1/ DeFi Summer Round 2 - The Game Plan

2/ So you remember the craziness of the first DeFi Summer (or maybe you're new)

How will DeFi Summer Round 2 be different? More Chains. More Incentives. More participants.

How will DeFi Summer Round 2 be different? More Chains. More Incentives. More participants.

3/ How will it start? It's actually already just started - kicked off by our good friends at @0xPolygon

https://twitter.com/Rewkang/status/1391413040298483714

4/ By running an aggressive liquidity mining partnership program, they've created what lies at the base of every thriving DeFi ecosystem - bountiful yield

5/ Yield brings farmers -> farmers bring capital & liquidity -> this attracts developers -> new farms incenticize MATIC liquidity -> increasing token price based on demand + growth speculation -> This increases yield (denominated in MATIC)

A flywheel - A pool 2 at the base layer

A flywheel - A pool 2 at the base layer

6/ No doubt, L1/L2 projects across the space have seen the success of MATIC and are jumping to put similar programs in place

7/ Projects as well, once hesitant to move to new chains, now see the value. If they don't dominate on the other chains, then others will.

A flurry of new liquidity mining programs and yield opportunities will sprout up

A flurry of new liquidity mining programs and yield opportunities will sprout up

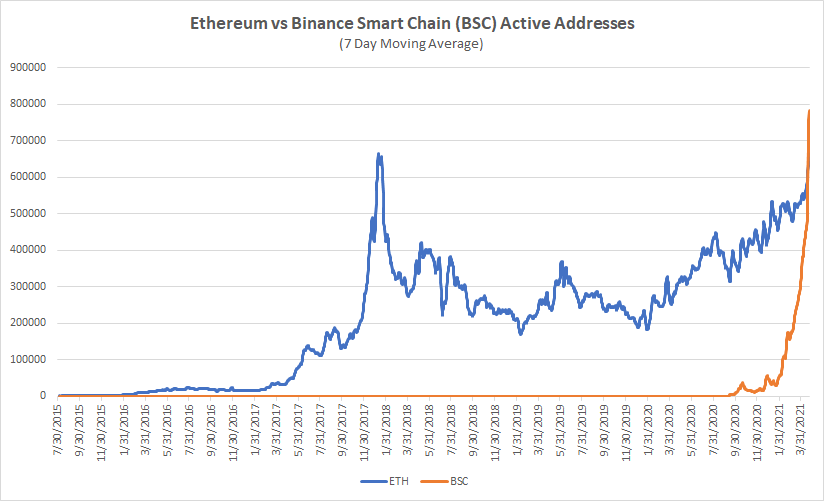

8/ The difference now is that DeFi has caught the attention of more people. Both retail, HWNI, and sophisticated hedge funds which have dipped their toes in and likely ready to put billions to work generating double to triple yields

Why not? The R/R of trad markets is shit

Why not? The R/R of trad markets is shit

9/The scale of last summer was a small scale experiment with friends

This summer, we're on the global stage

This summer, we're on the global stage

10/ Of course, just like last Summer, things will overhead and eventually need to reset. But if you're going to sit out just because you're anticipating that happening, well...

you're ngmi

you're ngmi

• • •

Missing some Tweet in this thread? You can try to

force a refresh