WHAT'D I DO?

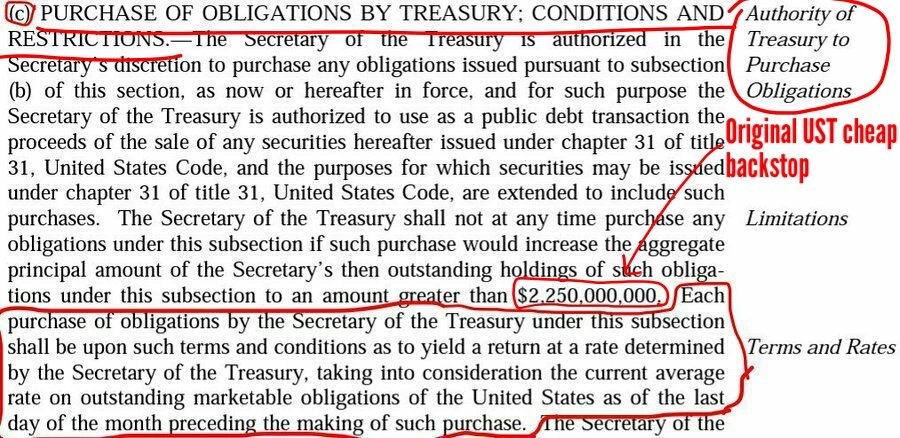

Financially,it's better a Govt taking over the common stocks(the JPS are redeemed by FnF or stay;No Voting Right)than a $182b refund.

A fair value could be the sector's PER 13,but I'd try to subtract the cost of Moral/Punitive damages from the price tag.#Fanniegate

Financially,it's better a Govt taking over the common stocks(the JPS are redeemed by FnF or stay;No Voting Right)than a $182b refund.

A fair value could be the sector's PER 13,but I'd try to subtract the cost of Moral/Punitive damages from the price tag.#Fanniegate

Then, the price of the Taking would be:

FNMA =$181ps

FMCC =$235ps

Calculated with an average of the adjusted EPS in the 4Q2020 and 1Q2021.

The resulting PER is 11.3 times.

Market Capitalization=$362b

Moral & Punitive damages(13%/12%)=$52b, defrayed by @TheJusticeDept.

Total=$415b

FNMA =$181ps

FMCC =$235ps

Calculated with an average of the adjusted EPS in the 4Q2020 and 1Q2021.

The resulting PER is 11.3 times.

Market Capitalization=$362b

Moral & Punitive damages(13%/12%)=$52b, defrayed by @TheJusticeDept.

Total=$415b

In the end,in a Taking we can't complain if the fair value is justified,but it's a subjective value. We don't get to sell the stocks to @USTreasury.Our stocks are taken away.

Reminder:@FHFA-C has to use its Inc Power prior day 1,to enable the redemption or refinancing of the JPS.

Reminder:@FHFA-C has to use its Inc Power prior day 1,to enable the redemption or refinancing of the JPS.

FHFA authorized FnF to double the g-fees since 2008➡️Today's fully private sector g-fees. Also, the Ref fee to boost the profitability(it can't fund Federal Prgms)

Being regulated entities has been a plus, thus PER 13x.

The new total makes UST think it isn't overpaying after all.

Being regulated entities has been a plus, thus PER 13x.

The new total makes UST think it isn't overpaying after all.

• • •

Missing some Tweet in this thread? You can try to

force a refresh