182.50ce = sold at 6(2 lots) , now 4.10.

Profit = 1.90*2 = +Rs.3.80

187.5ce = bought at 4( 3 lots), now at 2.50 .

Loss 1.50*3 = -Rs.4.50

Net loss = 70 paisa per lot

Will close this trade tomorrow

Profit = 1.90*2 = +Rs.3.80

187.5ce = bought at 4( 3 lots), now at 2.50 .

Loss 1.50*3 = -Rs.4.50

Net loss = 70 paisa per lot

Will close this trade tomorrow

https://twitter.com/SubhadipNandy16/status/1413396004120850433

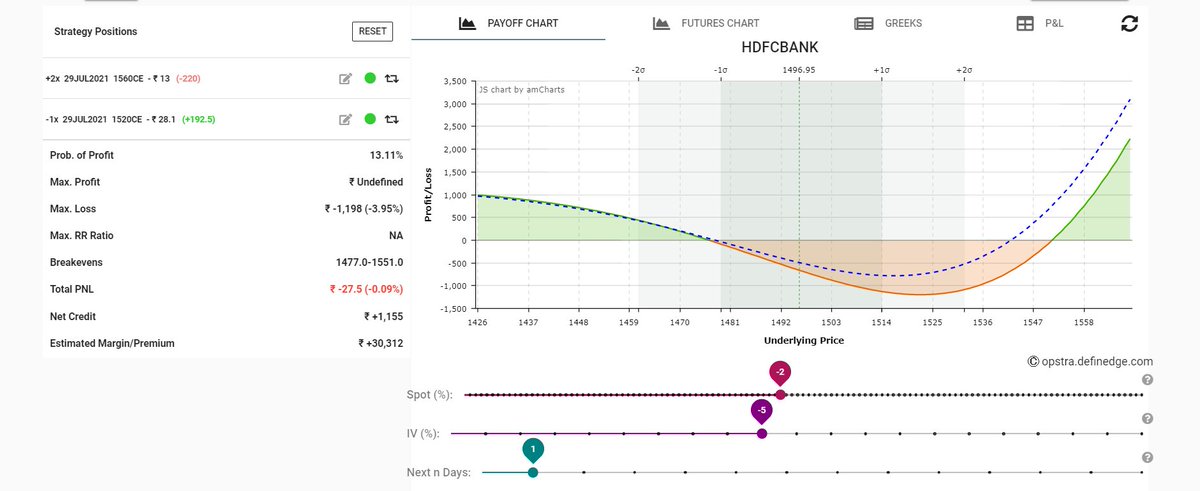

Understand this trade carefully

1. I stayed in the trade from 9th to 16th July, waited ( normally in any options trade, decay/theta would have killed you)

2. Stock did not move in my direction ( direction/delta has been against me)

3. My upsides were wide open

1. I stayed in the trade from 9th to 16th July, waited ( normally in any options trade, decay/theta would have killed you)

2. Stock did not move in my direction ( direction/delta has been against me)

3. My upsides were wide open

But still, I will escape with minimal loss.

This is the essence of options trading and trading in general. Profit trades are OK, but what really matters is how you can escape with minimal losses.

Proper option strategies help hugely in this matter. Not possible in futures/cash

This is the essence of options trading and trading in general. Profit trades are OK, but what really matters is how you can escape with minimal losses.

Proper option strategies help hugely in this matter. Not possible in futures/cash

Now consider I structure 10 such trades like this.

I lose 6 and win only 4. The RR of this trade is structured in my way, that's my edge so that I will get some profits even with a 40% or even lower win rate. This trade has both edge and risk mgmt both built into it

I lose 6 and win only 4. The RR of this trade is structured in my way, that's my edge so that I will get some profits even with a 40% or even lower win rate. This trade has both edge and risk mgmt both built into it

Lastly, a lot of traders have started trading backspreads after being influenced by my trades. Please remember, a backspread cannot be played in every scenario on all stocks. Though it looks simple, this is an advanced strategy. Knowledge of greeks is essential for success

• • •

Missing some Tweet in this thread? You can try to

force a refresh