Received a lot of queries on this as majority of the view that "IV generally drops post results", so any long vega strategy will lead to a loss and it's better to sell straddles/strangles.

I know that options selling to capture IV crush is a worldwide strategy :)

I know that options selling to capture IV crush is a worldwide strategy :)

https://twitter.com/SubhadipNandy16/status/1415912979522998274

But what none of the responses have seemed to remember that there is also "generally" a vol expansion before results, generally starts 10 days before results declaration or earlier.

Look what happened to HDFCBANK IVs this time

Look what happened to HDFCBANK IVs this time

Simple question : If there has been no vol expansion, can there be a further vol crush ?

Answer can be yes or no, both things possible. But the probabilities favour zero or minimal vol crush. Also remember, the theory of vol crush post results are "generally" , not a surety.

Answer can be yes or no, both things possible. But the probabilities favour zero or minimal vol crush. Also remember, the theory of vol crush post results are "generally" , not a surety.

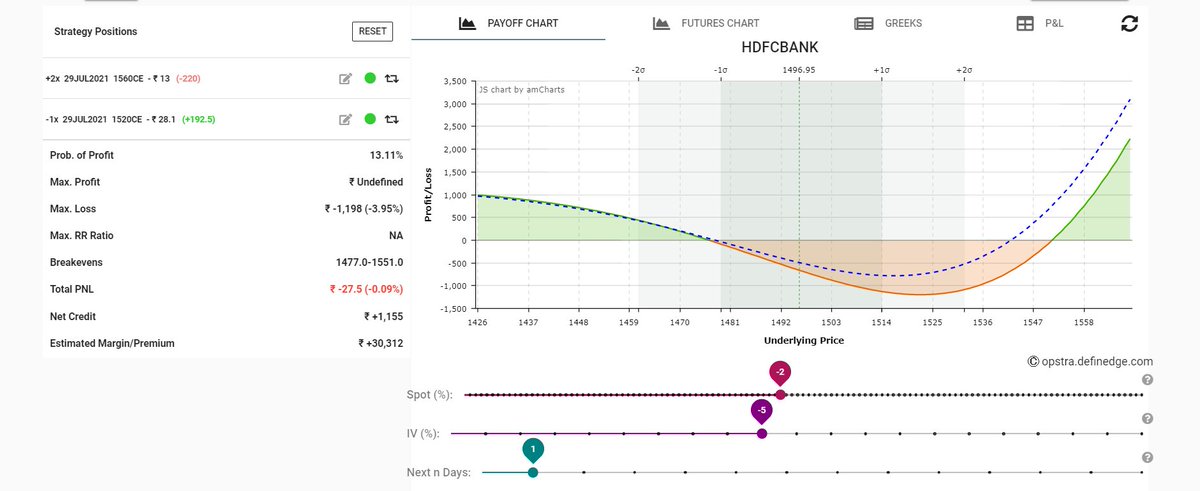

We might also see a vol expansion ( extremely low IVP). The position I have put on is a long vega bullish position. This is what I expect to happen :

1. Stock goes up sharply with slight vol crush : delta>vega --> I win small or do not lose much

1. Stock goes up sharply with slight vol crush : delta>vega --> I win small or do not lose much

2. Stock goes up sharply with vol expansion--> I win

3. Stock falls --> lead to vol expansion

( since I am long vega, I make a small amount or lose very small despite wrong on direction)

3. Stock falls --> lead to vol expansion

( since I am long vega, I make a small amount or lose very small despite wrong on direction)

4. Stock opens flat with vol crush --> I lose . But the whole vol crush does not happen in first 5 mins. If it opens flat, I will simply sqoff at a small loss or flat

Simply put, the probabilities favour the position making money.

Simply put, the probabilities favour the position making money.

And when we trade, that's what we do. Play the probabilities.

My best bet actually is HDFCBANK moving up or down sharply, direction is immaterial . I will make some.

Did this thread before results come in, so let's see how this plays out on Monday

My best bet actually is HDFCBANK moving up or down sharply, direction is immaterial . I will make some.

Did this thread before results come in, so let's see how this plays out on Monday

And the biggest beauty of this position is there is no undefined/unlimited, I don't have to fight to adjust. I can simply book my small losses and walk away 😃

"Normally" or "generally" will give you minor profits. Once you can pick up the "abnormalities", that's where one can get large payoffs due to the convexity of options. And that's what I do as an options buyer, pick on "abnormalities" 😀

-------end ----

-------end ----

• • •

Missing some Tweet in this thread? You can try to

force a refresh