15th July Ranges :

Nifty = 15969/15673

Balance = 15821

BNF = 35908/35302

Balance = 35605

Nifty = 15969/15673

Balance = 15821

BNF = 35908/35302

Balance = 35605

Trade 1 on @CNBC_Awaaz : Ambuja Cements

Buy1*370CE & sell 1*385CE

Debit = Rs.5 =max risk

SL 2.5 on the spread by closing

Price target 385

Buy1*370CE & sell 1*385CE

Debit = Rs.5 =max risk

SL 2.5 on the spread by closing

Price target 385

Trade 2 on @CNBC_Awaaz : Nifty ratio spread

Buy 1*16000ce monthly & sell 2*16150ce monthly

Debit = 10

Trade has unlimited risk above 16300.

SO 1. sqoff this trade when Nifty reaches 16150 OR

2. If nifty stays here for next 3-5 trading sessions, buy 1*16300ce < rs.10

Buy 1*16000ce monthly & sell 2*16150ce monthly

Debit = 10

Trade has unlimited risk above 16300.

SO 1. sqoff this trade when Nifty reaches 16150 OR

2. If nifty stays here for next 3-5 trading sessions, buy 1*16300ce < rs.10

The trade will be converted to a defined risk butterfly with max 20 risk if you use the 2nd option. I will update that when I do it

Basis of trade : Data suggests 16200 this expiry

Basis of trade : Data suggests 16200 this expiry

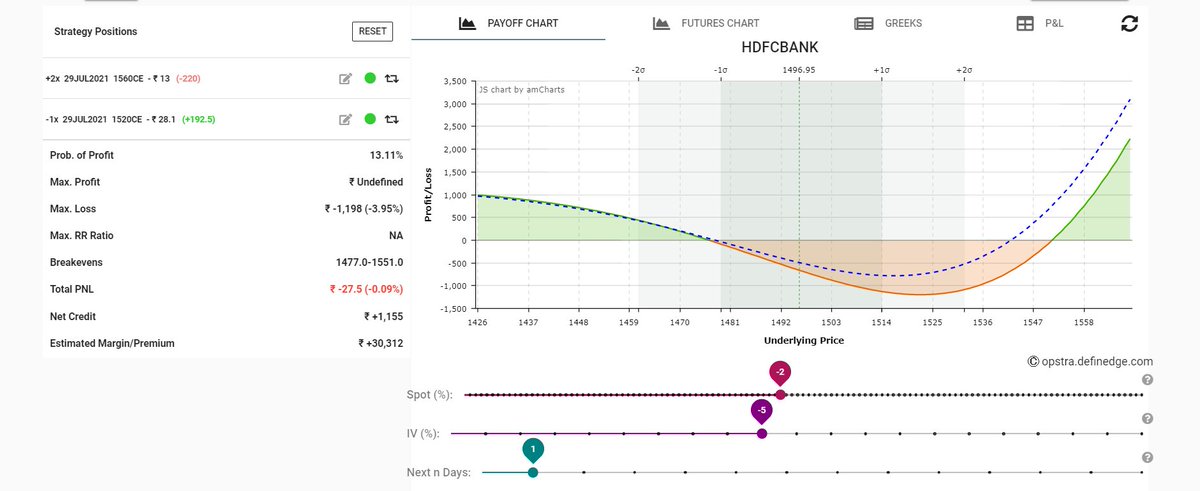

Nifty trade graph, trade is positive theta negative vega, fixed loss of initial debit on downside. profits on expiry between 16010-16290 ( profit zone), unlimited loss > 16300

• • •

Missing some Tweet in this thread? You can try to

force a refresh