A thread on Relaxo Footwears Limited

#Relaxo #footwear #Company #StockMarketindia #StockMarket #stocks

#Relaxo #footwear #Company #StockMarketindia #StockMarket #stocks

1/ About the Company

Relaxo, located in New Delhi, is one of the largest players in the non-leather footwear market in India and manufactures Hawai slippers, EVA (ethylene vinyl acetate) and PU (polyurethane) based, slippers, sports shoes and sandals

Relaxo, located in New Delhi, is one of the largest players in the non-leather footwear market in India and manufactures Hawai slippers, EVA (ethylene vinyl acetate) and PU (polyurethane) based, slippers, sports shoes and sandals

2/ Operational Facilities

Relaxo has 8 manufacturing facilities across India

Capacity to produce 7.5 lakh pairs per day

Access to 50K+ retailers through 650 distributors

398 exclusive brand outlets as on 31st March 2021

Sold 19.1 Cr. units in FY2021 across 9 brand names

Relaxo has 8 manufacturing facilities across India

Capacity to produce 7.5 lakh pairs per day

Access to 50K+ retailers through 650 distributors

398 exclusive brand outlets as on 31st March 2021

Sold 19.1 Cr. units in FY2021 across 9 brand names

3A/ Financials

The pandemic caused stunted growth

Net sales saw a marginal decline of 2% in FY21

EBITDA grew 21.5% in FY21 to INR 495.5 Cr. due to fall in RM cost, better product mix & improved efficiency

Volume of sale continued to grow by 7%

PAT grew by 29% to INR 291.6Cr

The pandemic caused stunted growth

Net sales saw a marginal decline of 2% in FY21

EBITDA grew 21.5% in FY21 to INR 495.5 Cr. due to fall in RM cost, better product mix & improved efficiency

Volume of sale continued to grow by 7%

PAT grew by 29% to INR 291.6Cr

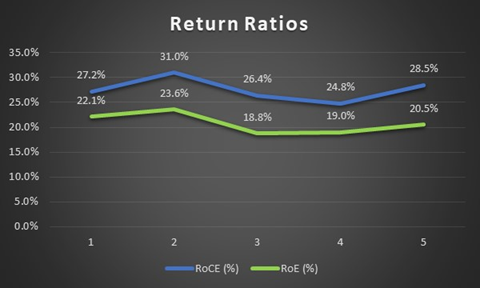

3B/ Financials

The EBITDA margin improved 451bps to 21.96% in FY21

PAT margin improved 297bps to 12.36%

The company generated INR 513 Cr. Cash flow from operations

They used to cash flow to become debt free

Additional cash was infused into current investments and purchase of PPE

The EBITDA margin improved 451bps to 21.96% in FY21

PAT margin improved 297bps to 12.36%

The company generated INR 513 Cr. Cash flow from operations

They used to cash flow to become debt free

Additional cash was infused into current investments and purchase of PPE

4/ Management

Ramesh Kumar Dua, Mukand Lal Dua and Nikhil Dua are part of the promoter group

The first two have over 45 years of experience in the industry

Promoters hold 70.9% of shares in the company

Ramesh Kumar Dua, Mukand Lal Dua and Nikhil Dua are part of the promoter group

The first two have over 45 years of experience in the industry

Promoters hold 70.9% of shares in the company

5A/ Sector Analysis

India is 2nd largest footwear producer accounting for 9% of world market

Indian exports 10% of its production

Indian share in global exports is 2% as compared to China with 40%

With rise in disposable income and ample growth room the industry is bound to rise

India is 2nd largest footwear producer accounting for 9% of world market

Indian exports 10% of its production

Indian share in global exports is 2% as compared to China with 40%

With rise in disposable income and ample growth room the industry is bound to rise

5B/ Sector Analysis

Footwear industry recognized by GoI as a focus in ‘Make In India’

Consumers becoming more brand-centric in tier II, tier III cities and rural markets

GST is making the shift from unorganized to organized

Organized segment today caters to 45% of the market

Footwear industry recognized by GoI as a focus in ‘Make In India’

Consumers becoming more brand-centric in tier II, tier III cities and rural markets

GST is making the shift from unorganized to organized

Organized segment today caters to 45% of the market

7/ Future Outlook

The company is the market leader in the value-priced segment

They will gain market share from unorganized players

Company investing in brand building & promotional activities

Expanding in PAN India & Overseas markets

Streamlined its strong distribution network

The company is the market leader in the value-priced segment

They will gain market share from unorganized players

Company investing in brand building & promotional activities

Expanding in PAN India & Overseas markets

Streamlined its strong distribution network

• • •

Missing some Tweet in this thread? You can try to

force a refresh