Questioning popular narratives (from my old notes).

(1/x)

(1/x)

We think in terms of stories. Stimuli direct our attention to real-world objects, which our inner writer explains via plausible stories.

Our brains contain sets of stories that we mostly borrowed from others. If the narratives seem reasonable, fit with our own observations and we hear them over and over again, then chances are high that we will eventually buy into them.

It takes considerable effort to analyse and question a given narrative. Challenging your existing set of beliefs is stressful, especially when there is money and ego is on the line.

So instead of actively questioning the narratives thrown at us, most of us end up exposing ourselves to those that fit our worldview.

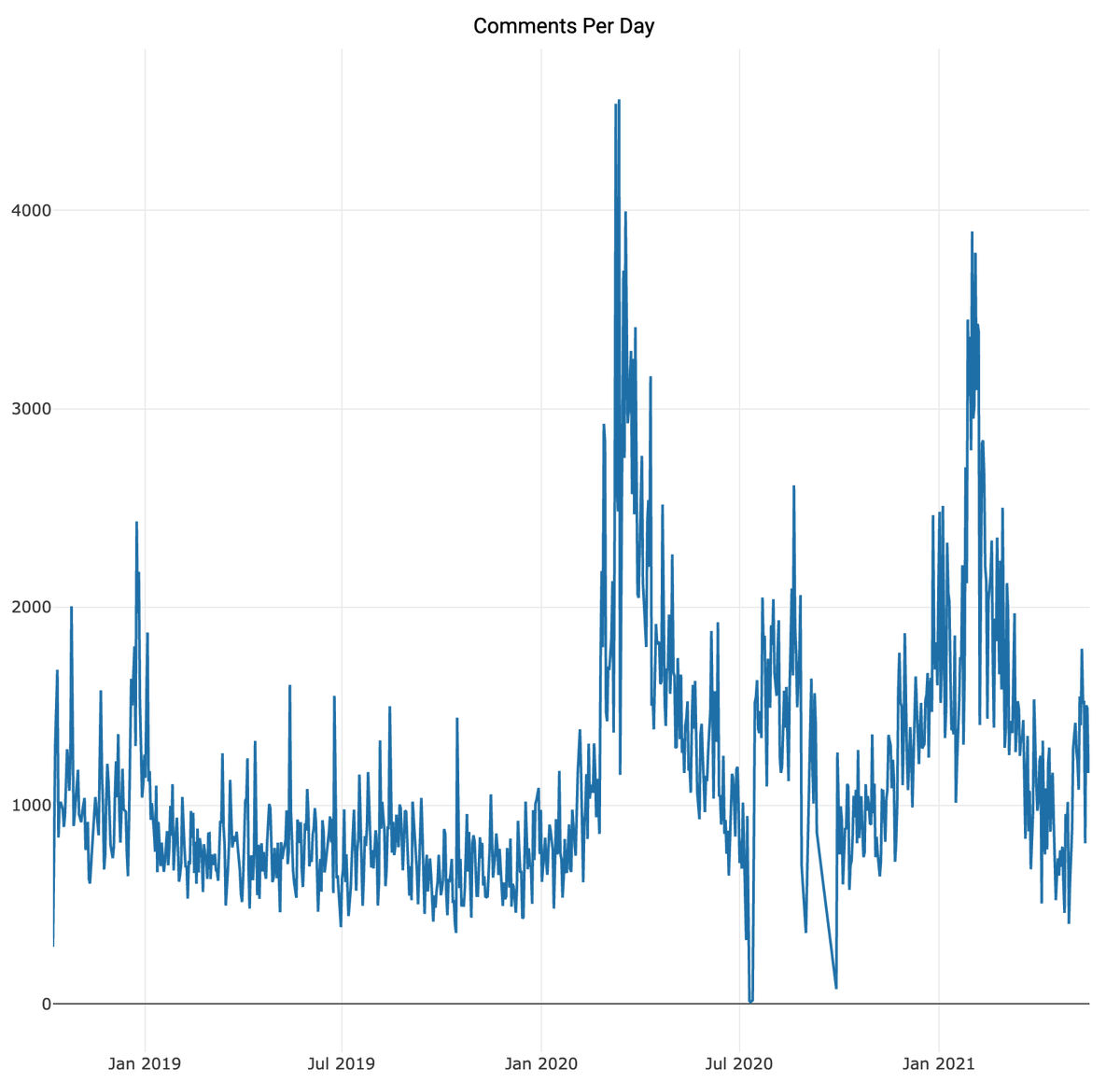

Word-of-mouth propagation of ideas spread like ripples in calm water. As one person often tells his view to several of his friends, and those friends tell pass on the story to their respective friends – ideas tend to spread in an exponential fashion

How far the ripple ultimately goes depends on how convincing the narrative is to the majority of people hearing it - how likely it is to "infect" people hearing it.

The infection rate is a function of how well it corresponds to "common sense" and common beliefs. But it also depends on the narrative’s ability to evoke emotions such as hope, fear of loss, dominance and connectedness.

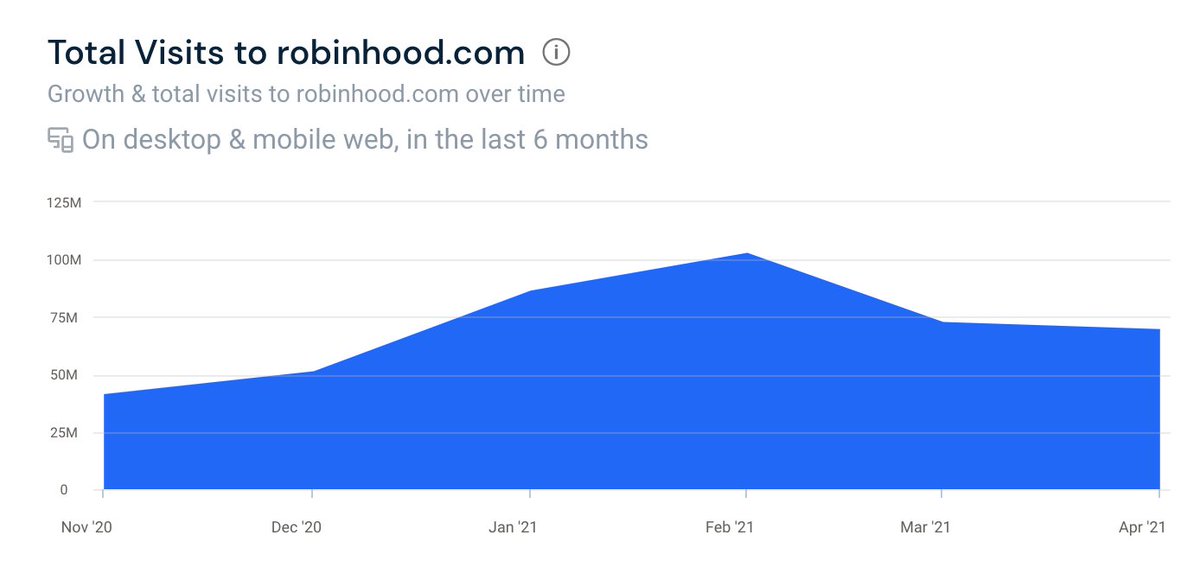

In the investment world, the propagation of narratives is exacerbated by the need to produce short-term performance. Not only to demonstrate our superior understanding of the situation but also to make a quick buck on what we perceive to be a near-term event.

The likelihood of catching a ripple early in the process is low. Imagine that a storyteller tells his stock recommendation to person 1 and 2, who then spread the tip to person 3, 4, 5 and 6, who in turn spread it to another two people.

If you are a random person, the likelihood of hearing the tip in stage 1 is 1/7. The likelihood of it in stage 3 is close to 60%. Meanwhile, most of the profits come from investing in stage 1 when the price hasn’t yet responded to the positive story.

So the expected profit from acting on a tip is low because you will most likely be one of the last to invest. And if the recommendation proves to be faulty in some respect, you run the risk of persons 1-14 liquidating their positions before you get a chance to react.

By continuously trying to assess narratives in mainstream news reports, you are likely to be one of the last to read and act on them. You end up chasing events that have already been priced in.

Given the nature of how narratives spread like ripples, we should be very careful about exposing ourselves to popular narratives – because most of the stories we hear are likely to be late-stage ripples.

Meanwhile, we are human – we don’t have the knowledge or the mental stamina to question everything we read. It’s too much to ask of anyone.

Dealing with stage 1 ripples:

• Ignore opinions and look forward instead

• Seek solitude

• Try to imagine how the future will be different

• Predict future decisions of individuals

• Figure out how investors will interpret and react to those events.

• Ignore opinions and look forward instead

• Seek solitude

• Try to imagine how the future will be different

• Predict future decisions of individuals

• Figure out how investors will interpret and react to those events.

Dealing with stage 2 ripples:

• Listen to non-mainstream experts for highly convincing narratives

• Make sure the trade isn't too crowded yet

• Exit immediately as soon as any flaw is exposed or technicals start breaking down

• Listen to non-mainstream experts for highly convincing narratives

• Make sure the trade isn't too crowded yet

• Exit immediately as soon as any flaw is exposed or technicals start breaking down

Dealing with stage 3 ripples:

• Identify popular narratives (“late-stage ripples”)

• Dig deep to find potential flaws

• Wait until the flaw is starting to get exposed

• Bet against the narrative

• Identify popular narratives (“late-stage ripples”)

• Dig deep to find potential flaws

• Wait until the flaw is starting to get exposed

• Bet against the narrative

Seven ways to dissect a narrative:

1. Base rate probability of the phenomenon

2. Premises: what needs to be true

3. Find disconfirming evidence

4. Invert the statement to see if still true

5. Reductio ad absurdum

6. Find a conflicting narrative

7. Analyse cause-effect linkages

1. Base rate probability of the phenomenon

2. Premises: what needs to be true

3. Find disconfirming evidence

4. Invert the statement to see if still true

5. Reductio ad absurdum

6. Find a conflicting narrative

7. Analyse cause-effect linkages

• • •

Missing some Tweet in this thread? You can try to

force a refresh