Thread🧵👇

Few Potential De-mergers or Value Unlock:

❶ ITC can unlock amazing shareholder wealth by its demerger:

TOBACCO: 70%

PERSONAL CARE: 14%

FOOD: 27%

PACKAGING & STATIONERY: 35%

HOTEL: 5%

May be 4 WAY Split:

→TOBACCO

→FMCG

→HOTELS

→PACKAGING

#investing

1/5

Few Potential De-mergers or Value Unlock:

❶ ITC can unlock amazing shareholder wealth by its demerger:

TOBACCO: 70%

PERSONAL CARE: 14%

FOOD: 27%

PACKAGING & STATIONERY: 35%

HOTEL: 5%

May be 4 WAY Split:

→TOBACCO

→FMCG

→HOTELS

→PACKAGING

#investing

1/5

❷ RIL (Reliance Industries)

→Possible demerger or IPOs of RR & Jio

~ Refinery

~ Telecom (Jio)

~ Reliance Retail

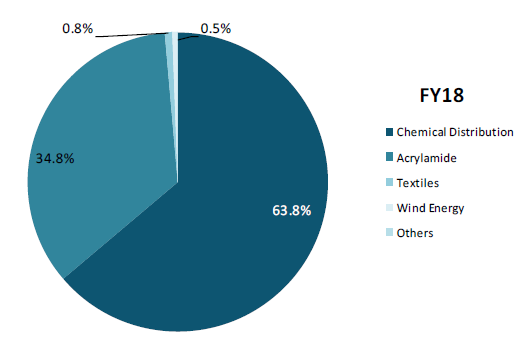

❸ GHCL (Gujarat Heavy Chemicals Ltd)

→Demerging the Chemicals & Textile business is on the cards.

2/

→Possible demerger or IPOs of RR & Jio

~ Refinery

~ Telecom (Jio)

~ Reliance Retail

❸ GHCL (Gujarat Heavy Chemicals Ltd)

→Demerging the Chemicals & Textile business is on the cards.

2/

❹ Piramal Enterprises

→Three way Demerger possible :

~ RealEstate

~ Pharma(CDMO)

~ NBFC

❺ Strides Shasun

Strides demerger of biopharmaceutical division 'Stelis Biopharma'

→2 way demerger would mean

The basic pharma play : Strides

Biopharma play : Stelis

3/

→Three way Demerger possible :

~ RealEstate

~ Pharma(CDMO)

~ NBFC

❺ Strides Shasun

Strides demerger of biopharmaceutical division 'Stelis Biopharma'

→2 way demerger would mean

The basic pharma play : Strides

Biopharma play : Stelis

3/

❻ KPR Mills

→Demerger of Garments & Sugar+Ethanol

❼ GNFC

Two Way Demerger:

→Fertilizers & Chemicals

❽ SRF

Two Way demerger:

Chemicals & textiles

❾ Auro Demerging Injectable Business & focus on Biosimilar. Next forefront in Medicine is going to be Biosimilar..

4/

→Demerger of Garments & Sugar+Ethanol

❼ GNFC

Two Way Demerger:

→Fertilizers & Chemicals

❽ SRF

Two Way demerger:

Chemicals & textiles

❾ Auro Demerging Injectable Business & focus on Biosimilar. Next forefront in Medicine is going to be Biosimilar..

4/

10. Deepak Fertilisers

Their core Businesses:

⓵ Industrial Chemical

⓶ Technical Ammonium Nitrate

⓷ Crop Nutrition Business

⓸ Value Added Real Estate

Possible de-merger in future.

5/5

Their core Businesses:

⓵ Industrial Chemical

⓶ Technical Ammonium Nitrate

⓷ Crop Nutrition Business

⓸ Value Added Real Estate

Possible de-merger in future.

5/5

• • •

Missing some Tweet in this thread? You can try to

force a refresh