Manchester United have announced financial results for Q3 of 2020/21, incorporating the first 9 months of the season. This covers January to March 2021, so provides further insight into the impact of COVID. Some thoughts in the following thread #MUFC

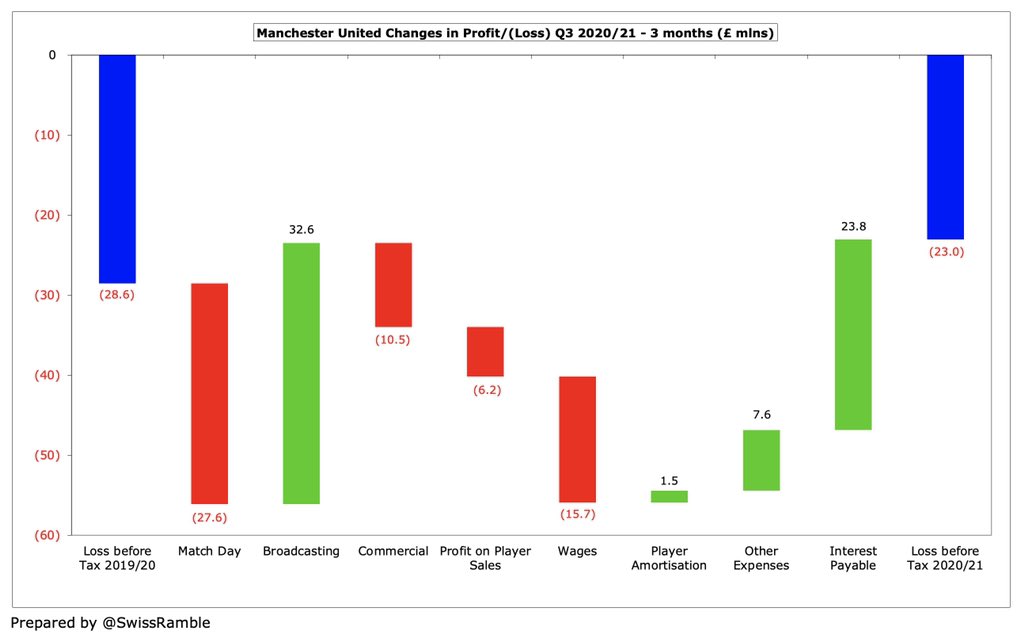

For Q3 #MUFC pre-tax loss improved from £29m to £23m, despite revenue dropping £5m (4%) to £118m, a £1m loss on player sales and expenses rising £7m (5%). This operational decline was offset by net interest payable falling from £25m to £1m thanks to forex gains.

The main reason that #MUFC revenue only fell 4% in Q3 was £33m increase in broadcasting to £59m, due to return to Champions League, which compensated for COVID influenced reductions in match day, down £28m (95%) to £2m, and commercial, down £10m (15%) to £58m.

Despite the revenue decrease, MUFC wages rose £16m (23%) from £69m to £85m, due to Champions League bonuses, and player amortisation increased £2m (5%) from £29m to £31m. Reduced business activity, due to COVID closures, meant £8m (29%) reduction in other expenses.

Over 9 months #MUFC managed to report a pre-tax profit, though this dropped £8m from £26m to £18m, as revenue fell £28m (6%) from £428m to £400m and profit on player sales was down £16m to zero. This was partly offset by interest flipping from £18m payable to £18m receivable.

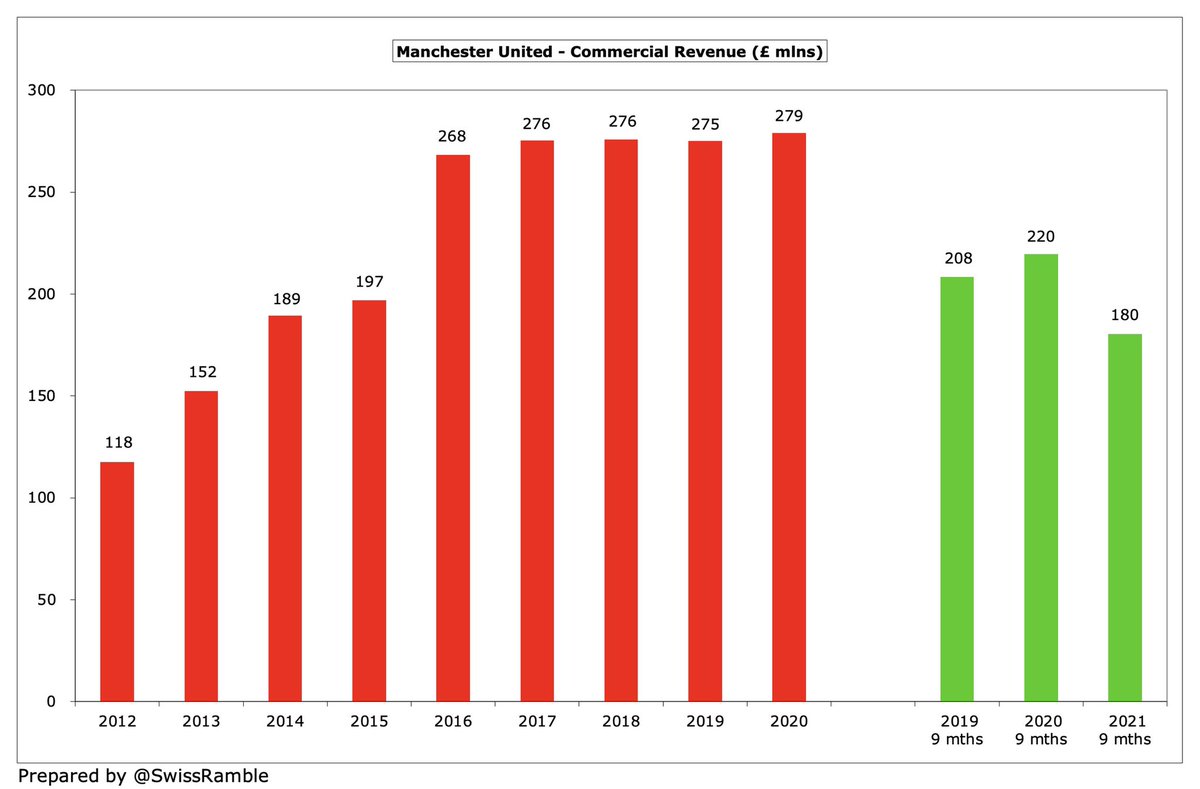

Over 9 months #MUFC £28m revenue reduction was driven by match day plummeting £80m (94%) to just £5m, as games were played without fans, and commercial falling £39m (18%) to £180m. This was offset by broadcasting rising £91m (74%) from £124m to £215m.

Over 9 months #MUFC wage bill rose £28m (13%) to £239m, driven by higher bonus payments and “continued investment in the squad”, while player amortisation was cut £1m to £91m. Other expenses fell £26m (32%) to £56m.

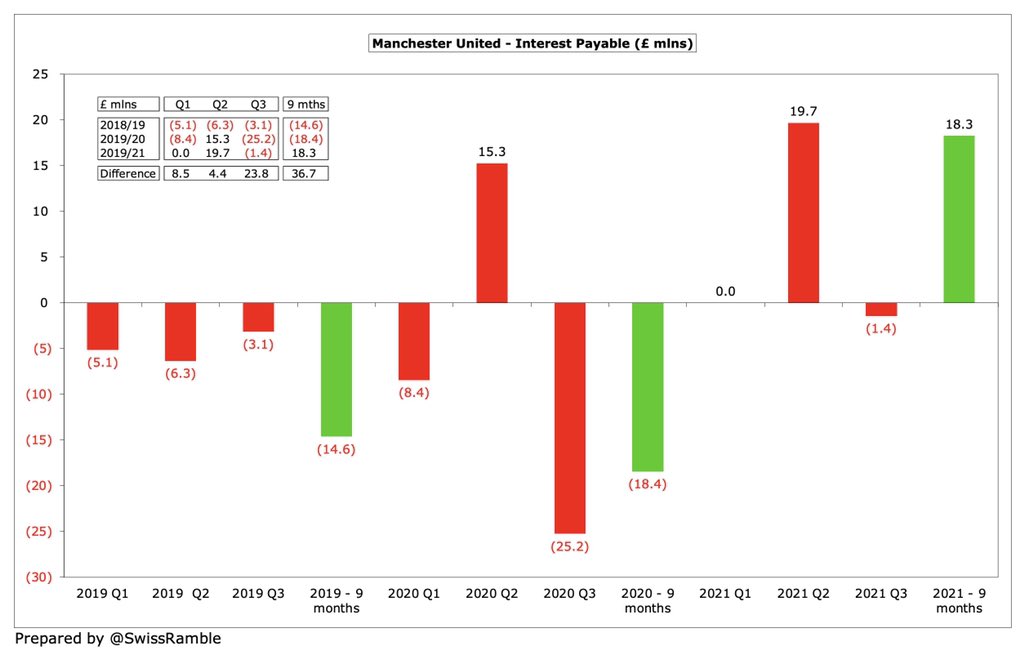

#MUFC interest went from £18m payable in 2020 to £18m receivable in 2021, a favourable movement of £36m. This was largely due to unrealised foreign exchange gains on the club’s debt, which is denominated in USD. This reverses a similar sized loss in the prior period.

Although it is impressive that #MUFC were still profitable even with COVID, their £18m profit before tax is a lot lower than the £58m they made in 2019 (pre-pandemic). Also worth noting that United’s £26m profit after 9 months in 2020 ultimately became a £21m full-year loss.

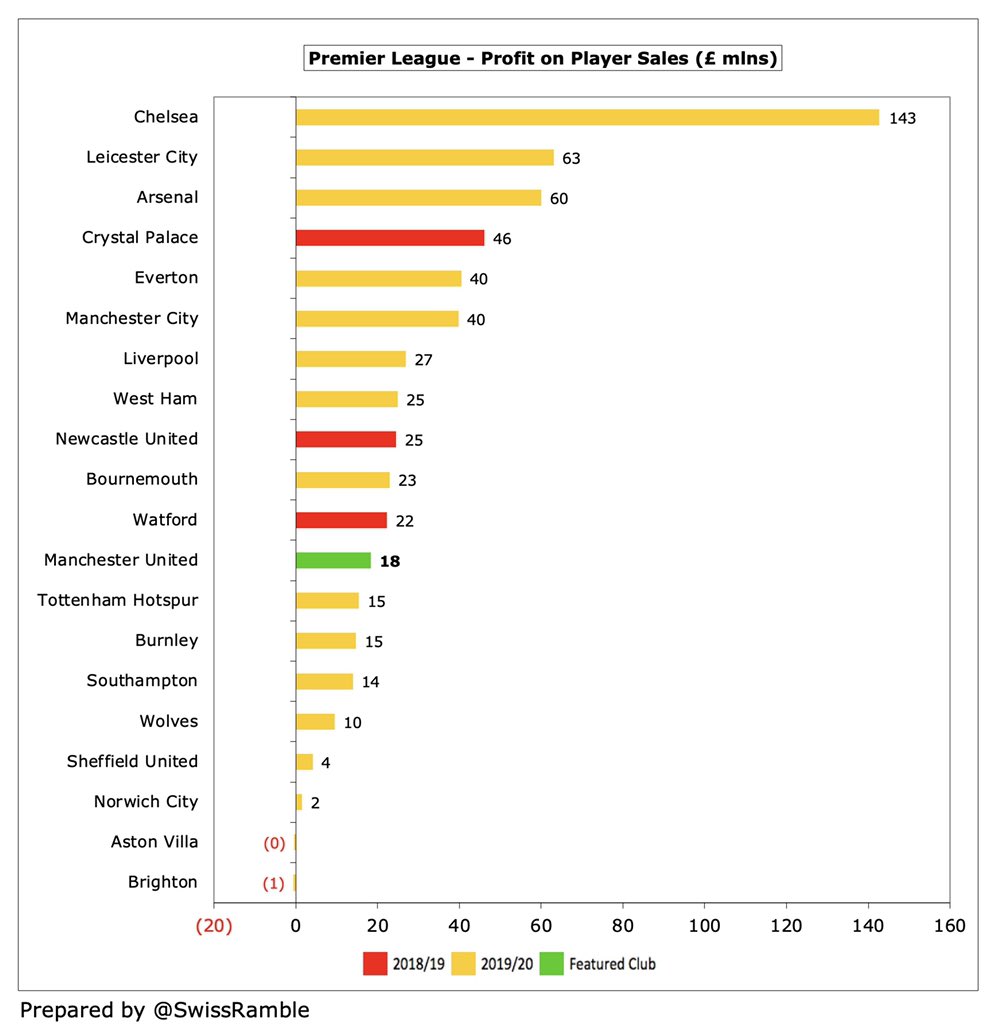

#MUFC profit from player sales for the first 9 months was only £259k, significantly lower than the £16m they made in the prior year (and £24m in 2019). This figure is unlikely to increase much in Q4, based on prior years.

#MUFC have rarely made big money from player sales, e.g. their £87m in the last 6 years is by far the lowest of the Big Six and was nearly £400m less than #CFC in the same period. That said, their profit from this activity is particularly small in 2020/21.

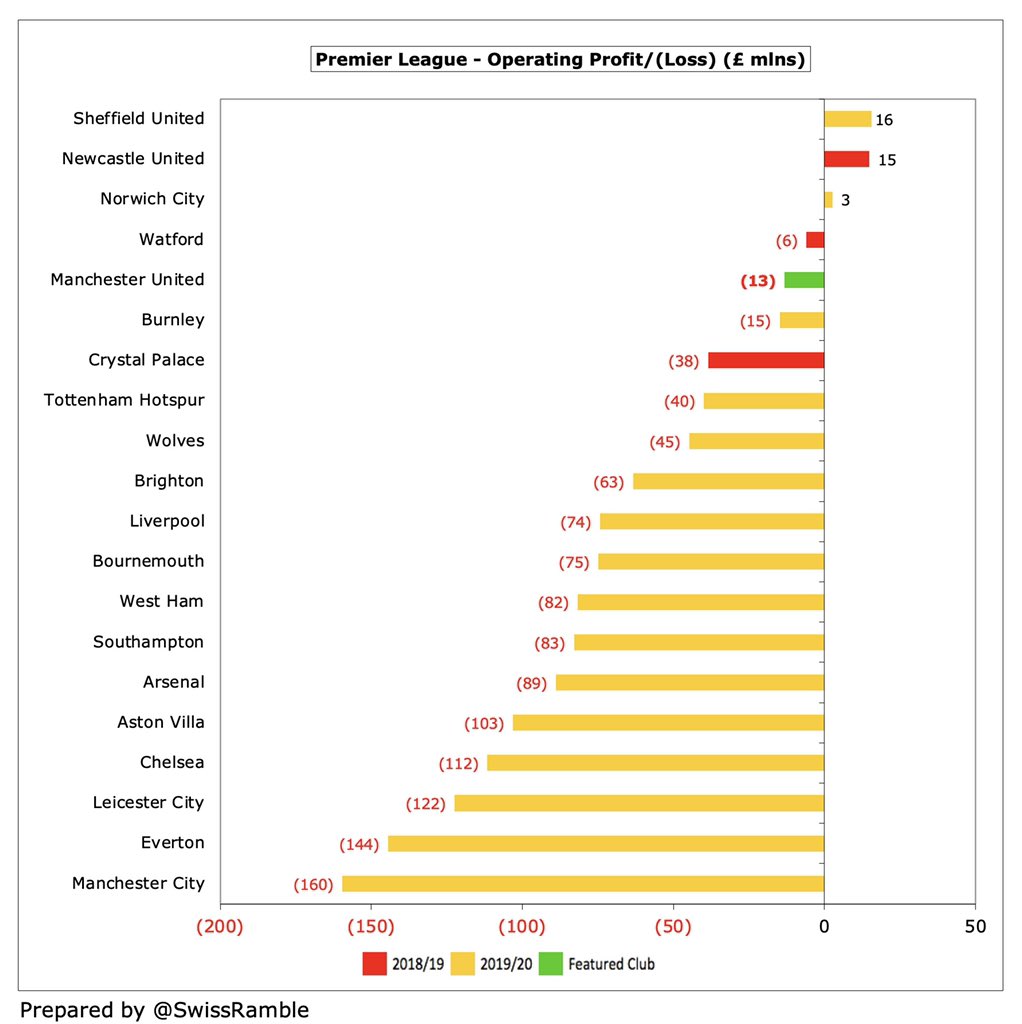

In 2019/20 #MUFC reported an operating loss for the first time in ages, £13m (excluding player sales and interest). This is likely to be repeated this season, as operating profit fell from £28m to break-even in the first 9 months and there will probably be a large loss in Q4.

#MUFC revenue fell £28m (6%) from £428m to £400m in the first 9 months of 2020/21, which means a £96m decrease from the £496m peak two years ago. Given the better performance by #MCFC and #LFC in Europe plus smaller match day losses, both clubs might overtake United in 2021.

Like every other club #MUFC match day revenue was decimated in first 9 months of 2020/21, falling £80m (94%) to just £5m. With £111m annual income pre-pandemic, they had more to lose than most with games played behind closed doors. Old Trafford hosted 10,000 fans in final match.

#MUFC broadcasting revenue shot up £91m (74%) from £124m to £215m, mainly due to participation in the Champions League, though also benefits from revenue deferred from 2019/20 after 6 games played after end-June accounting close (which I estimate as £21m) and prior year rebate.

#MUFC competed in the far more lucrative Champions League in 2020/21, though they were eliminated in the group stage, so dropped down to the Europa League where they reached the final. I estimate that they made £67m, split between £55m CL and £12m EL.

£67m is the second highest revenue that #MUFC have earned from European competitions in the last decade, only surpassed by £82m in 2019, but £41m higher than the previous season, when they only received £26m for reaching the Europa League semi-final.

#MUFC commercial income fell £40m (18%) from £220m to £180m in first 9 months of 2020/21, due to a sponsorship credit (for Chevrolet’s 6-month contract extension), the impact of the Old Trafford Megastore closure on merchandising sales and no pre-season tour.

#MUFC revenue advantage over other clubs has traditionally been due to their commercial prowess, which generated £279m income in 2019/20. This was the highest in England, well ahead of #MCFC £246m and #LFC £217m, but revenue in 2020/21 is down £40m (18%) for first 9 months.

#MUFC commercial income flat for last 4 years, while others have seen far higher growth. United’s new £47m TeamViewer shirt sponsorship is much less than Chevrolet £64m, while The Hut Group pulled out of replacing Aon training ground £15m deal due to bad Super League publicity.

#MUFC wage bill rose £28m (13%) from £211m to £239m, mainly due to higher bonuses for Champions League qualification. Assuming Q4 is the same as Q3 (£85m), full year would be £324m, £40m more than prior season, when they dropped to third place in England behind #MCFC and #LFC.

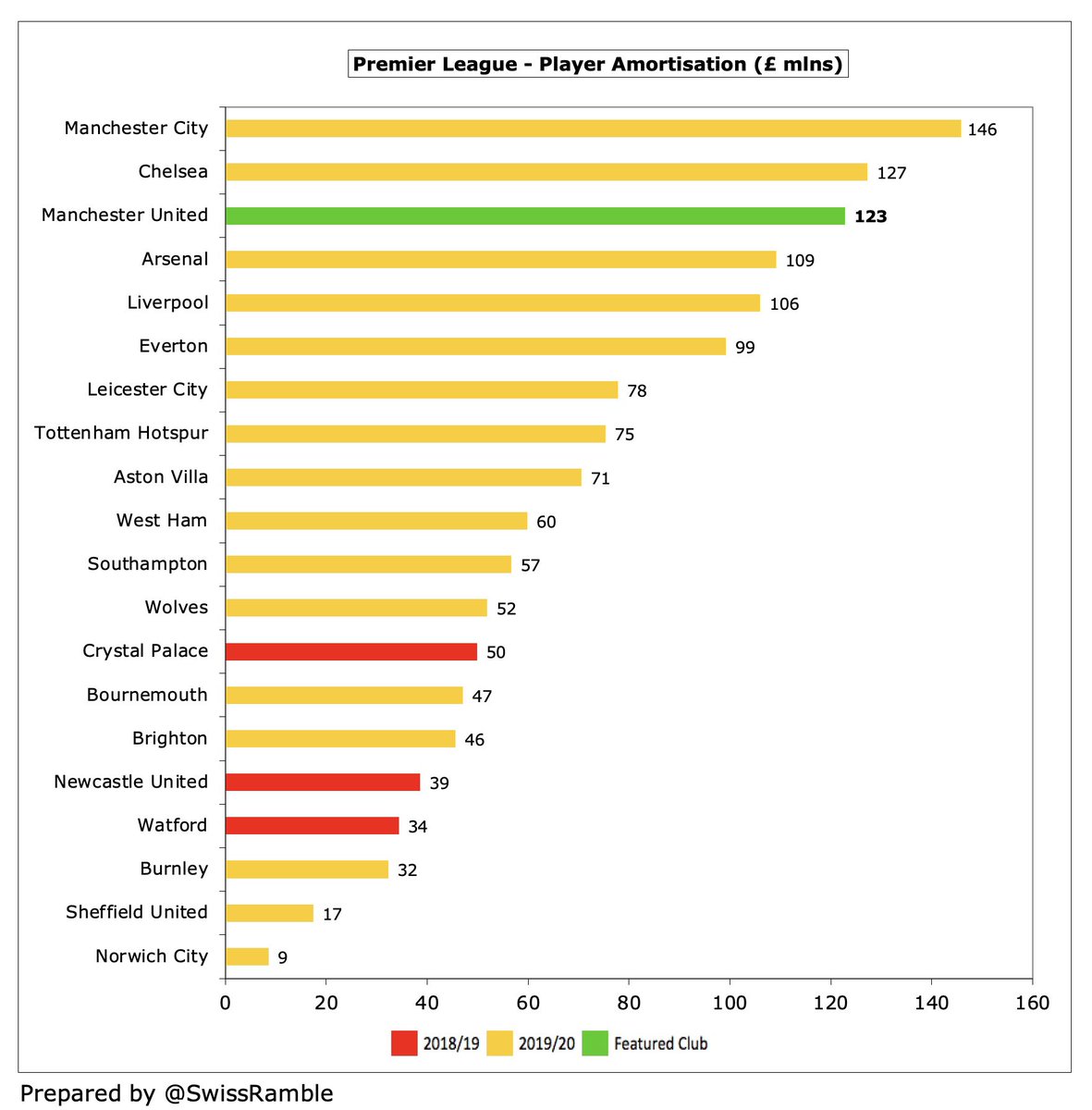

#MUFC player amortisation, the annual charge to expense transfer fees over the length of a player’s contract, fell slightly by £1m to £91m for first 9 months of 2020/21. Their full-year £123m in 2019/20 was below #MCFC £146m and #CFC £127m.

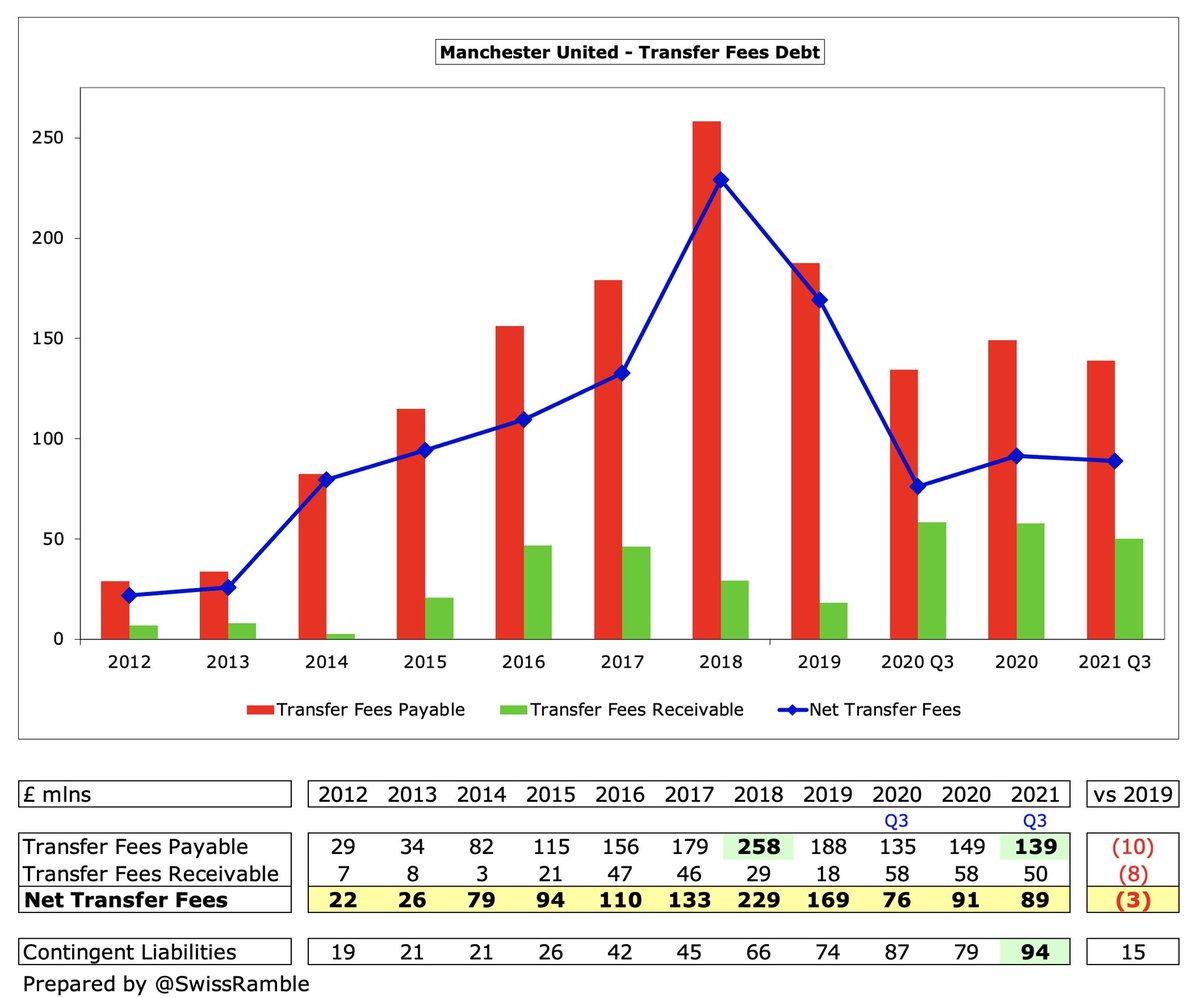

#MUFC spent £109m on player purchases in the first 9 months of 2020/21. This is £74m less than the £183m spent last season, which was the highest in the Premier League. In the 5 years up to 2020, United’s £902m gross transfer spend was only surpassed by #MCFC £974m.

#MUFC gross debt slightly increased to £528m, despite a £60m drawdown on the £200m revolving credit facility, as the (unchanged) US Dollar denominated borrowings were lower in GBP terms following foreign exchange gains.

That said, #MUFC debt is still very high at over half a billion pounds, even after all the refinancings by the Glazer family. It is only surpassed in England by #THFC £831m – and that was for the Londoners building their new stadium, as opposed to funding a leveraged buy-out.

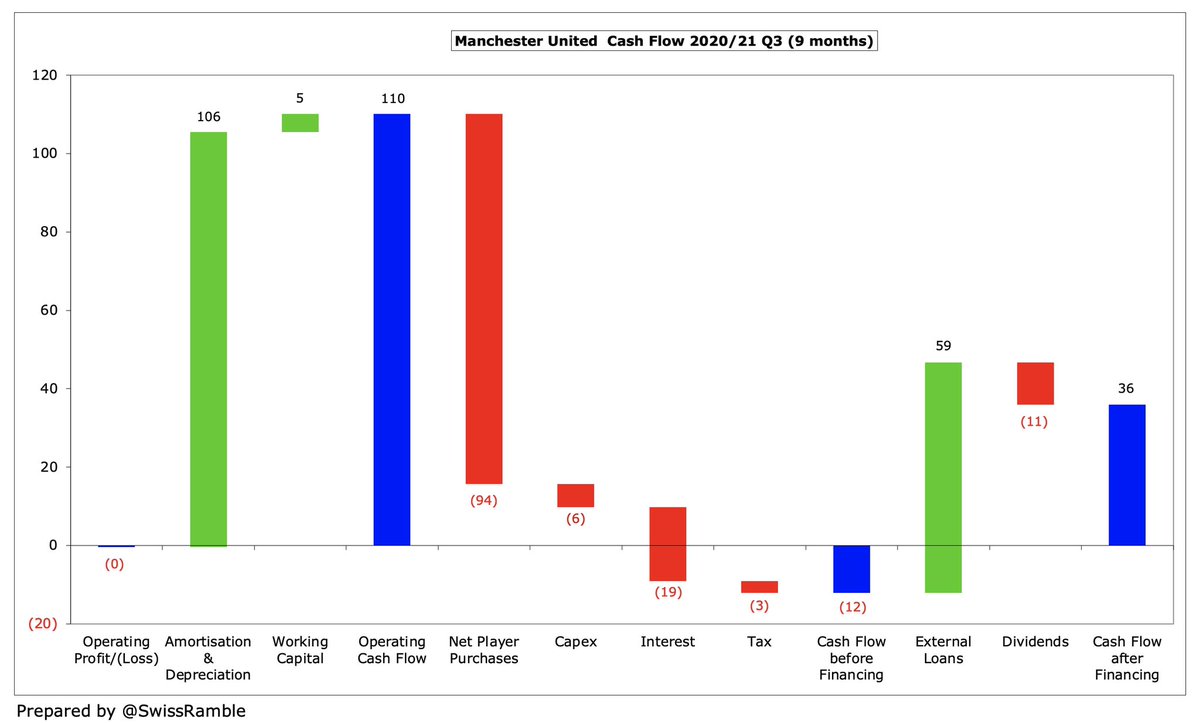

After adding back non-cash items and working capital movements, #MUFC had £110m operating cash flow in first 9 months of 2020/21, but then spent £94m on players (purchases £126m, sales £32m), interest £19m, dividends £11m, capex £6m and tax £3m. Funded by £59m external loans.

#MUFC cash balance was virtually unchanged at £85m, though down from (very high) £308m in 2019. The 2020 year-end balance of £52m was low for United, demonstrating the impact of COVID, as they had to “use a lot of cash reserves with no supporters in the stands”, per Joel Glazer.

#MUFC also have access to an additional £140m available under the club’s revolving credit facility, which would “provide financial flexibility to support United through the disruption caused by COVID-19”.

Much of the cash has also been used to pay outstanding stage payments on transfer fees, so #MUFC transfer debt has fallen from £149m to £135m, having been as high as £258m 3 years ago. Transfer receivables have decreased from £58m to £50m, so net transfer fees are £89m.

Although it has fallen from its peak, #MUFC annual interest payment of £20m is a lot higher than every other Premier League club with the closest challengers being #THFC £14m and #AFC £11m. More relevantly, #LFC and #MCFC only paid £2m and £1m respectively.

Despite the financial challenges, #MUFC have still found enough cash to pay shareholders (mainly the Glazers) a full £23m dividend. First half (£11m) already paid, while rest will be paid in July. United were the only Premier League club to pay a meaningful dividend in 2019/20.

Even though Joel Glazer attempted to justify the dividend payments as “a modest proportion of our five to six hundred million pounds of revenue”, it is striking how much the club has paid out here. Including the 2020/21 season, this will be around £135m in the last 6 years.

#MUFC would have had even more money to spend if they did not have to bear the cost of the Glazers’ leveraged buy-out. Since 2006 they have spent £1.1 bln on financing: £724m interest, £185m debt repayments and £149m dividends. Dividends/interest averaged £42m in last 7 years.

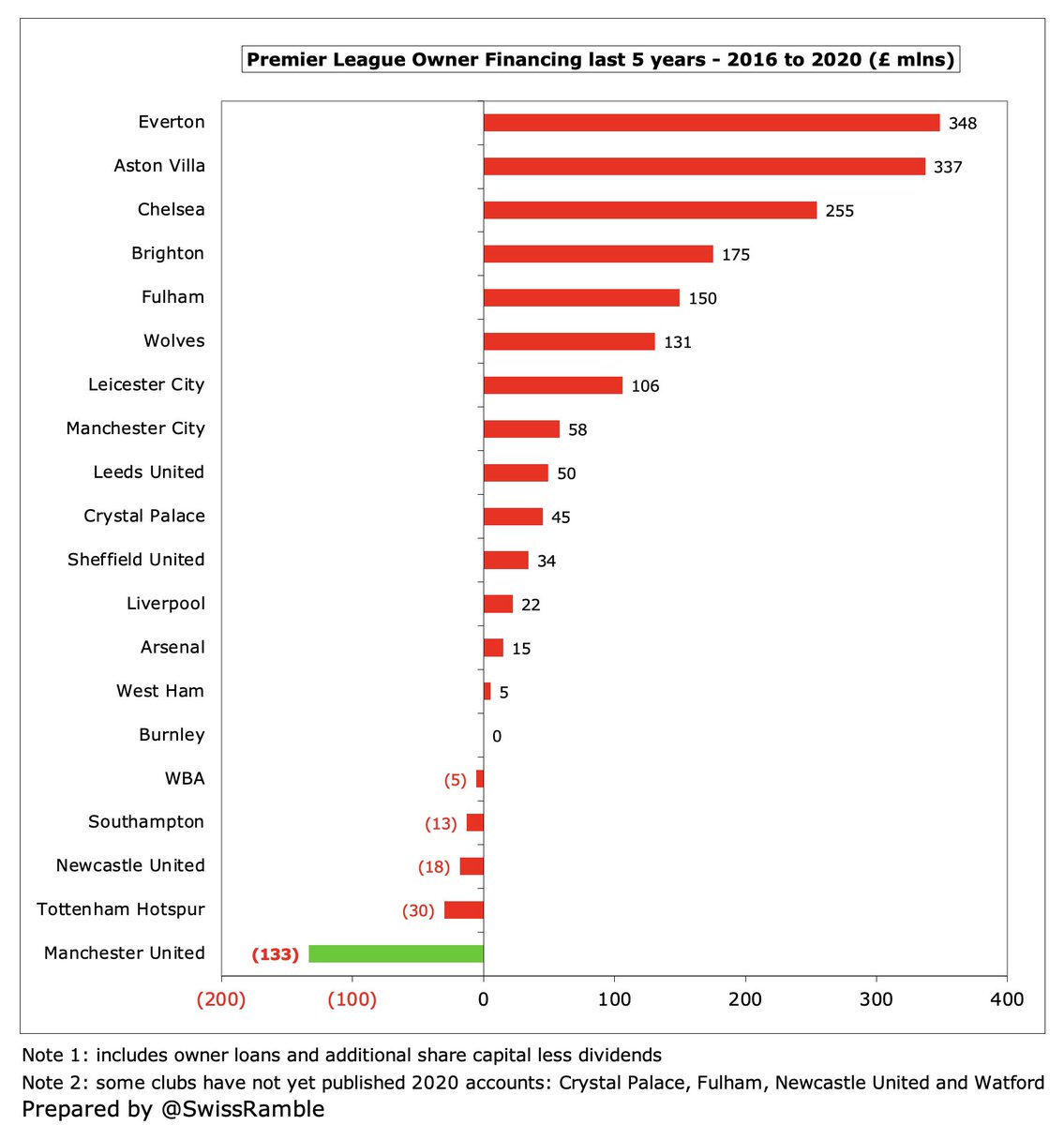

Furthermore, in the 5 years up to 2020, no owners in the Premier League have taken out more money than #MUFC’s £133m (dividends £112m, share buy back £21m). In stark contrast, some owners have put in significant funds: #EFC £348m, #AVFC £337m and #CFC £255m.

These financials are as good as could be expected in the current climate. As Joel Glazer said, #MUFC is “a very well run club” with a strong balance sheet and many commercial partners. However, they are not immune to COVID, so will hope for the return of fans as soon as possible.

• • •

Missing some Tweet in this thread? You can try to

force a refresh