THE @US1stCircuitCt SLAMS THE CONSPIRATORS' SLOGANS REGARDING

-The SPSPA is a contract

-The SPSPA is the backstop

-FHFA went out there to find financing in 08

Actions PURSUANT TO AN AUTHORITY IN THE CHARTER.Guess what! There are more provisions!#Fanniegate @TheJusticeDept @Scotus

-The SPSPA is a contract

-The SPSPA is the backstop

-FHFA went out there to find financing in 08

Actions PURSUANT TO AN AUTHORITY IN THE CHARTER.Guess what! There are more provisions!#Fanniegate @TheJusticeDept @Scotus

https://twitter.com/CarlosVignote/status/1402836251753938948

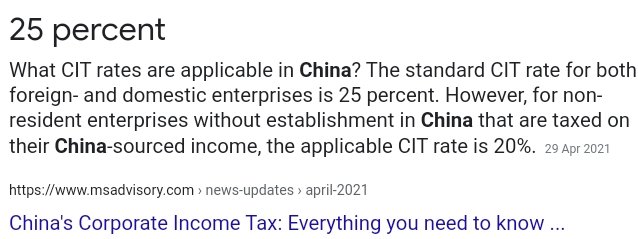

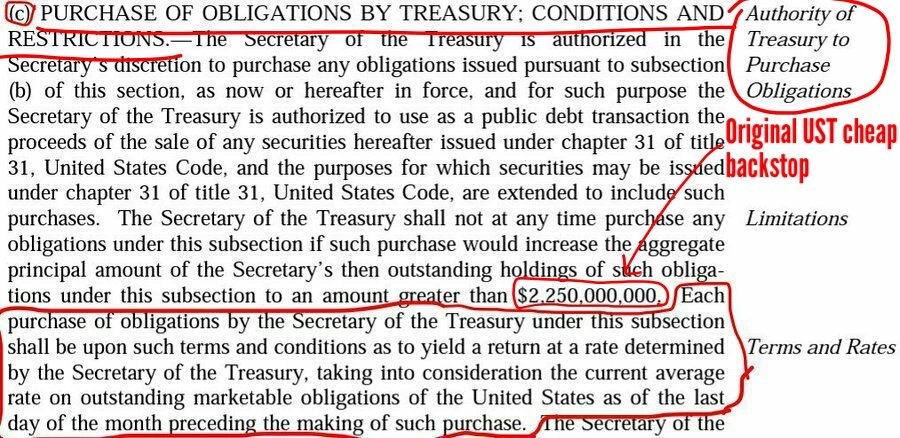

The judge cites an authority of UST(added by HERA)to purchase UNLIMITED YIELD obligations SPS +Warrant(iii)to protect the taxpayer.

But a provision W/ THE SAME NAME,already existed in the Charter w/ low cost funding,consistent w/ the provision FEE LIMITATION that bars the Warrant

But a provision W/ THE SAME NAME,already existed in the Charter w/ low cost funding,consistent w/ the provision FEE LIMITATION that bars the Warrant

The UST backstop is the Charter,not the PA.

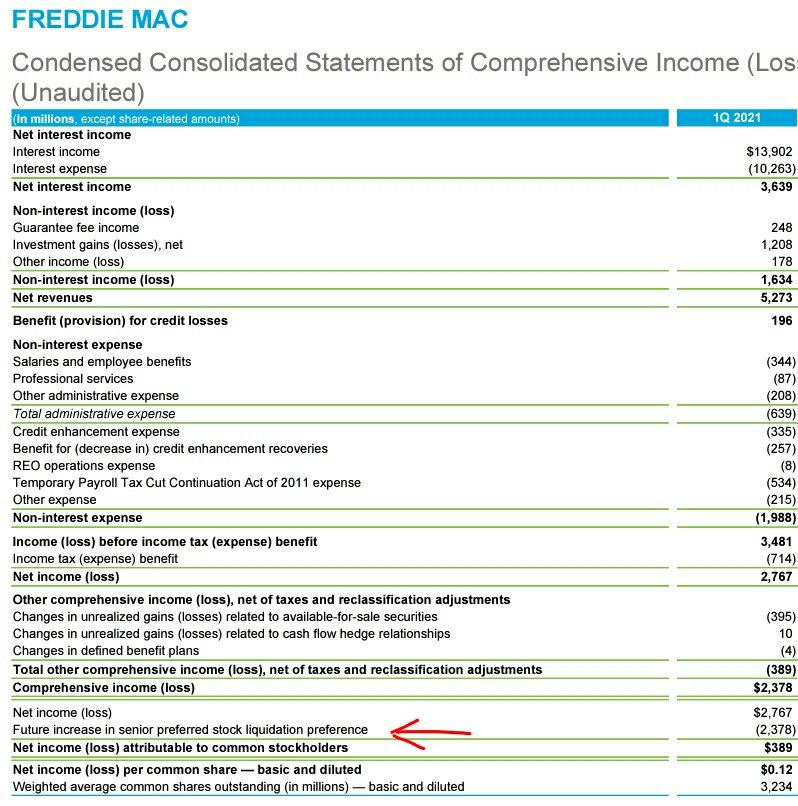

HERA allowed the 10%/NWS div,but the FHEFSSA restricts the Capital distributions unless it's applied towards SPS repayment(exception B).FHFA added(2011)a fraudulent exception(1)for Recap.

Low cost funding prevails: 0% due to collateral.

HERA allowed the 10%/NWS div,but the FHEFSSA restricts the Capital distributions unless it's applied towards SPS repayment(exception B).FHFA added(2011)a fraudulent exception(1)for Recap.

Low cost funding prevails: 0% due to collateral.

The warrant is a security,so we must see whether it was authorized in the law.

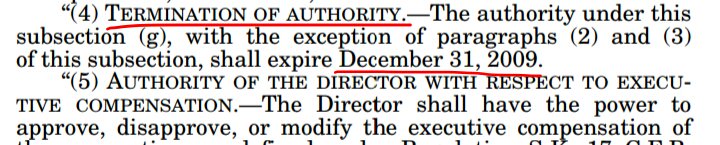

The law is related to the PURCHASE of securities and obligations,but it turns out that the UST hasn't PURCHASED a damned thing(either it gets SPS for free or LP increases)to evade the Dec2009 deadline.

The law is related to the PURCHASE of securities and obligations,but it turns out that the UST hasn't PURCHASED a damned thing(either it gets SPS for free or LP increases)to evade the Dec2009 deadline.

THE WARRANT

I don't care whether the requirement(iii)to protect the taxpayer applies or not.If you say it doesn't because it wasn't purchased but the UST got it for free as compensation(like today's SPS)➡️illegal in the Fee Limitation.Both lead to COLLATERAL.

REMINDER:restriction

I don't care whether the requirement(iii)to protect the taxpayer applies or not.If you say it doesn't because it wasn't purchased but the UST got it for free as compensation(like today's SPS)➡️illegal in the Fee Limitation.Both lead to COLLATERAL.

REMINDER:restriction

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh