1/ Our team @MechanismCap recently did some research on the growth of @CreamdotFinance in 2021

We share our findings in this thread

We share our findings in this thread

2/ We’ll cover:

- Cross-chain coverage (Arbitrum, Fantom, BSC)

- New developments (Iron Bank, Staking Services, Security Features, Community)

- Protocol growth (TVL, PS/PE ratios)

- Cross-chain coverage (Arbitrum, Fantom, BSC)

- New developments (Iron Bank, Staking Services, Security Features, Community)

- Protocol growth (TVL, PS/PE ratios)

3/ On cross-chain coverage, CREAM’s money market on BSC saw rapid growth earlier this year.

The protocol also went live on Fantom in March and recently announced plans to launch on Arbitrum mainnet

medium.com/cream-finance/…

The protocol also went live on Fantom in March and recently announced plans to launch on Arbitrum mainnet

medium.com/cream-finance/…

4/ The Iron Bank (which offers zero-collateral borrowing for whitelisted protocols) has taken off

It’s become the most efficient money market with a 51% utilization rate and $587m+ of borrowed assets (June 6th) — an ATH and a 60% MoM increase

cointelegraph.com/news/c-r-e-a-m…

It’s become the most efficient money market with a 51% utilization rate and $587m+ of borrowed assets (June 6th) — an ATH and a 60% MoM increase

cointelegraph.com/news/c-r-e-a-m…

5/ In addition to its money market, CREAM also offers staking services and runs validator nodes on Eth2, BSC and Fantom. To date, CREAM has earned 718 BNB [$250k], 100 ETH [$230k] and 100,125 FTM [$30k] in revenue.

medium.com/cream-finance/…

medium.com/cream-finance/…

6/ Listing so many long-tail assets comes with its own hosts of risks.

In May, CREAM introduced a new security feature — Collateral Cap — designed to diversify protocol-wide lending risk by measuring and limiting the “borrowing power” for each token.

medium.com/cream-finance/…

In May, CREAM introduced a new security feature — Collateral Cap — designed to diversify protocol-wide lending risk by measuring and limiting the “borrowing power” for each token.

medium.com/cream-finance/…

7/ Given CREAM’s focus on community, they also introduced Creamery — a program that encourages community contributions to the protocol by allowing members to claim tasks and earn rewards for completing them

medium.com/cream-finance/…

medium.com/cream-finance/…

8/ CREAM has also expanded to the NFT market via Iron Bank. They recently collaborated with @pleasrDAO to offer the first DAO-to-DAO loan collateralized with NFTs

https://twitter.com/CreamdotFinance/status/1415998512358035460

9/ On protocol asset growth, CREAM’s TVL/FDV ratio has been able to achieve efficiency above the rest of the market

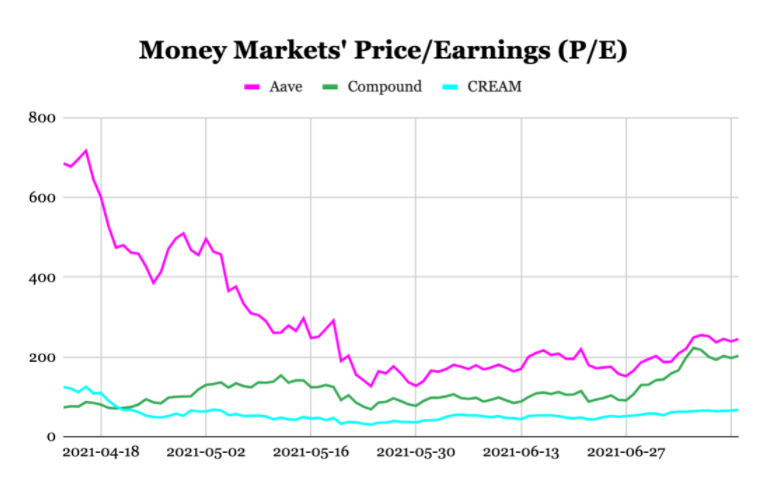

10/ As of July 12, the project had a P/S ratio of 10.7x and P/E of 67x, the lowest of the Money Markets examined

11/ Current CREAM growth has not been driven by any recent liquidity mining programs. Factoring in liquidity mining costs shows wide changes in net revenue for each protocol

https://twitter.com/Rewkang/status/1415870042307276803

12/ CREAM’s revenue remains largely driven by Ethereum lending and borrowing, but over the past nine months, BSC and a bit of Fantom activity have ramped up.

One trend to track will be CREAM’s revenue-generating activity once it launches on Arbitrum.

One trend to track will be CREAM’s revenue-generating activity once it launches on Arbitrum.

13/ Relative to other money markets, CREAM derives a higher % of its revenue from non-stablecoin borrows, showing that catering to long tail assets has been a driver of growth

H/T @Tokenterminal

H/T @Tokenterminal

14/ CREAM generates significant revenue for the protocol, and going forward, these revenues will be distributed via a new token, iceCREAM.

forum.cream.finance/t/icecream-pro…

forum.cream.finance/t/icecream-pro…

15/ Research led by @benjaminsimon97 and @wvaeu

Thanks to @CreamdotFinance and @tokenterminal teams for data support

Thanks to @CreamdotFinance and @tokenterminal teams for data support

• • •

Missing some Tweet in this thread? You can try to

force a refresh