MASTER THREAD on Short Strangles.

Curated the best tweets from the best traders who are exceptional at managing strangles.

• Positional Strangles

• Intraday Strangles

• Position Sizing

• How to do Adjustments

• Plenty of Examples

• When to avoid

• Exit Criteria

Curated the best tweets from the best traders who are exceptional at managing strangles.

• Positional Strangles

• Intraday Strangles

• Position Sizing

• How to do Adjustments

• Plenty of Examples

• When to avoid

• Exit Criteria

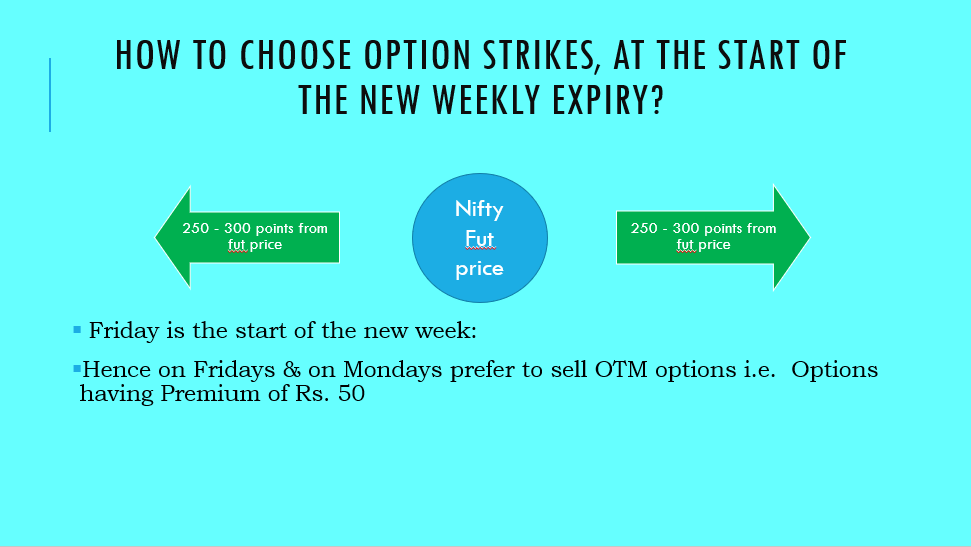

How to sell Strangles in weekly expiry as explained by boss himself. @Mitesh_Engr

• When to sell

• How to do Adjustments

• Exit Criteria

• When to sell

• How to do Adjustments

• Exit Criteria

https://twitter.com/Mitesh_Engr/status/1094442507595788288?s=19

Beautiful explanation on positional option selling by @Mitesh_Engr

Sir on how to sell low premium strangles yourself without paying anyone. This is a free mini course in itself.

Sir on how to sell low premium strangles yourself without paying anyone. This is a free mini course in itself.

https://twitter.com/Mitesh_Engr/status/1190876909887881217?s=19

1st Live example of managing a strangle by Mitesh Sir. @Mitesh_Engr

• Sold Strangles 20% cap used

• Added 20% cap more when in profit

• Booked profitable leg and rolled up

• Kept rolling up profitable leg

• Booked loss in calls

• Sold only puts

• Sold Strangles 20% cap used

• Added 20% cap more when in profit

• Booked profitable leg and rolled up

• Kept rolling up profitable leg

• Booked loss in calls

• Sold only puts

https://twitter.com/Mitesh_Engr/status/1116548622122749953?s=19

2nd example by @Mitesh_Engr Sir on converting a directional trade into strangles. Option Sellers can use this for consistent profit.

• Identified a reversal and sold puts

• Puts decayed a lot

• When achieved 2% profit through puts then sold calls

• Identified a reversal and sold puts

• Puts decayed a lot

• When achieved 2% profit through puts then sold calls

https://twitter.com/Mitesh_Engr/status/1225809128649412608?s=19

What to do when premiums are low? By @Mitesh_Engr

• Avoid Strangle Selling

• Wait patiently for rejection candle

• Bet heavy with a small stop loss

• Great Risk/Reward

I saw him do this live on one expiry I distinctly remember, he made good profit.

• Avoid Strangle Selling

• Wait patiently for rejection candle

• Bet heavy with a small stop loss

• Great Risk/Reward

I saw him do this live on one expiry I distinctly remember, he made good profit.

https://twitter.com/Mitesh_Engr/status/1341778383802253312?s=19

Ideal position sizing to play strangles aggressively by @Mitesh_Engr

Observe the quantity he is selling on a 20 lakh account,15 lots on 20 lakhs.

• Sold straddles aggressively

• Exited with 1% profit in a day

• Sold bullish strangles to extract more

Observe the quantity he is selling on a 20 lakh account,15 lots on 20 lakhs.

• Sold straddles aggressively

• Exited with 1% profit in a day

• Sold bullish strangles to extract more

https://twitter.com/Mitesh_Engr/status/1329742940558671873?s=19

What @_GauravVashisth looks for before selling strangles.

• Check 1 hour charts

• If in consolidation sells strangles

• If there's a breakout of a level sells directionally

• Check 1 hour charts

• If in consolidation sells strangles

• If there's a breakout of a level sells directionally

https://twitter.com/_GauravVashisth/status/1277174985136590849?s=19

https://twitter.com/_GauravVashisth/status/1336353947666186241?s=19

According to @_GauravVashisth strangles shouldn't be sold when

• Market closes at day high/low

• Probability of a big move is higher

• Probability of a severe gap up/gap down is higher

You can check my thread out on @_GauravVashisth logics here 👇

• Market closes at day high/low

• Probability of a big move is higher

• Probability of a severe gap up/gap down is higher

You can check my thread out on @_GauravVashisth logics here 👇

https://twitter.com/AdityaTodmal/status/1360597047254994948?s=19

This is a very nice thread by @Pathik_Trader Sir where he says Strangles are better than Straddles. Also covers:

• Ideal Position Sizing

• How to diversify

• How to not be affected by a black swan

• Ideal Position Sizing

• How to diversify

• How to not be affected by a black swan

https://twitter.com/Pathik_Trader/status/1359140152983969793?s=19

How @Pathik_Trader Sir keeps a stop loss in strangles?

• Premium recieved + 10% is SL.

• No need of adjustments

• Premium recieved + 10% is SL.

• No need of adjustments

https://twitter.com/Pathik_Trader/status/1212594535395545088?s=19

Multiple Examples of how @Pathik_Trader managed his strangles in multiple stocks.

• Sold Naked Puts

• When market reversed sold calls

• Rolled down calls to extract more

• Markets again reversed

• Shifted calls further otm

• Rolled up Puts

• Sold Naked Puts

• When market reversed sold calls

• Rolled down calls to extract more

• Markets again reversed

• Shifted calls further otm

• Rolled up Puts

https://twitter.com/Pathik_Trader/status/1372945473556733953?s=19

Best tweets of @sourabhsiso19 I researched on strangles. Go through all these links shared below. 👇

https://twitter.com/AdityaTodmal/status/1371037806131253251?s=19

https://twitter.com/AdityaTodmal/status/1371037808475828225?s=19

https://twitter.com/AdityaTodmal/status/1371037812745666562?s=19

Intraday Bank Nifty Strangle Strategy by @jigspatel1988

• Sell highest OI calls and puts

• Have a combined SL

• Your stop loss is VWAP

• Keep trailing

• Sell highest OI calls and puts

• Have a combined SL

• Your stop loss is VWAP

• Keep trailing

https://twitter.com/jigspatel1988/status/1397055564866195456?s=19

Researched thoroughly for the best tweets out there by all these amazing traders.

Put these efforts of sharing by them to good use and start practicing yourselves.

With practice you'll be amazing at this too. 😃✌️

Will keep adding more tweets to this topic.

_____________END

Put these efforts of sharing by them to good use and start practicing yourselves.

With practice you'll be amazing at this too. 😃✌️

Will keep adding more tweets to this topic.

_____________END

• • •

Missing some Tweet in this thread? You can try to

force a refresh