1/ IPO Details

Date of Offer: 7th July-9th July

Price Band: INR 880-900

Min. Order Qty: 16 Shares

Fresh Issue: INR 0 Cr

Offer for Sale: INR 1546.6 Cr

The company will not receive proceeds of the issue

Date of Offer: 7th July-9th July

Price Band: INR 880-900

Min. Order Qty: 16 Shares

Fresh Issue: INR 0 Cr

Offer for Sale: INR 1546.6 Cr

The company will not receive proceeds of the issue

2/ About

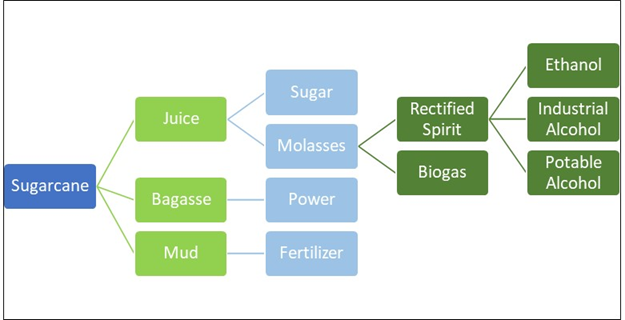

CSTL manufactures specialty chemicals such as performance chemicals, pharmaceutical intermediates & FMCG chemicals

Focused on developing newer technologies using in house catalytic processes

products used as key starting level materials, as inhibitors or additives

CSTL manufactures specialty chemicals such as performance chemicals, pharmaceutical intermediates & FMCG chemicals

Focused on developing newer technologies using in house catalytic processes

products used as key starting level materials, as inhibitors or additives

3/ Operational Highlights

Key customers include Bayer AG, SRF Ltd, Gennex Laboratories, Nutriad International NV & Vinati Organics

2 production facilities with capacity of 29,900 MTPA (Utilization 71.94% in FY21)

Majority exports to China, Europe and the US

Key customers include Bayer AG, SRF Ltd, Gennex Laboratories, Nutriad International NV & Vinati Organics

2 production facilities with capacity of 29,900 MTPA (Utilization 71.94% in FY21)

Majority exports to China, Europe and the US

4/ Financials

CSTL’s consolidated revenue, EBITDA and net profit recorded 14%, 38% and 43% CAGR, respectively through FY19-FY21

CSTL has maintained good profitability margins over the years

The company has remained debt free over the past few years with adequate liquidity

CSTL’s consolidated revenue, EBITDA and net profit recorded 14%, 38% and 43% CAGR, respectively through FY19-FY21

CSTL has maintained good profitability margins over the years

The company has remained debt free over the past few years with adequate liquidity

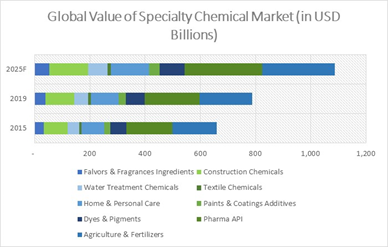

5/ Global Outlook

The global chemicals market is valued at $4738B in 2019

Expected to grow at a CAGR of 6.2% to $6785B by 2025

Growing trend in the chemicals industry to shift towards green chemicals

Global green chemicals market is expected to grow at a CAGR of 10.5% till FY25

The global chemicals market is valued at $4738B in 2019

Expected to grow at a CAGR of 6.2% to $6785B by 2025

Growing trend in the chemicals industry to shift towards green chemicals

Global green chemicals market is expected to grow at a CAGR of 10.5% till FY25

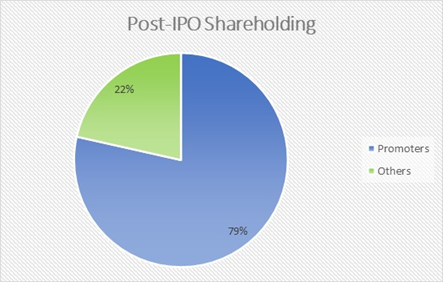

7/ Promoter & Major Shareholder Details

The promoters of the company held 94.65% and their

shareholding are as follows:

Ashok Ramnarayan Boob (15.4%)

Krishnakumar Ramnarayan Boob (4.7%)

Siddhartha Ashok Sikchi (3.4%)

Parth Ashok Maheshwari (6.4%)

Promoter Group (64.9%)

The promoters of the company held 94.65% and their

shareholding are as follows:

Ashok Ramnarayan Boob (15.4%)

Krishnakumar Ramnarayan Boob (4.7%)

Siddhartha Ashok Sikchi (3.4%)

Parth Ashok Maheshwari (6.4%)

Promoter Group (64.9%)

8/ Strengths

Leverage R&D capabilities and understanding of catalysis to develop new product portfolio

Expansion of manufacturing capacity for existing products – 4th facility planned

Strong and long-standing relationships with key customers

Leverage R&D capabilities and understanding of catalysis to develop new product portfolio

Expansion of manufacturing capacity for existing products – 4th facility planned

Strong and long-standing relationships with key customers

9/ Risk Factors

High reliance on top 10 customer (48%)

Major Revenue from exports thereby adverse global tensions can impact business

High reliance on sale of one product - MEHQ (48%)

All manufacturing facilities located in Maharashtra

None of its catalytic processes are patented

High reliance on top 10 customer (48%)

Major Revenue from exports thereby adverse global tensions can impact business

High reliance on sale of one product - MEHQ (48%)

All manufacturing facilities located in Maharashtra

None of its catalytic processes are patented

• • •

Missing some Tweet in this thread? You can try to

force a refresh