1/ Retail Bond Investors and Credit Ratings (deHaan, Li, Watts)

"Retail investors appear to select bonds by first screening on a credit rating level, then sorting by yield. They systematically trade in the opposite direction of accounting fundamentals."

papers.ssrn.com/sol3/papers.cf…

"Retail investors appear to select bonds by first screening on a credit rating level, then sorting by yield. They systematically trade in the opposite direction of accounting fundamentals."

papers.ssrn.com/sol3/papers.cf…

2/ "Ratings are known to lag observable fundamentals & prices and can be biased due to ratings agencies' incentive conflicts, so investors have good reasons *not* to use ratings.

"At least two major online brokers' bond search tools allow investors to screen on credit ratings."

"At least two major online brokers' bond search tools allow investors to screen on credit ratings."

3/ "Formal discontinuity tests confirm the buy-sell imbalance break across the investment-grade cutoff.

"Our tests indicate that retail investors seem to use rating levels at least as a starting point for making bond trading decisions and generally prefer safer-rated bonds."

"Our tests indicate that retail investors seem to use rating levels at least as a starting point for making bond trading decisions and generally prefer safer-rated bonds."

4/ "Despite our previous finding that retail investors generally prefer safer bonds, BSI increases across within rating yield quintiles, consistent with retail investors preferring the higher-yielding (i.e., riskier) bonds within each rating level."

5/ "Prior studies document that CRAs' incentives result in untimely, inaccurate, and biased ratings.

"Our findings provide evidence for the extant theory on CRAs, which assumes the existence of unsophisticated clientele who naively rely on ratings to measure risk."

"Our findings provide evidence for the extant theory on CRAs, which assumes the existence of unsophisticated clientele who naively rely on ratings to measure risk."

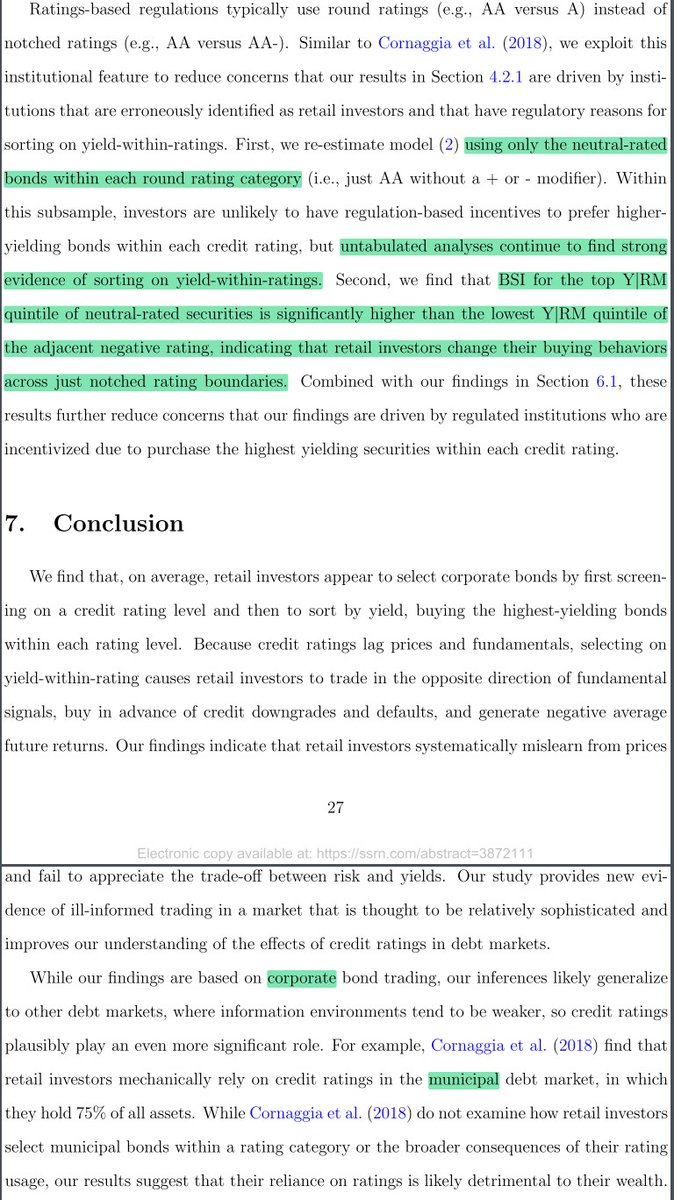

6/ "Prior studies find that insurance companies (mutual funds) select higher-yielding bonds to comply with rating-based capital requirements; (beat rating-based benchmarks).

" 'Reaching for income' by retail investors has different causes and is therefore a distinct phenomena."

" 'Reaching for income' by retail investors has different causes and is therefore a distinct phenomena."

7/ "Trades of $100,000 or less are attributed to retail investors.

"We proxy for aggregate retail investor demands using small transaction buy-sell imbalances ('BSI').

"All of our main results hold in a sample ending in 2007, long before algorithmic trading gained popularity."

"We proxy for aggregate retail investor demands using small transaction buy-sell imbalances ('BSI').

"All of our main results hold in a sample ending in 2007, long before algorithmic trading gained popularity."

8/ "Retail investors strongly prefer investment-grade securities.

"Focusing only on one month before to one month after a rating change provides a tighter event study of how retail investors respond to rating changes, especially for within-bond variation (columns 3 and 6)."

"Focusing only on one month before to one month after a rating change provides a tighter event study of how retail investors respond to rating changes, especially for within-bond variation (columns 3 and 6)."

9/ Table 3: "Retail investors are net buyers of each rating's riskiest securities.

"Results so far are consistent with retail investors following a two-step procedure: 1) screen on rating categories to narrow the universe, then 2) choose bonds with higher within-rating yields."

"Results so far are consistent with retail investors following a two-step procedure: 1) screen on rating categories to narrow the universe, then 2) choose bonds with higher within-rating yields."

10/ "Because credit ratings are slow to respond to market conditions & fundamentals, higher-yielding bonds within each rating level are likely to be those with deteriorating fundamentals... retail investors are likely trading in precisely the opposite direction of fundamentals."

11/ "Retail investors indeed trade in the opposite direction of fundamentals. Coefficients only slightly attenuate with bond fixed effects: investors are not just 'choosing the wrong bonds' in general but also dynamically buying (selling) as fundamentals deteriorate (improve)."

12/ Table 5: "Retail investors do not simply choose the worst bonds in general, but they dynamically time their trades to buy (sell) when credit deteriorates (improves). Estimated effect sizes increase in columns (4) through (6) over a six-month horizon."

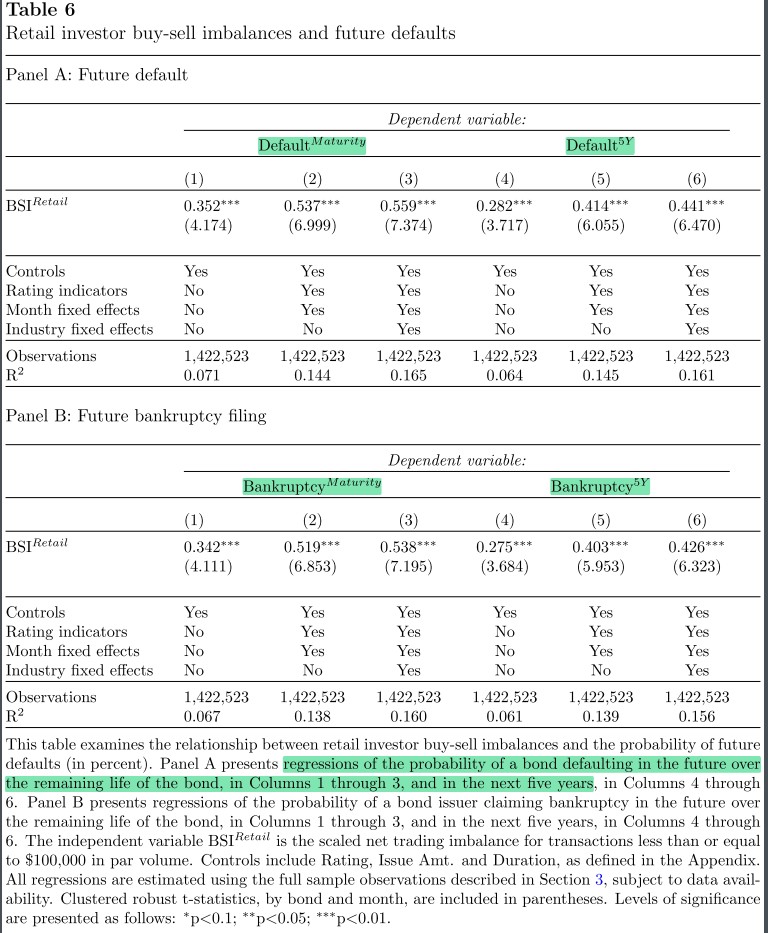

13/ "A 1σ increase in BSI is associated with a 0.217% to 0.344% higher default probability before maturity (the baseline rate is 2.153%). Most such defaults will happen within five years.

"Defaults include less severe events such as covenant violations and missed payments."

"Defaults include less severe events such as covenant violations and missed payments."

14/ "This provides strong evidence that retail investors buy into adverse credit events.

"Given that recovery values for defaulted securities are estimated to be just 24% to 37%, retail investors likely experience significant incremental losses due to their trading behavior."

"Given that recovery values for defaulted securities are estimated to be just 24% to 37%, retail investors likely experience significant incremental losses due to their trading behavior."

15/ "Attenuated value-weighted losses indicate that losses are concentrated in smaller bonds. Both equal- and value-weighted net losses are economically significant, given that the average monthly return is only 57 bps.

"Results are not explained by standard bond risk factors."

"Results are not explained by standard bond risk factors."

16/ "Figure 3 plots the cumulative return to a portfolio that is long the top quintile and short the bottom quintile of BSI. Apart from a short episode during the financial crisis, the portfolio generates consistently negative returns."

17/ "Columns 2 through 4 include control variables proposed to explain bond and stock returns. Including controls only slightly affects the results.

"We find a robust relationship between retail investor BSI and future returns, with all coefficients significant at the 1% level."

"We find a robust relationship between retail investor BSI and future returns, with all coefficients significant at the 1% level."

18/ "Exploiting this inefficiency is likely unprofitable due to limits to arbitrage. Corporate bonds can be illiquid, costly to trade, & especially costly to short. Retail investors' positions are potentially too shallow for many arbitrageurs to take the opposite direction."

19/ "Retail investors could collectively improve their bond portfolio returns by passively holding corporate bond index funds.

"Throughout our sample period, various fund families (e.g., Vanguard) offer low-fee corporate bond funds that are widely available through brokerages."

"Throughout our sample period, various fund families (e.g., Vanguard) offer low-fee corporate bond funds that are widely available through brokerages."

20/ The smallest investors have the greatest propensity toward problematic trading and negative alphas.

Institutional investors tend to trade in the opposite fashion, preferring safer bonds with improving fundamentals and (eventually) fewer negative credit events.

Institutional investors tend to trade in the opposite fashion, preferring safer bonds with improving fundamentals and (eventually) fewer negative credit events.

21/ "Trading on SUE, F-Score, or Mom signals rather than those currently followed by retail investors would help them avoid future downgrades and defaults and earn them higher risk-adjusted returns."

22/ More:

Corporate Bond Default Risk: A 150-Year Perspective

Beware of Chasing Yield: Bond Fund Yield, Flows & Performance

Rational Reminder on fixed-income factor investing (thread with links to papers)

Corporate Bond Default Risk: A 150-Year Perspective

https://twitter.com/ReformedTrader/status/1372672148683198467

Beware of Chasing Yield: Bond Fund Yield, Flows & Performance

https://twitter.com/ReformedTrader/status/1373499090781106176

Rational Reminder on fixed-income factor investing (thread with links to papers)

https://twitter.com/ReformedTrader/status/1368357840029507584

• • •

Missing some Tweet in this thread? You can try to

force a refresh