It's the weekend!

Grab a cup of coffee, in this thread I will explain

1. What is Dupont Method for ROE?

2. What is the difference between ROE, ROCE and ROIC?

3. How to identify companies that will improve their ROCE in future?

Lets dive right in.

Grab a cup of coffee, in this thread I will explain

1. What is Dupont Method for ROE?

2. What is the difference between ROE, ROCE and ROIC?

3. How to identify companies that will improve their ROCE in future?

Lets dive right in.

Believe it or not, DuPont method for ROE was introduced to capital markets by the chemical company, DuPont (duh) in the 1920s.

A DuPont explosives salesman called Donaldson Brown invented formula for an internal DuPont efficiency report in 1912.

en.wikipedia.org/wiki/DuPont_an…

en.wikipedia.org/wiki/DuPont_an…

Of all the great things DuPont has given to the world, including but not limited to - Lycra, Teflon, Kevlar, Nylon - the DuPont method to analyze ROE and Return on Investment has perhaps been its most influential.

To give you a perspective of how revolutionary this concept was when it was introduced in 1920 - most listed companies back then were controlled by families.

Decisions were made based on gut feelings of patriarchs rather than actual business insights.

Decisions were made based on gut feelings of patriarchs rather than actual business insights.

This method to make decisions based on metrics was revolutionary and it soon made way to other US giants of the era like General Motors and Ford.

You can read more commentary on this part of DuPont's history below

qz.com/569738/the-dup…

You can read more commentary on this part of DuPont's history below

qz.com/569738/the-dup…

Getting back to topic of the day - What is DuPont method for ROE and how is it useful for investment analysis?

Lets understand ROE or Return on Equity first.

Return on Equity is the money generated by the company by utilizing the funds provided to it by shareholders.

Return on Equity is the money generated by the company by utilizing the funds provided to it by shareholders.

Take this example.

If a company generates Rs 50 on Rs 100 of shareholder's equity, its ROE will be 50%.

*Shareholder's Equity = Term used to describe real money invested in the company by its shareholders.

All the Assets of the company - All the Liabilities.

If a company generates Rs 50 on Rs 100 of shareholder's equity, its ROE will be 50%.

*Shareholder's Equity = Term used to describe real money invested in the company by its shareholders.

All the Assets of the company - All the Liabilities.

Here is a link to an Investopedia article to help understand Shareholders equity in more detail.

investopedia.com/terms/s/shareh…

investopedia.com/terms/s/shareh…

Return on Equity simply helps us understand how much money a company is able to make by using all the funds invested in it by its Equity Shareholders.

The important distinction between ROE and ROCE & ROIC is that ROE only calculates returns based on money invested by equity shareholders.

It does not take into account the capital available to the business in the form of debt. ROCE and ROIC takes into account both Equity + Debt

It does not take into account the capital available to the business in the form of debt. ROCE and ROIC takes into account both Equity + Debt

What DuPont does, is to breakdown the ROE into its core components.

The three main parts of ROE are:

1. Net Profit Margin

2. Asset Turnover Ratio

3. Equity Multiplier or Leverage

The three main parts of ROE are:

1. Net Profit Margin

2. Asset Turnover Ratio

3. Equity Multiplier or Leverage

Net Profit Margin = Net Income of the Company / Sales

* How much profit company generated from its Sales after paying all expenses

* How much profit company generated from its Sales after paying all expenses

Asset Turnover Ratio = Sales / Total Assets

* How much sales can a company generate from all its Assets

* How much sales can a company generate from all its Assets

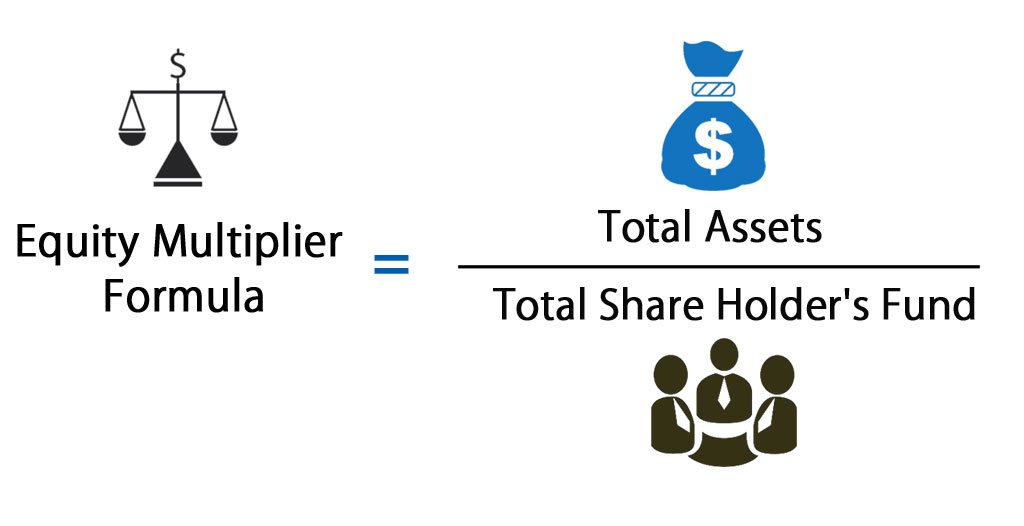

Equity Multiplier or Leverage = Total Assets / Shareholders Equity

* How much assets can a company deploy using all the funds invested in it by its equity shareholders

* How much assets can a company deploy using all the funds invested in it by its equity shareholders

These three main components help you break down ROE and see where the growth in ROE is coming from.

Growth in some components is more important than others.

Growth in some components is more important than others.

For example,

A growth is Net Profit Margin means the company can charge more for its sales, thus indicating that it has more pricing power and can better price its products.

A growth is Net Profit Margin means the company can charge more for its sales, thus indicating that it has more pricing power and can better price its products.

A High Asset Turnover Ratio tells me that a company is efficient in using its assets. It can use the same assets to generate more sales for itself there by increasing its capability to earn more.

A growth in Equity Multiplier or Leverage indicates that the company is leveraging itself too much and thus maybe a risky investment and has high chance of a leveraged balance sheet.

A growth in Equity Multiplier or Leverage is bad, (if and only if) it does not lead to more than proportionate growth in Net Profit Margin and Asset Turnovers.

The other two metrics are ROCE and ROIC.

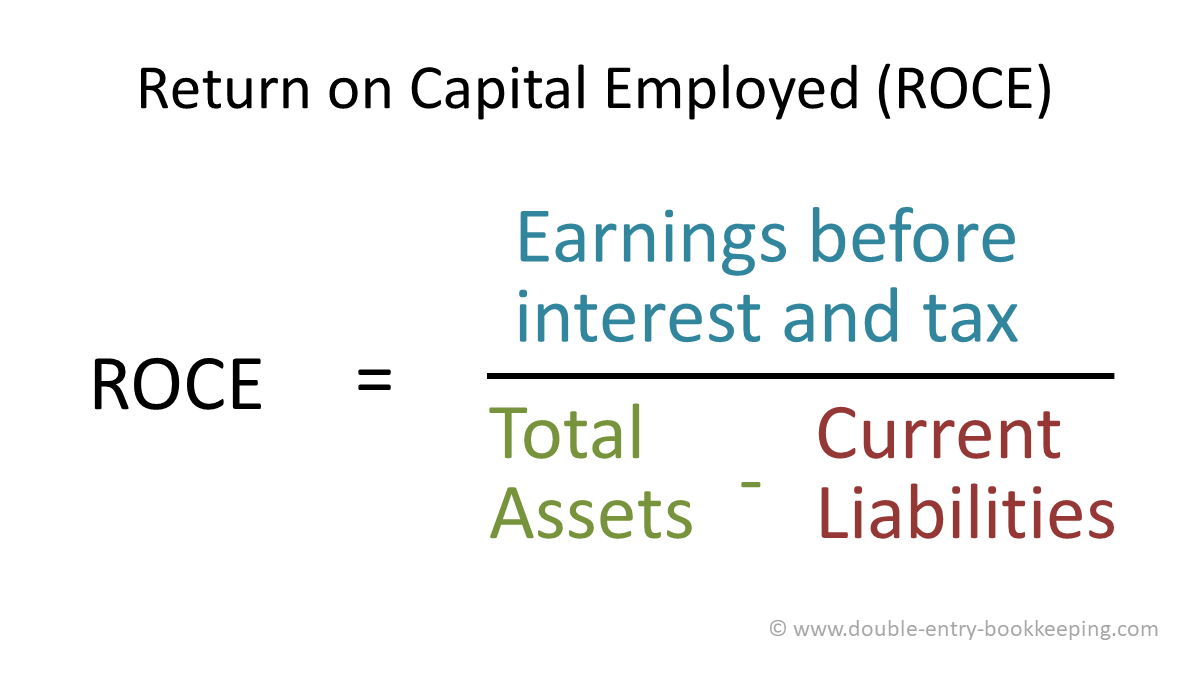

ROCE or Return on Capital Employed= is a measure of all the money generated by the company on ALL the funds available to it.

Here we take into account even the debt available to the company.

Here we take into account even the debt available to the company.

The denominator in ROCE

(Total Assets - Current Liabilities)

is also known as Capital Employed. This refers to all the funds available to the company in the form of Shareholder's Equity + Long Term Debt.

(Total Assets - Current Liabilities)

is also known as Capital Employed. This refers to all the funds available to the company in the form of Shareholder's Equity + Long Term Debt.

ROIC or Return on Invested Capital = is a measure to judge how efficiently a company is allocating the capital available to it.

It simply takes the formula of ROCE and changes the numerator from EBIT to NOPAT or Net Operating Profit After Tax.

It simply takes the formula of ROCE and changes the numerator from EBIT to NOPAT or Net Operating Profit After Tax.

Another key difference between ROCE and ROIC is that ROIC calculates the return after payments to suppliers of capital in the form of Dividends and Interest.

Before we move on to how to identify companies that will improve their ROE, ROCE and ROIC, lets quickly recap what we have learned so far.

ROE = Return on Equity

or

Income generated by company by using funds from shareholders only

or

Income generated by company by using funds from shareholders only

ROCE = Return on Capital Employed

or

Income generated by company by using all the funds available to it (both from shareholders and in the form of long term debt)

or

Income generated by company by using all the funds available to it (both from shareholders and in the form of long term debt)

ROIC = Return on Invested Capital

or

Income generated by company by using funds from both Shareholders and Long Term Debt (after paying for dividends and interest)

or

Income generated by company by using funds from both Shareholders and Long Term Debt (after paying for dividends and interest)

Now lets answer the question for which you're reading this thread.

How to find great investments early?

How to find great investments early?

Remember the DuPont parts of ROE?

The Net Profit Margin, Asset Turnover and Leverage.

It's these components that hold the key.

The Net Profit Margin, Asset Turnover and Leverage.

It's these components that hold the key.

Companies with large gross block, increasing asset turnover, increasing sales, improving margins and lowering debt. Those are the companies that will perform under any market and will keep improving.

*Gross Block = Funds invested by a company to increase its asset base

*Gross Block = Funds invested by a company to increase its asset base

If you can find companies that you know with a high degree of certainty will improve their sales or have a large gross block that will suddenly start contributing to sales and profit margins. Those are the companies to study and bet on.

If a company is reducing leverage, that's cherry on top.

Using DuPont you can decipher ROE into its bare constituents for any company and then analyze those components to see if they will improve in future.

If they do, chances are the company will earn more and its Return Ratios (ROE, ROCE, ROIC) will start improving.

If they do, chances are the company will earn more and its Return Ratios (ROE, ROCE, ROIC) will start improving.

With this, we come to an end of this thread.

I hope this helped you understand concepts of ROE, ROCE and ROIC better.

If you find this thread useful then follow me

@itsTarH

I write a new thread every weekend.

All my previous work, can be found here.

I hope this helped you understand concepts of ROE, ROCE and ROIC better.

If you find this thread useful then follow me

@itsTarH

I write a new thread every weekend.

All my previous work, can be found here.

https://twitter.com/itsTarH/status/1401095938945425410?s=20

I also teach a class on data visualization, if you're interested. The kind folks at Skillshare have increased the free trial length to 30 days if you sign up using this link skl.sh/2XNug6A

The class itself is 1.5 hours long so 30 days will give you enough time to learn.

The class itself is 1.5 hours long so 30 days will give you enough time to learn.

Sometimes write long form articles, researching into various industries, companies and concepts in personal finance here.

Subscribe for free, if you're interested.

Thank you for the 1200+ of you who already have!

investkaroindia.substack.com/p/coming-soon

Subscribe for free, if you're interested.

Thank you for the 1200+ of you who already have!

investkaroindia.substack.com/p/coming-soon

Thank you for reading, please retweet the first tweet in this thread for a broader reach.

See you all next weekend!

See you all next weekend!

• • •

Missing some Tweet in this thread? You can try to

force a refresh