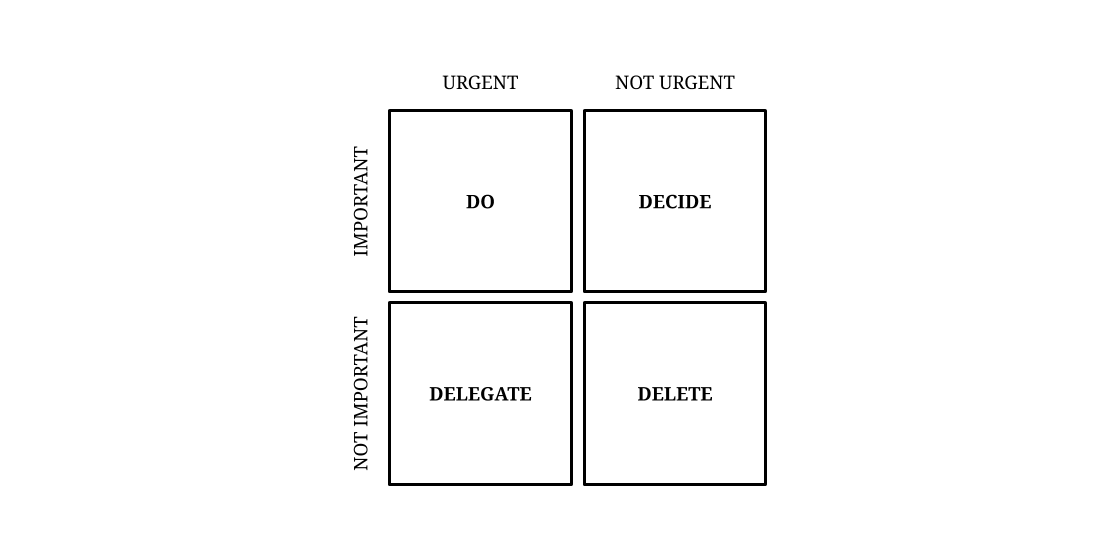

The Eisenhower Decision Matrix is a great way to think about delegation in the context of "high value" and "low value" decisions.

My friend @SahilBloom has written an wonderful thread about it:

The Eisenhower Decision Matrix is a great way to think about delegation in the context of "high value" and "low value" decisions.

My friend @SahilBloom has written an wonderful thread about it:

https://twitter.com/SahilBloom/status/1361688659242622976

24/

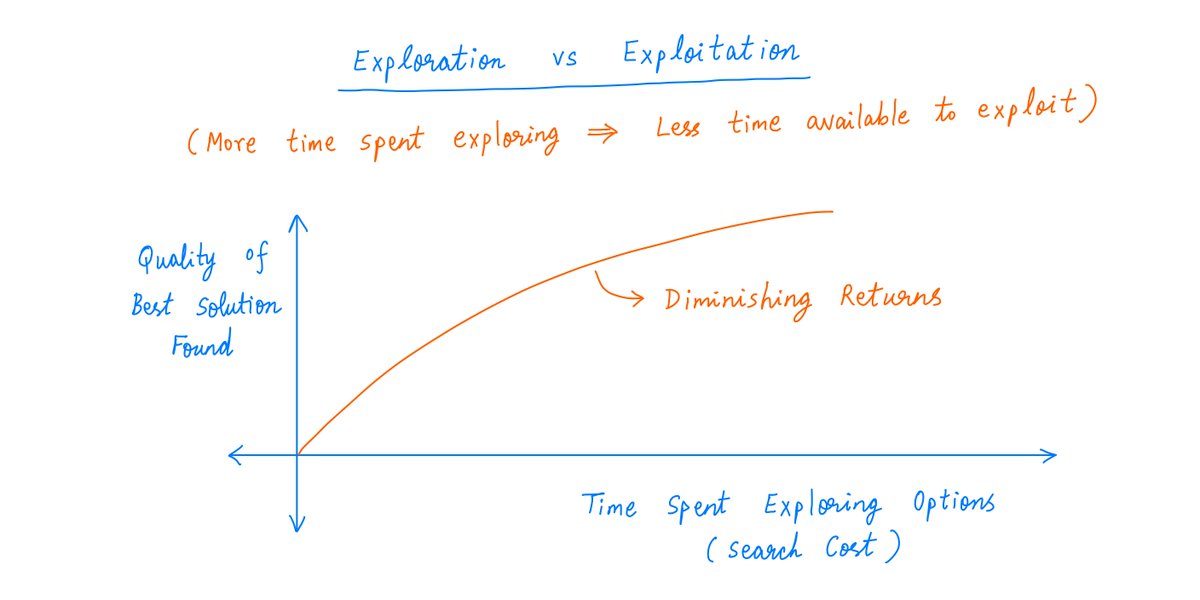

Tip 4. Balance "Exploration" vs "Exploitation".

This is a key idea from Artificial Intelligence.

Often, we can get better solutions to our problem than the one we have.

But there are "search costs" with diminishing returns: searching for these solutions takes time.

Tip 4. Balance "Exploration" vs "Exploitation".

This is a key idea from Artificial Intelligence.

Often, we can get better solutions to our problem than the one we have.

But there are "search costs" with diminishing returns: searching for these solutions takes time.

25/

With many decisions (what to watch on Netflix, what battery to buy on Amazon), a "good enough" solution works fine.

Instead of agonizing too much, it may be better to reduce Decision Fatigue by just going with the best option we find within a reasonable time/search cost.

With many decisions (what to watch on Netflix, what battery to buy on Amazon), a "good enough" solution works fine.

Instead of agonizing too much, it may be better to reduce Decision Fatigue by just going with the best option we find within a reasonable time/search cost.

26/

Tip 5. Plan for Decision Fatigue in others.

We should acknowledge, recognize, and plan for Decision Fatigue not only in ourselves, but also in the folks we work with -- folks who may not have read this thread!

Tip 5. Plan for Decision Fatigue in others.

We should acknowledge, recognize, and plan for Decision Fatigue not only in ourselves, but also in the folks we work with -- folks who may not have read this thread!

27/

For example, if we're meeting someone who will take decisions on our behalf (our doctor, lawyer, financial planner, etc.), it may be better to meet them in the morning, so that their Decision Fatigue doesn't affect us too adversely. nytimes.com/2019/05/14/opi…

For example, if we're meeting someone who will take decisions on our behalf (our doctor, lawyer, financial planner, etc.), it may be better to meet them in the morning, so that their Decision Fatigue doesn't affect us too adversely. nytimes.com/2019/05/14/opi…

28/

To summarize, here are my 5 tips to reduce the impact of Decision Fatigue:

- Make "high value" decisions early in the day,

- Make "low value" decisions O(1),

- Empower and Delegate,

- Balance "Exploration" vs "Exploitation", and

- Plan for Decision Fatigue in others.

To summarize, here are my 5 tips to reduce the impact of Decision Fatigue:

- Make "high value" decisions early in the day,

- Make "low value" decisions O(1),

- Empower and Delegate,

- Balance "Exploration" vs "Exploitation", and

- Plan for Decision Fatigue in others.

29/

In investing and personal finance, a small number of decisions can have an outsize impact.

As Charlie Munger says about Berkshire's outperformance over more than 5 decades:

"If you took our top fifteen decisions out, we'd have a pretty average record."

In investing and personal finance, a small number of decisions can have an outsize impact.

As Charlie Munger says about Berkshire's outperformance over more than 5 decades:

"If you took our top fifteen decisions out, we'd have a pretty average record."

30/

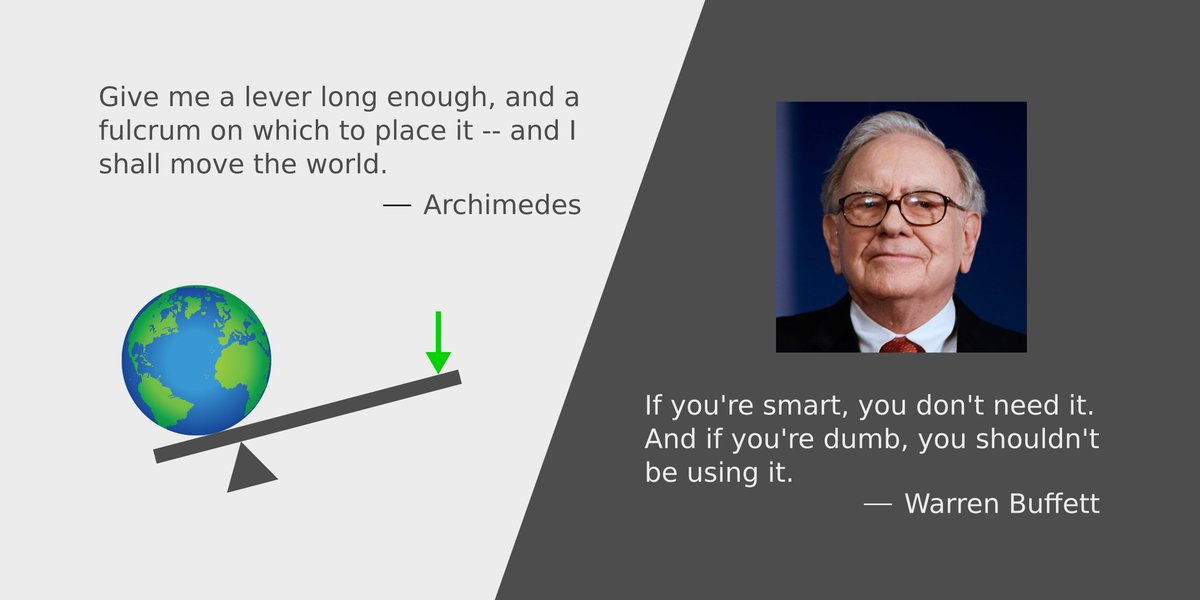

So, it's key to get the big decisions right.

Instead, if we err on the side of too much activity in our portfolios, and take too many decisions, we risk giving Decision Fatigue the upper hand.

As Buffett likes to say:

So, it's key to get the big decisions right.

Instead, if we err on the side of too much activity in our portfolios, and take too many decisions, we risk giving Decision Fatigue the upper hand.

As Buffett likes to say:

31/

If you're still with me, thank you very much!

Decision Fatigue may be a problem, but it's clear to me that you have excellent immunity against Thread Fatigue!

Please stay safe. Enjoy your weekend!

/End

If you're still with me, thank you very much!

Decision Fatigue may be a problem, but it's clear to me that you have excellent immunity against Thread Fatigue!

Please stay safe. Enjoy your weekend!

/End

• • •

Missing some Tweet in this thread? You can try to

force a refresh