1/ Market for Financial Advice: An Audit Study (Mullainathan, Noeth, Schoar)

"Advisers encourage returns-chasing behavior and push for actively managed funds with higher fees, even if the client starts with a well-diversified, low-fee portfolio."

papers.ssrn.com/sol3/papers.cf…

"Advisers encourage returns-chasing behavior and push for actively managed funds with higher fees, even if the client starts with a well-diversified, low-fee portfolio."

papers.ssrn.com/sol3/papers.cf…

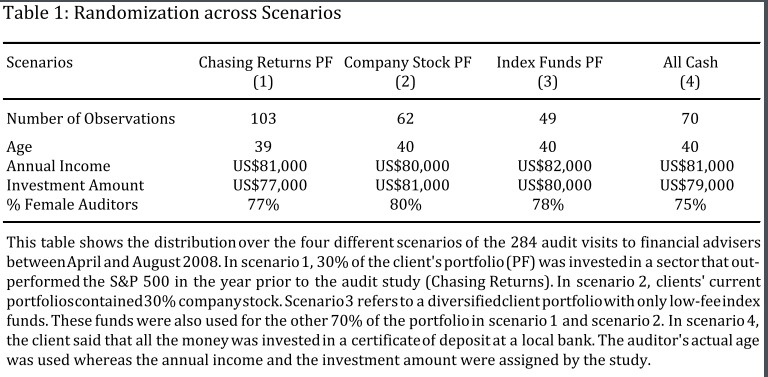

2/ "The advisers we study are usually paid based on the fees they generate but not based on AUM or the performance of the portfolio.

"We do not include tax advisers, advisers who also provide estate planning services, or providers of other wealth management services."

"We do not include tax advisers, advisers who also provide estate planning services, or providers of other wealth management services."

3/ "Financial advice generates $20-$50bn fees/year, depending on definition & compensation models.

"When advisers mentioned fees in our study, they did so in a way that downplayed them without lying (e.g., “This fund has 2% fee, but that is not much above the industry average.”"

"When advisers mentioned fees in our study, they did so in a way that downplayed them without lying (e.g., “This fund has 2% fee, but that is not much above the industry average.”"

4/ " “Mentioning fees” may include statements like “this is a no-load fund”, i.e. not all relevant fees are mentioned.

"Our audit methodology allows us to enables us to control for the selection of clients to advisers, addressing one of the problems with non‐experimental data."

"Our audit methodology allows us to enables us to control for the selection of clients to advisers, addressing one of the problems with non‐experimental data."

5/ "We sent trained auditors to impersonate customers seeking advice on how to invest retirement savings outside of a 401k plan."

Given the small purported client wealth, most of the advisors "are paid on commission based on fees & volume they generate" rather than % of AUM.

Given the small purported client wealth, most of the advisors "are paid on commission based on fees & volume they generate" rather than % of AUM.

6/ "Audit data was collected Apr-Aug 2008 (after Bear Stearns problems surfaced but before the Lehman bankruptcy).

"Changing economic conditions were especially important for the chasing returns treatment, since the outperforming industries of the previous year had changed."

"Changing economic conditions were especially important for the chasing returns treatment, since the outperforming industries of the previous year had changed."

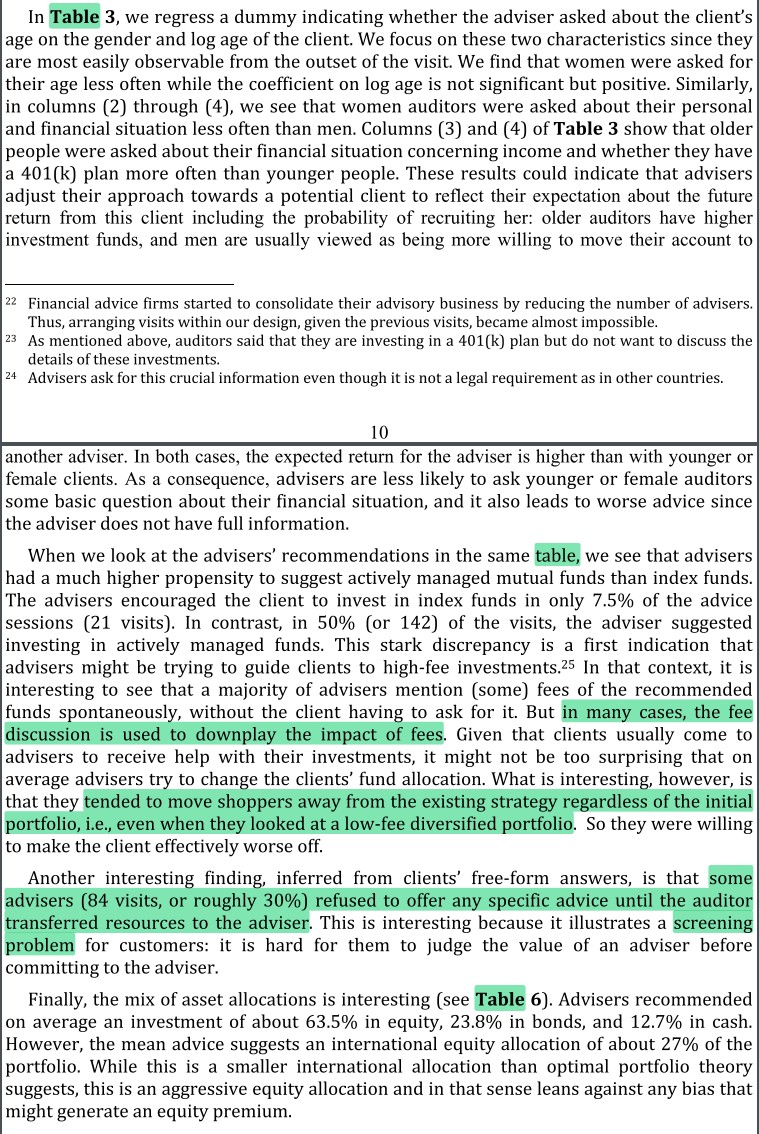

7/ "Advisers had a much higher propensity to suggest actively managed mutual funds (50% of visits) than index funds (7.5% of visits).

"This discrepancy is a first indication that advisers might be trying to guide clients to high‐fee investments."

"This discrepancy is a first indication that advisers might be trying to guide clients to high‐fee investments."

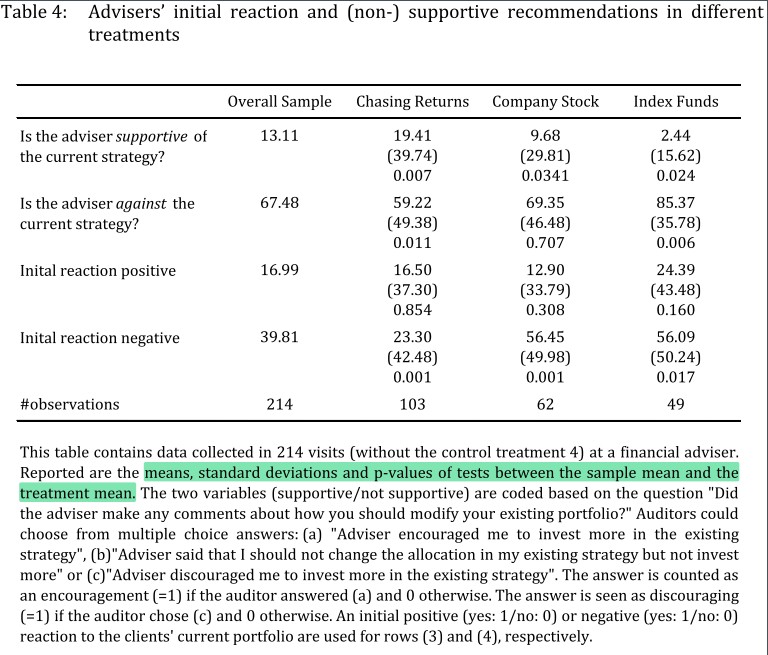

8/ "Overall, advisers seem to support strategies that result in more transactions and higher management fees.

"Advisers go against the revealed preferences of the client and suggest changes away from the current strategy (though they try to be more positive it initially)."

"Advisers go against the revealed preferences of the client and suggest changes away from the current strategy (though they try to be more positive it initially)."

9/ Table 5: "We cluster observations at individual client level to control for base-rate characteristics & include month-fixed effects.

"Results strongly suggest that advisers dissuade clients from an efficient portfolio, possibly b/c it minimizes fee income for the adviser."

"Results strongly suggest that advisers dissuade clients from an efficient portfolio, possibly b/c it minimizes fee income for the adviser."

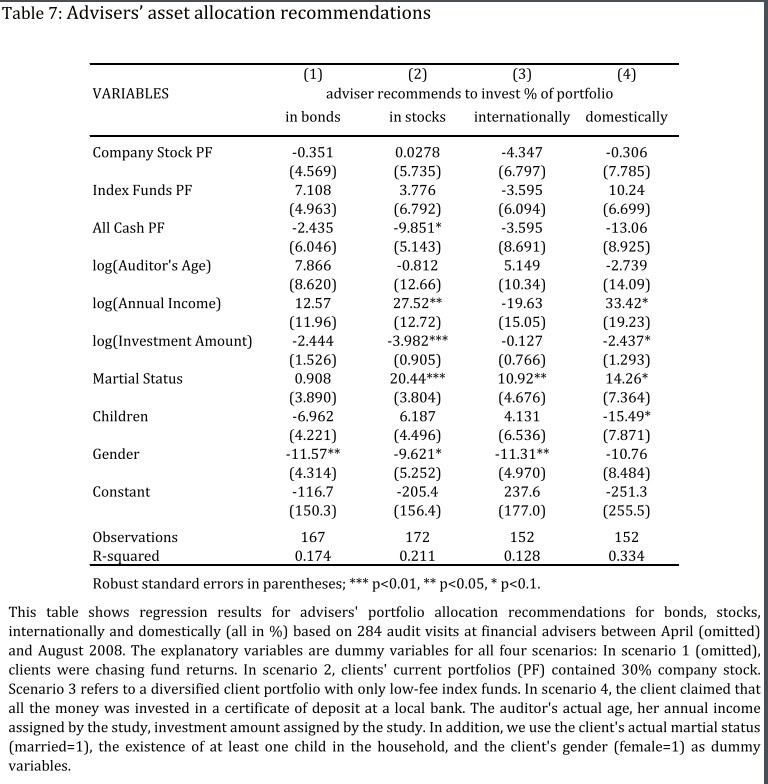

10/ "Advisers did not seem to tailor asset allocation based on the scenario auditors come in with (none of the comparisons are significant).

"Advisers were more likely to recommend actively managed (vs. index) funds, especially to auditors who came in with an index portfolio."

"Advisers were more likely to recommend actively managed (vs. index) funds, especially to auditors who came in with an index portfolio."

11/ "In a large fraction of the visits, we did not get very detailed quantitative advice about which specific funds to invest in, since many advisers insisted that the client should first place the funds with the adviser’s company."

12/ "This situation is puzzling, since it forces the client to choose an adviser without being able to get any indication of the person’s quality upfront. The result in Table 9, column 4 shows that this behavior was most pronounced towards female auditors."

13/ "In general, advisers did not proactively reach out to clients to rebalance the portfolio due to changing circumstances of the client but only to sell them new funds and generate fees."

14/ "In this audit study, auditors were willing to go back to 70% of the advisers they visited but now with their own money (see Table 2).

"In other words, most advisers succeeded in convincing their potential clients and thus have no need to change their advice-giving."

"In other words, most advisers succeeded in convincing their potential clients and thus have no need to change their advice-giving."

15/ Note: The "efficient" portfolio described in the paper may not necessarily be the best-performing one. More about this:

Mapping Investable Return Sources to Macro Environments

Can Risk Parity Outperform If Yields Rise?

Mapping Investable Return Sources to Macro Environments

https://twitter.com/ReformedTrader/status/1410309893425287171

Can Risk Parity Outperform If Yields Rise?

https://twitter.com/ReformedTrader/status/1337205904932945921

16/ Related reading on financial advice:

Misguided Beliefs of Financial Advisors

Financial Advice & Bank Profits

Misguided Beliefs of Financial Advisors

https://twitter.com/ReformedTrader/status/1225239381327302658

Financial Advice & Bank Profits

https://twitter.com/ReformedTrader/status/1231471053420912640

• • •

Missing some Tweet in this thread? You can try to

force a refresh