PayPal Holdings, Inc. ( $PYPL)

$1 trillion Company by 2028

Why?

• Alternative Payment Method

• Earnings are Increasing

• Rise in online Activities

• Reinvests Capital

• Cashless Society

• Constant growth

• User growth

• Scalable

• Crypto

(Thread) 👇🏽

$1 trillion Company by 2028

Why?

• Alternative Payment Method

• Earnings are Increasing

• Rise in online Activities

• Reinvests Capital

• Cashless Society

• Constant growth

• User growth

• Scalable

• Crypto

(Thread) 👇🏽

•Introduction

#PayPal is an American company that operates an online payments system. It’s widely accepted across the globe and supports money transfers.

It serves as an electronic payment system which is an alternative to the traditional paper method.

#PayPal is an American company that operates an online payments system. It’s widely accepted across the globe and supports money transfers.

It serves as an electronic payment system which is an alternative to the traditional paper method.

•Valuation

Currently, 4 US Companies enjoy the trillion $ valuation, in a few years $PYPL will too.

Market Cap: $340bill

$289

It’s a 3x company in my eyes.I see double digit growth over the next decade as digital payments become ubiquitous.

Let’s look at their financials👇🏽

Currently, 4 US Companies enjoy the trillion $ valuation, in a few years $PYPL will too.

Market Cap: $340bill

$289

It’s a 3x company in my eyes.I see double digit growth over the next decade as digital payments become ubiquitous.

Let’s look at their financials👇🏽

• Total Revenue

* $22billion 869million (TTM)

(2017-2020) =

(75% increase in revenue)

2020 = $21 billion 454 mill

2019 = $17 billion 772 mill

2018 = $15 billion 451 mill

2017 =$13 billion 94mill

Looking ahead

A 75% increase =

=37 bill 544 million in revenue by 2024

* $22billion 869million (TTM)

(2017-2020) =

(75% increase in revenue)

2020 = $21 billion 454 mill

2019 = $17 billion 772 mill

2018 = $15 billion 451 mill

2017 =$13 billion 94mill

Looking ahead

A 75% increase =

=37 bill 544 million in revenue by 2024

•Net Income

* $5 billion 215million (TTM)

(2017-2020) =

(134% increase in net income)

*134% increase = 9bill 832mil in net income by 2024

2020 = 4billion 202 mill

2019 = 2billion 459 mill

2018 = 2billion 57mill

2017 = 1billion 795mill

Even beat 2020 prediction ⬇️

* $5 billion 215million (TTM)

(2017-2020) =

(134% increase in net income)

*134% increase = 9bill 832mil in net income by 2024

2020 = 4billion 202 mill

2019 = 2billion 459 mill

2018 = 2billion 57mill

2017 = 1billion 795mill

Even beat 2020 prediction ⬇️

• Net Income Ratio

PayPal’s revenue is increasing each year and so is their profit margins. Not only are they earning more, but they are keeping more of it.

Net income ÷ Total revenue

TTM = 22.8%

2020 = 19.5%

2019 = 13.83%

2018 = 13.3%

2017 = 13.7%

This is attractive ✅

PayPal’s revenue is increasing each year and so is their profit margins. Not only are they earning more, but they are keeping more of it.

Net income ÷ Total revenue

TTM = 22.8%

2020 = 19.5%

2019 = 13.83%

2018 = 13.3%

2017 = 13.7%

This is attractive ✅

• Total Assets + Liabilities

A = $70bill 379mil

14% of this = Goodwill+ (intangibles )

L = $50bill 316 mill

•Shareholders Equity =

$20bill 63mill

(includes minority interest )

Fair ✅

A = $70bill 379mil

14% of this = Goodwill+ (intangibles )

L = $50bill 316 mill

•Shareholders Equity =

$20bill 63mill

(includes minority interest )

Fair ✅

• $PYPL Current Ratio

1.32

Would like to see it a bit higher, but still fairly decent.

PayPal has about $12.5 Billion in working capital.

So it’s got ample liquidity to keep it going.

Fair ✅

#StocksToBuy

1.32

Would like to see it a bit higher, but still fairly decent.

PayPal has about $12.5 Billion in working capital.

So it’s got ample liquidity to keep it going.

Fair ✅

#StocksToBuy

•Earnings Per Share

$PYPL has been growing their earnings per share each year.

2020 = $4.4

2019 = $2.09

2018 = $1.75

2017 = $1.49

Attractive ✅

But wait, let’s learn ⬇️

$PYPL has been growing their earnings per share each year.

2020 = $4.4

2019 = $2.09

2018 = $1.75

2017 = $1.49

Attractive ✅

But wait, let’s learn ⬇️

•Rewards

Companies reward shareholders in two ways:

• #dividends

• Rebuying shares

•Dividends payout profits

•Buying back shares puts profits into shareholders pockets another way. It increases EPS and helps the stock rise in price.

Dividends or buybacks?

Vote now

Companies reward shareholders in two ways:

• #dividends

• Rebuying shares

•Dividends payout profits

•Buying back shares puts profits into shareholders pockets another way. It increases EPS and helps the stock rise in price.

Dividends or buybacks?

Vote now

• Balance sheet.

You’ll see 3 things:

• Shares Issued (S/I)

• Ordinary Shares (O/S)

• Treasury Shares (T/S)

What’s the difference?

Let me explain

•S/I = Total shares

•O/S = Owned by shareholders

•T/S = Shares bought back by company

S/I -T/S = O/S

You’ll see 3 things:

• Shares Issued (S/I)

• Ordinary Shares (O/S)

• Treasury Shares (T/S)

What’s the difference?

Let me explain

•S/I = Total shares

•O/S = Owned by shareholders

•T/S = Shares bought back by company

S/I -T/S = O/S

•What does PayPal do?

They don’t

•Pay #dividends ❌

They do

•Buy back shares - which in turn lead to capital ⬆️

Sidenote:

It can be used to deceive shareholders, gives an impression that the company is doing better than what it really is

Net Income ÷ shares outstanding

They don’t

•Pay #dividends ❌

They do

•Buy back shares - which in turn lead to capital ⬆️

Sidenote:

It can be used to deceive shareholders, gives an impression that the company is doing better than what it really is

Net Income ÷ shares outstanding

•Price Per earnings

I hear a lot of talk how this is useless, I disagree. It’s a good indicator to use, but shouldn’t be used in its entirety.

Share price ÷ EPS

$PYPL P/E =65

IMO- For a company like this, that could 3x from here, it’s worth the risk.

Risk- Reward ✅

I hear a lot of talk how this is useless, I disagree. It’s a good indicator to use, but shouldn’t be used in its entirety.

Share price ÷ EPS

$PYPL P/E =65

IMO- For a company like this, that could 3x from here, it’s worth the risk.

Risk- Reward ✅

Higher P/E ratios demand higher earnings.

• PayPal is growing earnings

• Increasing profit margins

• Re-buying shares

These are strong tailwinds for the company.

IMO,

long term hold - it’s a buy ✅

• PayPal is growing earnings

• Increasing profit margins

• Re-buying shares

These are strong tailwinds for the company.

IMO,

long term hold - it’s a buy ✅

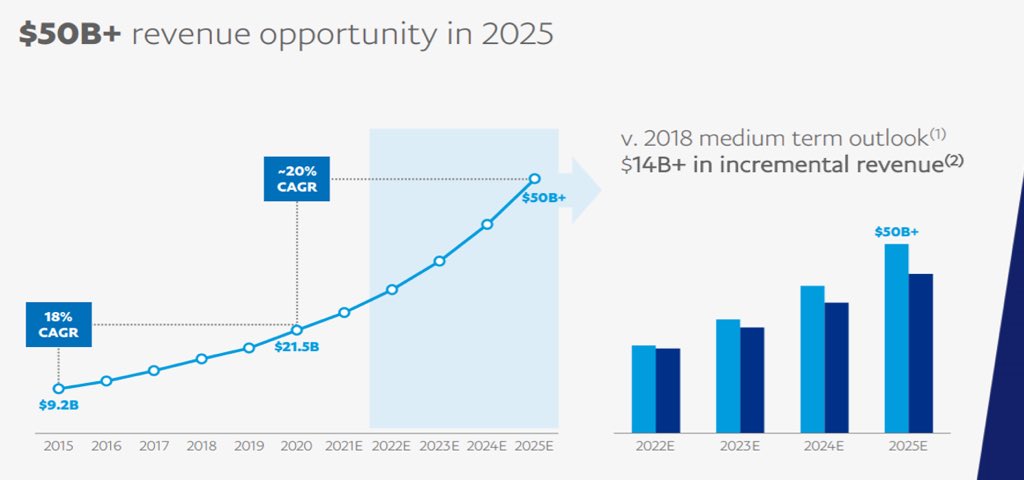

• Total Addressable Market

For them to grow into earnings, we need to know that the market is there.

And based on how successful they have been so far, and their growing network effect, I believe that this company will capture a large % of it.

More upside to come.

For them to grow into earnings, we need to know that the market is there.

And based on how successful they have been so far, and their growing network effect, I believe that this company will capture a large % of it.

More upside to come.

• Key Takeaways:

• PayPal continues to add users

• Constant revenue growth

• Margins are improving

• Pays no dividends

• Buys back shares

• Growing industry

• 392m Accounts

Overall rating 8/10 ✅

• PayPal continues to add users

• Constant revenue growth

• Margins are improving

• Pays no dividends

• Buys back shares

• Growing industry

• 392m Accounts

Overall rating 8/10 ✅

• YouTube

I can only say so much in a thread, get the detailed report of $PYPL here.

If you found this valuable, please:

- Retweet

-Subscribe

I can only say so much in a thread, get the detailed report of $PYPL here.

If you found this valuable, please:

- Retweet

-Subscribe

• Long term holds

(Individual name)

• PayPal ( $PYPL )

• Sibanye Stillwater ( $SSW)

• Purple Group ( $PPE)

• Grand Canyon Education ( $LOPE )

Check them below 👇🏽

(Individual name)

• PayPal ( $PYPL )

• Sibanye Stillwater ( $SSW)

• Purple Group ( $PPE)

• Grand Canyon Education ( $LOPE )

Check them below 👇🏽

•Sibanye Stillwater

JSE = $SSW

NYSE = $SBSW

•World's largest Primary Producer of Platinum

•Second largest Primary Producer of palladium

•Third largest Producer of Gold.

*PE= 5.6

Look into their financials 👇🏽

JSE = $SSW

NYSE = $SBSW

•World's largest Primary Producer of Platinum

•Second largest Primary Producer of palladium

•Third largest Producer of Gold.

*PE= 5.6

Look into their financials 👇🏽

https://twitter.com/talkcentss/status/1402161083385737217

Purple Group $PPE

Financial services and technology group founded in South Africa.

• Offers online trading

• Investing

• Asset management

*PE = 72

Check financials below 👇🏽

Financial services and technology group founded in South Africa.

• Offers online trading

• Investing

• Asset management

*PE = 72

Check financials below 👇🏽

https://twitter.com/talkcentss/status/1407178073439563776

• Lewis Group - Short Term Trade

South Africa’s largest furniture chain

PE= 5.6

👇🏽

South Africa’s largest furniture chain

PE= 5.6

👇🏽

https://twitter.com/talkcentss/status/1407540691777982467

•Newsletter

Want more gems?

Then signup to my newsletter to be the first to hear about it.

Monday mornings never felt this good👇🏽

davidketh.substack.com/p/coming-soon

Want more gems?

Then signup to my newsletter to be the first to hear about it.

Monday mornings never felt this good👇🏽

davidketh.substack.com/p/coming-soon

Shout-out 🔊

This is the definition of #DYOR Thanks for making it to the end, you rock.

$PYPL $SSW #PPE

This is the definition of #DYOR Thanks for making it to the end, you rock.

$PYPL $SSW #PPE

• • •

Missing some Tweet in this thread? You can try to

force a refresh