As account portability becomes the the standard in financial services, community ownership (i.e. providing customers with exposure the growth of the platform) gains ground as one of the most important factors considered by customers when deciding where to host their funds.

In other words, account portability turns equity crowdfunding into a competitive advantage vis-à-vis VC funding, as it offers the possibility to build loyalty amongst crowd investors and reduce churn rates.

Which potentially gives rise to an interesting, yet foreseeably frustrating phenomenon.

Whilst consumer-facing startups have incentives to open its ownership structures to their communities, not so much the back-end, infrastructure or B2B focused startups.

Whilst consumer-facing startups have incentives to open its ownership structures to their communities, not so much the back-end, infrastructure or B2B focused startups.

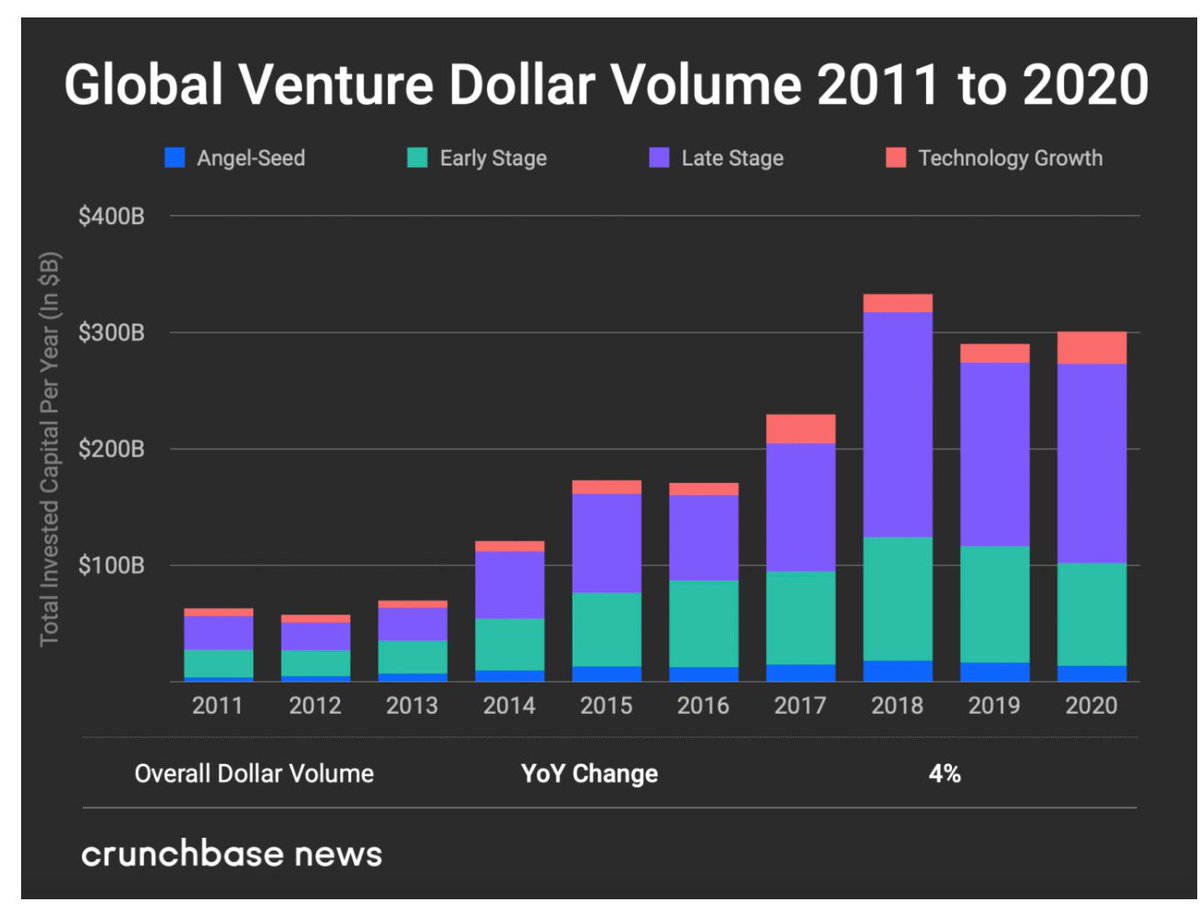

As we know, for purposes of scaling quickly, safely and cheaply, consumer-facing startups usually rely on third party providers, who —as pointed above— are more likely to be funded exclusively by VC firms. As VC investments concentrate in fewer back-end providers, the provision

of vital services for consumer-facing startups gets increasingly anticompetitive, which ultimately ends up affecting end users.

• • •

Missing some Tweet in this thread? You can try to

force a refresh