Its the middle of August. EIP-1559 is here. The current Base Fee is `40.` For simplicity, and 0% of confidence in the future state of the network, let's say there's an equal probability that the base fee is any number between `30` and `50` if your TX is included in block....

What TX fee do you use?

Oh what's that? You don't have enough information? Okay fine.

Oh what's that? You don't have enough information? Okay fine.

Background:

Base Fee = Set by network, is burned, changes each block by <12.5%. You know the Current Base Fee (40).

Tip = Set by user/wallet. Paid to miner.

Max Fee = Set by user/wallet. Amt you send your TX with. Max you could pay.

Base Fee = Set by network, is burned, changes each block by <12.5%. You know the Current Base Fee (40).

Tip = Set by user/wallet. Paid to miner.

Max Fee = Set by user/wallet. Amt you send your TX with. Max you could pay.

You pay the Future Base Fee—whatever it is—when your TX is mined. (You can only be mined if Max Fee - 1 < Future Base Fee.)

You pay a tip. The tip is either Tip or (Max Fee - Future Base Fee), whichever is lower, so long as > 0.

Get refunded anything that's leftover.

Examples:

You pay a tip. The tip is either Tip or (Max Fee - Future Base Fee), whichever is lower, so long as > 0.

Get refunded anything that's leftover.

Examples:

If the base fee when my transaction is mined is 40, if I use:

Max Fee = 50

Tip = 50

I send 50, 40 burned as base fee, pay 10 to miner, get 0 refund.

If I set my tx to

Max = 50

Tip = 1

I send 50, 40 burned as base fee, pay 1 to miner, get 9 refund.

Max Fee = 50

Tip = 50

I send 50, 40 burned as base fee, pay 10 to miner, get 0 refund.

If I set my tx to

Max = 50

Tip = 1

I send 50, 40 burned as base fee, pay 1 to miner, get 9 refund.

So? What TX fee do you use on your TX?

Oh, what's that? Okay fine, I'll make it multiple choice for you. 😂

Oh, what's that? Okay fine, I'll make it multiple choice for you. 😂

1) Pad current Base Fee by 1.5x to ensure your not excluded if shit gets a bit crazy. Use that # for Max Fee and Tip. (Note: you wont ever get a refund.)

Current Base = 40

Max Fee = 60

Tip = 60

Send (and end up paying) ~$7.50 TX fee.

Current Base = 40

Max Fee = 60

Tip = 60

Send (and end up paying) ~$7.50 TX fee.

2) Pad current Base Fee by more (2.5x) while limiting Tip (0.5x). Optimize for being mined whenever, but only pay what the network requires. Send more up front, but will likely get refund.

Current Base = 40

Max Fee = 100

Tip = 20

Send ~$12.50 TX fee. May get $?.?? refund.

Current Base = 40

Max Fee = 100

Tip = 20

Send ~$12.50 TX fee. May get $?.?? refund.

So? What TX fee do you choose for your TX?

Or, put another way, which strategy would you want your wallet to use? Because, let's be honest, no one wants to play this fucking game every time they send.

Or, put another way, which strategy would you want your wallet to use? Because, let's be honest, no one wants to play this fucking game every time they send.

Spew your answers and rationale. I'm getting lunch. Then I'll tell you if your right.

And please be right. If you're wrong this is gunna be a massive case study on why you should never give your users what they think they want. 😬

And please be right. If you're wrong this is gunna be a massive case study on why you should never give your users what they think they want. 😬

Let's up the stakes a bit. Because you know. ULTRA SOUND MONEY!!!!!!!!!!!!!!!!!!!!!!!!!!!! 🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉

ETH is now $10k. Demand for network has increased 10x.

ETH is now $10k. Demand for network has increased 10x.

1-USM. Pad current Base Fee by 1.5x to ensure your not excluded if shit gets a bit crazy. Use that # for Max Fee and Tip. (Note: you wont ever get a refund.)

Current Base = 400

Max Fee = 600

Tip = 600

Send (and end up paying) ~$300.00 TX fee.

Current Base = 400

Max Fee = 600

Tip = 600

Send (and end up paying) ~$300.00 TX fee.

2-USM. Pad current Base Fee by more (2.5x) while limiting Tip (0.5x). Optimize for being mined whenever, but only pay what the network requires. Send more up front, but will likely get refund.

Current Base = 400

Max Fee = 1000

Tip = 200

Send ~$500.00 TX fee. May get $??? refund.

Current Base = 400

Max Fee = 1000

Tip = 200

Send ~$500.00 TX fee. May get $??? refund.

So? What TX fee do you choose for your TX in $10k ETH land?

Did your TX pricing strategy change when number go up? 🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉🦇🔉

I promised I would tell you if you were right. Unfortunately, I'm a dirty fucking liar and you're all wrong. 🙈🙉🙊

Well, sorta.

First, being "right" requires context. The only party who can provide that context is the user—you. What are you optimizing for.

Well, sorta.

First, being "right" requires context. The only party who can provide that context is the user—you. What are you optimizing for.

That said, neither of these are optimal for pretty much anything you might be optimizing for.

Namely bc deriving TIP from the BASE FEE is completely illogical as the two don't have that type of relationship.

"If base fee is higher, will tip be higher?"

Sometimes?

🤷🤷🤷

Namely bc deriving TIP from the BASE FEE is completely illogical as the two don't have that type of relationship.

"If base fee is higher, will tip be higher?"

Sometimes?

🤷🤷🤷

That said, I picked these two strategies not because they were optimal but because they are clearly different from one another.

I expected one to be given clear preference in the poll. With a ~50/50 split though....LOL.

The numbers specifically make things even more fun:

I expected one to be given clear preference in the poll. With a ~50/50 split though....LOL.

The numbers specifically make things even more fun:

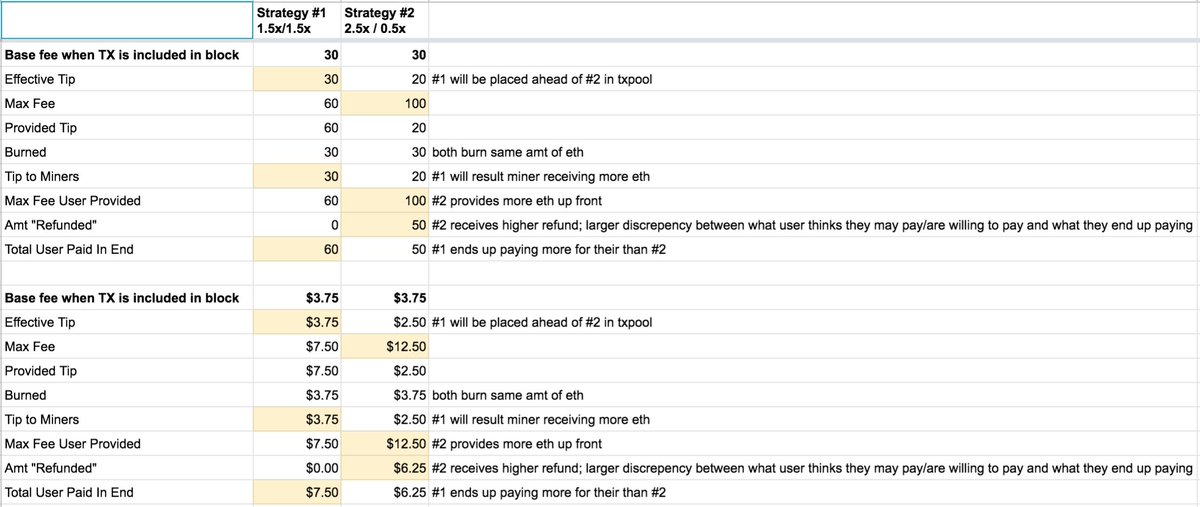

1. If the base fee remains unchanged

between the time you craft the transaction and the time the transaction is included in a block.

(Note: the bottom section just maps the top to USD using TX w 50k gas limit, $2.5k ETH price. It helps me with context.)

between the time you craft the transaction and the time the transaction is included in a block.

(Note: the bottom section just maps the top to USD using TX w 50k gas limit, $2.5k ETH price. It helps me with context.)

What do we see?

Both result in the same amount being paid in the end. Same being burned. Same going to miner.

The difference is strategy #2 pays way more up front.

Why pay more for same results?

Both result in the same amount being paid in the end. Same being burned. Same going to miner.

The difference is strategy #2 pays way more up front.

Why pay more for same results?

Well, it gives you a bit of lead when it comes to TX ordering in the pending TX pool, which determines if you'll be included in block & ejected from TX pool.

But the sorting is first done by Effective Tip. You're better relative to other TX's who share an ET. Congrats!

But the sorting is first done by Effective Tip. You're better relative to other TX's who share an ET. Congrats!

IMO paying capital up front to basically have the same results is. Well. Strategy 1 would be better in this case. IMHO.🤯

But recall my veeery first tweet:

> there's an equal probability that the base fee is any # between `30` and `50`

But recall my veeery first tweet:

> there's an equal probability that the base fee is any # between `30` and `50`

Unless you can know, with enough certainty, that the base fee will be the same later as it is now, you cannot select a strategy that works best in that scenario.

So let's look at....

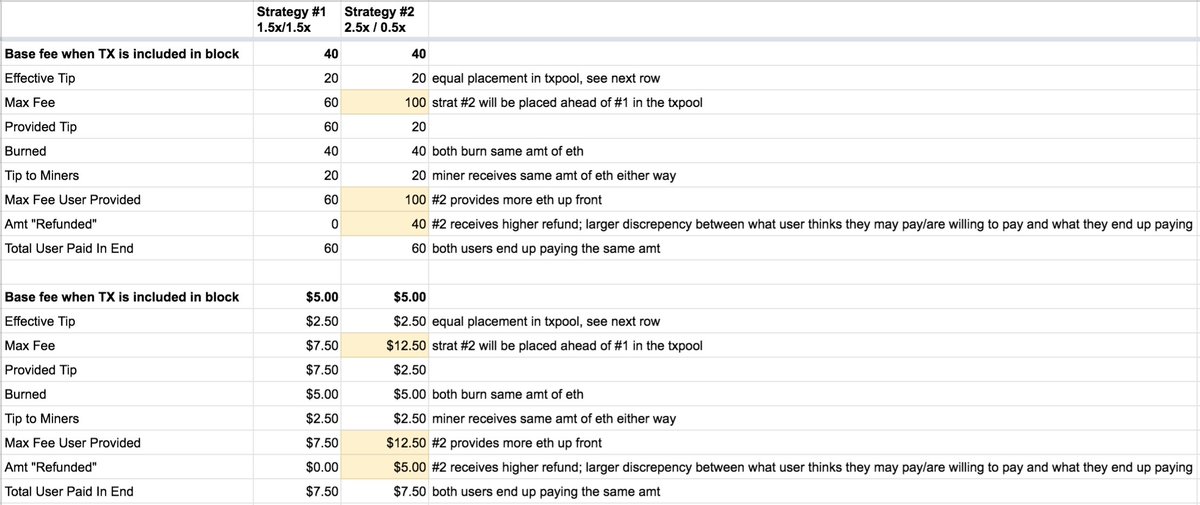

2. If the base fee decreases to 30!

(second image is `1. same base fee` for easy swiping)

So let's look at....

2. If the base fee decreases to 30!

(second image is `1. same base fee` for easy swiping)

If you were quick to decide strategy #1 was better up there, haha.

If the base fee DECREASES you pay more with strategy #1. #2 is better. If you have the capital. And no op cost.

Bc to pay less in the end, you have to provide more up front:

1: $7.50 -> $7.50

2: $12.50 -> $6.25

If the base fee DECREASES you pay more with strategy #1. #2 is better. If you have the capital. And no op cost.

Bc to pay less in the end, you have to provide more up front:

1: $7.50 -> $7.50

2: $12.50 -> $6.25

Just a note: #1 has higher placement in the pool that #2.

However this matters exactly none. Irrelevant af.

Bc the only way the base fee decreases is when the blocks are less than half full. Which means there's (probably) no fight for space/inclusion at the TX Pool level.

However this matters exactly none. Irrelevant af.

Bc the only way the base fee decreases is when the blocks are less than half full. Which means there's (probably) no fight for space/inclusion at the TX Pool level.

3. BASE FEE GO UPPPPPPPPPPPPPPPPPPP ULTRA SOUND MONEY SCREEEECH 🦇🔊

Oh fuck. When the base fee increases, strategy #2 ends up paying more. Damn.

Oh fuck. When the base fee increases, strategy #2 ends up paying more. Damn.

That said, #2 is also more likely to not be evicted from the tx pool/more likely to make it into a block.

Which is important during times of increasing congestion (aka the times when base fee go up)

Even tho you pay more, if you want to send period, it may be worth the cost.

Which is important during times of increasing congestion (aka the times when base fee go up)

Even tho you pay more, if you want to send period, it may be worth the cost.

Further, the difference in what you pay is pretty small.

There is a UX cost AND a real cost if you try send during a period of increasing congestion and your TX is not mined. Using strategy 1, you may need to resend, but once you resend the base fee may be 70. Or 700. Whoops.

There is a UX cost AND a real cost if you try send during a period of increasing congestion and your TX is not mined. Using strategy 1, you may need to resend, but once you resend the base fee may be 70. Or 700. Whoops.

So. Whats the best strategy?

Neither. It's all pretty damn irrelevant lol. Besides being a terrific amount of mind-bending fun.

You aren't competing with 1 other TX. There's not even 1 TX Pool there are thousands. There's no "default". The above shit would be simple to UX.

Neither. It's all pretty damn irrelevant lol. Besides being a terrific amount of mind-bending fun.

You aren't competing with 1 other TX. There's not even 1 TX Pool there are thousands. There's no "default". The above shit would be simple to UX.

The only answer to what strategy is best is...."it depends."

It depends on:

1. whether past base fee - current base fee correlates to future base fee

2. actual future base fee

3. number of competing txs for tx pool space

It depends on:

1. whether past base fee - current base fee correlates to future base fee

2. actual future base fee

3. number of competing txs for tx pool space

4. if user has capital to provide up front

5. user's risk tolerance

6. op. cost (if user has capital)

7. if user values speed, price, not resending, knowing it'll be mined, not "overpaying"

8. if user perceives paying more up front + bigger refund == paying final amt up front

5. user's risk tolerance

6. op. cost (if user has capital)

7. if user values speed, price, not resending, knowing it'll be mined, not "overpaying"

8. if user perceives paying more up front + bigger refund == paying final amt up front

9. # of nodes between node you broadcast from -> miner

10. the size of the tx pool of each those nodes (the pending tx pool)

11. the EFFECTIVE TIP of your tx vs other txs trying to fit in the txpool. = lower of (Max fee - now current base fee) or (Tip)

10. the size of the tx pool of each those nodes (the pending tx pool)

11. the EFFECTIVE TIP of your tx vs other txs trying to fit in the txpool. = lower of (Max fee - now current base fee) or (Tip)

12. Whether txpools are so full that your tx is dropped the second current base fee > max fee, or if it stays in the pool for any amt of blocks

13. rebroadcasting rules for node you broadcast thru.

14. if base fee stays the same, goes up, goes down between broadcasting & mined.

13. rebroadcasting rules for node you broadcast thru.

14. if base fee stays the same, goes up, goes down between broadcasting & mined.

15. the max fee you set if all the other tx's you're competing have the same effective tip as you.

16. the tip you set if all the tx's you're competing with have the same effective tip and max fee you set.

17. if your tip > minimum tip on most nodes/miner nodes

16. the tip you set if all the tx's you're competing with have the same effective tip and max fee you set.

17. if your tip > minimum tip on most nodes/miner nodes

...and on and on.😩

Some of these only user knows. Some we can't know. Not enough to act on at least.

Some user knows, but stupid human brain deceives them.

Some the wallet could know w more insights into live state of txpool (shoutout to txpool wizards @blocknative!)

Some of these only user knows. Some we can't know. Not enough to act on at least.

Some user knows, but stupid human brain deceives them.

Some the wallet could know w more insights into live state of txpool (shoutout to txpool wizards @blocknative!)

tbh, due to the sheer amt of uncertainty and variables and unknown and maybe knowns and resources to make it known, I think the best UX here, for normal users, will be one that optimizes for giving the user the most confidence and knowledge about *their TX* *right now*

Fuck pending states and waiting for who knows how long. Fuck guessing. Aim for certainty + adjusting if fee is wrong in <15 sex in single click. That would be good UX.

And easier. We know how now is diff than before, the problem is knowing how later is diff than now. 😉

🌈UX🌈

And easier. We know how now is diff than before, the problem is knowing how later is diff than now. 😉

🌈UX🌈

i mean ULLLLLLLLLLLLTTTRAAAASCREEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEEECH 🦇🔊🦇🦇🦇🦇🦇🦇🦇🦇🦇🦇🦇🦇🦇🦇🦇🦇🦇🦇🦇🦇🦇🦇🦇🦇🦇🦇🦇🦇🔊🦇🦇🦇🦇🦇🦇🦇🦇🦇🦇🦇🦇🦇🦇🦇🦇🦇🦇🦇🦇🦇🦇🦇🦇🦇🦇🦇🔊🦇🦇🦇🦇🦇 goodnight and i love you even if u have bat fetish 🤗💖

• • •

Missing some Tweet in this thread? You can try to

force a refresh