1/ Paycheck Protection Grants - stuff you wish you don't know.

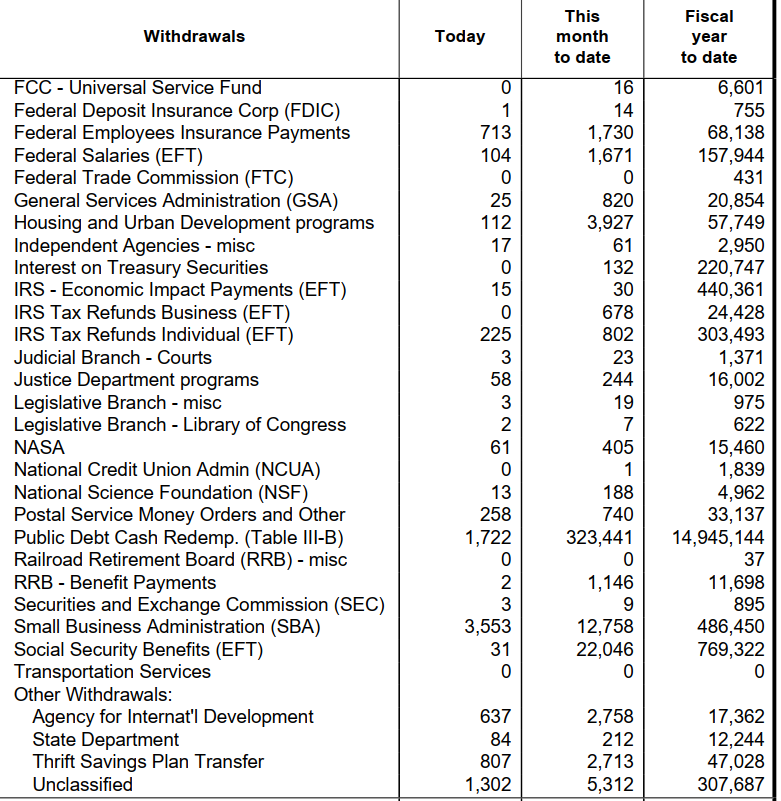

Right now, treasury is giving out $3-4Bn a day(!) in SBA PPP grants, free money for "small" business.

"" used, because Mnuchin allowed some mega churches to be paid via SBA. payment amount has grown since....

Right now, treasury is giving out $3-4Bn a day(!) in SBA PPP grants, free money for "small" business.

"" used, because Mnuchin allowed some mega churches to be paid via SBA. payment amount has grown since....

2/ so not sure who qualifies as small business any more.

so much free money is given out right now that Fiscal year to date SBA spending is the 2nd *largest expenditure* category (only behind social security).

so much free money is given out right now that Fiscal year to date SBA spending is the 2nd *largest expenditure* category (only behind social security).

3/ since "small" business is getting 33% more free payroll money from SBA than unemployment benefits being sent out, it is should be easy for small business to pay people a little more than unemployment?

4/ Wage inflation... if we don't see wage inflation after the government gave out $486Bn dollar to "small" business... maybe we would see some massive profit on K1 forms from "small" business owners next year?

• • •

Missing some Tweet in this thread? You can try to

force a refresh