There are many reasons to sell, but only one reason to buy.

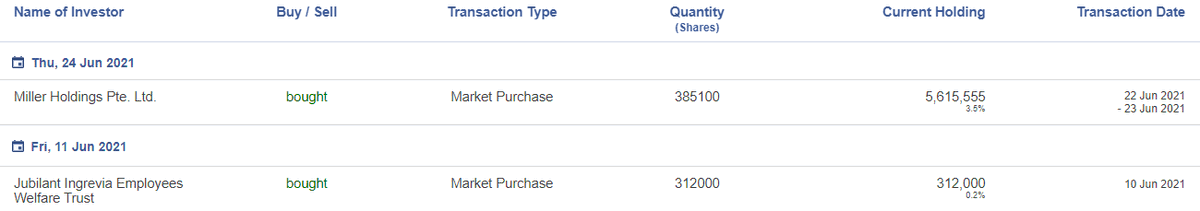

Jubilant Ingrevia's promoter bought significant stakes just a month back.

Earnings Call today at 5pm IST.

Company still branded as commodity chemicals when it derives ~50% of its revenue from specialty chemicals.

Jubilant Ingrevia's promoter bought significant stakes just a month back.

Earnings Call today at 5pm IST.

Company still branded as commodity chemicals when it derives ~50% of its revenue from specialty chemicals.

https://twitter.com/nid_rockz/status/1417421056420192257

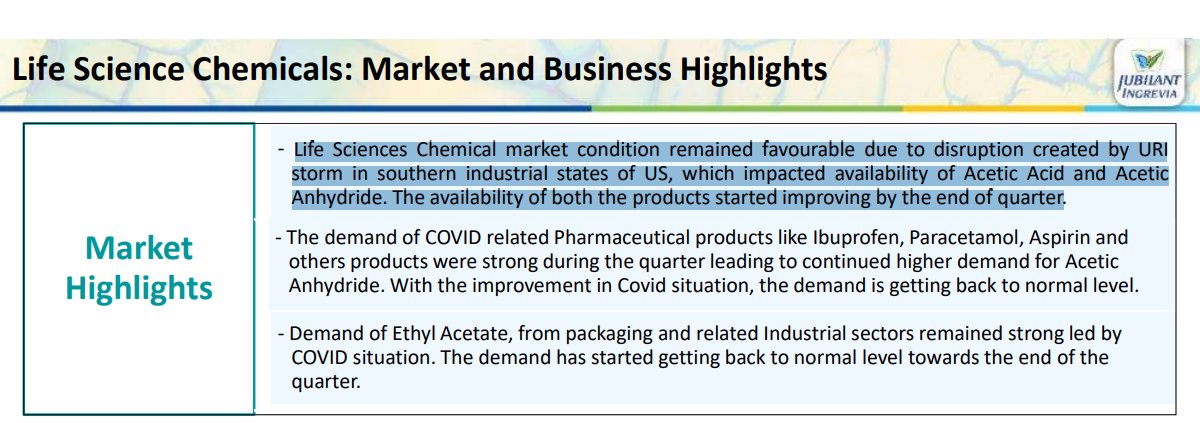

Most of the EPS increase this Quarter is due to increase revenue from Life Science Segement.

LS revenue grew mainly due to global increase in Acetic Acid prices and they had stock.

Not sure how sustainable is Rs10 EPS / Quarter.

Still good progress in overall business.

LS revenue grew mainly due to global increase in Acetic Acid prices and they had stock.

Not sure how sustainable is Rs10 EPS / Quarter.

Still good progress in overall business.

Storms in US states, lead to high prices for Acetic Acid. Don't think next Quarter we will see such a high EPS.

• • •

Missing some Tweet in this thread? You can try to

force a refresh