Ten Ways To Say 'No!'

Recently I profiled the health sector on the #ASX taking a top-down look for compounders, and skimming all 182 listed stocks to identify candidates for further research. I found 10.

Let's take 10 shallow dives!👇

Recently I profiled the health sector on the #ASX taking a top-down look for compounders, and skimming all 182 listed stocks to identify candidates for further research. I found 10.

Let's take 10 shallow dives!👇

https://twitter.com/DownunderValue/status/1404671794754166790

1. Saying ‘No’ is the polar opposite for clickbait on Fintwit. But I don't care.

For me it’s an important part of my research – I start top-down looking for sectors based themes using one of six investment thesis, and then hone in on the best company to play that.

For me it’s an important part of my research – I start top-down looking for sectors based themes using one of six investment thesis, and then hone in on the best company to play that.

2. Investment thesis: Quality, Value, Stalwart.

Preferably but not essential a compounder through roll-ups in a fragmented industry. I'm agnostic to market cap and sub-sector, but specifically avoiding high-risk bets on R&D outcomes (think: health tech, biopharma).

Preferably but not essential a compounder through roll-ups in a fragmented industry. I'm agnostic to market cap and sub-sector, but specifically avoiding high-risk bets on R&D outcomes (think: health tech, biopharma).

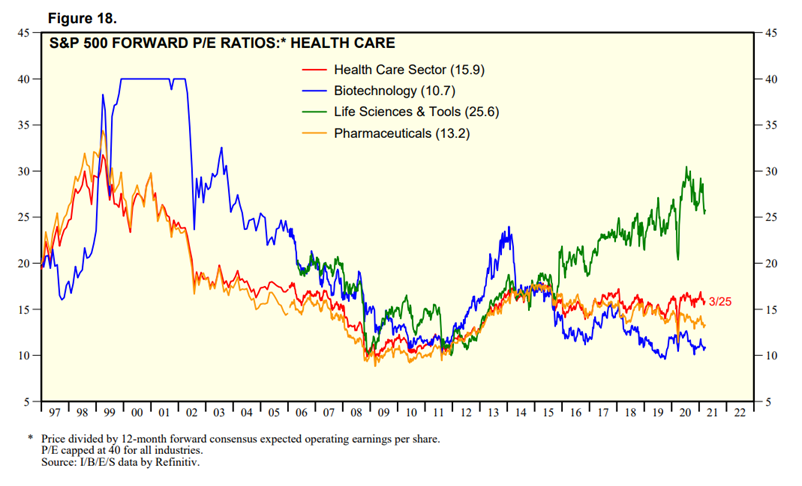

3. And here's some more macro data from @JPMorganAM 'Guide to the Markets' slide deck. Really quite good.

You'll see value = cheap, health / utilities / consumer staples impervious to GDP, while the gap with current vs historical forward PE is relatively low. ✅

You'll see value = cheap, health / utilities / consumer staples impervious to GDP, while the gap with current vs historical forward PE is relatively low. ✅

4. Probiotec $PBP $PBP.AX is on my watch list, it’s the closest I got in my shallow dives.

They are a contract manufacturer and packaging company. The thesis is they have a new management keen on acquisitions to roll-up a fragmented industry.

They are a contract manufacturer and packaging company. The thesis is they have a new management keen on acquisitions to roll-up a fragmented industry.

5. Management has been buying up good companies at really decent valuations – generally around x0.75 revenues and x4.5 EBITDA.

But hard to judge the FCF as this is not shared, and there could be CAPEX requirements > synergies achieved.

But hard to judge the FCF as this is not shared, and there could be CAPEX requirements > synergies achieved.

6. Financials have been mixed, but recently saw good top-line growth with PE=13 including multipack acquisition.

My reason for ‘No’ is the debt, shareholder dilution (10% since FY16), and that KPIs for management are not disclosed (!). The lack of clarity is my issue here.

My reason for ‘No’ is the debt, shareholder dilution (10% since FY16), and that KPIs for management are not disclosed (!). The lack of clarity is my issue here.

7. Cleanspace $CSX $CSX.AX designs respiratory systems for healthcare and industrial employees, all the rage with Covid. Pretty fancy looking respirators, masks, filters, etc. Share price has been up since Covid tailwinds.

8. Insider holding is low (<10%), with no participation in recent IPO (smart, price tumbled after that). Revenue dropped from $18m to $7m in previous quarter results – ouch – due to US regs on procurement changing. Really not clear the product is actually marketable. 🤷

9. Nova Eye Medical $EYE $EYE.AX has two impressive technologies for eye care health. iTRACK for glaucoma's, and 2RT for laser surgery of macular degeneration.

Their tech is approved in Europe, Australia and going through DFA approval in US.

Their tech is approved in Europe, Australia and going through DFA approval in US.

10. While they have $30m cash (mC $47m, EV $18m), they are burning cash at $6m p/a as they up their R&D but lack the scale. This is a bet on their glaucoma surgical device, which is a big unknown as it’s not clearly ‘best in class’.

Risk of further cap raise is why I'm a No.

Risk of further cap raise is why I'm a No.

11. Quantum Health Group $QTM $QTM.AX is a medical imaging company operating in a range of Asian markets including Australia.

Oh, and they have heating and cooling energy-saving pump technology globally.

Oh, and they have heating and cooling energy-saving pump technology globally.

12. Despite EV/EBITDA <7; PE of 11; P/S of 1; P/B of 1.5, the FY20 results look better as they are infalted through Jobkeeper.

The lack of clear profit and strategic direction is a clear No for me.

The lack of clear profit and strategic direction is a clear No for me.

13. Trajan $TRJ $TRJ.AX provides testing / sampling instruments and solutions (think: pathology, nutrition) across the world.

Founder/CEO Tomisch has turned this into a $75m rev business with no external cap! Revenue is forecast to continue to grow at 10% CAGR FY22+

Founder/CEO Tomisch has turned this into a $75m rev business with no external cap! Revenue is forecast to continue to grow at 10% CAGR FY22+

14. I said No because of valuation and growth forecasts.

Margin expansion has been the main driver of EBITDA growth, and from 20-40% that seemed good, but will it go from 40-60%? With increasing R&D, and potential CAPEX/acquisitions? Seems a lot of risk built into the price.

Margin expansion has been the main driver of EBITDA growth, and from 20-40% that seemed good, but will it go from 40-60%? With increasing R&D, and potential CAPEX/acquisitions? Seems a lot of risk built into the price.

15. Capitol health $CAJ $CAJ.AX is 3rd or 4th fiddle to Sonic Health in the diagnostics and imaging space. Similarly, the investment thesis is based on roll-up in a fragmented sector.

https://twitter.com/DownunderValue/status/1406816476460249090

16. Topline has grown from $45m in FY11 to $153m in FY20, but stalled at $156m in Fy16 along with NPAT. Meanwhile shares outstanding has grown 300m to 1bn including cap raise in April 20.

Clearly, the model ain’t delivering value to shareholders.

Clearly, the model ain’t delivering value to shareholders.

17. Australian Clinical Labs $ACL $ACL.AX is another diagnostics and imaging company IPO'd in 2021 out of spinoff from Healthscope Group. They service 90 private and public hospitals, so even more commoditized than other diagnostic companies.

18. EV of $728m, Revs of $600m growing 5% CAGR. Forecast NPAT of $85m (PE=8) with 3.5% DPS.

Challenge is a lack of growth and poor ROIC, making the hurdle rate of IRR>10% really hard to achieve.

Challenge is a lack of growth and poor ROIC, making the hurdle rate of IRR>10% really hard to achieve.

19. Pacific Smiles Group $PSQ $PSQ.AX own and operate dental clinics – mainly in shopping centres with new stores rolling out. It also does some limited white-label dental clinics for NIB / health insurers.

@EquityMates are probably their largest shareholder 😉

@EquityMates are probably their largest shareholder 😉

20. ROIC is pretty good at 17-20%, while revenue growing without shareholder dilution.

BUT, the recent earnings are jacked up by Jobkeeper (+$12m EBITDA to $34m), and share price has skyrocketed🚀 With 1.5% DPS with 80% payout, where's the value?

BUT, the recent earnings are jacked up by Jobkeeper (+$12m EBITDA to $34m), and share price has skyrocketed🚀 With 1.5% DPS with 80% payout, where's the value?

21. 1300Smiles $ONT $ONT.AX is another dental outfit, but mainly they do backend corporate support for self employed dentists – and in addition they own 30 separate clinics. This provides real stability as they clip the ticket for a small section of the dentist industry.

22. Revenue growing but slow ($28m in ‘11 to $40m in ‘20), EBITDA growing slightly quicker from increasing margins.

However, ROIC has slid from 25% to 17%. With 3.75% dividend yield, max 5% earnings CAGR, and current PE=20, doesn’t pass the IRR>10% hurdle for value.

However, ROIC has slid from 25% to 17%. With 3.75% dividend yield, max 5% earnings CAGR, and current PE=20, doesn’t pass the IRR>10% hurdle for value.

23. SDI Limited $SDI $SDI.AX manufactures dental inputs: whitening & restorative materials, adhesives, cavity cleansers, etc.

Covid ruined their FY20, but expect to return 10% FCF yield at normalized PE=10, Dividend=4%. But I need more of a discount for such low growth.

Covid ruined their FY20, but expect to return 10% FCF yield at normalized PE=10, Dividend=4%. But I need more of a discount for such low growth.

If you’ve read this far, congratulations. It was a bit tedious, confirming why I invest in international health, and why I hold cash.

If you enjoyed this, bash the like / retweet / follow buttons.

A deep dive per week is my commitment to FinTwit.

DM’s open. DYOR. 🙏

If you enjoyed this, bash the like / retweet / follow buttons.

A deep dive per week is my commitment to FinTwit.

DM’s open. DYOR. 🙏

• • •

Missing some Tweet in this thread? You can try to

force a refresh