My 10 Favourite Fintech Apps 💰💳

And Compilation of other Thread(s) 🧵

And Compilation of other Thread(s) 🧵

Stock and Trading:@zerodhaonline

4 Years of a strong relationship, Easy to use, and one of the best out there.

I evaluated other rivals Paytm Money, Groww, Upstox but couldn’t find anyone matching my expectations and use cases.

🧵on my journey so far:

4 Years of a strong relationship, Easy to use, and one of the best out there.

I evaluated other rivals Paytm Money, Groww, Upstox but couldn’t find anyone matching my expectations and use cases.

🧵on my journey so far:

https://twitter.com/Ravisutanjani/status/1394641341146042375?s=20

Money Management:(@INDmoneyApp)

Nothing can beat a spreadsheet but for anyone who’s starting their financial journey, INDMoney is an awesome product that covers almost everything (Investment, Debt, Ins)

e.g. Stocks, Mutual Funds, FD, EPF/PPF, Bonds, PMS, and other instruments.

Nothing can beat a spreadsheet but for anyone who’s starting their financial journey, INDMoney is an awesome product that covers almost everything (Investment, Debt, Ins)

e.g. Stocks, Mutual Funds, FD, EPF/PPF, Bonds, PMS, and other instruments.

But for few other use cases, I also like Kuvera (@Kuvera_In) Simple, easy to use, and smooth reporting for taxes, capital gains, etc.

There are few other offerings e.g. Remittances, Digital Gold, Tax Harvesting and Insurance, etc.

Old Thread on #PF101

There are few other offerings e.g. Remittances, Digital Gold, Tax Harvesting and Insurance, etc.

Old Thread on #PF101

https://twitter.com/Ravisutanjani/status/1354840382023073794?s=20

Mutual Funds: CAMS @Camsonline /Karvy @KarvyInvestment

I prefer RTAs for SIP and Lumpsum Investing in Mutual Funds, there are various reasons to settle with them instead of any fancy MF Apps.

Here I've shared details! ⬇️

I prefer RTAs for SIP and Lumpsum Investing in Mutual Funds, there are various reasons to settle with them instead of any fancy MF Apps.

Here I've shared details! ⬇️

https://twitter.com/Ravisutanjani/status/1411025378009698305?s=20

Credit Card Management

The answer is @CRED_club takes care of end-to-end card management. Few features I like:

• Smart Statement

• Due Date Reminder

• Easy Payment Options

• CRED Protect

• Reward Points Overview

• Few Offers

Convenience is 🔥🔥

The answer is @CRED_club takes care of end-to-end card management. Few features I like:

• Smart Statement

• Due Date Reminder

• Easy Payment Options

• CRED Protect

• Reward Points Overview

• Few Offers

Convenience is 🔥🔥

https://twitter.com/Ravisutanjani/status/1416413740061188112?s=20

Crypto: @CoinSwitchKuber

I’m not an active Crypto Investor, because it doesn’t suit my risk appetite so have invested around 2% of my total net worth.

@WazirXIndia is also another good alternative but I personally didn’t like the UX.

I’m not an active Crypto Investor, because it doesn’t suit my risk appetite so have invested around 2% of my total net worth.

@WazirXIndia is also another good alternative but I personally didn’t like the UX.

Credit Score Monitoring: @GetOneScore

One of the finest app there, with no SPAM or promotions. You can refresh every month and find detailed insights about your credit report.

Read more about DCs:

One of the finest app there, with no SPAM or promotions. You can refresh every month and find detailed insights about your credit report.

Read more about DCs:

https://twitter.com/Ravisutanjani/status/1412115956080386049?s=20

UPI: @PhonePe_ Anytime. For end-to-end UPI, AutoPay, etc, I personally like the app experience.

Although the app is heavily crowded by promotions all around I couldn’t find any strong reason to use Paytm or Google Pay.

Although the app is heavily crowded by promotions all around I couldn’t find any strong reason to use Paytm or Google Pay.

https://twitter.com/Ravisutanjani/status/1415761696124129282?s=20

Insurance: No Apps, @joinditto, and @BeshakIN is my go-to place as this is one area that requires extensive research.

Just don’t mix Insurances with any kind of investment, go with a good Health and plain Term Insurance Plan.

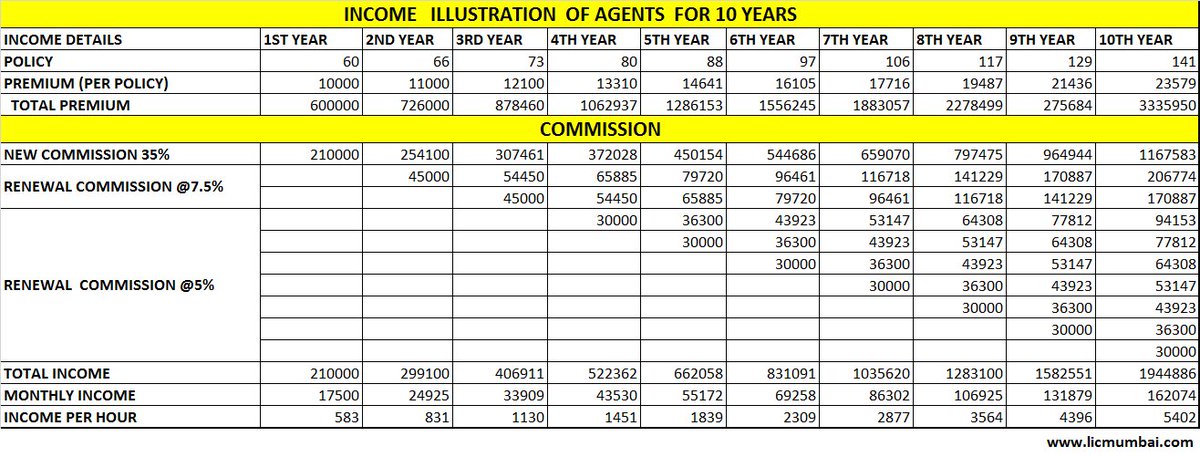

Here’s a thread on LIC.

Just don’t mix Insurances with any kind of investment, go with a good Health and plain Term Insurance Plan.

Here’s a thread on LIC.

https://twitter.com/Ravisutanjani/status/1413770932426919937?s=20

Banking: @IDFCFIRSTBank

Quite biased here, Love the offerings, from Transfer, Credit Cards, Wealth Management, I've found them covering almost all my banking needs in a single app.

Customer Exp + Tech is good as compared to peers!

A 🧵on Neo Banks:

Quite biased here, Love the offerings, from Transfer, Credit Cards, Wealth Management, I've found them covering almost all my banking needs in a single app.

Customer Exp + Tech is good as compared to peers!

A 🧵on Neo Banks:

https://twitter.com/Ravisutanjani/status/1411660575453581322?s=20

Other(s): "We don’t need an app for everything, these 9-10 apps are more than enough to cover our requirements."

Consider transacting on the web if it’s a one-time activity, I'm a big fan of Sovereign Gold Bond(s). Here’s why ⬇️

Consider transacting on the web if it’s a one-time activity, I'm a big fan of Sovereign Gold Bond(s). Here’s why ⬇️

https://twitter.com/Ravisutanjani/status/1394201253433909254?s=20

PS: Based on my personal experience with best efforts to reconcile correct information(s).

DYOR and consult your financial advisor before making any investment-related decision.

Thanks for reading, RT for awareness. 🙏

DYOR and consult your financial advisor before making any investment-related decision.

Thanks for reading, RT for awareness. 🙏

• • •

Missing some Tweet in this thread? You can try to

force a refresh