Nintendo's approach to product development is a key reason behind the company's success.

Here's the story of the man who developed it.

👇👇

Here's the story of the man who developed it.

👇👇

Nintendo started in Kyoto in 1889 out as a producer of "flower cards" - playing cards used for gambling.

Japan had just allowed gambling within its borders and Nintendo's flower card business was thriving.

Japan had just allowed gambling within its borders and Nintendo's flower card business was thriving.

By the 1950s, Nintendo had already 100 workers employed at the factory.

But there was new competition. After the war, the Japanese turned to Pachinko machines as a new form of gambling and recreation. Like pinball machines, these captured an element of both skill and luck.

But there was new competition. After the war, the Japanese turned to Pachinko machines as a new form of gambling and recreation. Like pinball machines, these captured an element of both skill and luck.

After the founder's great-grandson took over in the 1950s, Nintendo was in trouble. The playing card business was in decline.

He began scattershot investing: first into instant rice. There was a taxi venture. He even started a rent-by-the-hour love hotel. They all failed.

He began scattershot investing: first into instant rice. There was a taxi venture. He even started a rent-by-the-hour love hotel. They all failed.

By this time, Nintendo was deeply in debt.

Out of desperation, Nintendo tried to hire new graduates from top Japanese universities to help come up with new ideas. No one wanted to work at the failed Kyoto firm.

In 1965, an engineer called Gunpei Yokoi stepped into the office.

Out of desperation, Nintendo tried to hire new graduates from top Japanese universities to help come up with new ideas. No one wanted to work at the failed Kyoto firm.

In 1965, an engineer called Gunpei Yokoi stepped into the office.

Yokoi had struggled through his degree and received no other offers. So he settled for Nintendo.

His first job was to service the card-making machines. In his first few months, there was so little to do that he spent his time playing with company equipment.

His first job was to service the card-making machines. In his first few months, there was so little to do that he spent his time playing with company equipment.

Luckily, Yokoi was a tinkerer. He liked to play around with new contraptions.

One day, Yokoi built a wooden box with an extendable arm. Nintendo's president saw him tinkering. Yokoi thought he would be scolded. Instead, the president said: "Why not turn it into a game?"

One day, Yokoi built a wooden box with an extendable arm. Nintendo's president saw him tinkering. Yokoi thought he would be scolded. Instead, the president said: "Why not turn it into a game?"

That was the moment that Nintendo started pivoting into making toys. Yokoi's extendable arm turned into a game called the "Ultra hand" which went on to sell 1.2 million units. This game alone helped Nintendo pay back a large chunk of its debt.

Grateful for Yokoi's contribution, Nintendo's president assigned him to start Nintendo's first R&D department. Finally, he could tinker away all day.

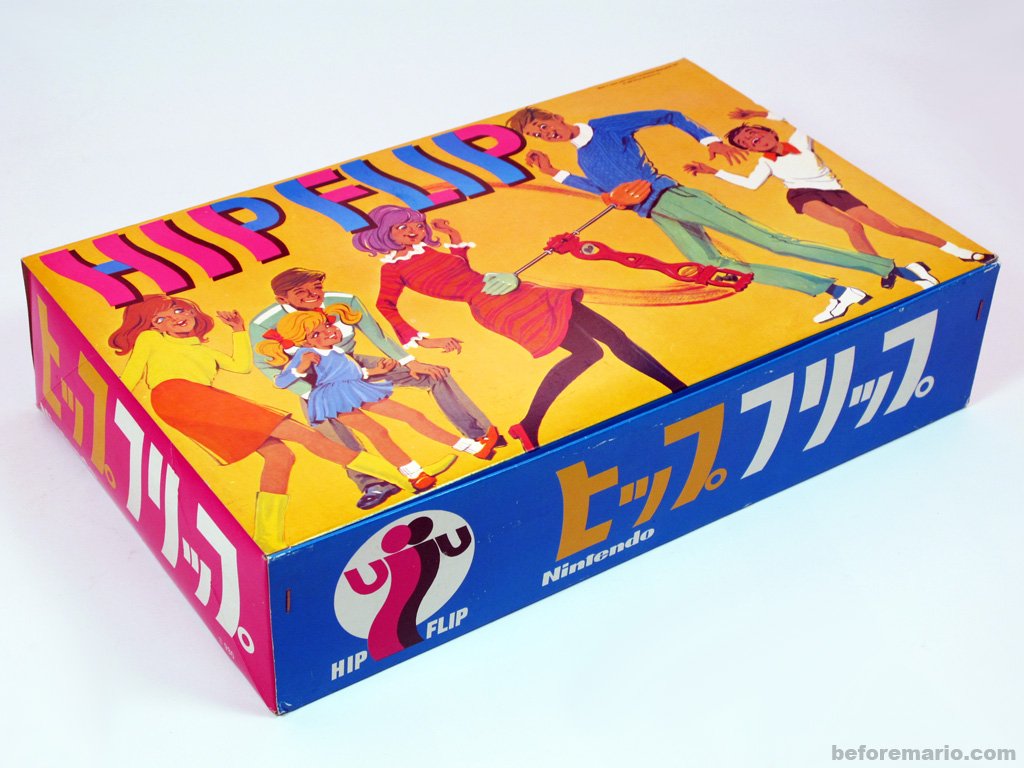

In the coming years, Yokoi would invest a series of new toys: Home bowling, Ultra Machine, the Hip Flip and the People House.

In the coming years, Yokoi would invest a series of new toys: Home bowling, Ultra Machine, the Hip Flip and the People House.

Yokoi's first major failure was a toy called "Drive Game": a tabletop unit where a player used a steering wheel to guide a plastic car.

But the mechanism was so advanced that it became expensive & fragile, riddled with defects. It flopped.

Yokoi vowed not to repeat his mistake.

But the mechanism was so advanced that it became expensive & fragile, riddled with defects. It flopped.

Yokoi vowed not to repeat his mistake.

Following his experience with Drive Game, Yokoi embarked on a new approach called "lateral thinking with withered technology".

The heart of Nintendo's new philosophy was to use cheap and simple technology in ways no one else considered before.

The heart of Nintendo's new philosophy was to use cheap and simple technology in ways no one else considered before.

For example, by the early 1970s radio-controlled cars became popular but prohibitively expensive.

So Yokoi found a way to take the technology backwards.

He developed a RC car that could only turn one way - left. His "Lefty RX" game only cost 1/10 and became a massive success.

So Yokoi found a way to take the technology backwards.

He developed a RC car that could only turn one way - left. His "Lefty RX" game only cost 1/10 and became a massive success.

In 1977, Yokoi awake from a nap on the bullet train back from Tokyo. He saw a man play with his calculator to relieve boredom.

What if Nintendo could create a device small enough to play while commuting?

What if Nintendo could create a device small enough to play while commuting?

At this point, it was just an embryo of an idea. But Yokoi happened to be drafted to be the president's chauffeur during the following day.

When driving him to a meeting at Sharp, he mentioned his new idea. The president then tested the idea with the executives at Sharp.

When driving him to a meeting at Sharp, he mentioned his new idea. The president then tested the idea with the executives at Sharp.

Lo and behold, a week later the executives from Sharp turned up at his office. They wanted to back his idea of a portable gaming device.

Sharp had produced calculators for years, but the market became saturated. They wanted to find a new use for their LCDs.

Sharp had produced calculators for years, but the market became saturated. They wanted to find a new use for their LCDs.

True to his idea of "lateral thinking with withered technology", Yokoi developed his first gaming console on outdated technology.

The first "Game & Watch" machine hit the market in 1980 and sold 0.6m units. Donkey Kong Game & Watch in 1982 sold 8m units.

The first "Game & Watch" machine hit the market in 1980 and sold 0.6m units. Donkey Kong Game & Watch in 1982 sold 8m units.

It developed into the Game Boy in 1989.

From a technological standpoint, the Game Boy was laughable. It only had greyscale. It used a 1970s CPU. There was screen lag.

But it was cheap, long battery life and indestructible. Again: "lateral thinking with withered technology"

From a technological standpoint, the Game Boy was laughable. It only had greyscale. It used a 1970s CPU. There was screen lag.

But it was cheap, long battery life and indestructible. Again: "lateral thinking with withered technology"

Gunpei Yokoi died in a tragic car accident in 1997.

But his product development ethos lives on at Nintendo, which continues to use old technology but in new innovative ways.

• 3D graphics at N64

• The Wii controller

• Double screens on the DS

• Dual-usage nature of Switch

But his product development ethos lives on at Nintendo, which continues to use old technology but in new innovative ways.

• 3D graphics at N64

• The Wii controller

• Double screens on the DS

• Dual-usage nature of Switch

The culture of putting the user at the centre of innovation is uniquely Nintendo.

Most other companies chase the latest (often very expensive) technology. But they often miss what the consumer really cares about and can afford.

That was Gunpei Yokoi's greatest contribution.

Most other companies chase the latest (often very expensive) technology. But they often miss what the consumer really cares about and can afford.

That was Gunpei Yokoi's greatest contribution.

For those who want to read more about Nintendo, I just posted an article on where Nintendo stands today.

And the key factors that will affect its future.

asiancenturystocks.com/p/nintendo

And the key factors that will affect its future.

asiancenturystocks.com/p/nintendo

• • •

Missing some Tweet in this thread? You can try to

force a refresh