Nigeria's inflation report for June 2021 has just been released. 🇳🇬

But we didn’t get the usual Twitter update from @sgyemikale and the good people of @nigeranstat because of the Twitter ban. #KeepItOn

See, we hate to say it but prices are still rising. 📈

A THREAD

1/31

But we didn’t get the usual Twitter update from @sgyemikale and the good people of @nigeranstat because of the Twitter ban. #KeepItOn

See, we hate to say it but prices are still rising. 📈

A THREAD

1/31

From the price of coca-cola that has risen from ₦100 to ₦120 (or ₦150) to yam that has gone from ₦800 to ₦1,500 per tuber in one year.

Prices can't seem to stop increasing.

2/31

Prices can't seem to stop increasing.

2/31

But it's not all doom and gloom. The inflation rate (the pace at which prices increase) fell to 17.7% in June, from 17.9% in May, the third consecutive decline this year.

3/31

3/31

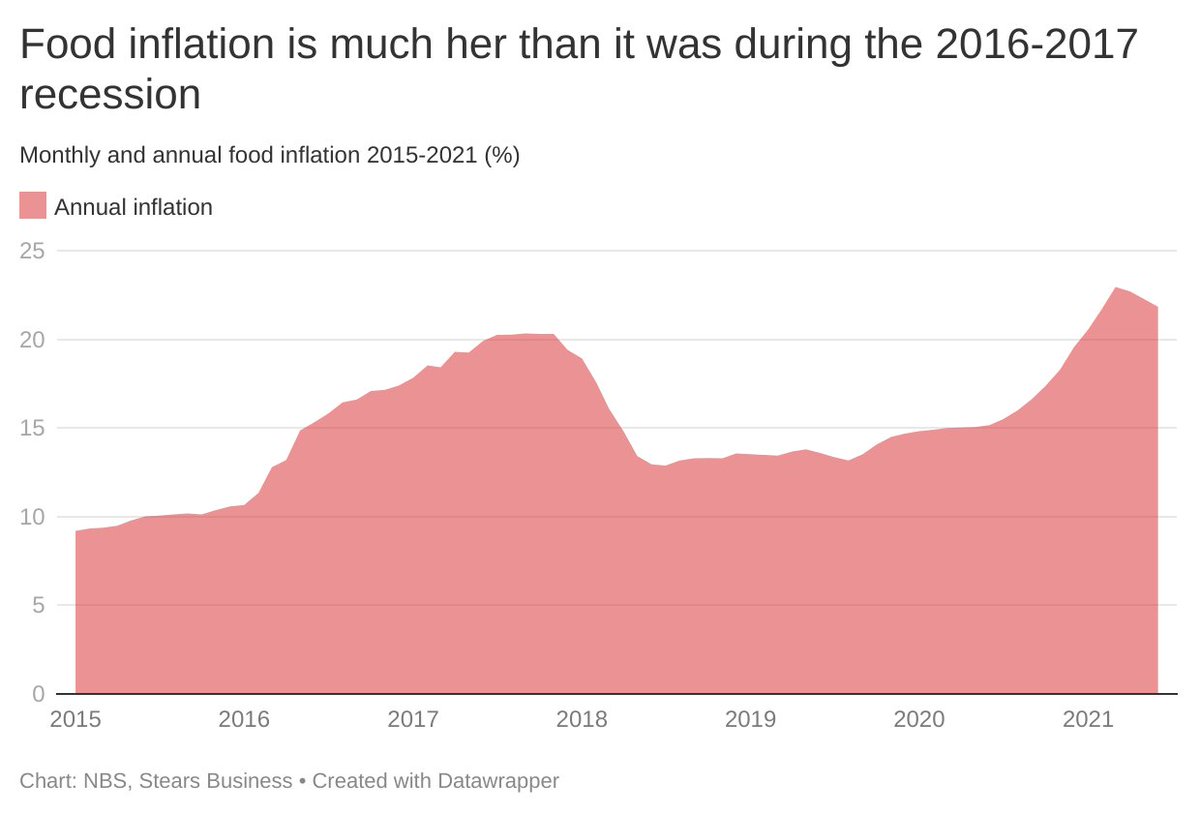

Looking at the data more closely, we realise that prices could have increased at a much higher rate. So, let’s start with the good news:

The inflation today is not as bad as it was in 2016 and 2017.

4/31

The inflation today is not as bad as it was in 2016 and 2017.

4/31

Remember, there was a recession in those years. Businesses shut down, and the prices of everything increased drastically. But, even with how bad things are today, prices are not rising as fast as they did in 2016.

5/31

5/31

Before we go into the data, though, we need to explain a few things about inflation. There are two types: core and headline inflation.

6/31

6/31

Headline inflation measures the rise in the prices of all the goods consumers typically consume, while core inflation is the headline inflation minus food inflation.

7/31

7/31

Given how volatile food prices can be—due to being in and out of season, importation, etc.—they are exempted from the headline inflation to show the accurate picture of price increases in other aspects of people's lives.

8/31

8/31

Sometimes, countries also deduct price changes in energy and fuel because they can also be volatile.

However, in Nigeria, these figures are pretty stable over time, so food is the only sub-sector removed to calculate core inflation.

9/31

However, in Nigeria, these figures are pretty stable over time, so food is the only sub-sector removed to calculate core inflation.

9/31

However, one thing to note is that inflation is calculated by breaking down the consumption basket into categories of items or segments that Nigerians typically spend their money on—from food to fashion and household items.

10/31

10/31

Then, statisticians attach weights to these items based on their importance on consumers’ expenditure basket.

11/31

11/31

According to the consumption expenditure pattern report by the @nigerianstat, 56% of household consumption in Nigeria is used for food. In line with this, food takes up over half of the weight.

12/31

12/31

Now, to the numbers.

In January 2017, when headline inflation was at its peak, it was 18.7%. This year, headline inflation was the highest in March since the 2016-17 recession at 18.2%.

13/31

In January 2017, when headline inflation was at its peak, it was 18.7%. This year, headline inflation was the highest in March since the 2016-17 recession at 18.2%.

13/31

Also, look at core inflation which peaked at around 18.2% in November 2016, after increasing by about 1% every month from April 2016.

14/31

14/31

However, it fell back to 8% in 2019, before increasing again. In May this year, despite the rise since 2019, its highest was 13.1%, much lower than the peak in 2016.

15/31

15/31

This means that unlike 2016-2017, where every aspect of consumer spending was affected by inflation, this time around, the primary culprit for the increase in inflation is food.

16/31

16/31

The rise in food inflation, this time, has been due to two significant factors: the restrictions on food importations and the constraints on domestic production and supply.

18/31

18/31

The inflation on imported food has been increasing much slower than general food inflation since mid-2019, despite the continuous devaluation of the currency.

This is largely because of the land border closure and decline in food importation.

19/31

This is largely because of the land border closure and decline in food importation.

19/31

The decline in imported food meant that demand had to be met with local food production, which is low in supply. This drove food inflation up, increasing monthly until April this year.

21/31

21/31

In 2020, however, farmers were faced with supply restrictions which reduced their production. First, the state borders were closed because of the nationwide lockdown to reduce the spread of Covid-19.

22/31

22/31

This prevented farmers from getting inputs for their farms.

Then there were unexpected weather disruptions like delayed rains and flooding when the rains eventually came, which disrupted the farming calendar and led to huge harvest losses.

23/31

Then there were unexpected weather disruptions like delayed rains and flooding when the rains eventually came, which disrupted the farming calendar and led to huge harvest losses.

23/31

Finally, lack of security on farms has hindered production on some farms, causing an increase in prices.

Other aspects of consumer spending where inflation was much higher than in 2016-2017 were healthcare, restaurants and hotels, communication & miscellaneous expenses.

24/31

Other aspects of consumer spending where inflation was much higher than in 2016-2017 were healthcare, restaurants and hotels, communication & miscellaneous expenses.

24/31

Prices in healthcare expectedly rose. Majorly due to the Covid-19 pandemic and the increased need for pharmaceutical products and paramedical services.

Hotels and restaurants too were affected because of the shutdown and the need to increase their costs after reopening.

25/31

Hotels and restaurants too were affected because of the shutdown and the need to increase their costs after reopening.

25/31

Another interesting increase is the communication category, with the inflation rate going from 3% in late 2017 to 10.5% in 2021.

26/31

26/31

This steep increase is mainly driven by the growth in postal services, which could be due to the spike in logistics and courier service providers during this period.

27/31

27/31

Then there is Housing, Water, Electricity, Gas and Other Fuel which is one segment. In 2017, the inflation in this segment increased to an extreme peak of 27%.

28/31

28/31

However, this year, despite the hike in the electricity tariffs and removal of fuel subsidies, inflation has only risen to 10%. Showing that the price increases may not have been as significant as it was in 2017.

29/31

29/31

Let’s wrap this up with some more good news: the inflation rate is reducing. Sadly, this doesn’t mean the price of Coca-cola or yam tubers will reduce, but that the prices will not increase as fast as it has been in the past few months.

30/31

30/31

Subscribe to Stears Bussiness Premium today to get smarter and to understand the economy around you!

Get started here: stearsng.com/subscriptions

31/31

Get started here: stearsng.com/subscriptions

31/31

• • •

Missing some Tweet in this thread? You can try to

force a refresh