Lot of IPOs hitting the market. As a general rule, I stay away from applying for IPOs. Here are a few reasons why 👇🏼

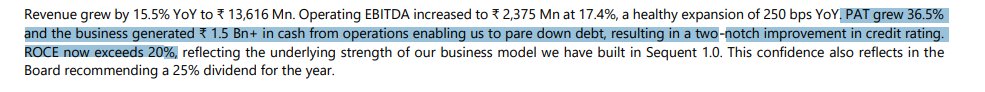

1️⃣ Companies are dressed up a year or so before IPO to allure investors

2️⃣ Insiders get an opportunity after waiting for years to liquidate their investment

1️⃣ Companies are dressed up a year or so before IPO to allure investors

2️⃣ Insiders get an opportunity after waiting for years to liquidate their investment

3️⃣ Most IPOs are aimed at giving insiders an exit rather than raising growth capital for a company

4️⃣ I look at IPOs 3 to 4 quarters out, this gives me enough clarity on what the company has done post raising funds. By this time insiders had liquidated whatever they wanted to.

4️⃣ I look at IPOs 3 to 4 quarters out, this gives me enough clarity on what the company has done post raising funds. By this time insiders had liquidated whatever they wanted to.

5️⃣ The initial exuberance dies down post 3 to 4 quarters and price action settles down

This strategy has worked out for me quite well and has prevented me from sucking into the euphoria of market.

This strategy has worked out for me quite well and has prevented me from sucking into the euphoria of market.

Lots of Examples being throw at this post of IRCTC, Happiest Mind, Burger King, DMart.

I do not apply for 1 lot of listing gains, my portfolio moves by more than that in a given day.

Applying for an IPO for listing gains = gambling (in my opinion)

I do not apply for 1 lot of listing gains, my portfolio moves by more than that in a given day.

Applying for an IPO for listing gains = gambling (in my opinion)

https://twitter.com/itsTarH/status/1413166729006489602?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh