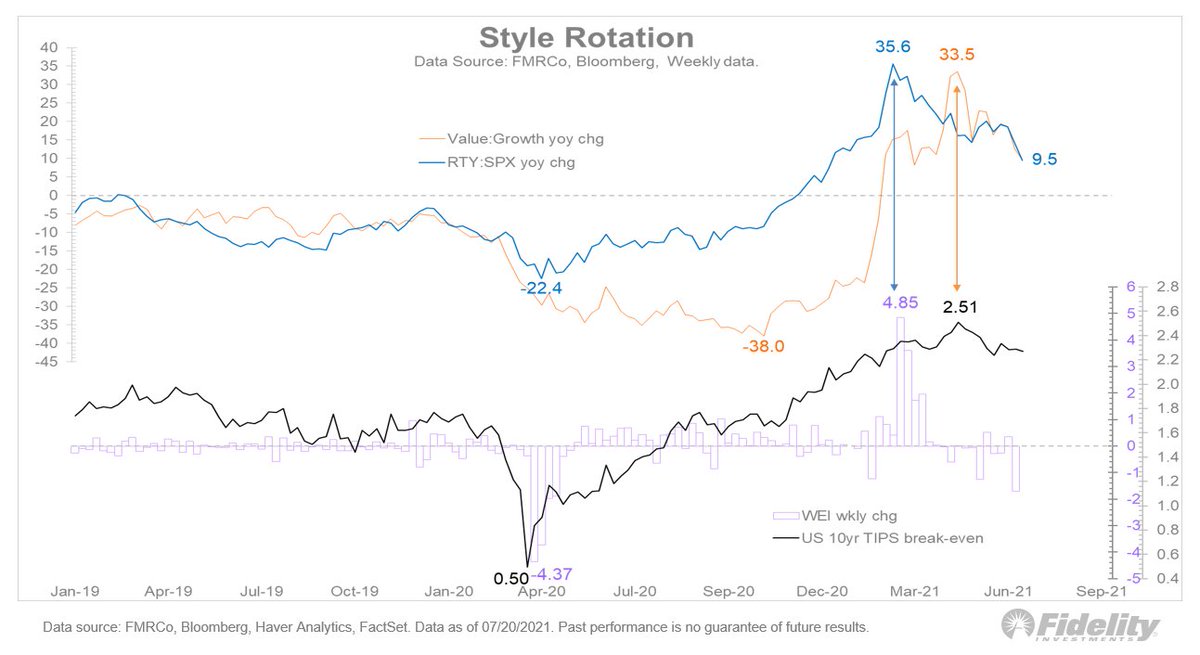

The rotations we are seeing in the market right now fit perfectly with the “peak reopening” and “peak inflation” themes that I have been highlighting since March. (THREAD)

As the chart shows below, back in March the rate of change in the NY Fed’s Weekly Economic Index (WEI) peaked at the same time the year-over-year change in the small/large ratio peaked. /2

Then, a few months later the year-over-year change in the value/growth ratio peaked during the same week that the 10-year TIPS breakeven spread peaked. /3

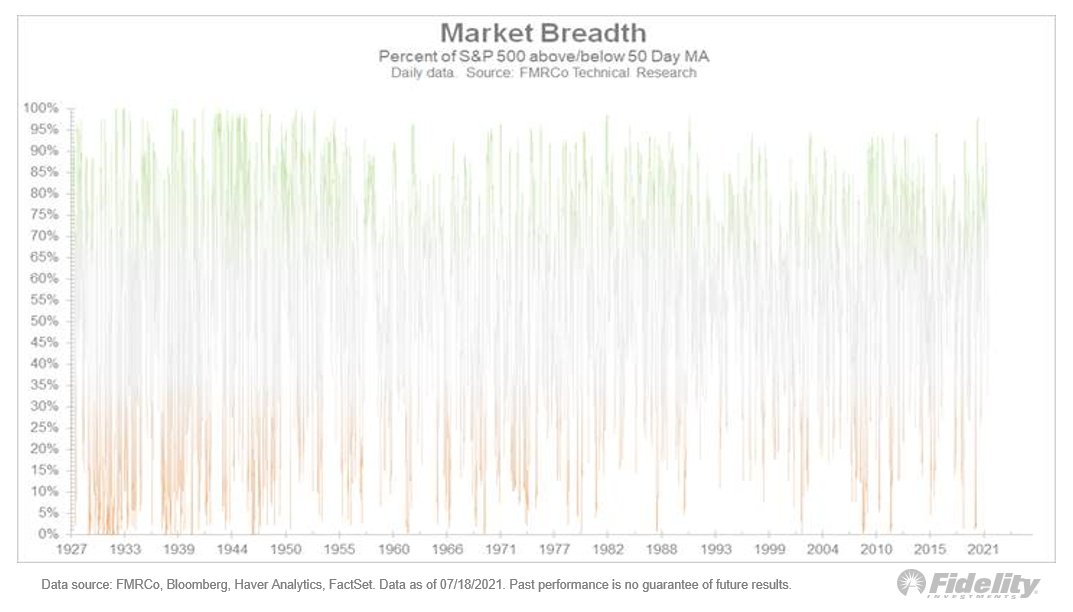

Taking a wider view of the market, we can see below how much rotation has taken place since the liquidity-driven phase of the market cycle ended earlier this year. /END

• • •

Missing some Tweet in this thread? You can try to

force a refresh