1/ Who Profits From Trading Options? (Hu, Kirilova, Park, Ryu)

"Retail investors using simple strategies lose to the rest of the market. Volatility trading earns the highest return, and risk-neutral strategies deliver the highest Sharpe ratio."

papers.ssrn.com/sol3/papers.cf…

"Retail investors using simple strategies lose to the rest of the market. Volatility trading earns the highest return, and risk-neutral strategies deliver the highest Sharpe ratio."

papers.ssrn.com/sol3/papers.cf…

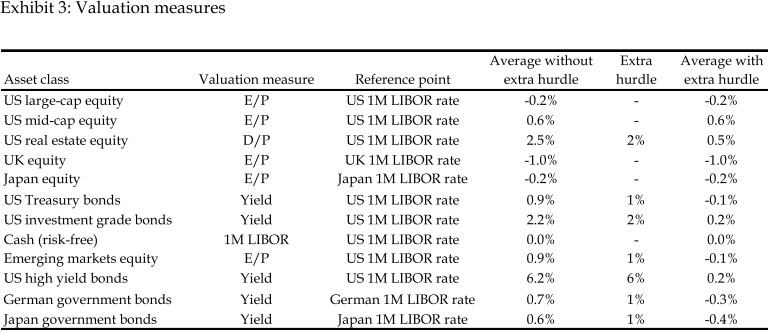

2/ "We use a unique transaction-level data set with detailed account information.

"The KOSPI 200 index listed only futures and options during our sample period, allowing us to observe an investor’s full exposure to the underlying index to determine each investor's strategy."

"The KOSPI 200 index listed only futures and options during our sample period, allowing us to observe an investor’s full exposure to the underlying index to determine each investor's strategy."

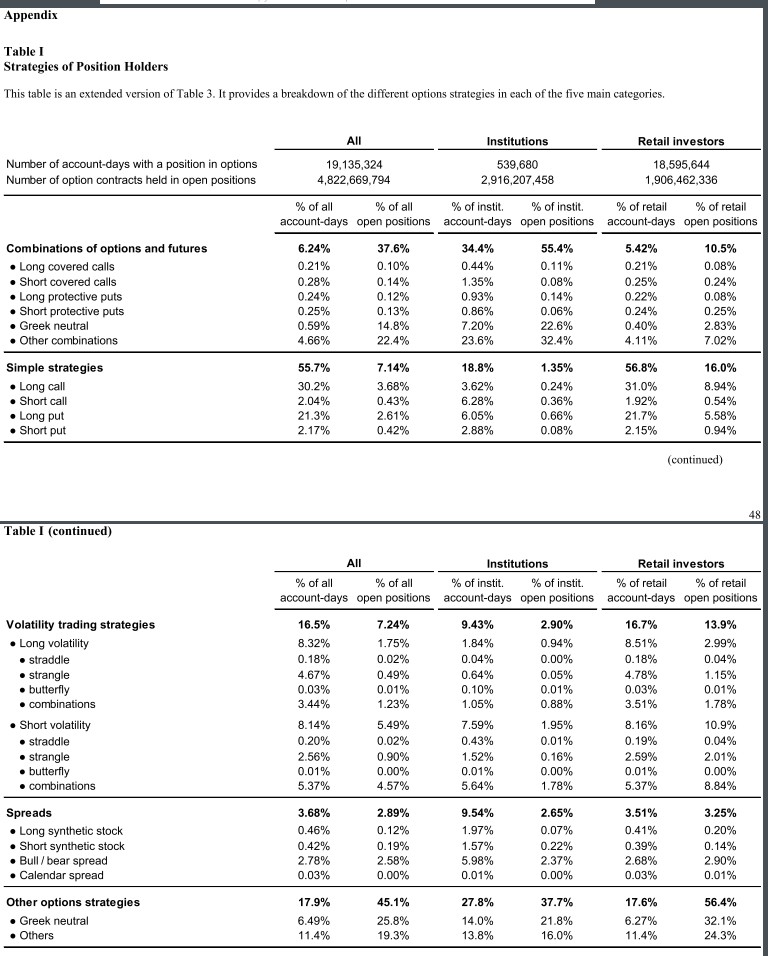

3/ "Each account in our data set has a unique encrypted ID. There are no restrictions in Korean derivatives markets regarding retail participation, and KOSPI options have low notional values.

"Institutional (retail) investors as a class tend to be liquidity takers (providers)."

"Institutional (retail) investors as a class tend to be liquidity takers (providers)."

4/ "We verify that long (short) volatility positions have average delta of 0.01 (-0.02) and average vega of 0.11 (-0.16).

"Complex combinations can reflect market making and arbitrage." Greek neutral positions = below median in both absolute scaled delta & absolute scaled vega

"Complex combinations can reflect market making and arbitrage." Greek neutral positions = below median in both absolute scaled delta & absolute scaled vega

5/ "The median appears to be an appropriate cutoff for defining the Greek-neutral positions, since they have average absolute delta (vega) of 0.01 (0.01).

"Because Greek-neutral strategies are complex & require both skill and capital, they are more popular among institutions."

"Because Greek-neutral strategies are complex & require both skill and capital, they are more popular among institutions."

6/ "An average Greek neutral trader account generates the largest mean daily trading volume of all types of traders, especially if it is an institutional account. This is consistent with our conjecture that Greek-neutral traders likely act as market makers or arbitrageurs."

7/ "Unfortunately, the exchange data we obtained do not include information on cash positions in each account. Therefore, in our analysis of investor skills, we focus on the skill of choosing option portfolios and do not address the position-sizing skill."

8/ "Simple strategy traders have the worst profitability.

"Volatility strategies are subject to negative skewness (-0.83 vs. -0.29 for the benchmark group and positive skewness for all other styles.)

"Greek neutral traders outperform everyone else in terms of Sharpe ratios."

"Volatility strategies are subject to negative skewness (-0.83 vs. -0.29 for the benchmark group and positive skewness for all other styles.)

"Greek neutral traders outperform everyone else in terms of Sharpe ratios."

9/ "As volatility trading profits depends on the market conditions during a particular time period, it is significant that our sample can be considered representative, as it contains both periods of low volatility and periods of market stress with spikes in volatility."

10/ "Table 6 supports our hypothesis that both investor class and trading style complexity measure investor sophistication and trading skills. Trading styles have an important effect on investment performance, in addition to, and even greater than, the effect of investor class."

11/ "Trading style effects remain the same after we account for systematic risk.

"But when we remove the loadings on systematic risk factors from the daily returns in regression 1, we find that institutional investors on average do not earn higher returns than retail investors."

"But when we remove the loadings on systematic risk factors from the daily returns in regression 1, we find that institutional investors on average do not earn higher returns than retail investors."

12/ "Retail investors using simple strategies and day trading heavily underperform peers.

"However, institutional investors using the same strategies perform well, which may be due to their advanced information and low trading latency."

"However, institutional investors using the same strategies perform well, which may be due to their advanced information and low trading latency."

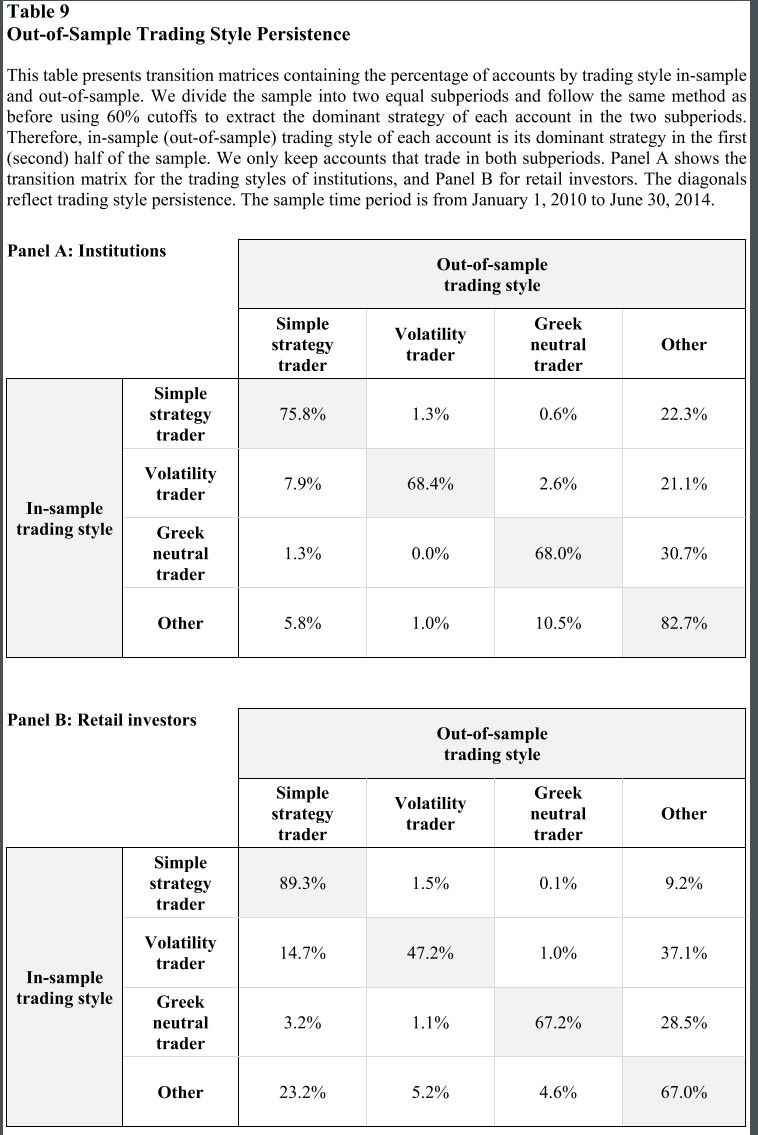

13/ "We split the sample into two subperiods (Jan 2010–Mar 2012 & Apr 2012–Jun 2014). We mark the in-sample & out of-sample style of each account as its dominant strategy in the first & second half of the sample, respectively.

"Investors tend to adhere to one style over time."

"Investors tend to adhere to one style over time."

14/ "When we use the dominant strategies identified in the *first* half as instruments for those in the *second* half, we find the effects of trading style on investment performance to be similar to those in our main results. This confirms that the style effects are not random."

15/ "Results suggest that sophisticated traders have learned which trading style is most profitable for them and adopted it as their dominant one.

"On the other hand, retail investors who predominantly use simple strategies do not appear to learn from their lack of success."

"On the other hand, retail investors who predominantly use simple strategies do not appear to learn from their lack of success."

16/ "Greek-neutral traders seem to perform better with nondominant strategies, but this may be misleading. Greek-neutral strategies, by nature, may not have high absolute returns; investors primarily using these strategies may focus on risk control instead of absolute returns."

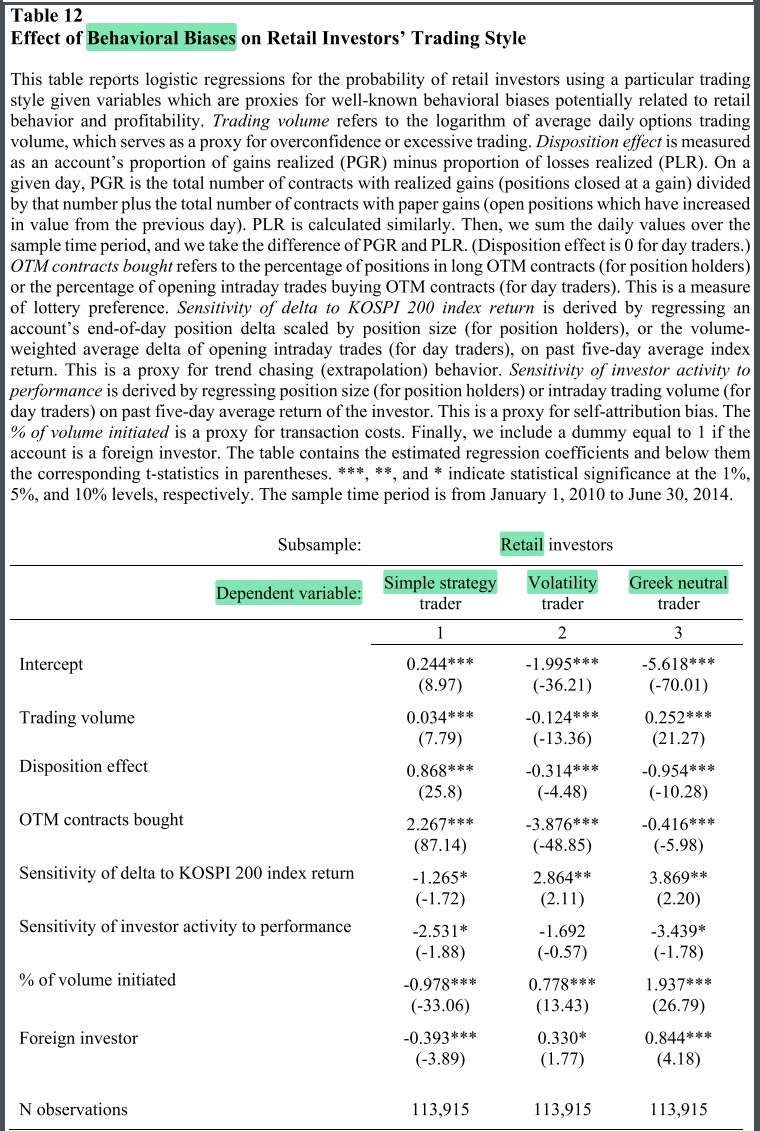

17/ "We explore possible causes of the underperformance by retail simple strategy traders.

"Using each account’s activity and performance measures, we construct account-level proxies for the five behavioral biases that are among the most well-known in the literature."

"Using each account’s activity and performance measures, we construct account-level proxies for the five behavioral biases that are among the most well-known in the literature."

18/ "Though results do show many of the behavioral biases adversely affecting performance, trading style effects remain strongly significant.

"This suggests a separate venue for styles to impact performance through investor (un)sophistication rooted in yet-unidentified causes."

"This suggests a separate venue for styles to impact performance through investor (un)sophistication rooted in yet-unidentified causes."

19/ "Trading style effects may exist in other financial markets and enable investors to explore various trading strategies. Examining the additional style effects in other markets would be a valuable line of research for future studies."

• • •

Missing some Tweet in this thread? You can try to

force a refresh