Trimming or permanently selling out of winners for no good reason is a terrible idea!

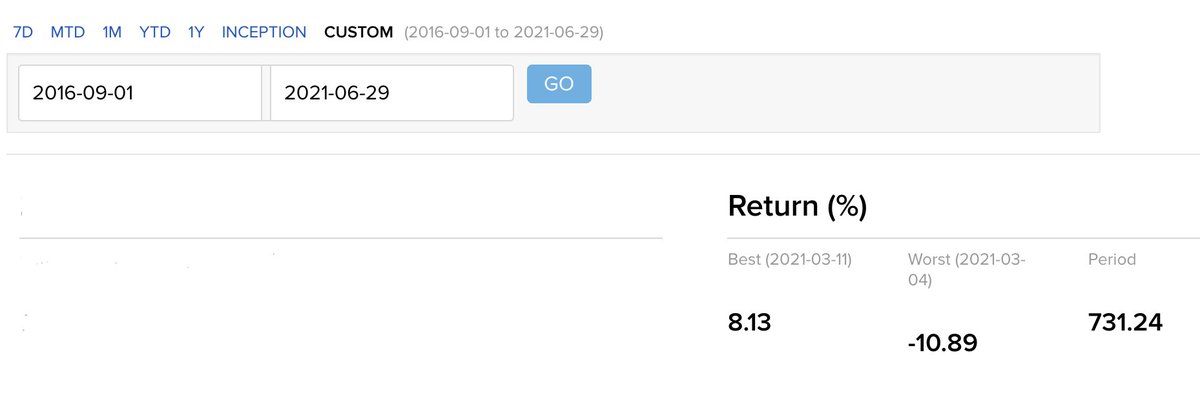

The big returns are generated by holding, not by selling.

The big returns are generated by holding, not by selling.

By "taking" a 20% or 30% of 40% profit, one misses out on 200% or 300% or 400% gains.

If you sell, you can no longer benefit from those stocks.

Very few companies compound like crazy, best to hold onto them for as long as possible.

If you sell, you can no longer benefit from those stocks.

Very few companies compound like crazy, best to hold onto them for as long as possible.

IMHO, the reasons when a great stock should be sold -

- Business matures (can't grow)

- Management changes or deteriorates

- The business outlook deteriorates (competition)

- Cash is needed for a younger compounder

- Stock triples/quadruples within months

Hope this is helpful.

- Business matures (can't grow)

- Management changes or deteriorates

- The business outlook deteriorates (competition)

- Cash is needed for a younger compounder

- Stock triples/quadruples within months

Hope this is helpful.

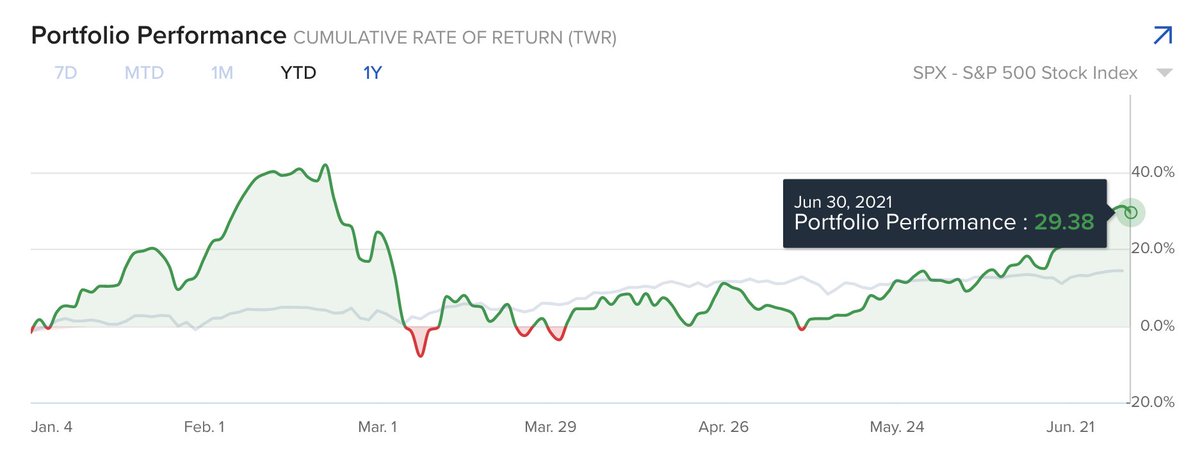

Finally, out of all the above reasons, selling solely because of a huge run up is *very* risky.

Stock can keep running even more and its very hard to time the pullback and know when to re-invest (not to mention tax consequences).

Therefore, best to just hold onto winners.

Stock can keep running even more and its very hard to time the pullback and know when to re-invest (not to mention tax consequences).

Therefore, best to just hold onto winners.

• • •

Missing some Tweet in this thread? You can try to

force a refresh