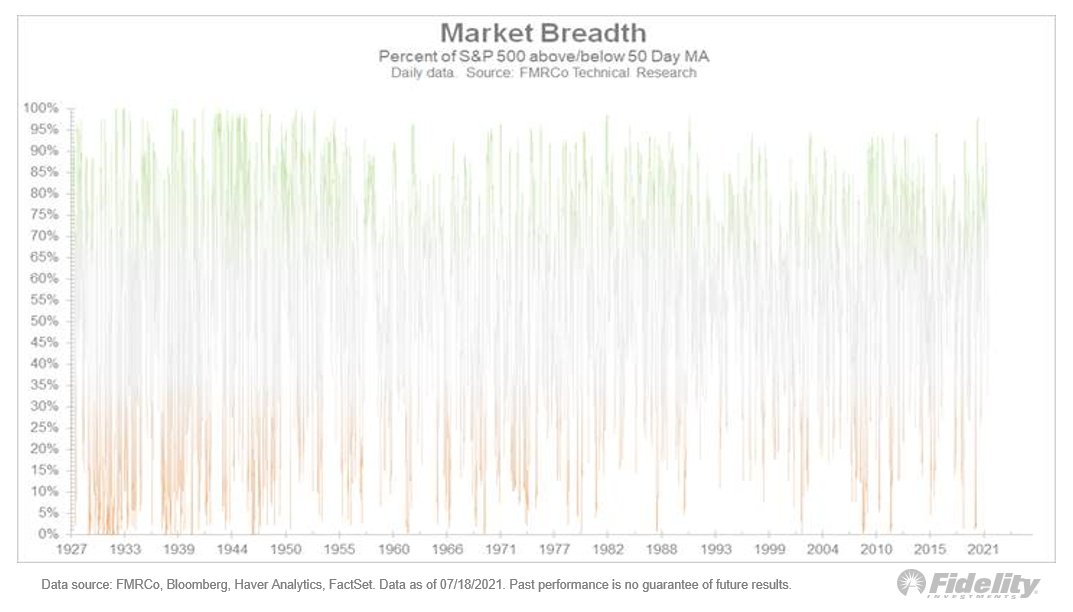

Unusual: The S&P 500 index is at an all-time high while fewer than 50% of its constituents are above their 50-day moving average. In fact, by my calculation, the recent signal is only the third one since 1927… (THREAD)

The first one was June 24, 1998, just before the LTCM fund top (for those who recall it) and the second one was December 21,1999, just before the dotcom bubble peak. The first preceded a 20% drawdown & the second preceded a 53% decline. /2

I’m not calling for a major drawdown but the narrowness of the current advance does fit with the narrative that the market is in a holding pattern as it transitions from early-cycle to mid-cycle while, at the same time, the Fed is trying (again) to take away the punchbowl. /END

• • •

Missing some Tweet in this thread? You can try to

force a refresh