Finance minister Smt. @nsitharaman yesterday announced slew of measures to help sectors hit by 2nd wave of pandemic.

Rs 6,28,993 crore package to support Indian economy

See below set of tweets for more details 👇

#IndiaFightsCorona #Unite2FightCorona

(1/9)

Rs 6,28,993 crore package to support Indian economy

See below set of tweets for more details 👇

#IndiaFightsCorona #Unite2FightCorona

(1/9)

✅ Rs 1.1 lakh crore loan guarantee scheme for COVID affected sectors

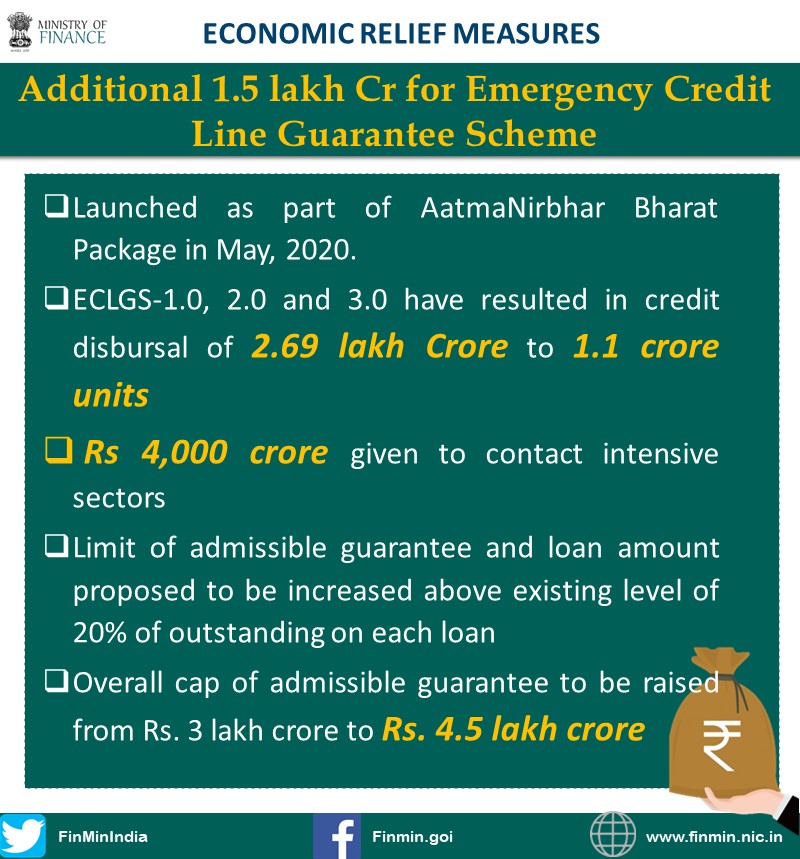

✅Additional Rs 1.5 lakh crore for Emergency Credit Line Guarantee Scheme

✅Credit Guarantee Scheme to facilitate loans to 25 lakh persons through Micro Finance Institutions (MFIs)

(2/9)

✅Additional Rs 1.5 lakh crore for Emergency Credit Line Guarantee Scheme

✅Credit Guarantee Scheme to facilitate loans to 25 lakh persons through Micro Finance Institutions (MFIs)

(2/9)

✅ Financial support to more than 11,000 Registered Tourists/ Guides/ Travel and Tourism Stakeholders

✅ Free one month Tourist Visa to first 5 lakh tourists

(3/9)

✅ Free one month Tourist Visa to first 5 lakh tourists

(3/9)

✅Extension of AatmaNirbhar Bharat Rozgar Yojana till 31st March 2022

✅Additional subsidy of Rs. 14,775 crore for DAP & P&K fertilizers

✅Extension of Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY) – Free food grains from May to November, 2021

(4/9)

✅Additional subsidy of Rs. 14,775 crore for DAP & P&K fertilizers

✅Extension of Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY) – Free food grains from May to November, 2021

(4/9)

✅Rs. 23,220 crore more for public health with emphasis on children and paediatric care/paediatric beds

✅21 varieties of bio-fortified crop for nutrition, climate resilience and other traits to be dedicated to the nation

(5/9)

✅21 varieties of bio-fortified crop for nutrition, climate resilience and other traits to be dedicated to the nation

(5/9)

✅Revival of North Eastern Regional Agricultural Marketing Corporation (NERAMAC) with package of Rs 77.45 crore

✅Rs. 33,000 crore boost for project exports through National Export Insurance Account (NEIA)

(6/9)

✅Rs. 33,000 crore boost for project exports through National Export Insurance Account (NEIA)

(6/9)

✅Rs. 88,000 crore boost to Export Insurance Cover

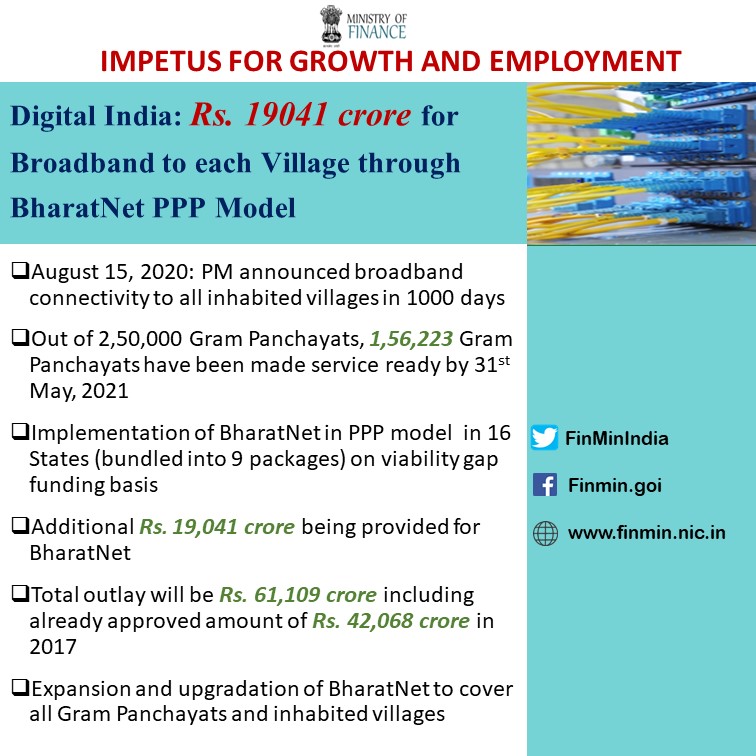

✅Rs. 19,041 crore For Broadband to each Village through BharatNet PPP Model

✅Extension of Tenure of PLI Scheme for Large Scale Electronics Manufacturing till 2025-26

(7/9)

✅Rs. 19,041 crore For Broadband to each Village through BharatNet PPP Model

✅Extension of Tenure of PLI Scheme for Large Scale Electronics Manufacturing till 2025-26

(7/9)

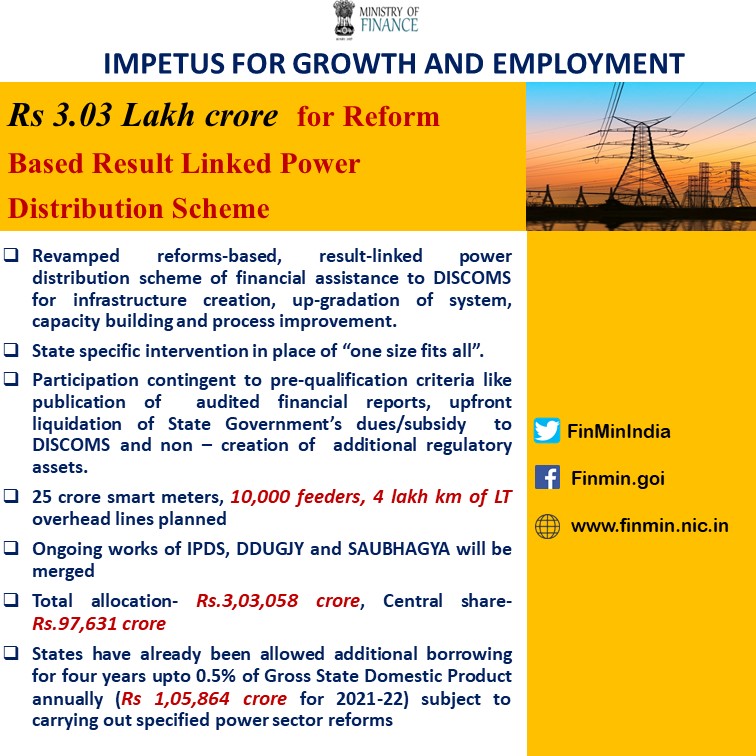

✅Rs 3.03 lakh crore for Reform-Based Result-Linked Power Distribution Scheme

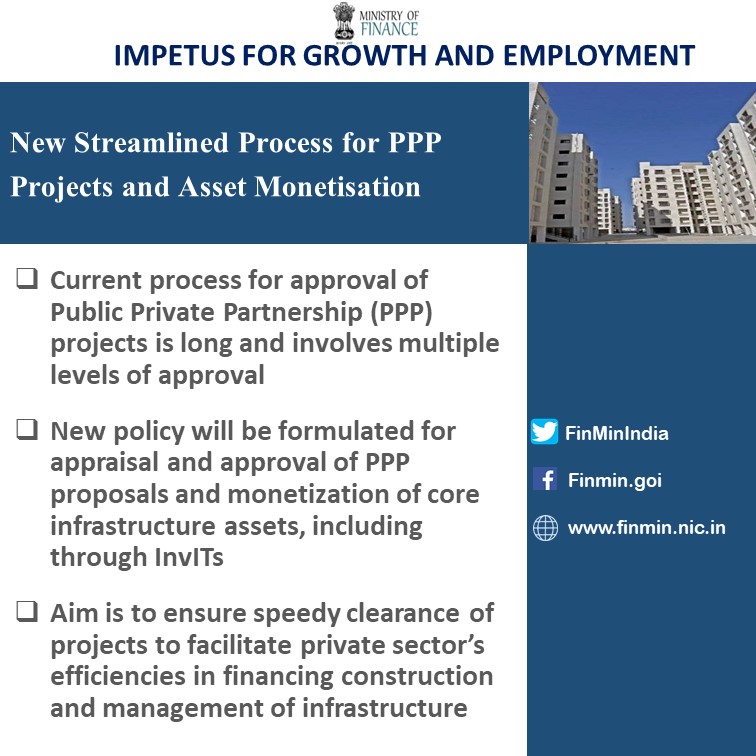

✅New Streamlined Process for PPP Projects and Asset Monetization

(8/9)

✅New Streamlined Process for PPP Projects and Asset Monetization

(8/9)

Snapshot of financial details of the schemes announced yesterday

✅Economic Relief from #COVID19 Pandemic - Rs. 3,76,244 Cr.

✅New Scheme for Public Health - Rs. 15,000 Cr.

✅Impetus for Growth and Employment - Rs. 2,37,749 Cr.

✅Total - Rs. 6,28,993 Cr.

#IndiaFightsCorona

(9/9)

✅Economic Relief from #COVID19 Pandemic - Rs. 3,76,244 Cr.

✅New Scheme for Public Health - Rs. 15,000 Cr.

✅Impetus for Growth and Employment - Rs. 2,37,749 Cr.

✅Total - Rs. 6,28,993 Cr.

#IndiaFightsCorona

(9/9)

• • •

Missing some Tweet in this thread? You can try to

force a refresh