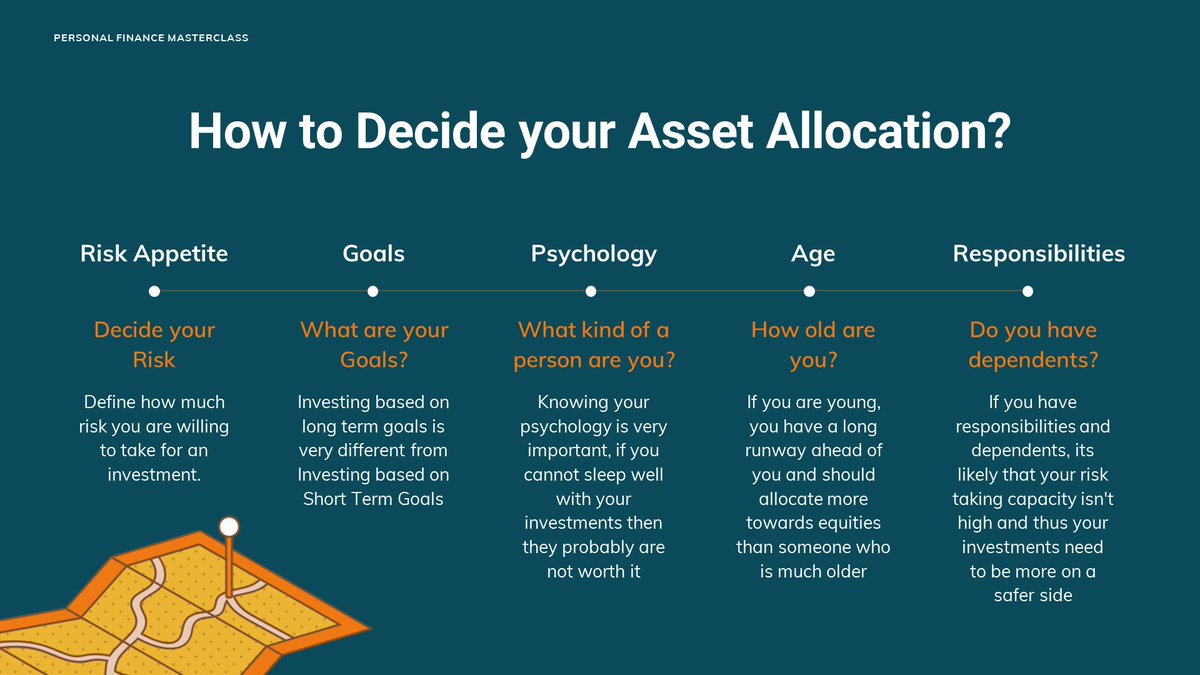

Asset Allocation doesn't have one clear answer and shouldn't depend on stage of the market.

It depends on your

- Risk Appetite

- Goals

- Psychology

- Age

- Responsibilities

1/n

It depends on your

- Risk Appetite

- Goals

- Psychology

- Age

- Responsibilities

1/n

https://twitter.com/HeyAmrit/status/1418500487821758467

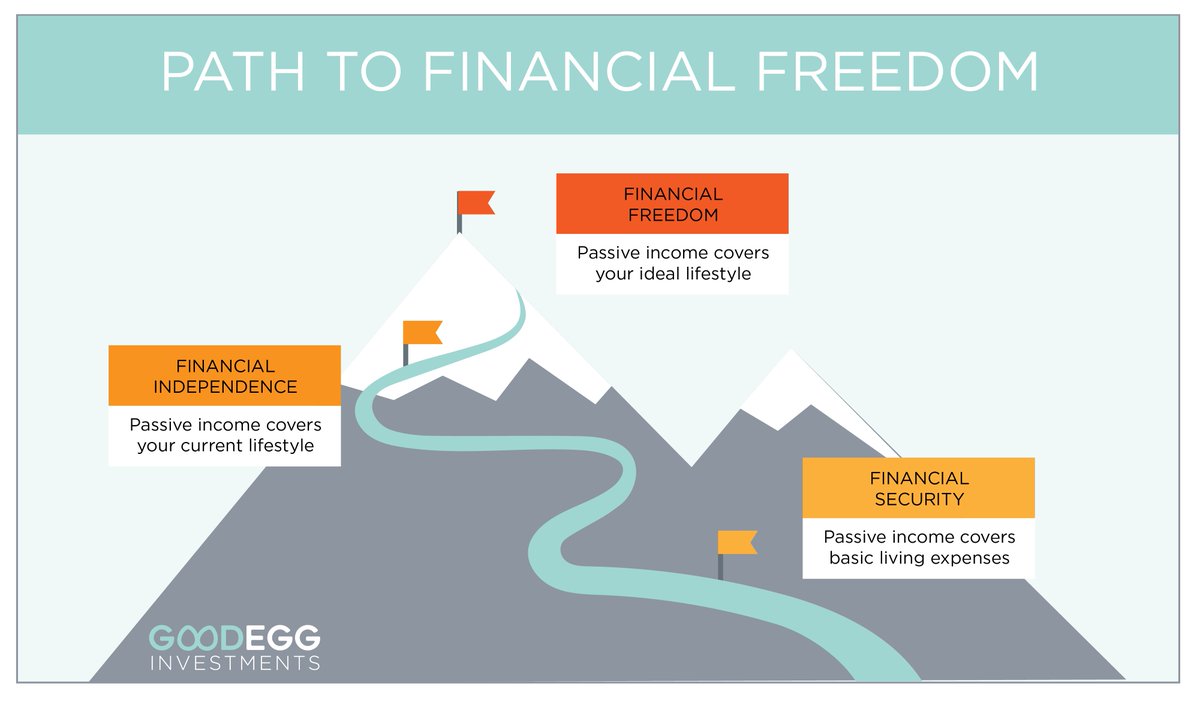

Someone who is

Young

Right out of College

Doesn't Need Money for Next 10 years

Doesn't Have any Dependents

should be allocated more towards Equities than someone who is

Old

Heading for Retirement

Needs Consistent Income

Has Many Dependents

2/n

Young

Right out of College

Doesn't Need Money for Next 10 years

Doesn't Have any Dependents

should be allocated more towards Equities than someone who is

Old

Heading for Retirement

Needs Consistent Income

Has Many Dependents

2/n

Your psychology also has the biggest impact. Are you someone who gets afraid and loses sleep over 5 to 10% drawdowns and wants to book profits as soon as an investment gains in value

or Are you someone who can sit peacefully and do not let the daily movement of market impact you

or Are you someone who can sit peacefully and do not let the daily movement of market impact you

Also allocate based on Goals.

(Extract taken from my Personal Finance Course, Releasing on SkillShare on Sunday, link to sign up for a Free access below)

skl.sh/2XNug6A

(Extract taken from my Personal Finance Course, Releasing on SkillShare on Sunday, link to sign up for a Free access below)

skl.sh/2XNug6A

• • •

Missing some Tweet in this thread? You can try to

force a refresh