Sheffield Wednesday’s financial results for 2019/20 cover a season when they finished 16th in the Championship, though they have since been relegated to League One. Manager Garry Monk since replaced by Tony Pulis, in turn succeeded by Darren Moore. Some thoughts follow #SWFC

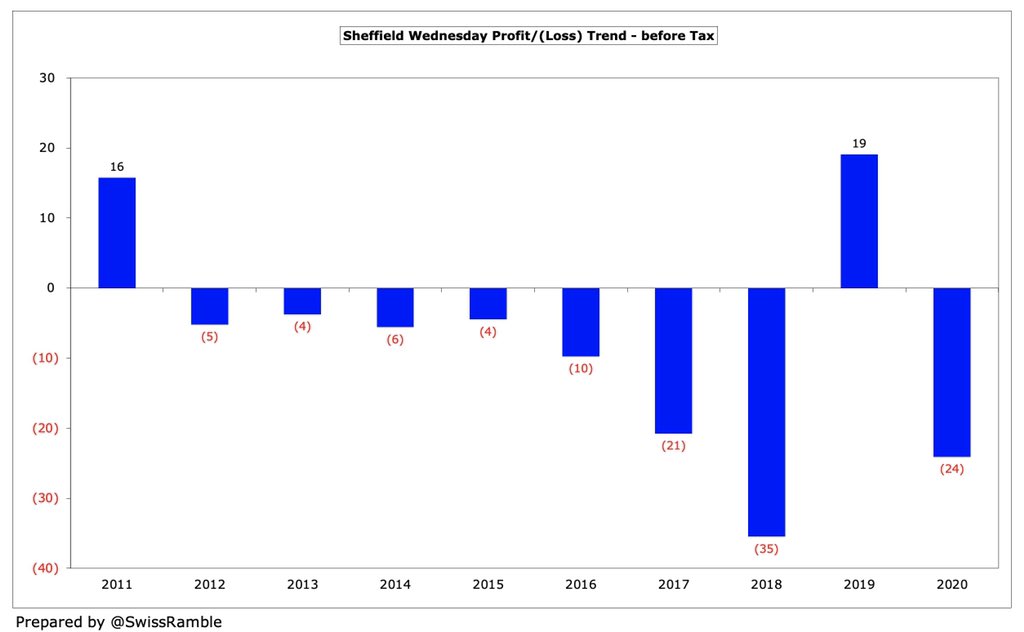

#SWFC swung from £19m profit to £24m loss, largely due to prior year including £38m profit from selling the stadium and a £6.5m “confidential settlement payment”. Revenue fell £1.9m (8%) from £22.8m to £20.9m, while expenses were flat. Profit on player sales rose £3.4m to £6.2m.

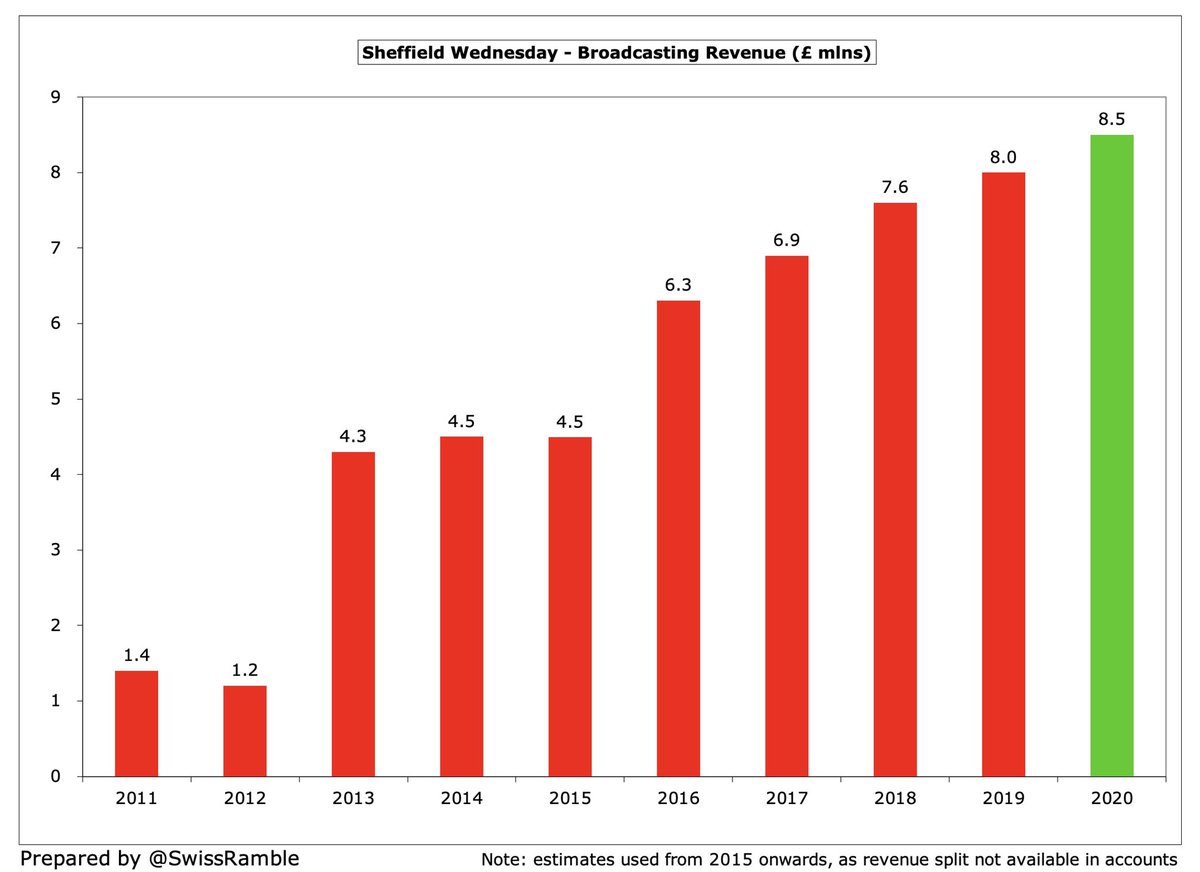

#SWFC match day fell £2.0m (23%) from £8.6m to £6.6m, while commercial was down £0.4m (7%) from £6.1m to £5.7m, but broadcasting rose £0.5m (6%) from £8.0m to £8.5m. Note: match day and broadcasting not separated in accounts, so I have estimated these based on similar clubs.

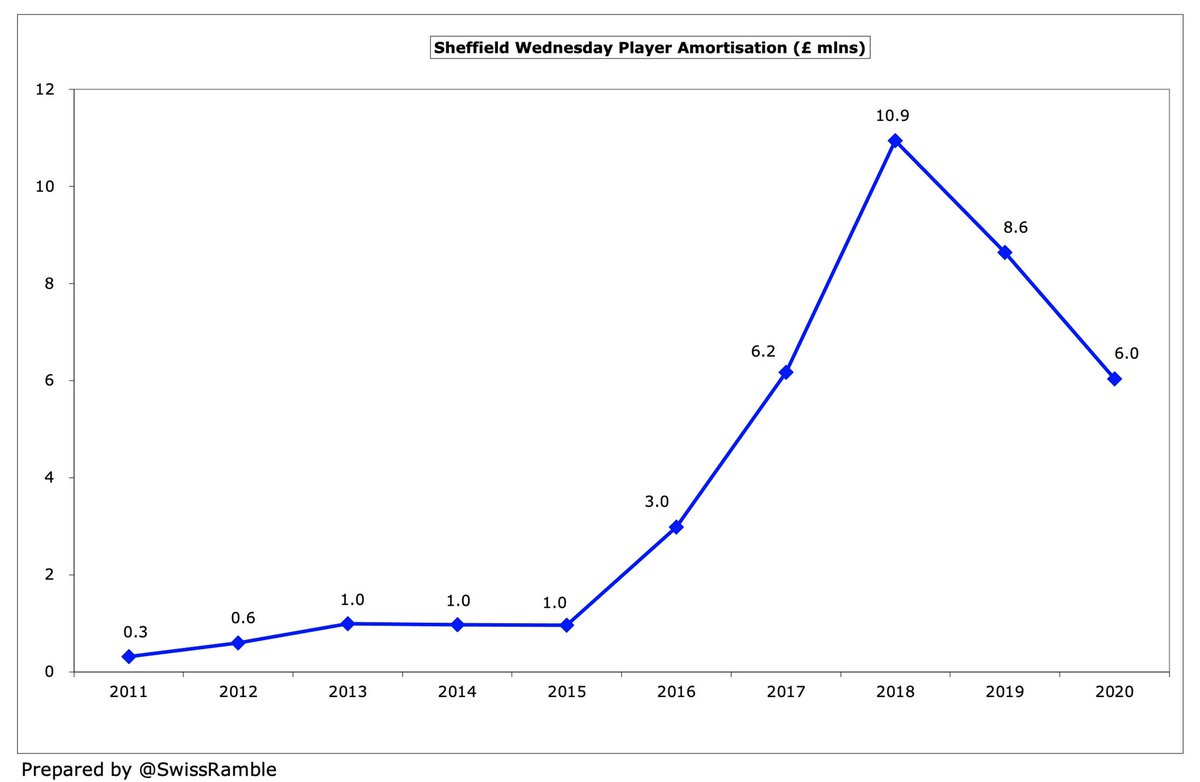

#SWFC staff costs were cut: wage bill fell £2.9m (8%) from £36.4m to £33.5m, while player amortisation decreased £2.6m (30%) to £6.0m. However, other expenses more than doubled from £5.2m to £11.1m, partly due to rent paid for the (sold) stadium.

As a reminder, #SWFC sold their stadium for £60m, which gave them a £38m profit after deducting the £22m book value. If this transaction were excluded, they would have reported a £19m loss in 2019, which means that the £24m underlying loss in 2020 was £5m higher.

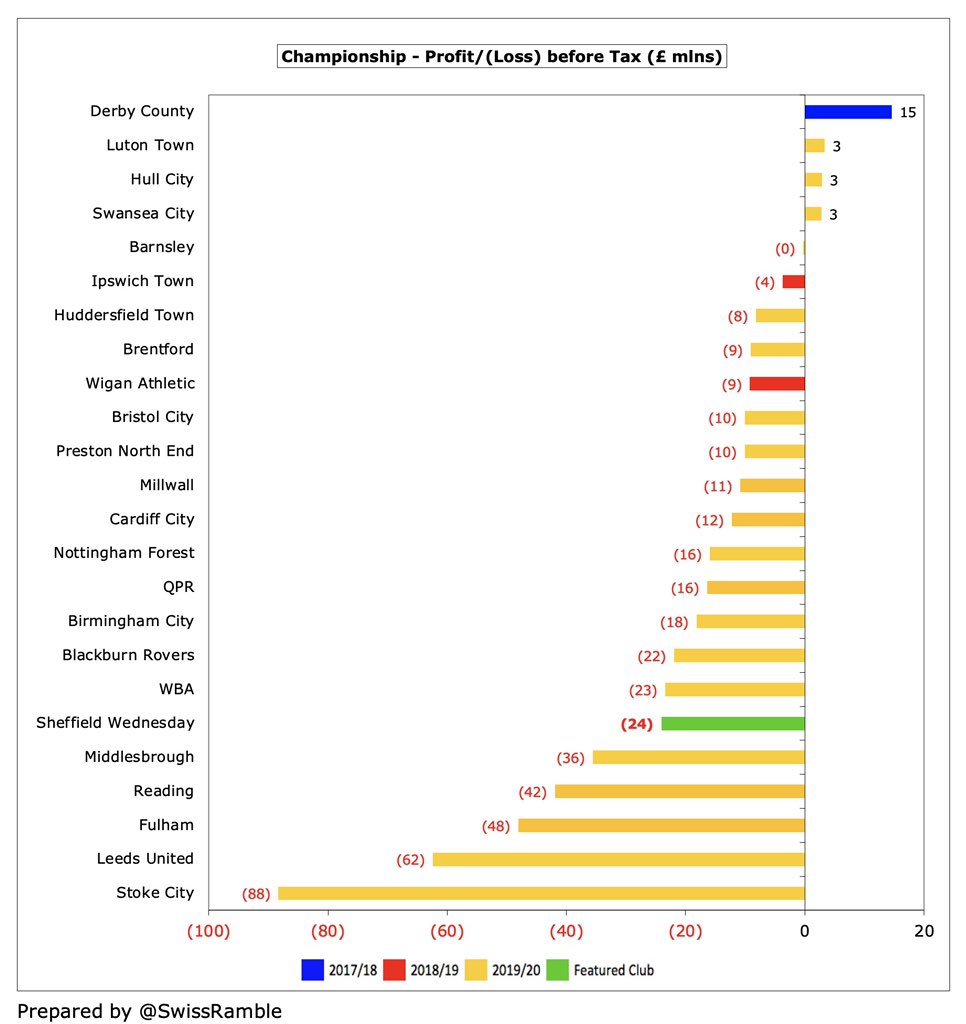

Most clubs in the Championship lose money, but #SWFC £24m loss is the sixth highest in the division to date, though far below Stoke City £88m, #LUFC £62m and #FFC £48m (the latter two were impacted by the inclusion of large promotion bonuses).

#SWFC figures have obviously been hit by the pandemic, which has resulted in money lost from a rebate to broadcasters and games played behind closed doors, while revenue for games played after the 30th June accounting close has been deferred to 2020/21 accounts.

I estimate that COVID led to £3.2m reduction in #SWFC revenue, split between £1.9m lost (match day £1.6m, TV rebate £0.3m) and £1.4m broadcasting deferred to 2020/21, offset by a £0.9m government grant, leading to a net £2.4m adverse impact.

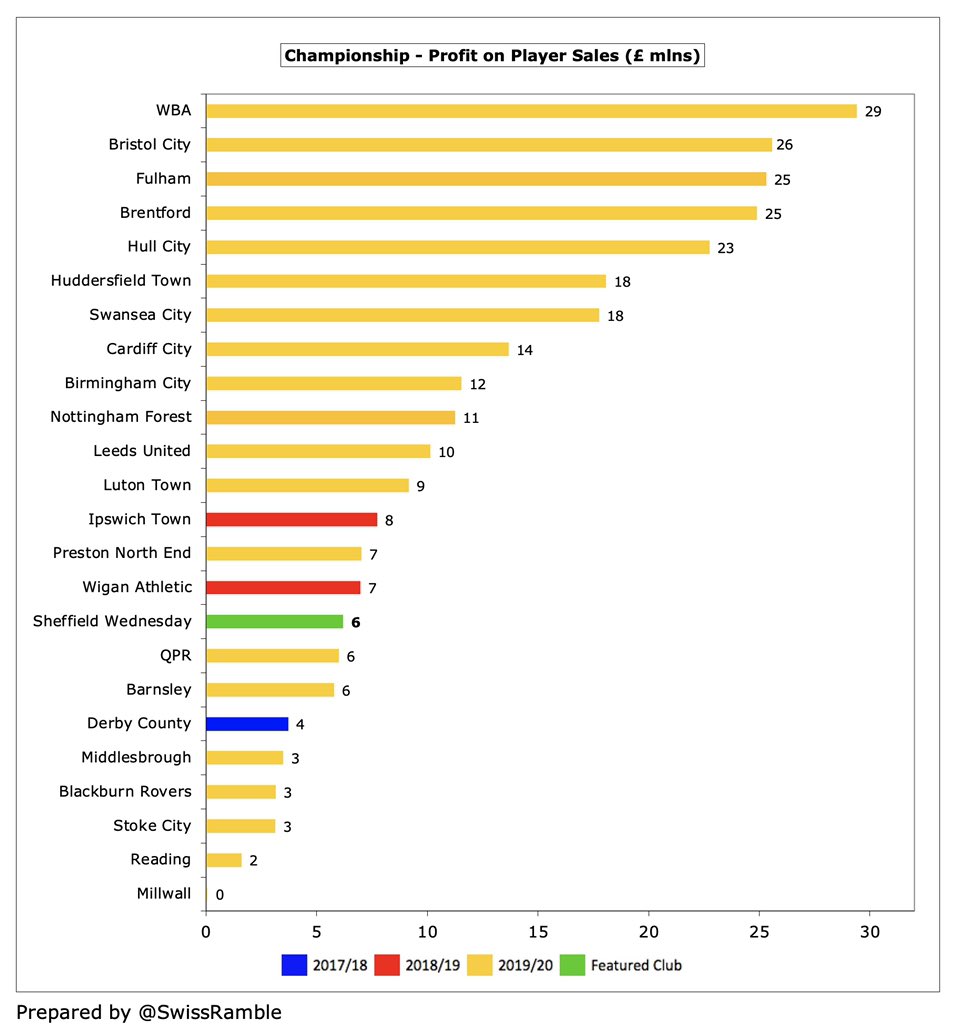

#SWFC profit on player sales increased from £2.8m to £6.2m, mainly Lucas Joao’s move to Reading. Some suggest that this also includes compensation for manager Steve Bruce’s departure to #NUFC, though others claim that this was covered by prior year compensation payment.

#SWFC have consistently lost money, only reporting a profit twice in the last decade, and both of those were due to one-offs. Underlying losses have been rising since the arrival of owner Dejphon Chansiri, aggregating £71m over the last 5 years (£109m excluding the stadium sale).

#SWFC only managed to report profits in 2011 and 2019 thanks to exceptional items: £21m loan waiver in 2011; £38m stadium sale and £6.5m confidential settlement payment, adding up to £45m in 2019.

Profit on player sales can also improve the bottom line, but this has not been a big money-spinner at #SWFC. While the 2020 profit of £6.2m was the highest ever, (I think) they have made less than £16m profit from this activity in the last 10 years.

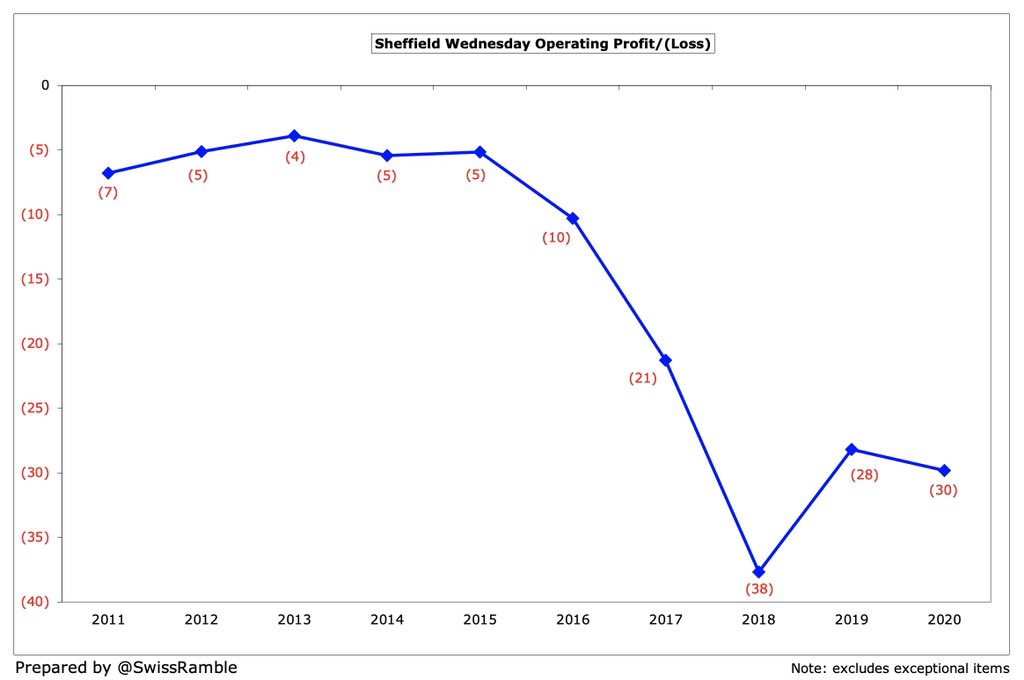

#SWFC operating loss (i.e. excluding player sales and interest) rose slightly from £28m to £30m, though much better than LUFC £65m, WBA £53m and Stoke City £49m. Almost every club in the competitive Championship posts large operating losses, i.e. half of them are above £30m.

Despite the 2020 fall, #SWFC owner Dejphon Chansiri has managed to grow revenue by £6m (40%) since he bought the club from £14.9m to £20.9m. The 2018 peak of £25.2m was inflated by accounting period being extended to 14 months, as the club attempted to include the stadium sale.

Based on my estimate, #SWFC most important revenue stream is broadcasting (41%), followed by match day (32%) and commercial (27%). Championship clubs without parachute payments have a much more even balance than Premier League clubs, who are far more reliant on TV money.

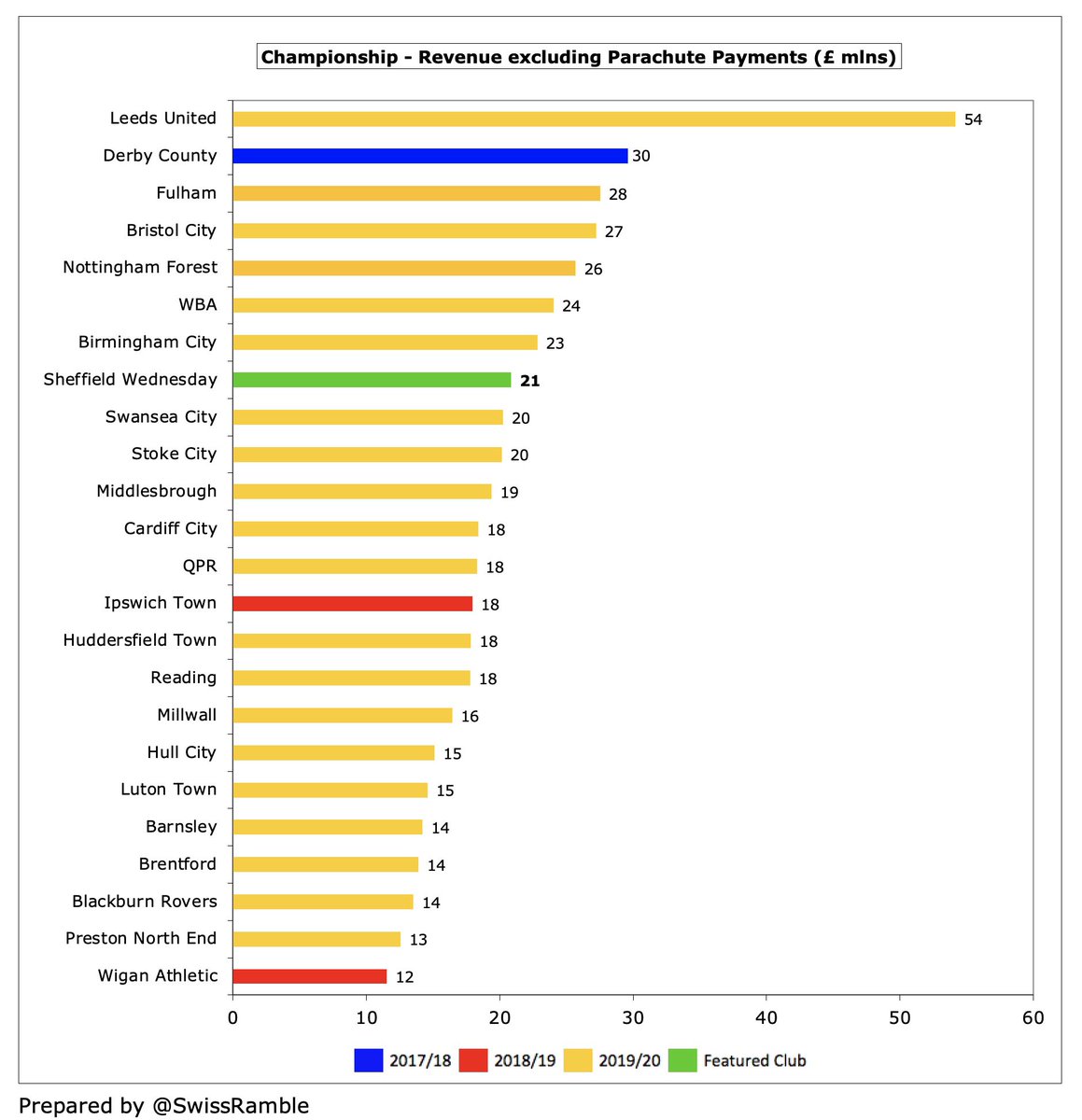

Following the decrease, #SWFC £21m revenue is mid-table in the Championship, but a long way below #FFC £58m, #LUFC £54m (massive commercial income), WBA £54m and #HTAFC £53m.

As Chansiri once said, “The Championship is incredibly competitive and gets stronger and stronger each year with the parachute money from the Premier League clubs.” This leads to a huge revenue disparity with 6 clubs benefiting in 2020, led by Cardiff City, #FFC & #HTAFC (£42m).

If parachute payments were excluded, #SWFC £21m would move them up to 8th highest revenue in the Championship, sandwiched between #BCFC and Swansea City. However, they would still be £33m behind #LUFC £54m.

#SWFC (estimated) broadcasting income rose £0.5m (6%) from £8.0m to £8.5m. Most clubs earn £7-10m, but there is a significant gap to those with parachute payments. Some clubs benefited from a later accounting close, so less revenue was deferred to 2020/21.

#SWFC (estimated) match day income fell £2.0m (23%) from £8.6m to £6.6m, largely due to playing 5 home games behind closed doors because of the pandemic. This would still be 4th highest in the Championship, though a fair way behind #LUFC £11m.

#SWFC average attendance (for games played with fans) dropped 3% from 24,426 to 23,752, down 3,554 (13%) from the recent 27,306 peak in 2017, though still 5th highest in the Championship. Ticket prices were frozen in 2019/20 and have been significantly cut following relegation.

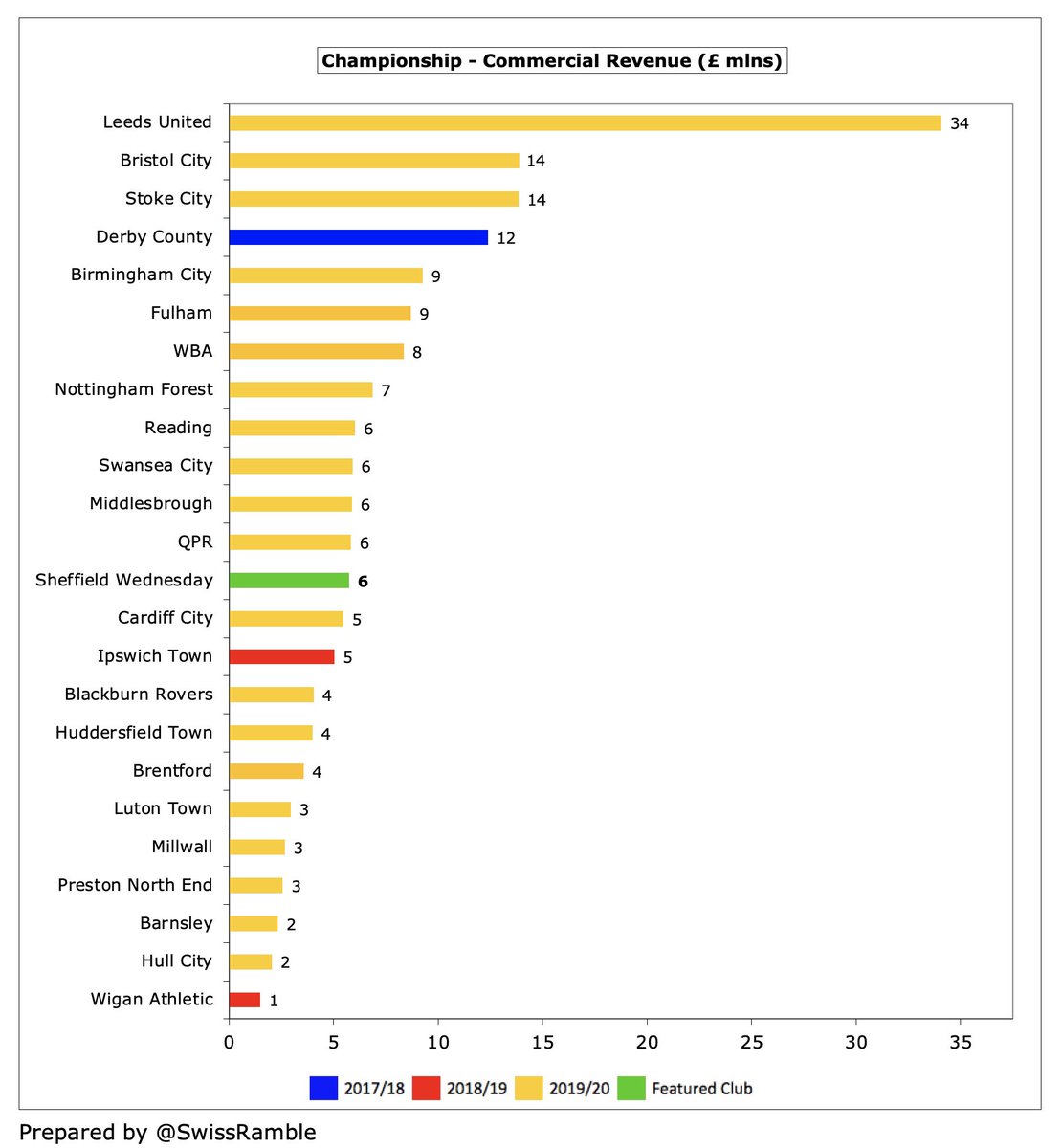

#SWFC commercial income fell £0.4m (7%) from £6.1m to £5.7m, the club’s lowest since 2016. This was mid-table in the Championship, far below the likes of #LUFC £34m, Bristol City £14m and Stoke City £14m.

#SWFC owner Dejphon Chansiri provided £1.6m sponsorship “relating to the club shirt and certain areas around the stadium”, up from £1.1m the previous season. Wednesday manufactured their own kits under Chansiri’s ‘Elev8’ brand, but have just signed a long-term deal with Macron.

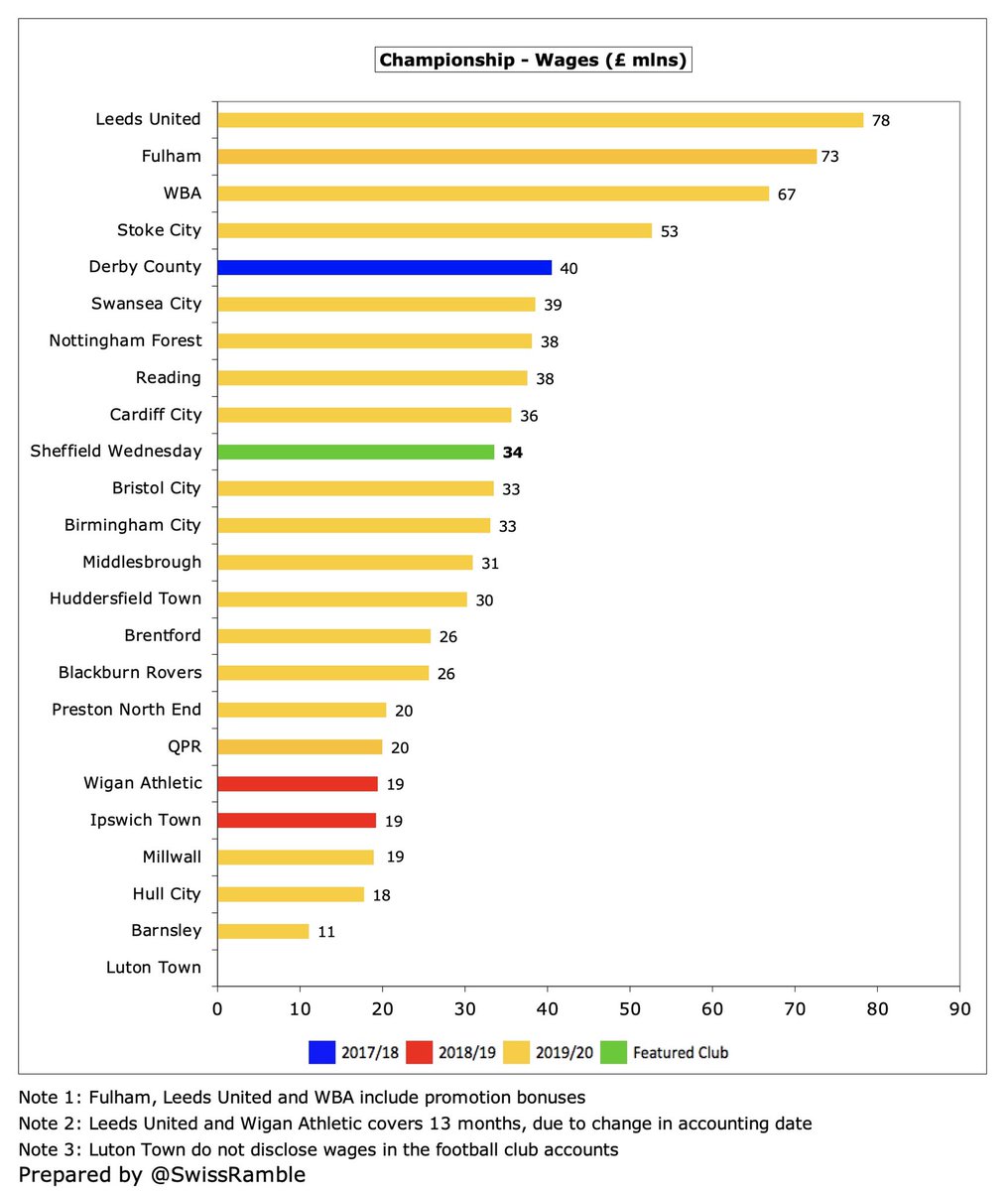

#SWFC wages fell £2.9m (8%) from £36.4m to £33.5m, which is £9m less than 2018 £42m peak (14 months), though still much more than £13m in 2015. Since these accounts many high earners (Fletcher, Forestieri, Rhodes, Westwood, Reach, etc) have left, so wages will drop significantly.

Even after the decrease, #SWFC £34m wage bill was 10th highest in the Championship, which means that the club has punched well below its weight. That said, less than half of #LUFC £78m and #FFC £73m, though they both included hefty promotion bonuses.

#SWFC wages to turnover ratio was virtually unchanged at 161%, the sixth highest in the Championship. This is obviously unsustainable, though it is pretty much the norm in this division, where the vast majority of clubs have ratios well over 100%.

#SWFC did not pay any directors’ remuneration in 2019/20, down from £137k the previous year, which was presumably for former chief executive, Katrien Meire, who has since left the club, leaving Chansiri as the sole director.

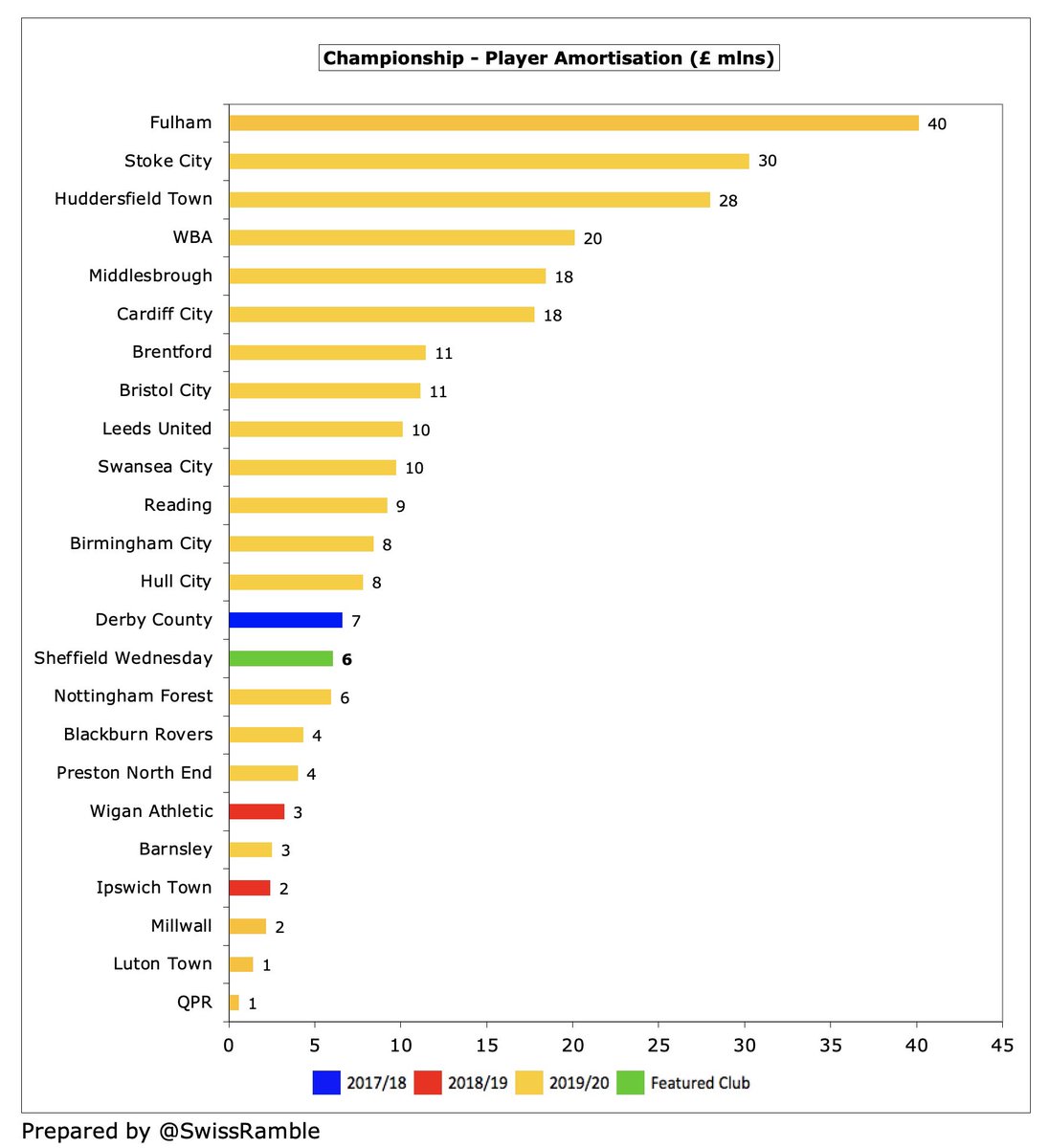

#SWFC player amortisation, the annual charge to write-off transfer fees over a player’s contract, fell £2.6m (30%) from £8.6m to £6.0m, though much higher than £1m in 2015. Far below clubs recently relegated from the Premier League like #FFC £40m, Stoke City £30m & #HTAFC £28m.

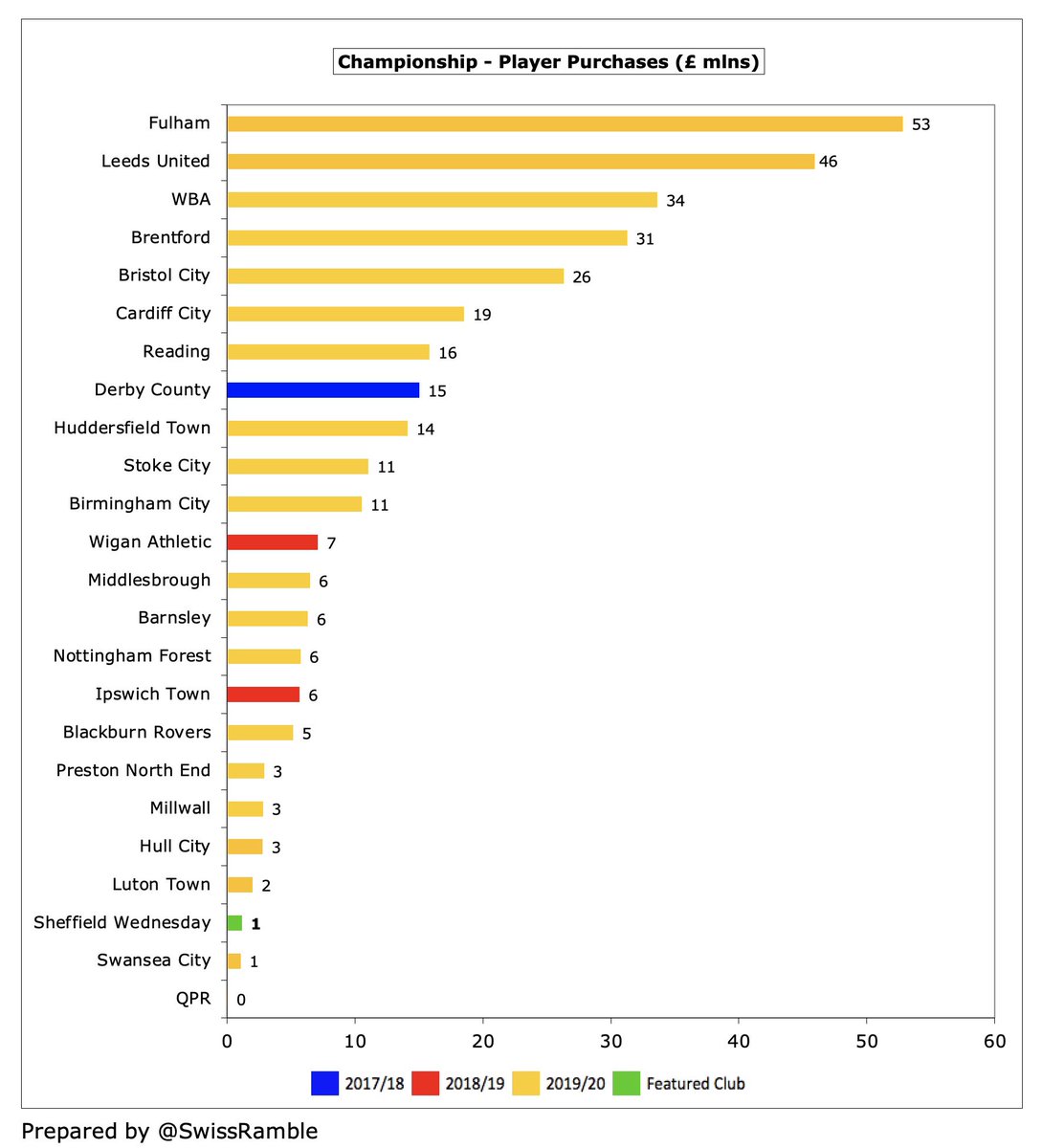

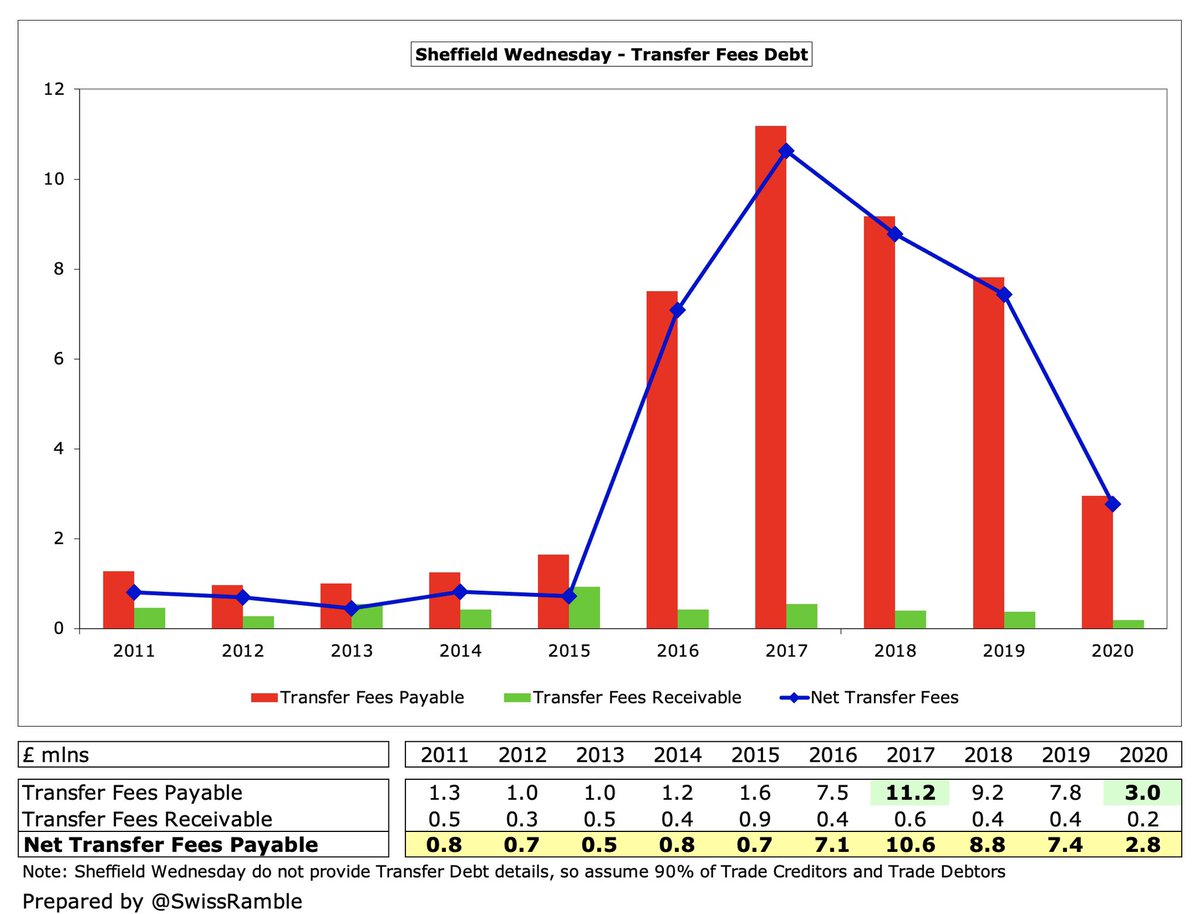

#SWFC only spent £1m on new players in 2020, a similar amount to the previous season, partly due to a soft transfer embargo imposed by EFL for breach of rules. This was miles below #FFC £53m, #LUFC £46m, #WBA £34m, Brentford £31m and Bristol City £26m.

Initially after his takeover, Chansiri funded a relatively large outlay in the transfer market, amounting to £37m in three years, though the taps have been turned off since then with just £2m spent in the last two years.

#SWFC other expenses more than doubled from £5.2m to £11.1m, partly due to the club having to pay rent for the use of the stadium (averaging £1.65m over the next 5 years). Accounts note £3.2m paid to Chansiri, but not clear what else is included besides the rent.

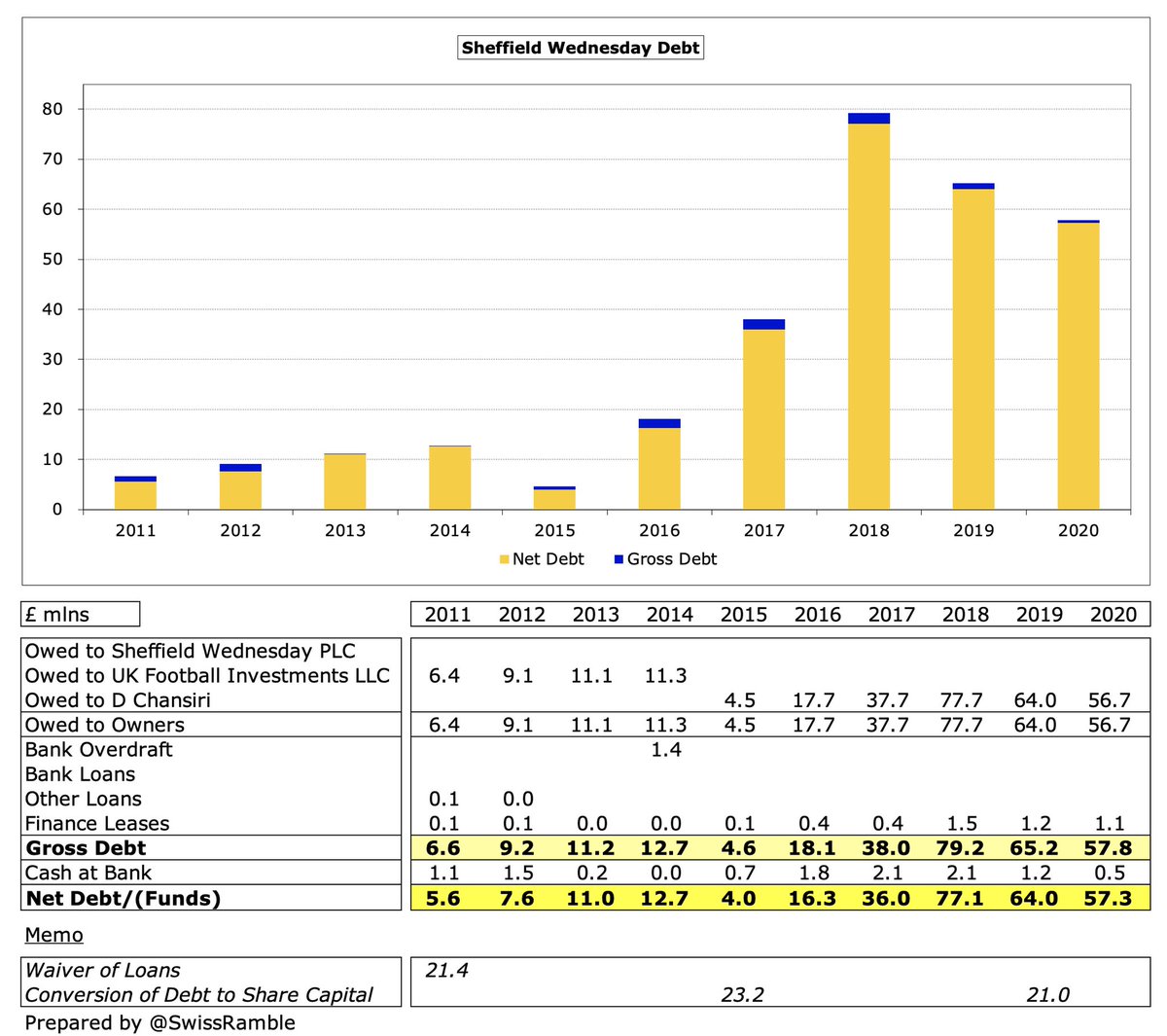

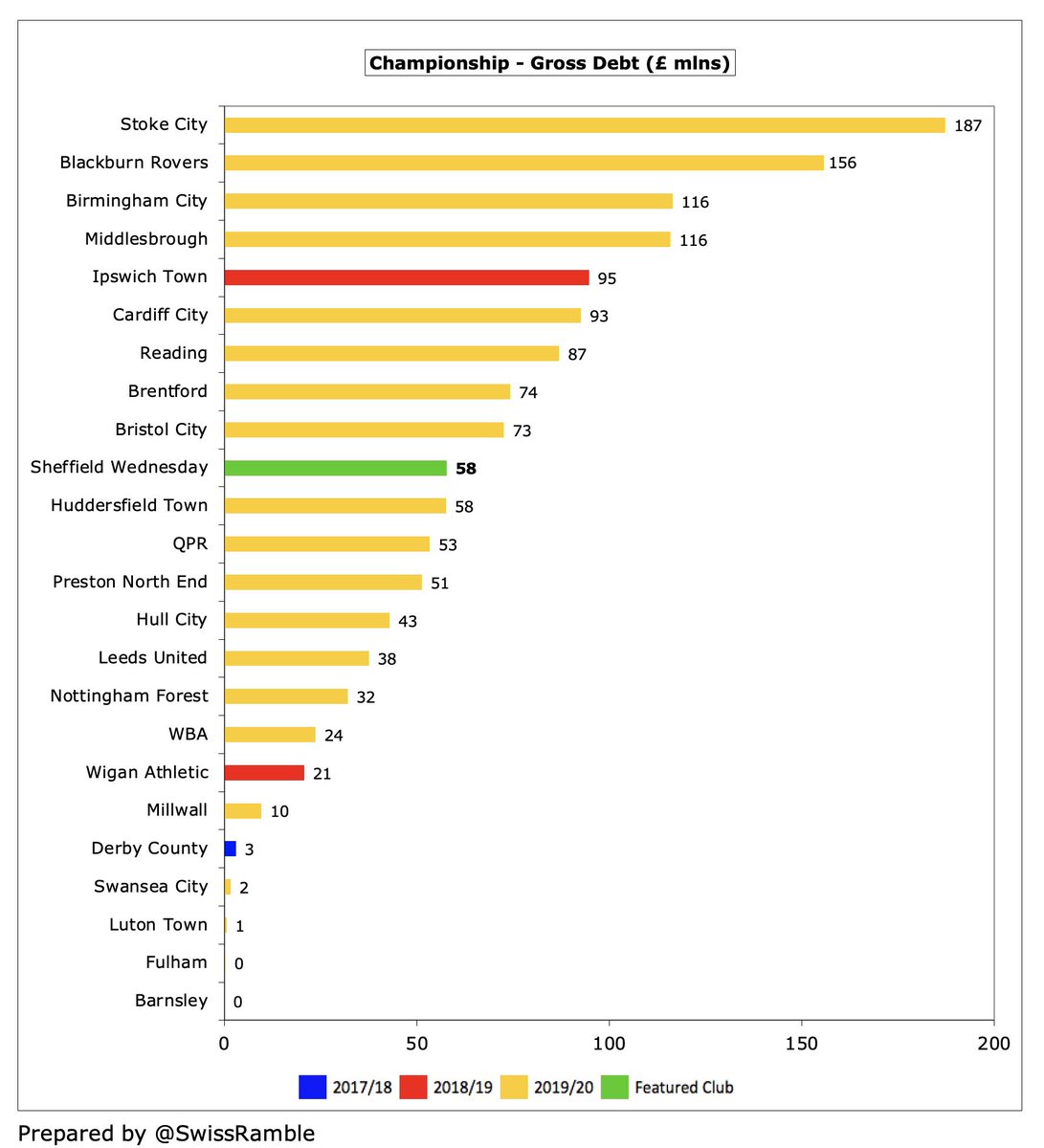

#SWFC gross debt decreased by £7m to £58m, almost all (£57m) owed to Chansiri with “no set repayment or interest terms”. The debt would have been much higher if Chansiri had not converted £44m into share capital and the former owner had not waived £21m loans.

Following the decrease, #SWFC £58m debt is 10th highest in the Championship, a fair way below the likes of Stoke City £187m, #BRFC £156m, #BCFC £116m and #Boro £116m. However, it has risen from less than £5m in 2015.

In fairness, the debt is not an issue – so long as Chansiri continues to provide financial support. The owner has not charged any interest, though #SWFC had a (lease) interest payment of £473k. Only five clubs in the Championship paid more than £1m.

#SWFC don’t separately report transfer debt, but assuming this is 90% of Trade Creditors, it has decreased from £11m in 2017 to only £3m in 2020, which reflects the limited transfer spend in the last couple of years.

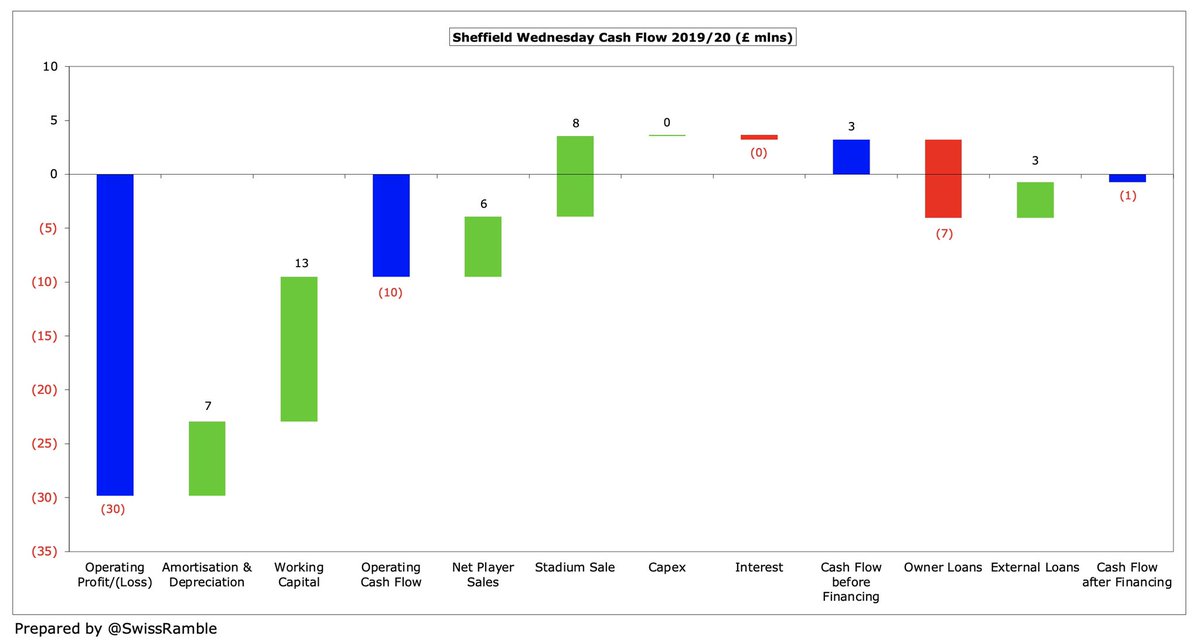

#SWFC £30m operating loss became £10m negative cash flow after adding back player amortisation/depreciation and working capital movements. Boosted by £6m player trading (sales £7m, purchases £1m) and £7.5m stadium sale. Repaid £7m of Chansiri loan, but added £3m external loan.

As a result, #SWFC cash balance fell £0.7m from £1.2m to £0.5m. This is on the low side, but in reality, most Championship clubs have less than £2m cash in the bank.

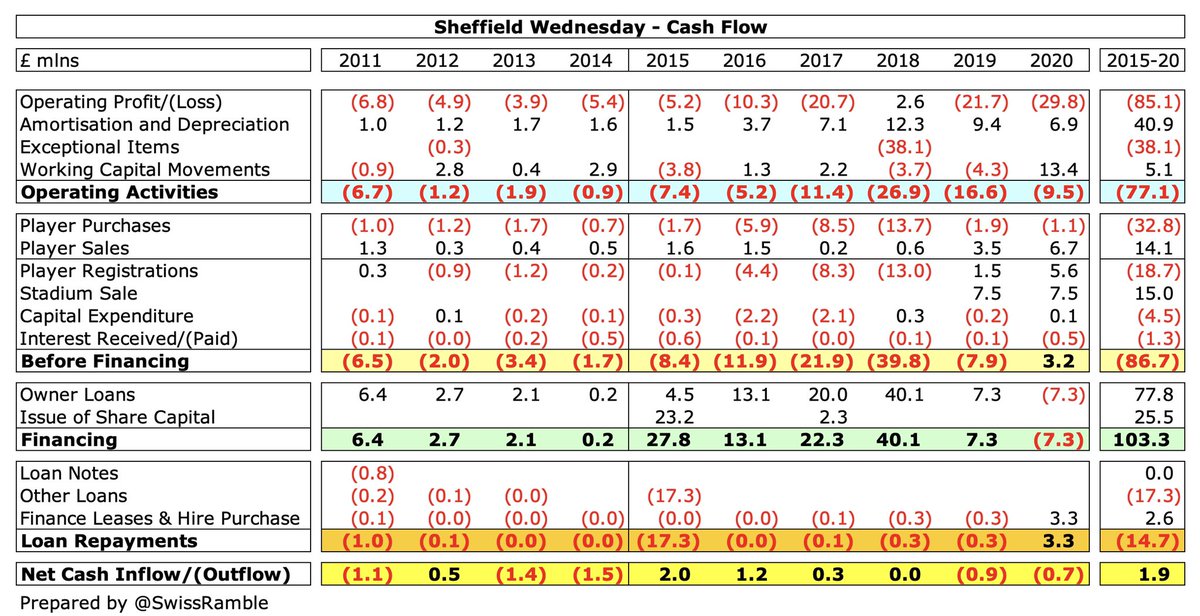

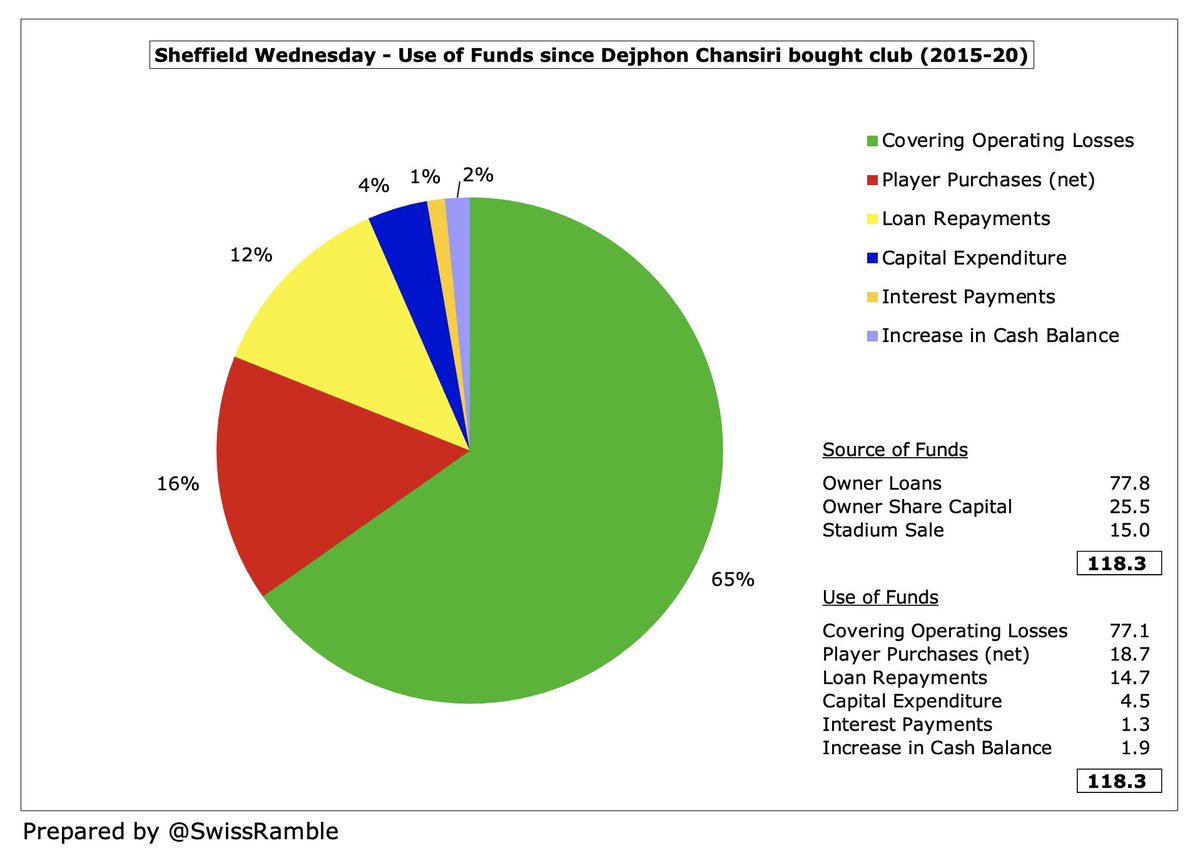

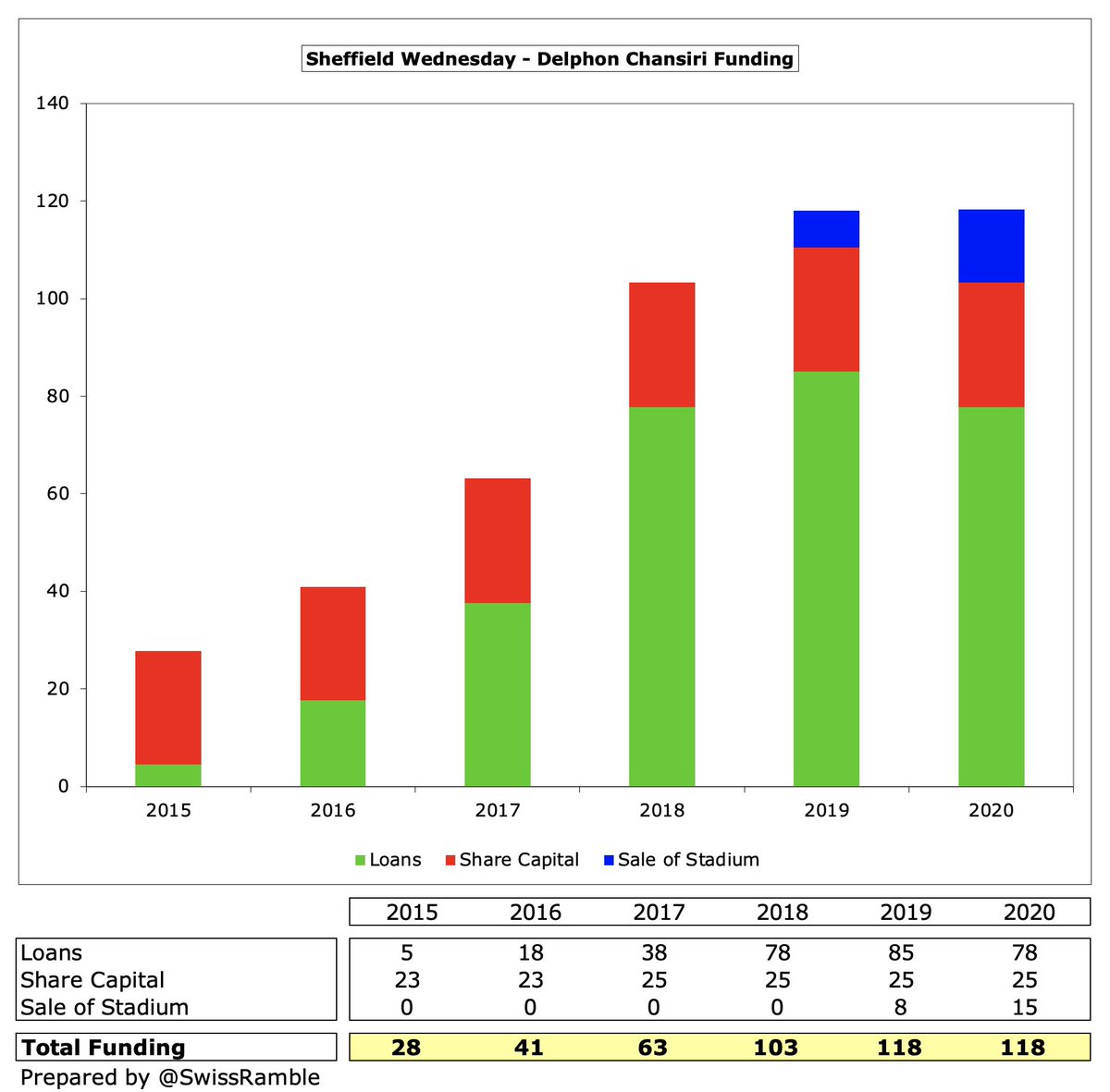

Since Chansiri bought #SWFC from Milan Mandaric in February 2015, he has provided £118m funding. This has been mainly used to cover £77m operating losses, while £19m was spent on players (net), £15m paid off old loans, £5m invested in infrastructure and £1m interest.

So Chansiri has pumped £118m into #SWFC, comprising loans £78m, share capital £26m and £15m payments for the stadium sale (as part of his total £60m commitment). However, his £7.5m stadium payment in 2020 was effectively funded by a loan repayment.

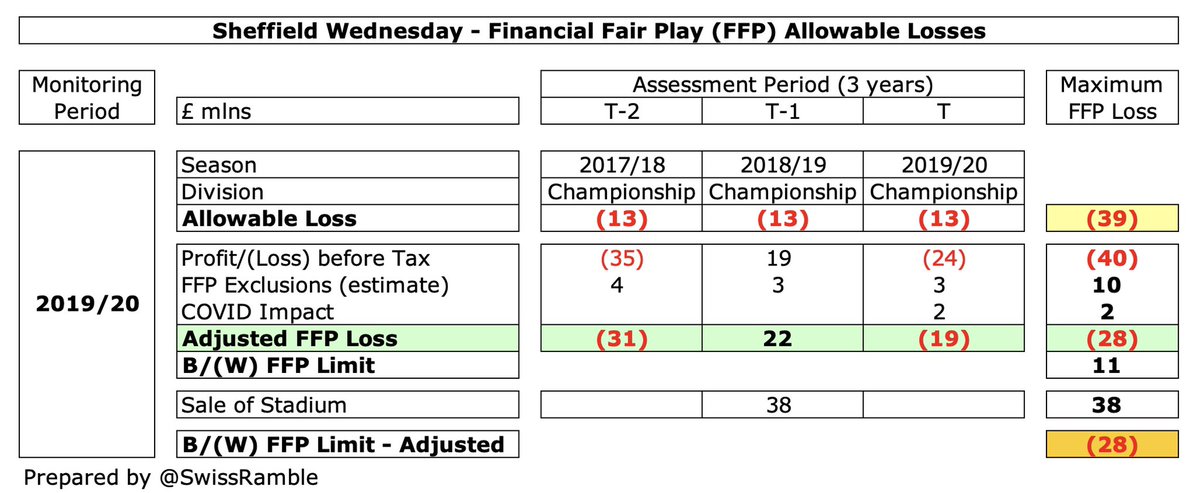

#SWFC FFP situation was fine, though only after including £38 profit from the stadium sale (EFL loophole since closed). As a result, their £40m losses in the 3-year monitoring period were close to the £39m limit even before allowable deductions (including COVID impact).

#SWFC auditors noted material uncertainty about club’s ability to continue as going concern, though Chansiri has confirmed financial support for at least next 12 months. This is a “red flag”, but worth noting that Wednesday’s accounts have included similar comments since 2013.

#SWFC have since been relegated to League One, due to a six-point deduction applied by the EFL (reduced from 12 points). This was because the club submitted paperwork late, as opposed to the stadium sale itself, so very avoidable. Without the penalty, they would have stayed up.

More positively, #SWFC transfer embargo has now been lifted, though the club has recently accepted a suspended six-point deduction for not paying player wages between March and June 2021. However, it has been reported that these arrears have now been largely paid.

#SWFC fans will be utterly fed up with reading about the club’s issues off the pitch, which have clearly influenced the performances on the pitch. They will hope for a period of stability, which would help Wednesday’s bid for immediate promotion back to the Championship.

• • •

Missing some Tweet in this thread? You can try to

force a refresh