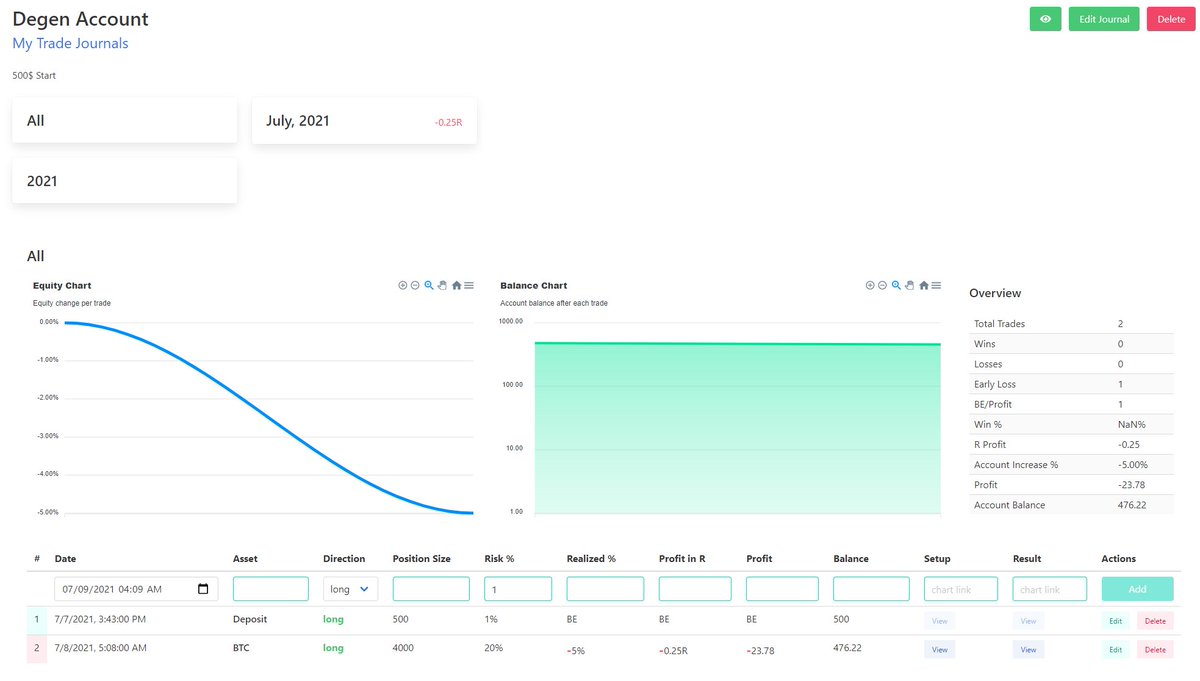

Degen Account:

500$ Start Balance

Price Action is kinda flat so gonna mix it up a bit and break or make this account within this thread.

Need a little bit of fun.

High Risk/High Reward.

#Bitcoin

500$ Start Balance

Price Action is kinda flat so gonna mix it up a bit and break or make this account within this thread.

Need a little bit of fun.

High Risk/High Reward.

#Bitcoin

Degen Account Update:

Started the account out with an L risking 20% and cutting it for -5% acc hit.

Currently long on ETH off the daily open and looking for the LTF FVG Fill.

As mentioned; high risk.

Will log the trades once they close and update.

LFG!

Started the account out with an L risking 20% and cutting it for -5% acc hit.

Currently long on ETH off the daily open and looking for the LTF FVG Fill.

As mentioned; high risk.

Will log the trades once they close and update.

LFG!

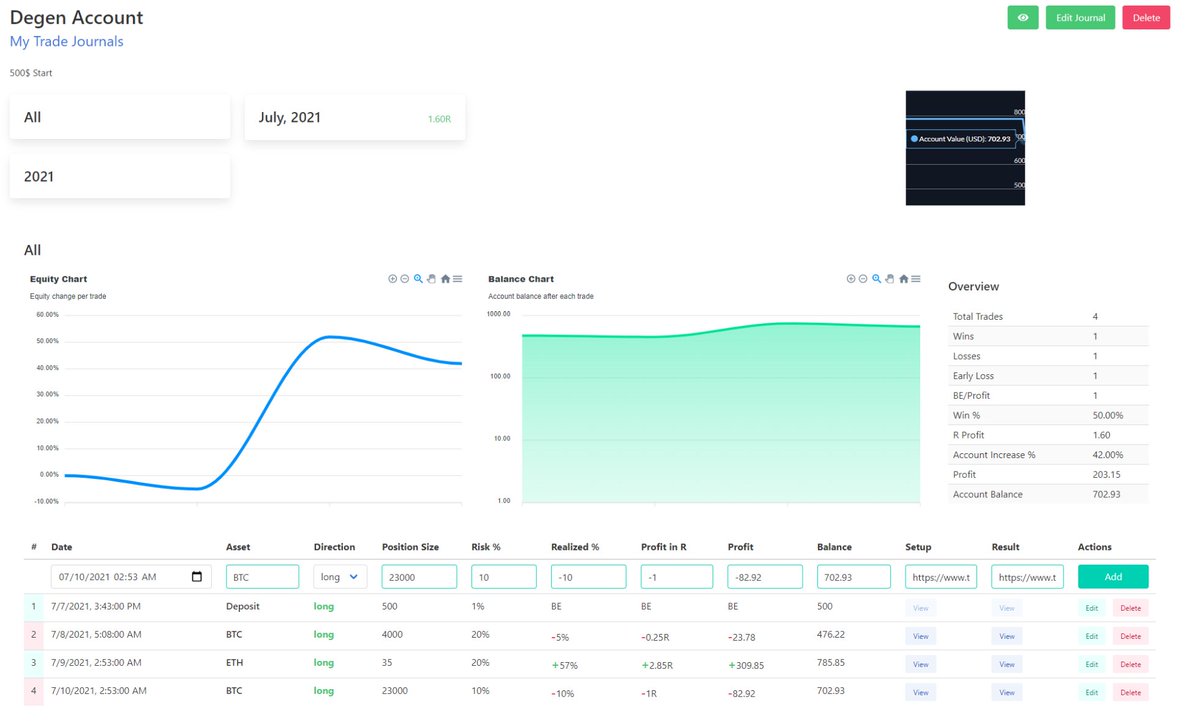

Degen Account Update:

Not much to update been sitting on my hands the last week. Volatility is absolute 🗑️

3 trades so far: 2 L's/ 1W but up 42% on the account.

Got stopped on a BTC long but was low conviction so cut the risk in half.

For now I'm just marking out levels.

Not much to update been sitting on my hands the last week. Volatility is absolute 🗑️

3 trades so far: 2 L's/ 1W but up 42% on the account.

Got stopped on a BTC long but was low conviction so cut the risk in half.

For now I'm just marking out levels.

Degen Account Update:

Start Balance: 500$

Current Balance: 809.93$

Up 51%+

4 trades in and managed a long scalp into the range high not the most glamorous R but enough to a hit ATH.

Looking for shorts once we fill the FVG.

#BTC

Start Balance: 500$

Current Balance: 809.93$

Up 51%+

4 trades in and managed a long scalp into the range high not the most glamorous R but enough to a hit ATH.

Looking for shorts once we fill the FVG.

#BTC

Degen Account Update:

Start Balance: 500$

Current Balance: 966.93$

Up 71%

Three tap below for a long and three tap above for a short.

Not a bad day considering this is all within a 500$ range.

Will sit out for now and watch for something new to develop.

#BTC

Start Balance: 500$

Current Balance: 966.93$

Up 71%

Three tap below for a long and three tap above for a short.

Not a bad day considering this is all within a 500$ range.

Will sit out for now and watch for something new to develop.

#BTC

Degen Account Update:

Start Balance: 500$

Current Balance: 2,119.12$

Up 323.94%

2 Solid back to back wins on AXS short and a BTC day trade long. Market finally giving some volatility so lets see if we can nail more trades instead of waiting out.

#BTC

Start Balance: 500$

Current Balance: 2,119.12$

Up 323.94%

2 Solid back to back wins on AXS short and a BTC day trade long. Market finally giving some volatility so lets see if we can nail more trades instead of waiting out.

#BTC

Degen Account Update:

Start Balance: 500$

Current Balance: 3,404.65$

Up 581%

Got hit on a ETH/LTC position but recovered with 2 back to back ETH Longs hitting full TP.

I went a little overboard on a running BTC long and went for 60% risk missed my SL twice, JFC.

#Bitcoin

Start Balance: 500$

Current Balance: 3,404.65$

Up 581%

Got hit on a ETH/LTC position but recovered with 2 back to back ETH Longs hitting full TP.

I went a little overboard on a running BTC long and went for 60% risk missed my SL twice, JFC.

#Bitcoin

Degen Account Update:

Start Balance: 500$

Current Balance: 3,404.65$

Up 581%

Pending: 10k+ balance

Currently have 3 positions opened and this is the break it or make it point.

The next time I report the account will either be 20x+ or liquidated.

#bitcoin

Start Balance: 500$

Current Balance: 3,404.65$

Up 581%

Pending: 10k+ balance

Currently have 3 positions opened and this is the break it or make it point.

The next time I report the account will either be 20x+ or liquidated.

#bitcoin

Degen Account Update:

Start Balance: 500$

Current Balance: 12,204.19$

Up 2340.84% (23.4x)

Have officially 23.4x the Degen account

BTC risk long paid a majority of the account and closed out ETH long to secure some profits. Currently just holding LTC long.

LFG!

#Bitcoin

Start Balance: 500$

Current Balance: 12,204.19$

Up 2340.84% (23.4x)

Have officially 23.4x the Degen account

BTC risk long paid a majority of the account and closed out ETH long to secure some profits. Currently just holding LTC long.

LFG!

#Bitcoin

Degen Account Update:

Start Balance: 500$

Current Balance: 14,623.75$

Up 2824.75% (28.75x)

Was looking to hold LTC but rather start fresh this week. Laid out some game plans for btc both short and longs

Only taking 1 position at a time on this account for now.

#Bitcoin

Start Balance: 500$

Current Balance: 14,623.75$

Up 2824.75% (28.75x)

Was looking to hold LTC but rather start fresh this week. Laid out some game plans for btc both short and longs

Only taking 1 position at a time on this account for now.

#Bitcoin

Degen Account Update:

Start Balance: 500$

Current Balance: 10,272.55$

Up 1954.51% (19.54x)

First major L getting stopped at the ETH Low.

No worries, entered a positional long on ICP so might not update for a little while trying to manage as little as possible.

#Bitcoin

Start Balance: 500$

Current Balance: 10,272.55$

Up 1954.51% (19.54x)

First major L getting stopped at the ETH Low.

No worries, entered a positional long on ICP so might not update for a little while trying to manage as little as possible.

#Bitcoin

Degen Account Update:

Start Balance: 500$

Current Balance: 10,272.55$

Up 1954.51% (19.54x)

12k+ Pending profit

Around 40x+ floating on the account but still haven't closed. Nice bounce back from the ETH L

ICP and MATIC longs doing me well

Will update when I close

#Bitcoin

Start Balance: 500$

Current Balance: 10,272.55$

Up 1954.51% (19.54x)

12k+ Pending profit

Around 40x+ floating on the account but still haven't closed. Nice bounce back from the ETH L

ICP and MATIC longs doing me well

Will update when I close

#Bitcoin

Degen Account Update:

Start Balance: 500$

Current Balance: 24,786.77$

Up 4857.35% (48.35x)

Closed my positions since I just hit a new benchmark on the account. Matic and ICP paid off huge and In no way did I expect this progression.

This challenge has been fun.

#Bitcoin

Start Balance: 500$

Current Balance: 24,786.77$

Up 4857.35% (48.35x)

Closed my positions since I just hit a new benchmark on the account. Matic and ICP paid off huge and In no way did I expect this progression.

This challenge has been fun.

#Bitcoin

Degen Account Update:

Start Balance: 500$

Current Balance: 24,786.77$

Up 4857.35% (48.57x)

Not much to comment except I toned down my risk a little and got some exposure on a few alts

BTC Still chopping around and don't have a clear view on it

Lets see what we get

#Bitcoin

Start Balance: 500$

Current Balance: 24,786.77$

Up 4857.35% (48.57x)

Not much to comment except I toned down my risk a little and got some exposure on a few alts

BTC Still chopping around and don't have a clear view on it

Lets see what we get

#Bitcoin

Degen Account Update:

Start Balance: 500$

Current Balance: 32,843.71$ (44k+ Pending)

Up 6468.74% (64.68x)

Picked up alts at the right time and closed some to reduce risk. Holding SRM and averaging down on ICP.

Alot of luck involved in this account with oversizing

#Bitcoin

Start Balance: 500$

Current Balance: 32,843.71$ (44k+ Pending)

Up 6468.74% (64.68x)

Picked up alts at the right time and closed some to reduce risk. Holding SRM and averaging down on ICP.

Alot of luck involved in this account with oversizing

#Bitcoin

Degen Account Update:

Start Balance: 500$

Current Balance: 52,113.44$

Up 10,665.1% (100.65x)

SRM long paid off big to bring the account into 100x+

Currently underwater on ICP/BTC and averaging down.

Lets see what we get this week.

LFG!

#Bitcoin

Start Balance: 500$

Current Balance: 52,113.44$

Up 10,665.1% (100.65x)

SRM long paid off big to bring the account into 100x+

Currently underwater on ICP/BTC and averaging down.

Lets see what we get this week.

LFG!

#Bitcoin

Degen Account Update:

Start Balance: 500$

Current Balance: 55,216.82$

Up 10,943.1% (100.94x)

Currently scuba diving underwater with 2 open longs SRM/ICP.

Averaging down on SRM mostly as I still see another leg up. ICP a different story, ffs

Lets see if we scale out

#Bitcoin

Start Balance: 500$

Current Balance: 55,216.82$

Up 10,943.1% (100.94x)

Currently scuba diving underwater with 2 open longs SRM/ICP.

Averaging down on SRM mostly as I still see another leg up. ICP a different story, ffs

Lets see if we scale out

#Bitcoin

Degen Account Update:

Start Balance: 500$

Current Balance: 58,432.5$ ( 5k+ Pending profit)

Up 11,586.5% (115.86x)

SRM absolutely came through with scaling in and out.

Got some BTC Exposure and still holding ICP.

LFG!

#Bitcoin

Start Balance: 500$

Current Balance: 58,432.5$ ( 5k+ Pending profit)

Up 11,586.5% (115.86x)

SRM absolutely came through with scaling in and out.

Got some BTC Exposure and still holding ICP.

LFG!

#Bitcoin

Degen Account Update:

Start Balance: 500$

Current Balance: 65,220.63$ + Pending profit

Up 11,586.5% (129.44x)

Account going strong.

Took a small hit on BTC but SRM was a hitter and ICP finally turned around

Scooped up some LTC/AGO.

#Bitcoin

Start Balance: 500$

Current Balance: 65,220.63$ + Pending profit

Up 11,586.5% (129.44x)

Account going strong.

Took a small hit on BTC but SRM was a hitter and ICP finally turned around

Scooped up some LTC/AGO.

#Bitcoin

Degen Account Update:

Start Balance: 500$

Current Balance: 69,359.94$ +Pending profit

Up 13,772% (137.72x)

Hit 80k+ Account balance and positions looking solid

Added ETH to the mix of running longs

Taking off for the weekend so will come back around weekly close

#Bitcoin

Start Balance: 500$

Current Balance: 69,359.94$ +Pending profit

Up 13,772% (137.72x)

Hit 80k+ Account balance and positions looking solid

Added ETH to the mix of running longs

Taking off for the weekend so will come back around weekly close

#Bitcoin

Degen Account Update:

Start Balance: 500$

Current Balance: 81443.58$

Up 16,188.7% (161.88x)

Hope everyone had a good weekend.

Just getting in and closed off most of my positions to get a fresh take for the week. Account looking good and just holding ICP for now.

#Bitcoin

Start Balance: 500$

Current Balance: 81443.58$

Up 16,188.7% (161.88x)

Hope everyone had a good weekend.

Just getting in and closed off most of my positions to get a fresh take for the week. Account looking good and just holding ICP for now.

#Bitcoin

Degen Account Update:

Start Balance: 500$

Current Balance: 78,273.48$

Up 15,554.7% (15.55x)

What a week been stuck between 70-80k back and forth

Got some allocation into the weekend with SRM being a blessing. Underwater on a few but risk is managed to around -+5% ea.

#Bitcoin

Start Balance: 500$

Current Balance: 78,273.48$

Up 15,554.7% (15.55x)

What a week been stuck between 70-80k back and forth

Got some allocation into the weekend with SRM being a blessing. Underwater on a few but risk is managed to around -+5% ea.

#Bitcoin

Degen Account Update:

Start Balance: 500$

Current Balance: 92,011.27$

Up 18,302.3% (183.02x)

What a day had the balance at 97k+ and had to capitulate SRM/AVAX to reduce downside risk.

Scuba diving on 3 open positions and will hold out. Removing SRM from watchlist, F

#Bitcoin

Start Balance: 500$

Current Balance: 92,011.27$

Up 18,302.3% (183.02x)

What a day had the balance at 97k+ and had to capitulate SRM/AVAX to reduce downside risk.

Scuba diving on 3 open positions and will hold out. Removing SRM from watchlist, F

#Bitcoin

Degen Account Update:

Start Balance: 500$

Ending Balance: 105,655.72$

21,031.1% (210.31x)

Thanks for playing.

Have officially capitulated my running positions and ending this challenge. For those that followed I appreciate you.

LFG!

#Bitcoin

Start Balance: 500$

Ending Balance: 105,655.72$

21,031.1% (210.31x)

Thanks for playing.

Have officially capitulated my running positions and ending this challenge. For those that followed I appreciate you.

LFG!

#Bitcoin

• • •

Missing some Tweet in this thread? You can try to

force a refresh