Fulham’s financial results for 2019/20 cover a season when they were promoted to the Premier League after just a single year in the Championship, finishing 4th, then winning the play-off under manager Scott Parker. Some thoughts in the following thread #FFC

#FFC pre-tax loss widened from £20m to £48m, as revenue fell £80m (58%) from £138m to £58m, due to relegation to the Championship and the impact of COVID, partly offset by profit on player sales rising £23m to £25m, while expenses were cut £29m (18%). Loss after tax was £45m.

#FFC £80m revenue fall was largely driven by broadcasting’s £65m (60%) decrease from £109m to £44m, due to lower TV money in Championship, though commercial also dropped £9m (52%) from £18m to £9m and match day fell £5m (48%) from £11m to £6m.

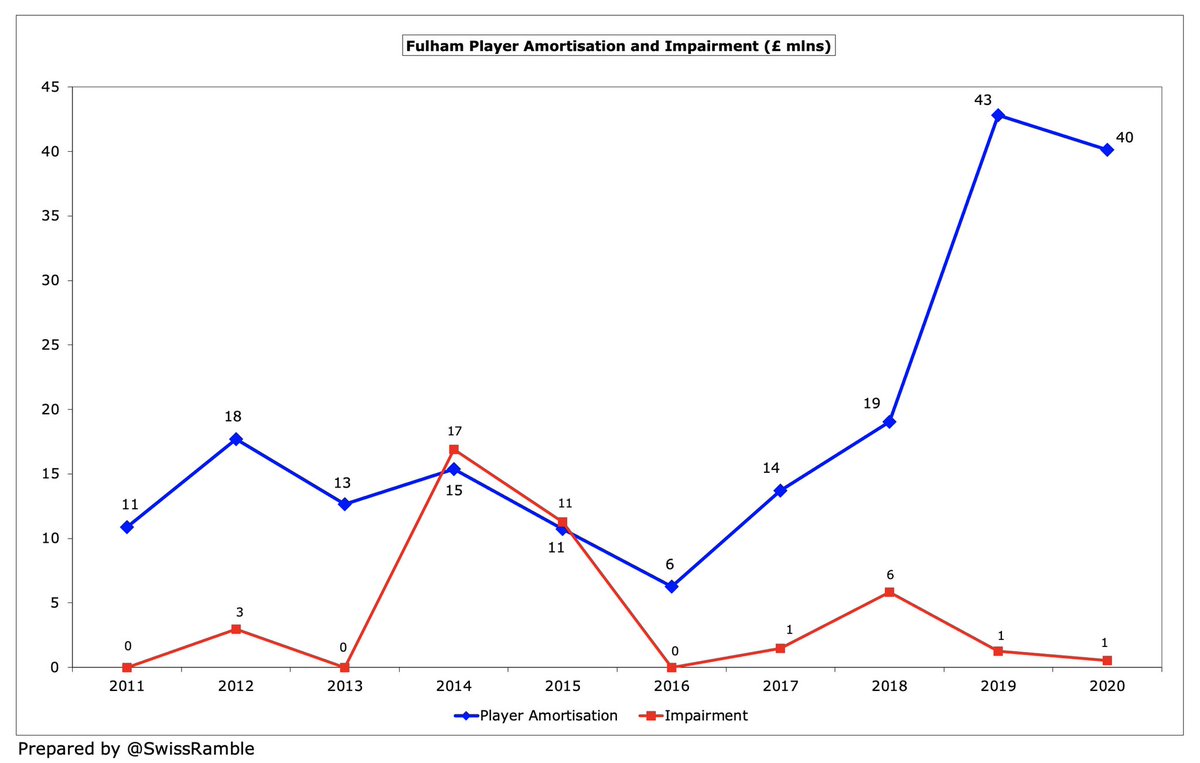

To compensate for the steep revenue decline, #FFC cut the wage bill by £20m (22%) from £93m to £73m and other expenses by £5m (24%) to £16m. Player amortisation and impairment also fell £3m (8%) to £41m, while there was no repeat of prior year £0.6m stadium impairment.

As a technical aside, #FFC £45.2m post-tax loss was increased by £8.6m to a £36.6m net loss (“Total Comprehensive Expense”), due to revaluation of land and buildings. Stadium value was reduced by £20m prior year after the Riverside Stand was decommissioned for redevelopment.

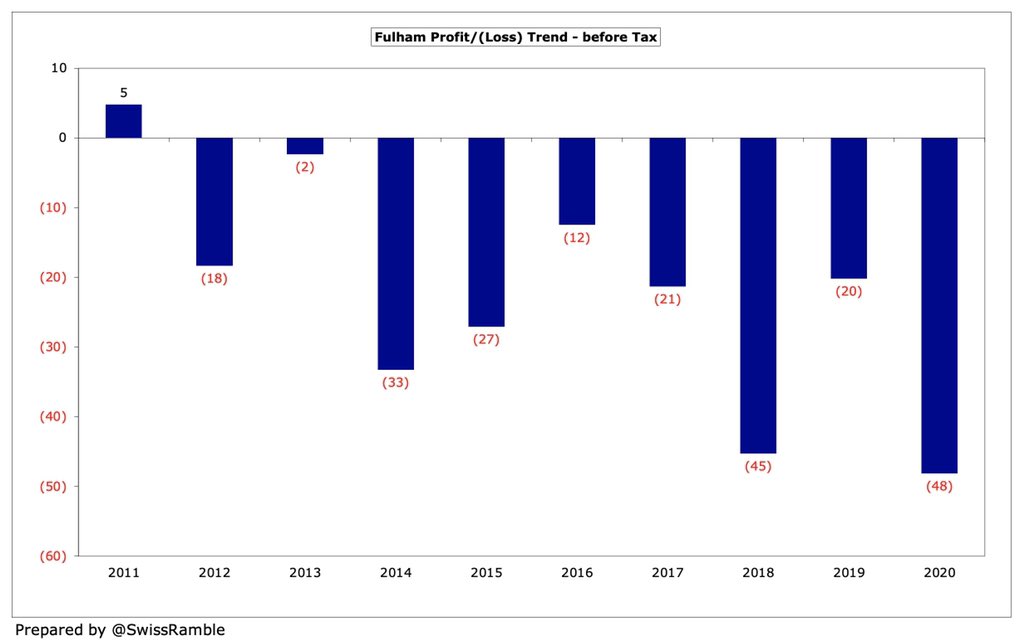

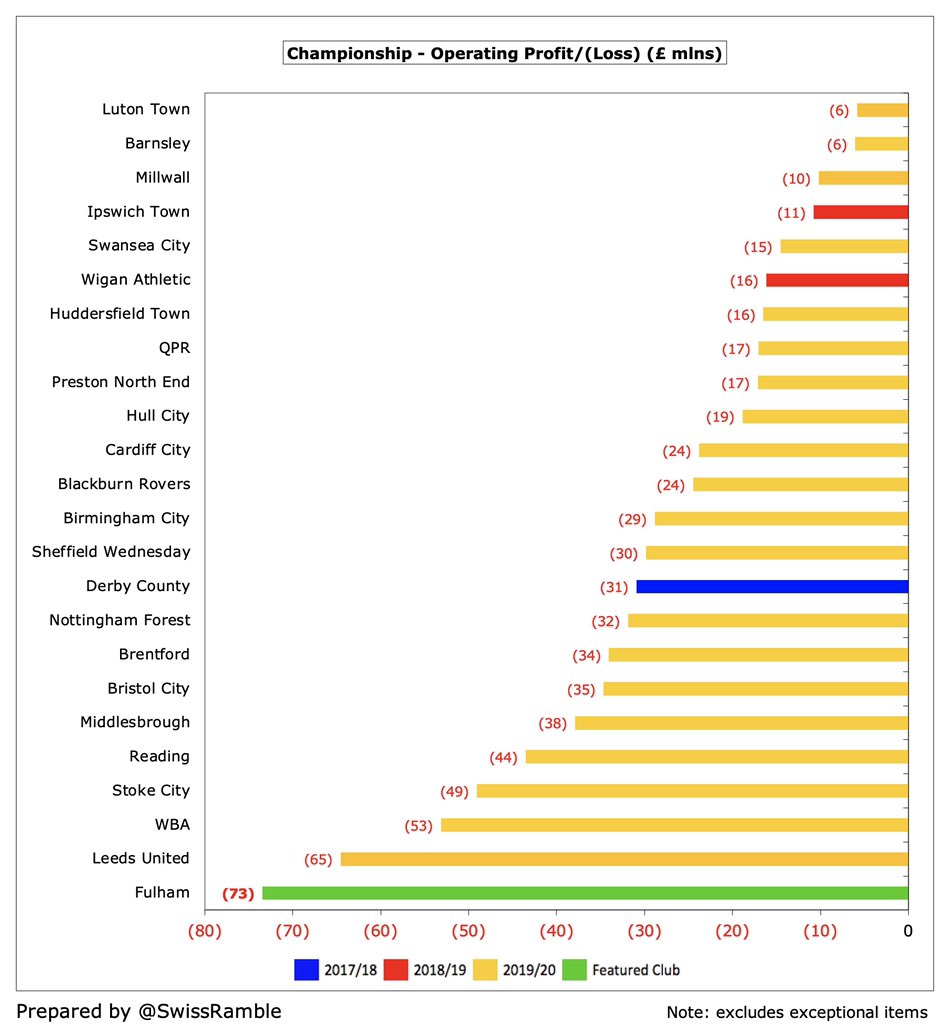

Most clubs in the Championship lose money, but #FFC £48m loss was one of the highest in the division, only surpassed by Stoke City £88m and #LUFC £62m. Worth noting that both Leeds and Fulham were impacted by the inclusion of large promotion bonuses.

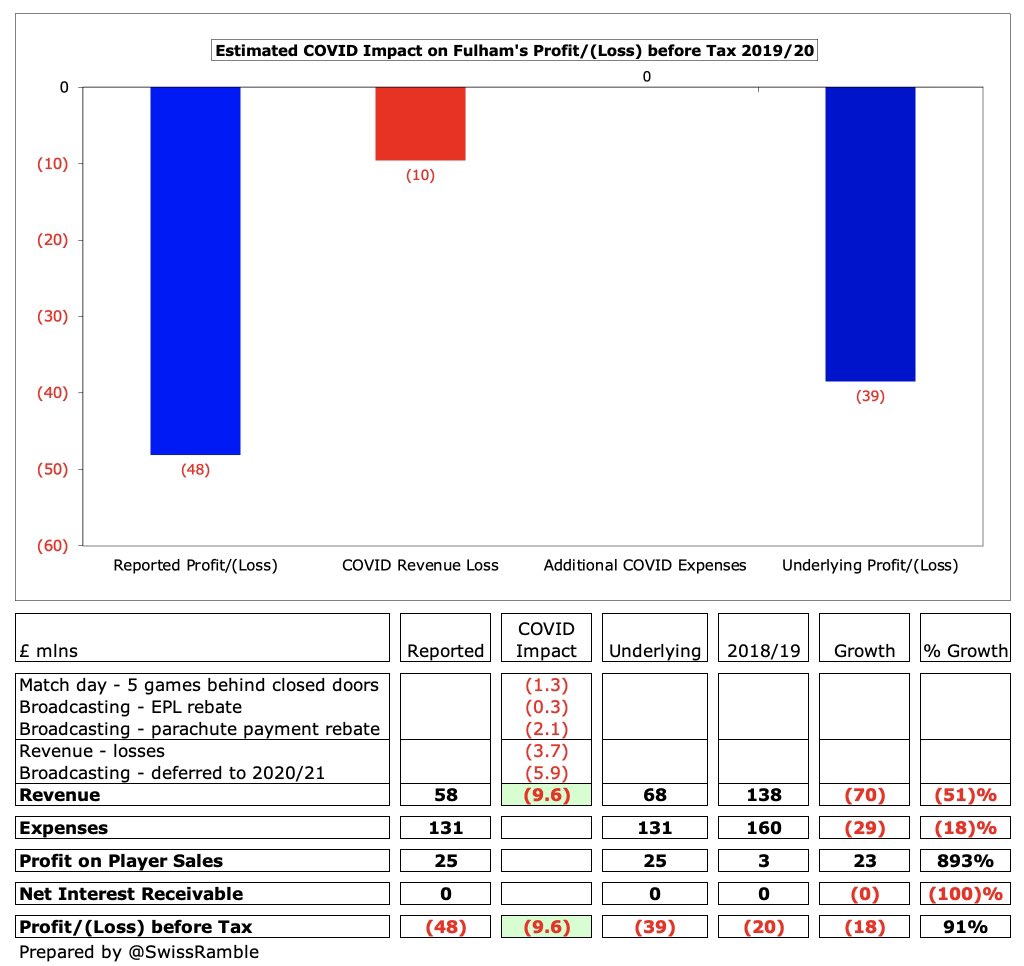

#FFC figures have obviously been hit by the pandemic, which has resulted in money lost from a rebate to broadcasters and games played behind closed doors, while revenue for games played after the 30th June accounting close has been deferred to 2020/21 accounts.

I estimate that COVID led to £9.6m reduction in #FFC revenue, split between £3.7m lost (match day £1.3m, TV rebates £2.4m) and £5.9m broadcasting deferred to 2020/21. Without this, revenue would have been £68m with a £39m loss. Full extent will only be clear this season.

#FFC loss would have been even higher without £25m profit on player sales, up from prior year £2m, almost entirely due to Ryan Sessegnon’s move to #THFC. That’s actually the third highest profit from this activity in the Championship, only behind WBA £29m and Bristol City £26m.

Losses are nothing new for #FFC, as the last time they made a profit was in 2011. In fact, they have only made money twice in the last 23 years. Losses have accelerated since Shahid Khan bought the club in July 2013, amounting to £208m in the last 7 years (averaging £30m a year).

The #FFC bottom line has been adversely impacted by significant exceptional charges of £56m in the last 11 years, specifically due to the write-down of asset values, also known as impairment (players £48m and stadium £8m), though nothing booked in 2019/20.

#FFC have not made much money from player sales with only £66m in total in the last 5 years. Moreover, according to the accounts, profit from player sales in 2020/21 was only £100k, though they will also include compensation from #LFC for Harvey Elliott’s 2019 move.

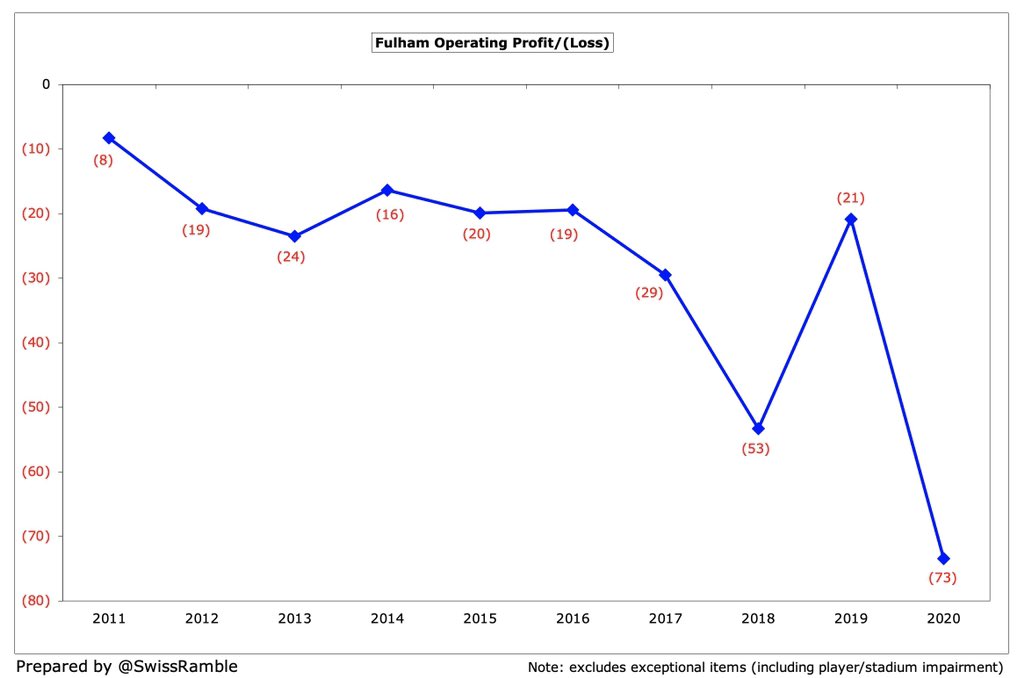

#FFC operating loss (i.e. excluding player sales, impairment and interest) of £73m was the worst in the Championship, higher than #LUFC £65m, WBA £53m and Stoke City £49m. In fairness, almost every club posts substantial operating losses, i.e. half of them are above £30m.

Despite the COVID impact, #FFC £58m revenue is still £20m higher than when they were last in the Championship in 2018, thanks to £22m broadcasting growth (higher parachute payment), though match day and commercial are both lower, by £1.4m and £0.9m respectively.

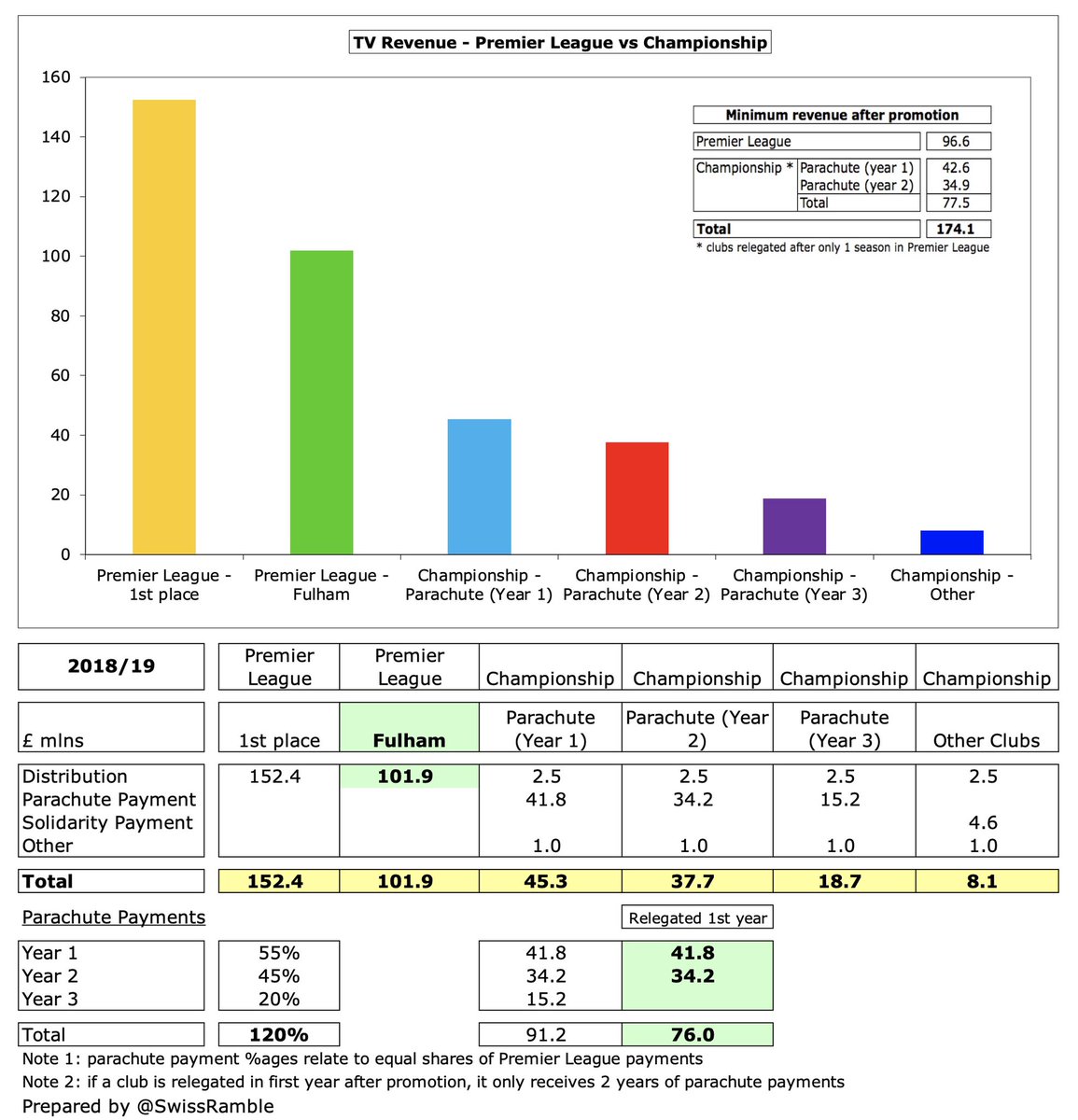

#FFC revenue decrease was softened by £42m Premier League parachute payment, though this was reduced by estimated £2.1m COVID rebate and £4.9m deferral. Despite broadcasting falling from £109m to £44m, it still accounts for 75% of total revenue (commercial 15% and match day 10%).

Even after the reduction, #FFC £58m revenue was still the highest in the Championship, just ahead of #LUFC £54m (massive commercial income), WBA £54m and #HTAFC £53m.

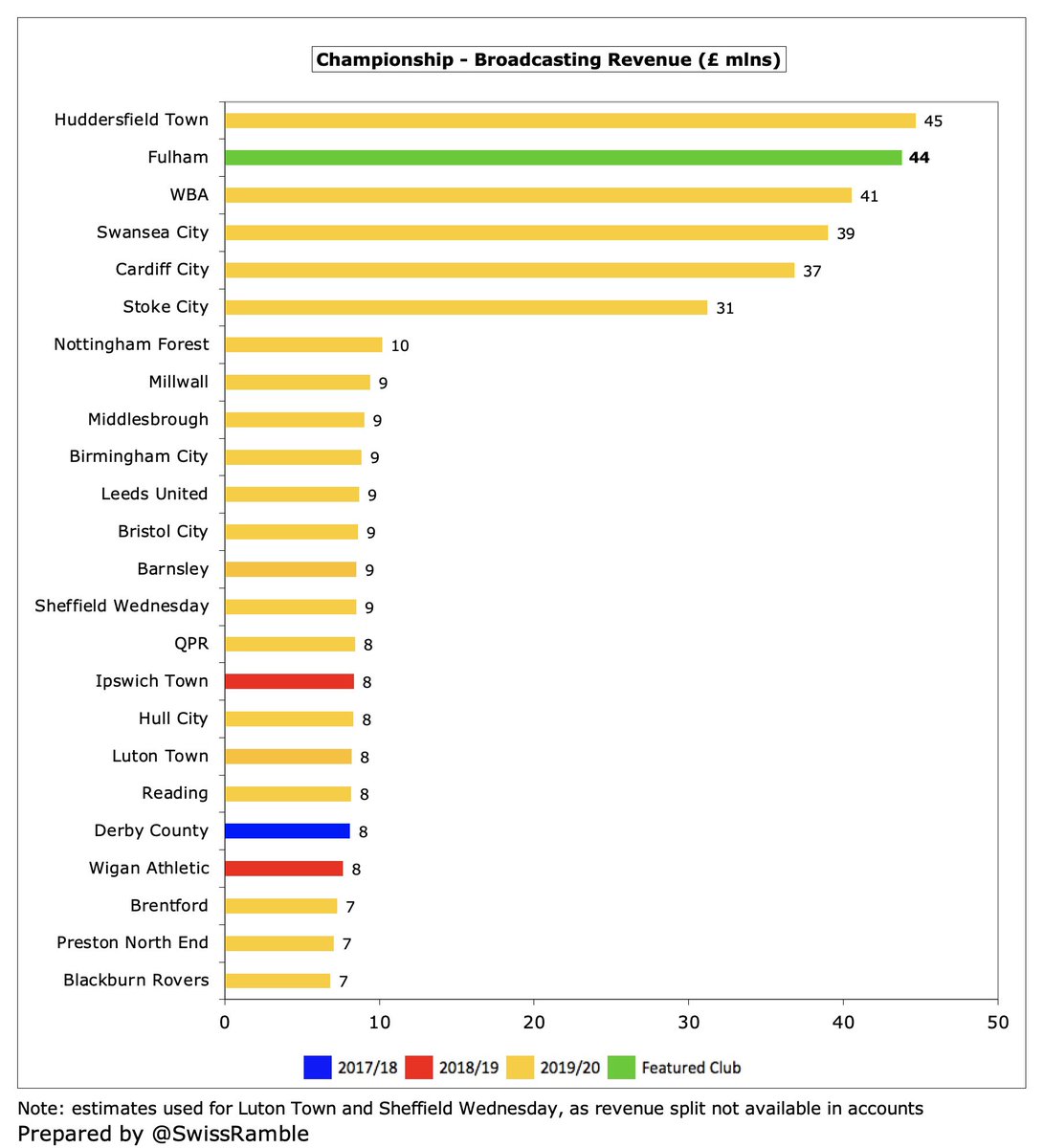

Obviously #FFC benefited from £42m parachute payment (before rebate & revenue deferral). Six other clubs received parachutes in 2019/20: Cardiff City and #HTAFC (£42m), followed by Stoke City, Swansea City and WBA (£34m for second year payment), Sunderland (£15m for third year).

If parachute payments were excluded, #FFC revenue would fall to £28m (£42m parachute less estimated £2.1m rebate and £4.9m revenue deferral, replaced by £4.5m solidarity payment). This would still have placed them third in the Championship, but a long below #LUFC £54m.

#FFC broadcasting income fell £65m (60%) from £109m to £44m, but still second highest in the Championship. Most clubs earn £7-10m, but a significant gap to those with parachute payments. Some clubs benefited from later accounting close, so less revenue deferred to 2020/21.

Following promotion to the Premier League, #FFC will have received over £100m in TV money in 2020/21 (as was the case in 2018/19). However, they will only get 2 years of parachute payments instead of usual 3 years as they were relegated after just one season in the top flight.

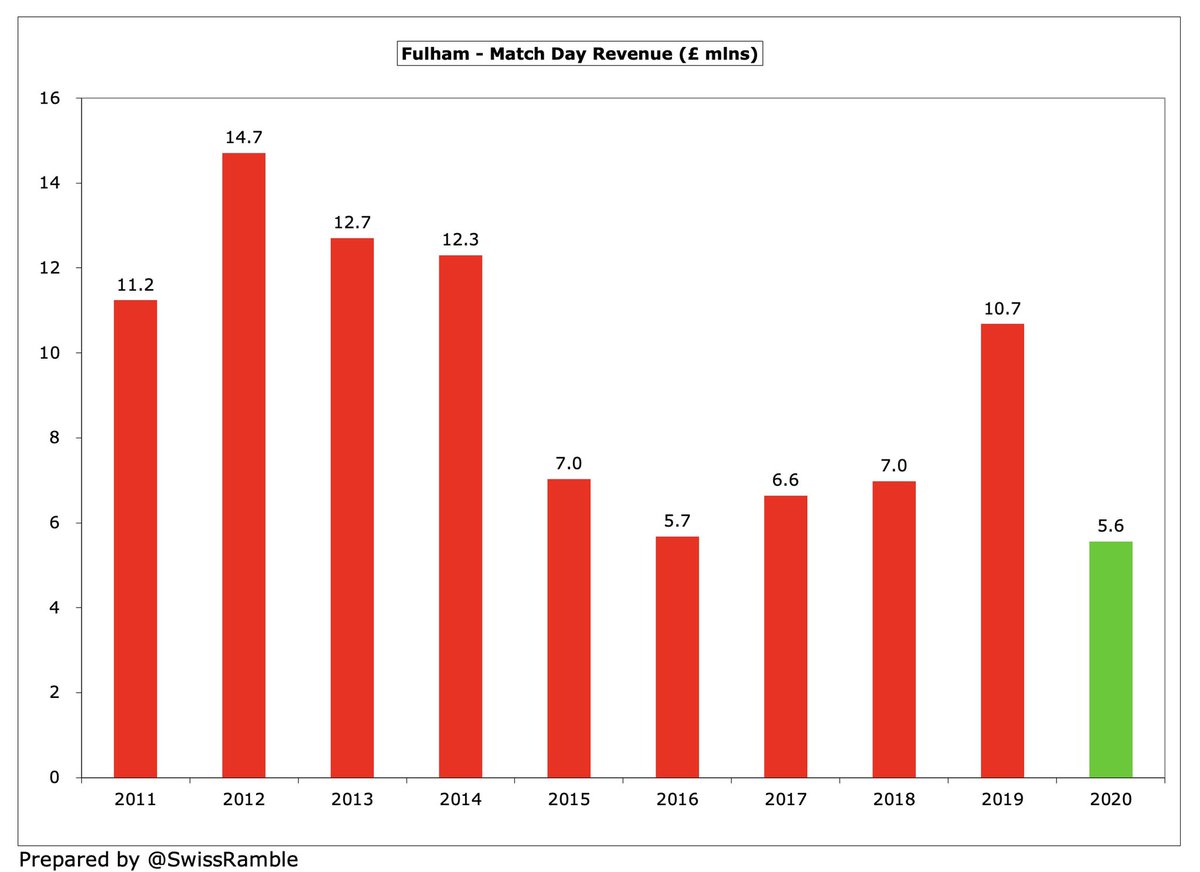

#FFC gate receipts fell £5.1m (48%) from £10.7m to £5.6m, largely due to playing 5 home games behind closed doors because of the pandemic (including play-off semi-final). This revenue was still 5th highest in the Championship, but less than half #LUFC £11m.

#FFC average attendance (for games played with fans) dropped 25% from 24,371 to 18,239, partly as a result of relegation, but also due to the closure of the Riverside Stand for development. This was mid-table in the Championship.

Work started on expanding the Riverside Stand at Craven Cottage at the end of the 2018/19 season. This will increase capacity from 25,700 to around 30,000 at a cost of £80m. The pandemic has delayed construction, but it should be completed in 2022.

#FFC commercial income more than halved from £18.1m to £8.7m, a bit lower than the last time they were in the Championship, partly due to COVID. This was sixth highest in the Championship, but far below the likes of #LUFC £34m, Bristol City £14m and Stoke City £14m.

#FFC shirt sponsorship was with Dafabet in 2019/20 (reportedly £3m a year), but has been replaced by BetVictor with a two-year deal following promotion. The Adidas kit supplier deal has been extended to 2023. New sleeve sponsor, ClearScore, in 2020/21.

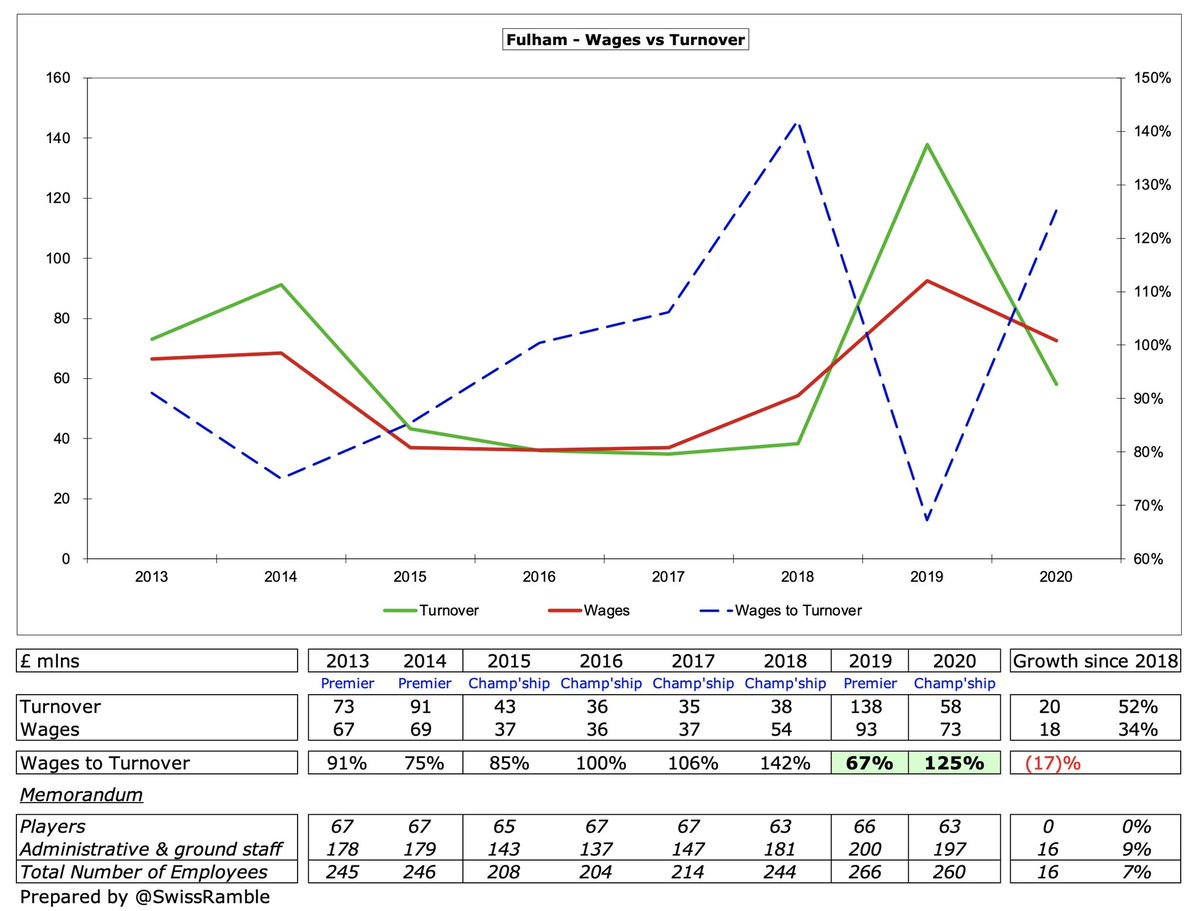

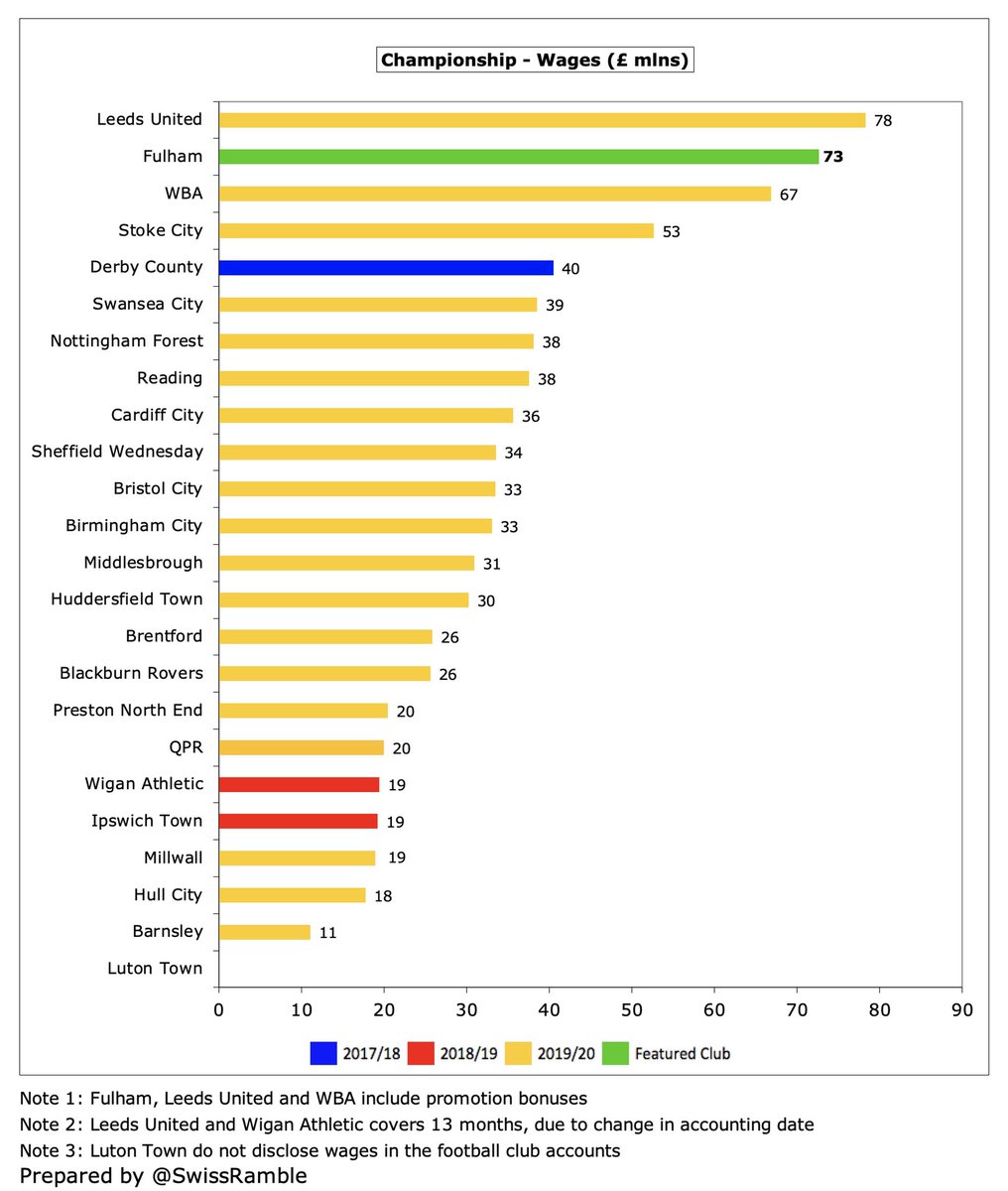

#FFC wages fell £20m (22%) from £93m to £73m, due to departure of some high earners (including loanees) and relegation clauses. Inflated by substantial promotion bonuses, though interesting to note that wages were a third (£18m) higher than the last time they were promoted.

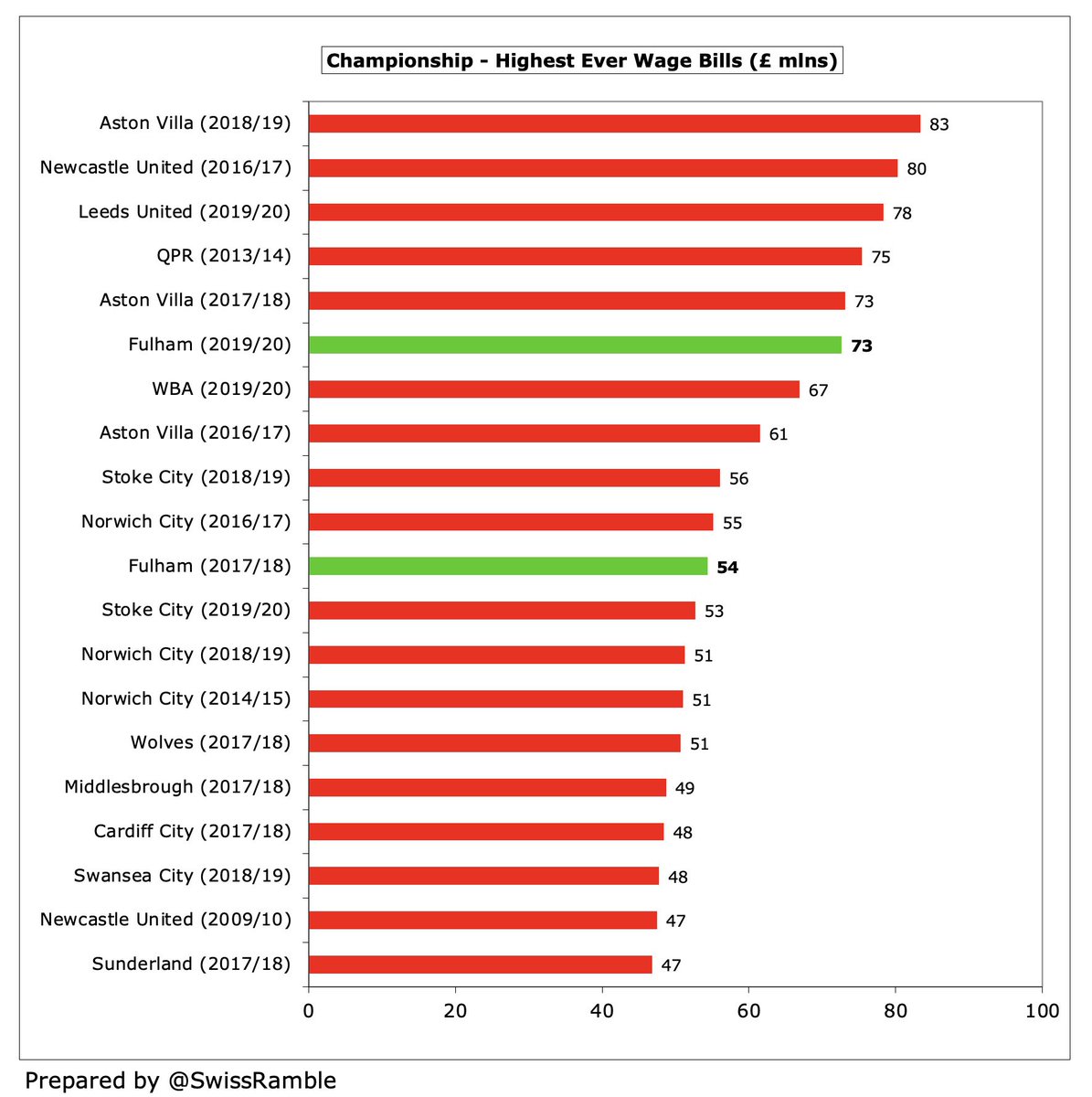

Even after the decrease, #FFC £73m wage bill was second highest in the Championship, only below #LUFC £78m, but ahead of WBA £67m (all three clubs included hefty promotion bonuses). In fact, this was the sixth highest wage bill ever in the second tier.

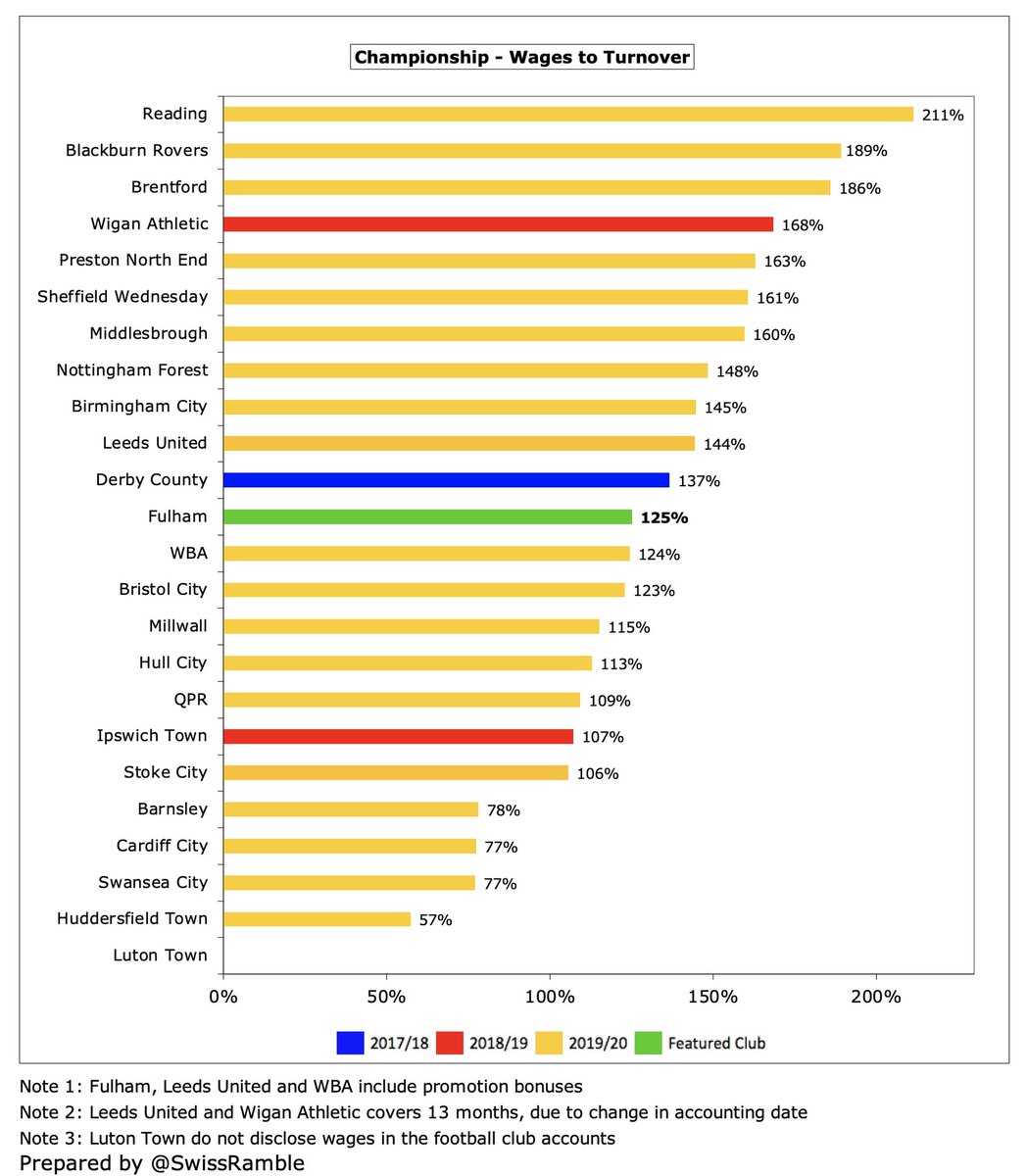

Following relegation #FFC wages to turnover ratio nearly doubled from 67% in the Premier League to 125% in the Championship. This is par for the course in this division, where the vast majority of clubs have unsustainable ratios well over 100%.

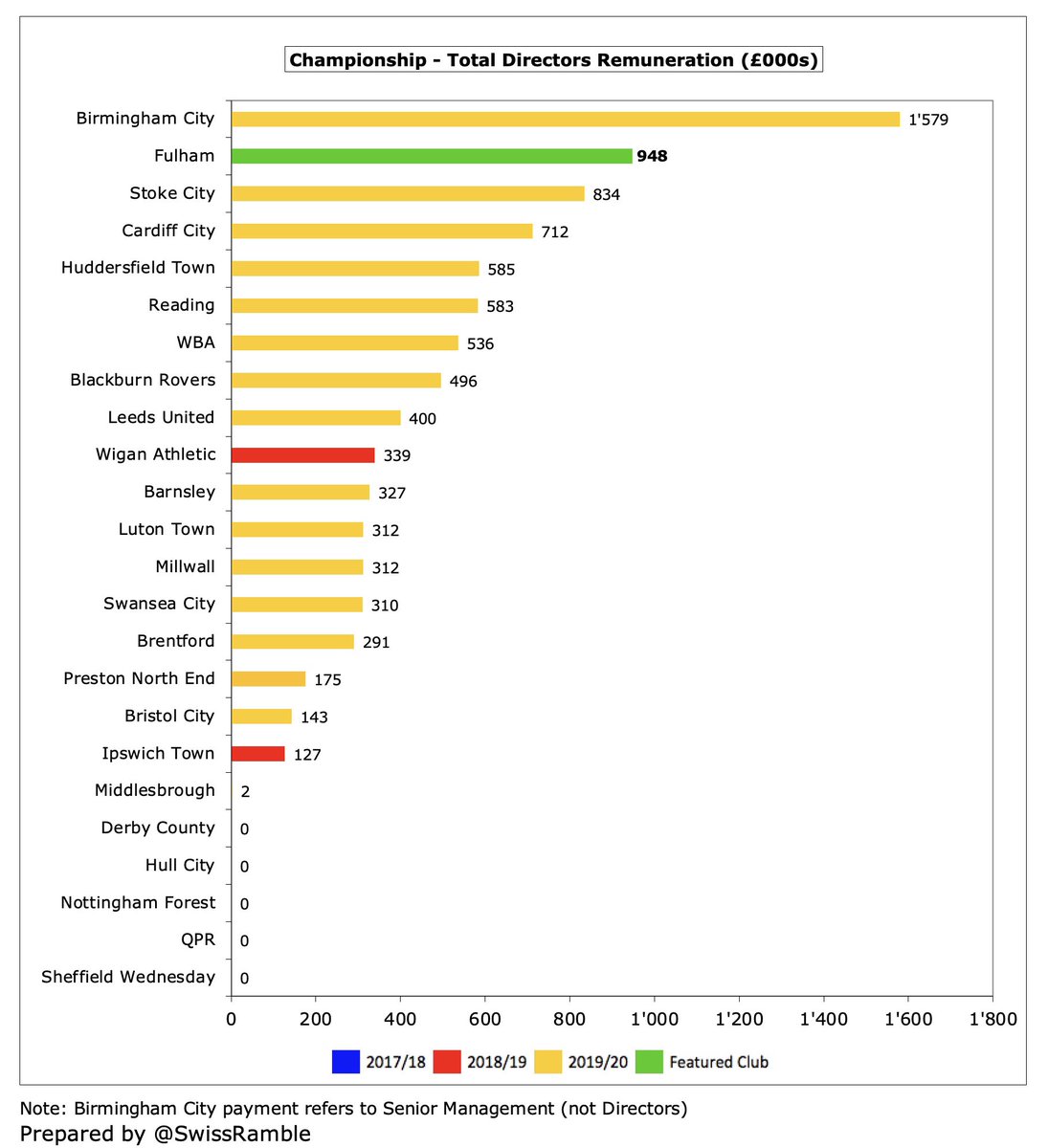

#FFC total directors’ remuneration fell 44% from £1.5m to £948k in the Championship, though this was still the second highest in the Championship. This was all earned by the highest paid director, presumably chief executive Alistair Mackintosh.

#FFC player amortisation, the annual charge to write-off transfer fees over a player’s contract, fell £3m (6%) from £43m to £40m, but this was still comfortably the highest in the Championship, far above Stoke City £30m. Also booked £0.5m impairment charge.

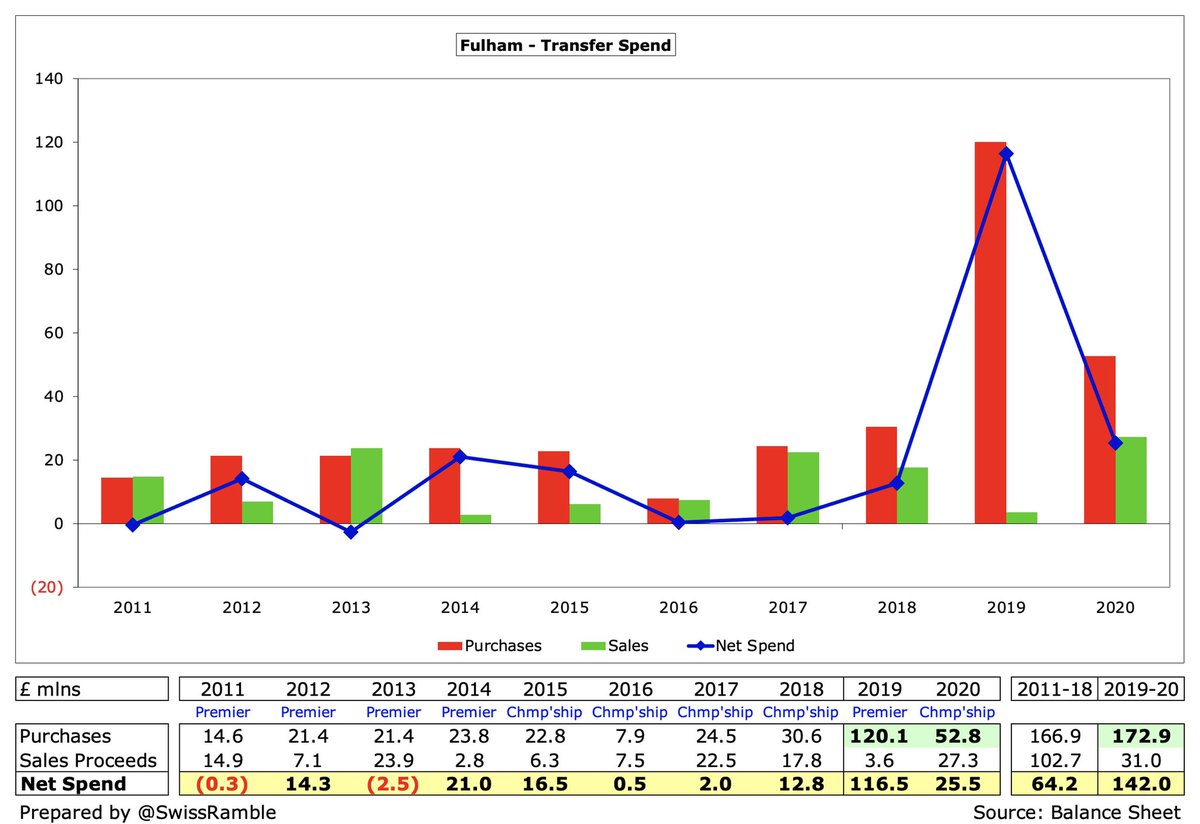

#FFC spent £53m on players in 2019/20, including Cavaleiro, Decordova-Reid, Knockaert and Hector. This was the second largest annual outlay in the club’s history and the highest in the Championship, ahead of #LUFC £46m, #WBA £34m, Brentford £31m and Bristol City £26m.

In the last 2 years #FFC have spent an amazing £173m on player purchases, which is more than the previous 8 years combined. This included a barely credible £120m in 2019, which was the 4th highest in the Premier League that season. There was a further £52m recruitment in 2020/21.

#FFC gross debt is less than £1m, despite Shahid Khan loaning an additional £78m in 2020, as he converted this into equity. Over half a billion of debt has now been “written-off” in this way (£290m by Khan plus £212m by former owner Mohamed Al Fayed).

As a result of the significant conversion of loans into capital, #FFC £0.4m debt is unsurprisingly one of the smallest in the Championship, far below the likes of Stoke City £187m, #BRFC £156m, #BCFC £116m and #Boro £116m.

However, it is worth noting that the vast majority of debt in the Championship is provided by generous owners. Furthermore, much of this is interest-free, so very little interest is actually paid (only five clubs above £1m) with nothing for #FFC.

On the other hand, #FFC have seen huge growth in transfer debt, which has risen from just £2m in 2016 to £86m, only partly offset by £18m owed to Fulham by other clubs. This means that much of the player recruitment has been done on credit with £53m payable within 12 months.

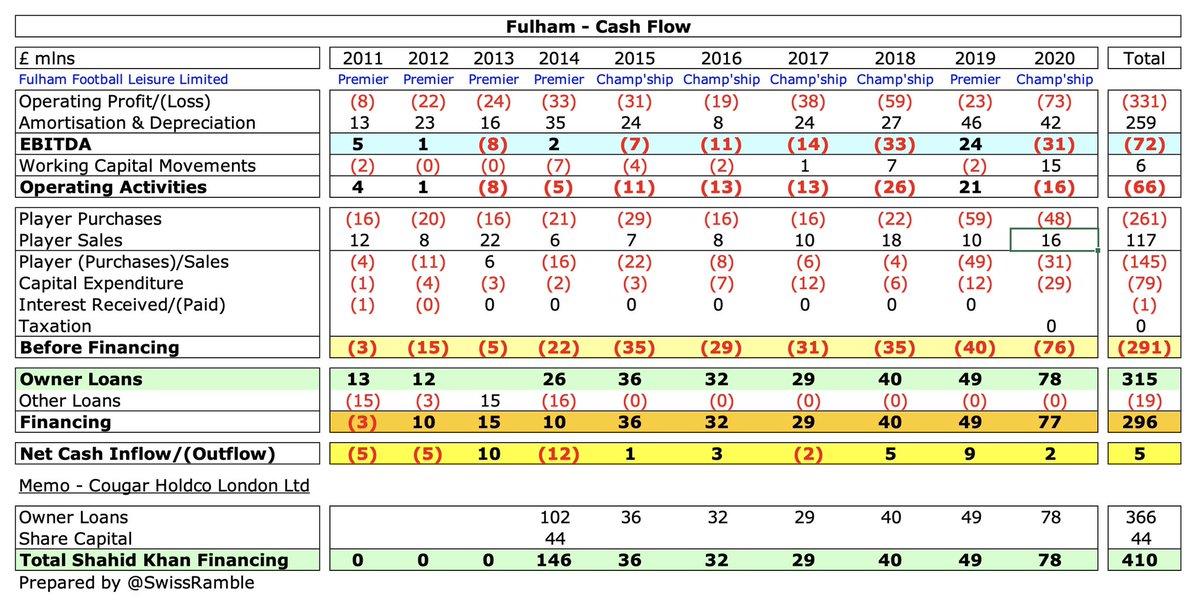

#FFC £73m operating loss became £16m negative cash flow after adding back £42m player amortisation/depreciation and £15m working capital movements, but club then spent £31m on players (purchases £48m, sales £16m) and £29m on infrastructure. Covered by £78m funding from the owner.

As a result, #FFC cash balance rose £2m from £17m to £19m, which was the second highest in the Championship, only beaten by #LUFC £32m. Most Championship clubs have less than £2m cash in the bank.

In the last decade all of #FFC £315m available cash has come from the owners’ pockets with £145m used for player purchases (net), £79m on infrastructure, £66m to cover losses and £20m on loan/interest payments. Cash balance increased by £5m.

Looking at the accounts of Cougar Holdco London Limited, the #FFC holding company, Shahid Khan has now provided the club with £410m, split between £44m new shares and £366m loans (since converted to equity). That’s an awful lot of money to preside over three relegation campaigns.

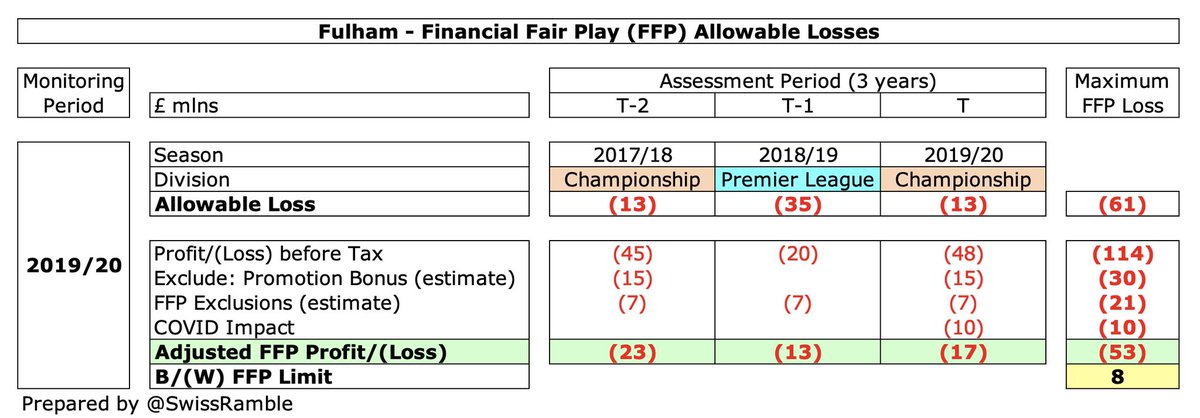

#FFC are “mindful” of FFP regulations with director of football Tony Khan saying that the club does not want to “damage itself irreparably on FFP”, adding, “I’ve tried to manage FFP really closely while still investing in the squad.”

Despite the losses, my model suggests #FFC are fine with FFP, as they can exclude £30m promotion bonuses, £7m a year for academy, community & infrastructure and £10m COVID impact. That gives £53m FFP loss against £61m limit (2 years Championship at £13m plus 1 year PL at £39m).

#FFC posted a huge operating loss in 2020, partly offset by player trading, but they are fortunate that their owner Shahid Khan has provided significant financial support. They did well to immediately bounce back to the Premier League, but have since suffered another relegation.

• • •

Missing some Tweet in this thread? You can try to

force a refresh