Most people have heard of Masa Son. What most people don't know is that Masa has a brother who is a billionaire in his own right.

He helped launch Yahoo Japan, founded one of the biggest gaming companies and and is an investor in companies like Zoox.

Here's Taizo Son's story 👇

He helped launch Yahoo Japan, founded one of the biggest gaming companies and and is an investor in companies like Zoox.

Here's Taizo Son's story 👇

Taizo was born on the island of Kyushu, Japan as the youngest child of the Son family.

The age difference between Taizo and Masa? 15 years.

By the time Taizo was in primary school, Masa was already a millionaire.

The age difference between Taizo and Masa? 15 years.

By the time Taizo was in primary school, Masa was already a millionaire.

Due to the large age difference, Taizo didn't consider Masa as a role model.

As he describes it, his brother was so much older than him that it was hard to compare himself to Masa.

The person that inspired him most: Jerry Yang, the co-founder of Yahoo and 3 years his elder.

As he describes it, his brother was so much older than him that it was hard to compare himself to Masa.

The person that inspired him most: Jerry Yang, the co-founder of Yahoo and 3 years his elder.

After failing the entrance exam twice, Taizo finally enrolled at the University of Tokyo .

Excited by the prospects of the internet, he started his first company Indigo in 1996 as a college student.

Indigo is a web services company that still exists to this day.

Excited by the prospects of the internet, he started his first company Indigo in 1996 as a college student.

Indigo is a web services company that still exists to this day.

Taizo had another fateful encounter right around that time.

Masa was in talks with Jerry Yang to bring Yahoo to Japan.

Taizo, eager to meet his role model, pitched strategies to effectively launch Yahoo in his country.

Indeed, Jerry brought Taizo on board to do just that.

Masa was in talks with Jerry Yang to bring Yahoo to Japan.

Taizo, eager to meet his role model, pitched strategies to effectively launch Yahoo in his country.

Indeed, Jerry brought Taizo on board to do just that.

Yahoo ≠ Yahoo Japan.

While Yahoo faded into irrelevance in most parts of the world, Yahoo Japan is still a juggernaut.

It's the 2nd most visited website in Japan.

Last valued at $20B in 2018 by Forbes, it's now a joint venture between Softbank and Naver.

While Yahoo faded into irrelevance in most parts of the world, Yahoo Japan is still a juggernaut.

It's the 2nd most visited website in Japan.

Last valued at $20B in 2018 by Forbes, it's now a joint venture between Softbank and Naver.

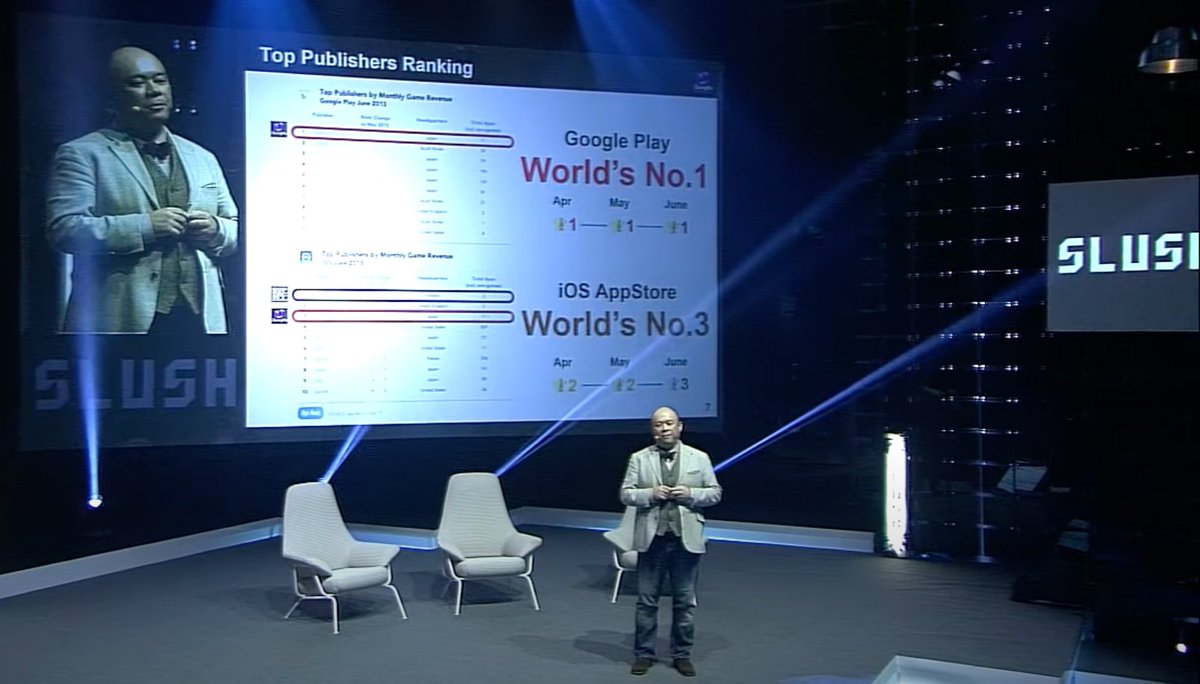

After his time at Yahoo, in 1998 he founded GungHo, a video game conglomerate.

GungHo is most well-known for Puzzle & Dragons, which was the first mobile game to surpass $1bn in revenue.

The company IPOed a few years later in 2005, minting another billionaire in the Son family.

GungHo is most well-known for Puzzle & Dragons, which was the first mobile game to surpass $1bn in revenue.

The company IPOed a few years later in 2005, minting another billionaire in the Son family.

In 2013, GungHo together with Softbank (aka Taizo + Masa) bought 51% of Clash of Clans publisher Supercell, valuing the company at $2.55bn.

In 2016, Tencent acquired those shares at a valuation of $10.2bn.

Not bad for a 3-year investment...

In 2016, Tencent acquired those shares at a valuation of $10.2bn.

Not bad for a 3-year investment...

Following his stint at GungHo and seeding 50 startups through his accelerator Movida, Taizo went on to found Mistletoe.

Mistletoe is a mix of startup incubator, VC fund and community with Taizo as the sole LP and GP.

Investments range from Ninjacart in India to Zoox in the US.

Mistletoe is a mix of startup incubator, VC fund and community with Taizo as the sole LP and GP.

Investments range from Ninjacart in India to Zoox in the US.

These days, Taizo can be found in Singapore building a "collective impact community".

For now, he's focused on the South East Asia as he believes it could leapfrog other regions through innovation.

With over $100m dedicated to SEA, he's putting his money where his mouth is.

For now, he's focused on the South East Asia as he believes it could leapfrog other regions through innovation.

With over $100m dedicated to SEA, he's putting his money where his mouth is.

Stay tuned for an upcoming deep dive into his brother Masa...

If you enjoyed this read, follow @mariodgabriele and take a look at this thread on Nikola Tesla!

If you enjoyed this read, follow @mariodgabriele and take a look at this thread on Nikola Tesla!

https://twitter.com/mariodgabriele/status/1301302318508519426?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed&ref_url=https%3A%2F%2Fwww.notion.so%2FTaizo-Son-5d014613033d4eaca2742f120254ec38

• • •

Missing some Tweet in this thread? You can try to

force a refresh