1) Portfolio update Jun-end -

$ADYEY $AFTPY $AGC $CRWD $DKNG $DOCU $FVRR $GHVI $GLBE $LSPD $MELI $OZON $PINS $PLTR $ROKU $RTP $SE $SHOP $SNAP $SNOW $TWLO $UPST

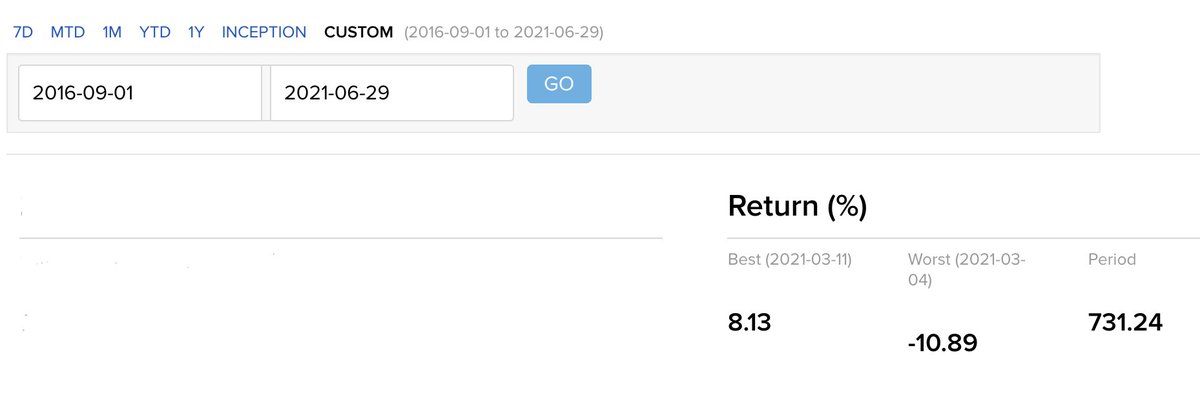

Return since 1 Sept '16 -

Portfolio +731.24% (55.03%pa)

$ACWI +72.91% (12.01%pa)

$SPX +97.96% (15.19%pa)

$ADYEY $AFTPY $AGC $CRWD $DKNG $DOCU $FVRR $GHVI $GLBE $LSPD $MELI $OZON $PINS $PLTR $ROKU $RTP $SE $SHOP $SNAP $SNOW $TWLO $UPST

Return since 1 Sept '16 -

Portfolio +731.24% (55.03%pa)

$ACWI +72.91% (12.01%pa)

$SPX +97.96% (15.19%pa)

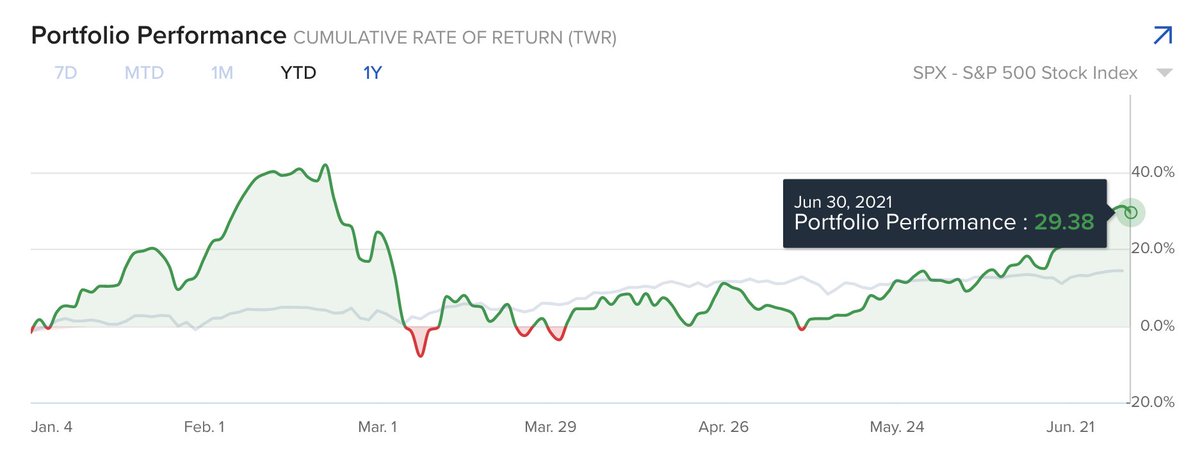

2) YTD return -

Portfolio +29.38%

$ACWI +11.40%

$SPX +14.41%

Biggest positions -

1) $GLBE 2) $SE 3) $MELI 4) $ROKU 5) $SNAP

New buys - $FVRR

Sales - $CPNG $PATH

Contd....

Portfolio +29.38%

$ACWI +11.40%

$SPX +14.41%

Biggest positions -

1) $GLBE 2) $SE 3) $MELI 4) $ROKU 5) $SNAP

New buys - $FVRR

Sales - $CPNG $PATH

Contd....

Commentary -

June turned out to be a good month for my portfolio.

After the spring swoon, growth stocks finally rebounded on the back of declining long dated rates and this benefited my portfolio.

During the month, I made a handful of changes. In terms of sales, I got rid..

June turned out to be a good month for my portfolio.

After the spring swoon, growth stocks finally rebounded on the back of declining long dated rates and this benefited my portfolio.

During the month, I made a handful of changes. In terms of sales, I got rid..

...of my shares in $CPNG , $PATH and #NQ_F .

$CPNG was sold at a pretty decent loss (~30%) as I reassessed the company's TAM and low gross margin. Even though this looks like a good business, I don't think its stock will set the world on fire due to its already big market cap,..

$CPNG was sold at a pretty decent loss (~30%) as I reassessed the company's TAM and low gross margin. Even though this looks like a good business, I don't think its stock will set the world on fire due to its already big market cap,..

...lack of optionality and limited TAM. Consequently, I decided to take my loss.

Elsewhere, I sold my shares in $PATH with a small profit because its revenue growth rate decelerated sharply in Q1' 21 and I couldn't justify its hefty valuation. Plus, I didn't feel comfortable...

Elsewhere, I sold my shares in $PATH with a small profit because its revenue growth rate decelerated sharply in Q1' 21 and I couldn't justify its hefty valuation. Plus, I didn't feel comfortable...

...with its on-premise offering.

I used those sale proceeds to re-invest in $FVRR after its large pullback. This looks like a promising, category leading business in the gig economy space which is still pretty early in its lifecycle and has excellent operating metrics!...

I used those sale proceeds to re-invest in $FVRR after its large pullback. This looks like a promising, category leading business in the gig economy space which is still pretty early in its lifecycle and has excellent operating metrics!...

...This is why I decided to buy shares and build a medium size position.

$GLBE was a star performer in June as its stock nearly doubled in a month and it is now my biggest position by a country mile.

Today, I finally trimmed some shares (~10%) and added to my position....

$GLBE was a star performer in June as its stock nearly doubled in a month and it is now my biggest position by a country mile.

Today, I finally trimmed some shares (~10%) and added to my position....

... in Matterport, which published an exciting news release about a collaboration with $FB AI.

In my view, Matterport will probably become the dominant player in the 3-D capture + modelling space (perhaps a verb like Zoom) and it is still very early in its growth phase, which..

In my view, Matterport will probably become the dominant player in the 3-D capture + modelling space (perhaps a verb like Zoom) and it is still very early in its growth phase, which..

...is why I decided to increase my position after today's news release. Since $GLBE had run up a lot this month and I needed cash, trimmed this large position.

Turning to liquidity, it appears as though the Fed will make some sort of QE taper announcement in August...

Turning to liquidity, it appears as though the Fed will make some sort of QE taper announcement in August...

...and that could create some volatility in the stock market. However, if history is any guide, the next 18-20% pullback in $SPX (and more in high beta stocks) will probably arrive towards the end of QE but in this business, there are no guarantees so best to keep an open mind...

For my part, I'm just staying invested in some of the best businesses that I've been able to find and during this difficult period, they are growing like weeds -->

Q1 YOY revenue growth rates between 49-175%!

Their business success is being reflected in their market caps...

Q1 YOY revenue growth rates between 49-175%!

Their business success is being reflected in their market caps...

...which is why my portfolio has appreciated by 29.38% YTD...okay, the hedging during the spring swoon helped...but you get the drift.

The best part is that I'm no genius and anybody can invest in and profit from these wonderful businesses!

Post retirement (mid-2016)...

The best part is that I'm no genius and anybody can invest in and profit from these wonderful businesses!

Post retirement (mid-2016)...

...my portfolio CAGR has been ~55% and my entire account has appreciated by 731.24% (after 4 years and 10 months, $1 invested has grown to $8.31).

I'm mentioning this not to gloat but to show that anybody who invests in world-class businesses and stays the course can do this...

I'm mentioning this not to gloat but to show that anybody who invests in world-class businesses and stays the course can do this...

...As long as one diversifies sufficiently (18-22 companies are the sweet spot), doesn't take on excessive leverage and is able to ignore the macro calls of impending doom, he/she can beat the market and generate decent returns.

Hope this has been helpful. All the best!

Hope this has been helpful. All the best!

• • •

Missing some Tweet in this thread? You can try to

force a refresh