Robinhood could be the most important company to IPO in 2021.

Here are 9 things you should know before they go public. ⇣⇣

readthegeneralist.com/briefing/robin…

Here are 9 things you should know before they go public. ⇣⇣

readthegeneralist.com/briefing/robin…

TL;DR

- 18M users

- $959M in 2020 revenue

- 245% revenue growth from 2019

- Expected valuation of $40B

Solid numbers.

- 18M users

- $959M in 2020 revenue

- 245% revenue growth from 2019

- Expected valuation of $40B

Solid numbers.

1. They want you to trade a lot

Robinhood mostly makes money when you trade, through something called "Payment for Order Flow." That means they want you to trade a lot.

Robinhood mostly makes money when you trade, through something called "Payment for Order Flow." That means they want you to trade a lot.

2. They want you to trade options

RH earns more money when you trade *options* which are riskier. They earn $2.90 per options trade and just $0.40 for a typical equities trade. This has caused some controversy (we unpack).

RH earns more money when you trade *options* which are riskier. They earn $2.90 per options trade and just $0.40 for a typical equities trade. This has caused some controversy (we unpack).

3. They're making money from memes

RH offers crypto-trading. Dogecoin trading activity drove 34% of Q1 crypto revenue. RH is the home of meme finance, and it shows.

RH offers crypto-trading. Dogecoin trading activity drove 34% of Q1 crypto revenue. RH is the home of meme finance, and it shows.

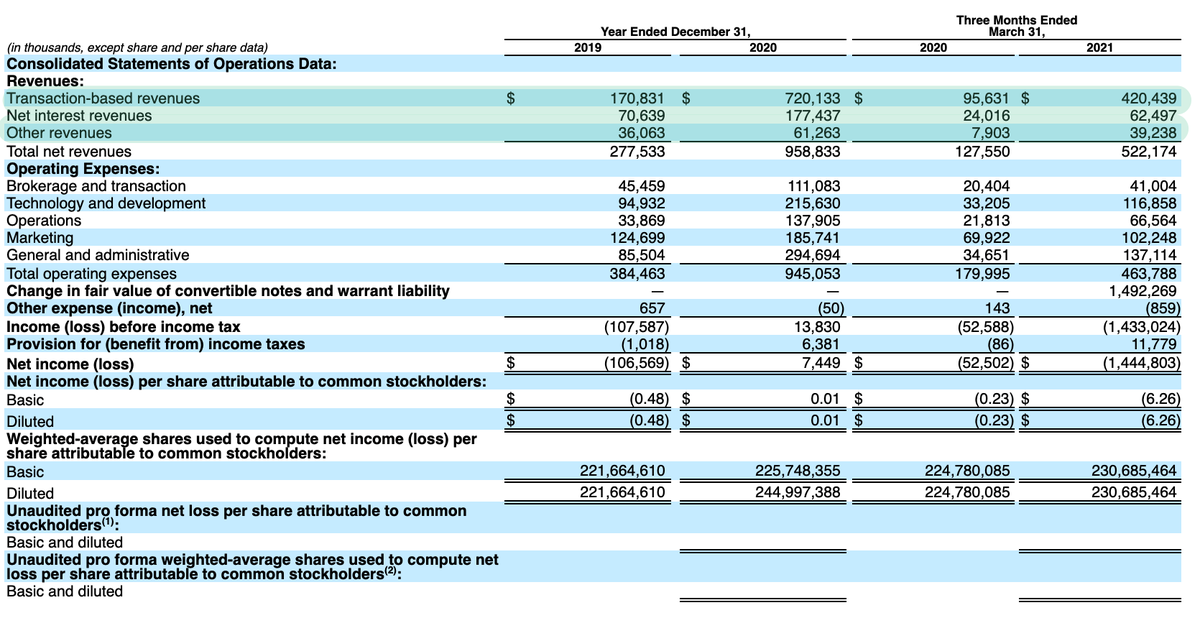

3. Revenue is on fire🔥

Total 2020 revenue surpassed $950 million, up 2.5x. It's only growing. They brought in $522M in Q1, a run rate of +$2B. That was a 309% increase from the previous year.

Total 2020 revenue surpassed $950 million, up 2.5x. It's only growing. They brought in $522M in Q1, a run rate of +$2B. That was a 309% increase from the previous year.

4. Management has clear strengths and weaknesses

Vlad is apparently excellent at scaling product and eng teams. He's also great and seeing the big picture. But his communication skills could apparently use some work.

Vlad is apparently excellent at scaling product and eng teams. He's also great and seeing the big picture. But his communication skills could apparently use some work.

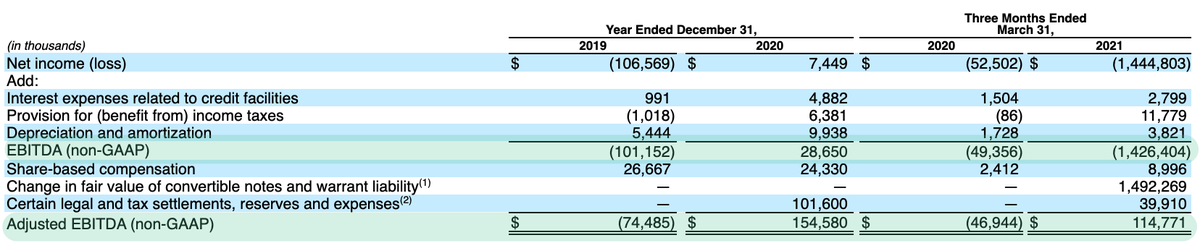

5. They're profitable

(Basically.)

They're adjusted EBITDA came in at +$150 million in 2020, and $115 million in Q1 of this year. This is not just another unprofitable unicorn.

(Basically.)

They're adjusted EBITDA came in at +$150 million in 2020, and $115 million in Q1 of this year. This is not just another unprofitable unicorn.

6. They've built a huge audience

RH's first acquisition was a media company. That looks like it's paid off. RobinhoodSnacks has 32 million subscribers. That's a lot of people hearing RH's messaging.

RH's first acquisition was a media company. That looks like it's paid off. RobinhoodSnacks has 32 million subscribers. That's a lot of people hearing RH's messaging.

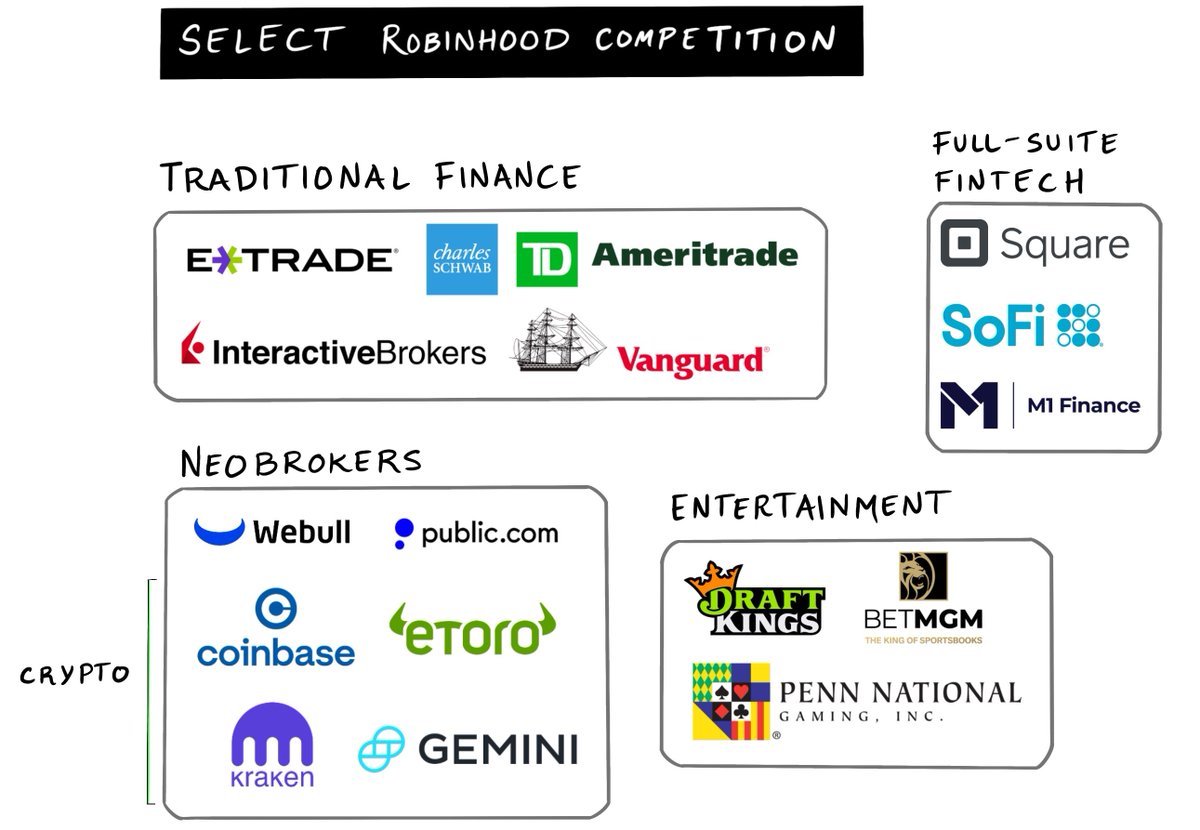

7. They've got competition

RH has to fight on multiple fronts. Traditional finance, neobrokers, other fintech, and entertainment companies all battle with the business.

RH has to fight on multiple fronts. Traditional finance, neobrokers, other fintech, and entertainment companies all battle with the business.

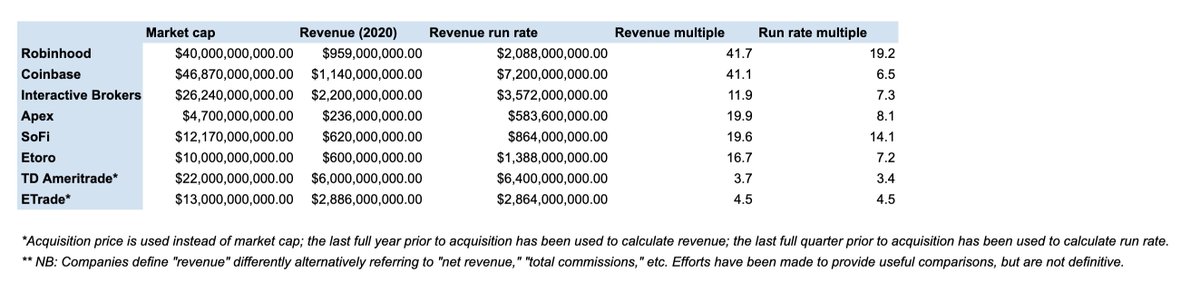

8. Their valuation is high?

I could see this popping to +$60B. Still, compare RH to Coinbase and it looks expensive. Coinbase is being valued at 6.5x its run rate, and is growing faster. RH is being valued at 19.2x.

I could see this popping to +$60B. Still, compare RH to Coinbase and it looks expensive. Coinbase is being valued at 6.5x its run rate, and is growing faster. RH is being valued at 19.2x.

9. They're facing a lot of lawsuits

These likely won't harm the company much. So far fines have been immaterial and bad press has spurred signups. Still, something to keep an eye on.

These likely won't harm the company much. So far fines have been immaterial and bad press has spurred signups. Still, something to keep an eye on.

10. They're trendsetters

No company has been played a bigger role in making investing a cultural phenomenon than RH.

No company has been played a bigger role in making investing a cultural phenomenon than RH.

There's so much more to this business. Join +39K more and join below.

Incredible work from @iamjakestream @itsmeeraclark @pearkes @howardlindzon @sidharthajha @LouisOrigny @iamMeganKelly @julieverhage @michaelsidgmore @yrechtman

readthegeneralist.com/briefing/robin…

Incredible work from @iamjakestream @itsmeeraclark @pearkes @howardlindzon @sidharthajha @LouisOrigny @iamMeganKelly @julieverhage @michaelsidgmore @yrechtman

readthegeneralist.com/briefing/robin…

• • •

Missing some Tweet in this thread? You can try to

force a refresh