1/ Deep & fully transparent data is a core part of what makes dApp ecosystems so incredible

@Covalent_HQ unlocks this data for all users which is why we were excited to lead their fundraising last summer alongside @1kxnetwork and Woodstock

covalenthq.com/blog/covalent-…

@Covalent_HQ unlocks this data for all users which is why we were excited to lead their fundraising last summer alongside @1kxnetwork and Woodstock

covalenthq.com/blog/covalent-…

2/ They have since raised another strategic round led by Hashed with participation from Binance, Coinbase and others

theblockcrypto.com/post/99202/blo…

theblockcrypto.com/post/99202/blo…

3/ In terms of addressable market, Covalent serves every person, project and blockchain that needs data querying. Since January of this year, they’ve grown from 20 Million Monthly API calls to 142 Million API calls in March

4/ At current, we often see decisions being without access to insightful data; this is due to a myriad of factors from incomplete data to low-data literacy levels

5/ When we found out that Covalent builds out-of-the-box analytics for everyday users, we knew they were a crucial missing piece in the data infrastructure vertical. By removing the need for custom code, they allow any DeFi user to make data-backed decisions

6/ From day 1, Covalent’s unified API has been designed for mainstream adoption while their no-code solutions empower people to easily extract blockchain data

7/ They rebuilt MongoDB’s aggregation layer in-house and bolted it into the Covalent API to address both the limitations of GraphQL and REST. These native aggregations and custom endpoints make working with Covalent more accessible to the 5+ million developers who know MongoDB

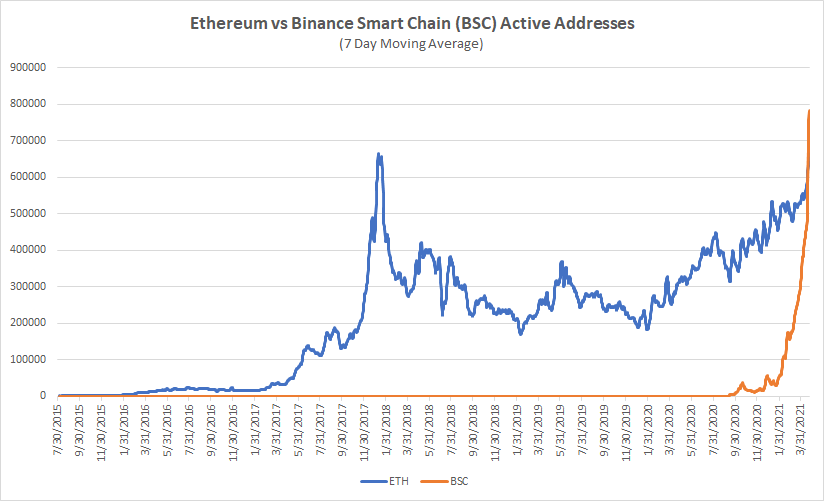

8/ Further, they are the only project to fully index entire blockchains (every single contract, wallet address and transaction) with a focus on indexing as many different blockchain networks as possible. This allows data to be analyzed cross-chain and as granularly as possible

9/ Covalent currently provides a wide amount of support to the crypto ecosystem supporting a dozen major blockchains and hundreds of projects

10/ From the moment we met @gane5h, it was obvious that his people-first approach combined with his focus on quantitative data, made him the type of star founder we wanted to back

11/ In addition to spending the past three years building best-in-class technology, Covalent also takes a strong community approach to build a vibrant network of data enthusiasts

12/ With this in mind, the team has hosted competitions, hackathons and programs to develop the space’s data literacy. These events continue to reward the community and educate people on how to use the Covalent API, allowing everyone to get the most out of the data.

13/ These Covalent-trained data enthusiasts also maintain research and DeFi visuals at @AlphaAlarm_HQ and @AlphaResponseHQ. Follow for free alpha

Cowritten w/ @wvaeu - Covalent Alchemist

• • •

Missing some Tweet in this thread? You can try to

force a refresh