FUD is not good. FUD is bad. Don’t spread FUD.

This write up will be dedicated for debunking common FUD in crypto I see all too often.

A thread by 🥐…

This write up will be dedicated for debunking common FUD in crypto I see all too often.

A thread by 🥐…

“Bitcoin wastes energy”

People often say $BTC uses as much energy as countries

But did you know Christmas lights in the US use about as much energy as El Salvador & Ethiopia combined?

Furthermore, $BTC actually has mechanisms to promote green energy as a buyer of last resort

People often say $BTC uses as much energy as countries

But did you know Christmas lights in the US use about as much energy as El Salvador & Ethiopia combined?

Furthermore, $BTC actually has mechanisms to promote green energy as a buyer of last resort

https://twitter.com/nayibbukele/status/1402714926800674827

“EIP-1559 won’t lower fees”

EIP-1559 makes several changes to the ways tx fees work, introducing a “base fee” + “miner tip”

Base fee = 🔥

Miner tip = 🪙

The base fee will be set by the protocol, allowing wallets to set it automatically

(which means no more spamming 200 gwei)

EIP-1559 makes several changes to the ways tx fees work, introducing a “base fee” + “miner tip”

Base fee = 🔥

Miner tip = 🪙

The base fee will be set by the protocol, allowing wallets to set it automatically

(which means no more spamming 200 gwei)

“China controls Bitcoin”

Most $BTC mining was concentrated in China was due to rich hydropower

This is inconceivable now that it has been banned

The U.S. alone could effectively dwarf the existing mining industry with just 20% capacity of wind & solar projects on the grid

Most $BTC mining was concentrated in China was due to rich hydropower

This is inconceivable now that it has been banned

The U.S. alone could effectively dwarf the existing mining industry with just 20% capacity of wind & solar projects on the grid

https://twitter.com/croissanteth/status/1411496552535822340

“Crypto will be banned”

Despite the obvious facts, some still believe crypto will be banned

Little do they know Tim Wu, Joe Biden’s top White House advisor owns millions of dollars worth of #Bitcoin

Furthermore, SEC Chairman Gensler once called Bitcoin “digital gold”

Despite the obvious facts, some still believe crypto will be banned

Little do they know Tim Wu, Joe Biden’s top White House advisor owns millions of dollars worth of #Bitcoin

Furthermore, SEC Chairman Gensler once called Bitcoin “digital gold”

“But MEV”

Did you know “MEV” is actually a common practice in the banking industry?

The reordering of txs is known as “debt-sequencing,” & banks are making hundreds of billions of dollars from it

In $ETH, we have entire communities and solutions being built to solve the issue

Did you know “MEV” is actually a common practice in the banking industry?

The reordering of txs is known as “debt-sequencing,” & banks are making hundreds of billions of dollars from it

In $ETH, we have entire communities and solutions being built to solve the issue

“Tether is a scam”

The New York Attorney General’s office settled a case against Tether regarding its backing by US dollars in treasury

There was no wrongdoing found from the $850M probe, and they will be required to provide reports on their reserves for the next two years

The New York Attorney General’s office settled a case against Tether regarding its backing by US dollars in treasury

There was no wrongdoing found from the $850M probe, and they will be required to provide reports on their reserves for the next two years

“ETH will kill BTC”

$ETH and $BTC serve entirely different purposes, & it’s ridiculous to even compare the two

With interoperability and their own unique features, interaction between the two will be all but seamless

These solutions co-exist, and it was built to be this way

$ETH and $BTC serve entirely different purposes, & it’s ridiculous to even compare the two

With interoperability and their own unique features, interaction between the two will be all but seamless

These solutions co-exist, and it was built to be this way

https://twitter.com/CroissantEth/status/1401506402594603015

“EIP-1559 is priced in”

It is simply impossible for this event to be priced in because of its supply shock for $ETH

Immediately once the proposal goes into place, sell pressure from $ETH will drop 30%

For reference, that is about the same as an entire #Bitcoin halving event

It is simply impossible for this event to be priced in because of its supply shock for $ETH

Immediately once the proposal goes into place, sell pressure from $ETH will drop 30%

For reference, that is about the same as an entire #Bitcoin halving event

“We are not early”

Despite what many think about this, we are so dramatically early that it should not be understated

There are as little as 3M wallets having ever interacted with DeFi contracts

We haven’t even begun to discover what can be made with $ETH tech

Despite what many think about this, we are so dramatically early that it should not be understated

There are as little as 3M wallets having ever interacted with DeFi contracts

We haven’t even begun to discover what can be made with $ETH tech

“Crypto is in a bubble”

This is one of the most common arguments I see.

There have been no assets in the world to outperform #Bitcoin , but when you take a closer look at why this is, it will all become clear.

Crypto is not the bubble, the bubble is in the fed balance sheet.

This is one of the most common arguments I see.

There have been no assets in the world to outperform #Bitcoin , but when you take a closer look at why this is, it will all become clear.

Crypto is not the bubble, the bubble is in the fed balance sheet.

“Crypto is a ponzi”

You’ll come to find that there are far more things to do with #Bitcoin than just sell it at a higher price

There are even more things to do within DAO’s

In fact, some tokens even allow you to have a core decision in the development process, and much more

You’ll come to find that there are far more things to do with #Bitcoin than just sell it at a higher price

There are even more things to do within DAO’s

In fact, some tokens even allow you to have a core decision in the development process, and much more

“Bitcoin is dead”

Every single time even the most seasoned of traders have claimed that #Bitcoin is dead, it has come back even stronger

It survived the Mt Gox hack, & recent China bans

On the road from $50 to $19,666 $BTC retraced more than 80% 3 times & came back stronger

Every single time even the most seasoned of traders have claimed that #Bitcoin is dead, it has come back even stronger

It survived the Mt Gox hack, & recent China bans

On the road from $50 to $19,666 $BTC retraced more than 80% 3 times & came back stronger

“Bitcoin is used by criminals”

This has been a popular narrative since the creation of #Bitcoin, but it is far from the reality

Not only are crimes with cryptocurrency on the fall, but they also only make up about a total of 1% of all transactions on the blockchain…

This has been a popular narrative since the creation of #Bitcoin, but it is far from the reality

Not only are crimes with cryptocurrency on the fall, but they also only make up about a total of 1% of all transactions on the blockchain…

“Eth is for scams and memes”

Whether you like it or not, there are tons of projects breaking into trillion dollar industries utilizing $ETH

For example, with $ETH thousands of Kenyan farmers are able to access crop insurance

This is just one of many real world use cases today

Whether you like it or not, there are tons of projects breaking into trillion dollar industries utilizing $ETH

For example, with $ETH thousands of Kenyan farmers are able to access crop insurance

This is just one of many real world use cases today

https://twitter.com/croissanteth/status/1399499507356815363

“Bitcoin isn’t secure”

$BTC has been live with no downtime for over 10 years

It is battle-tested & uses the SHA256 cryptographic hash function

It’s known for being astronomically impossible to crack

Your device may be using this SHA256 to view my tweet with secure connection

$BTC has been live with no downtime for over 10 years

It is battle-tested & uses the SHA256 cryptographic hash function

It’s known for being astronomically impossible to crack

Your device may be using this SHA256 to view my tweet with secure connection

“Bitcoin is not a store of value”

Historically, #Bitcoin has held its value significantly better than all other asset classes in existence, yes even gold.

Though still relatively young in age, $BTC continues to outperform even the Fed Balance Sheet

Historically, #Bitcoin has held its value significantly better than all other asset classes in existence, yes even gold.

Though still relatively young in age, $BTC continues to outperform even the Fed Balance Sheet

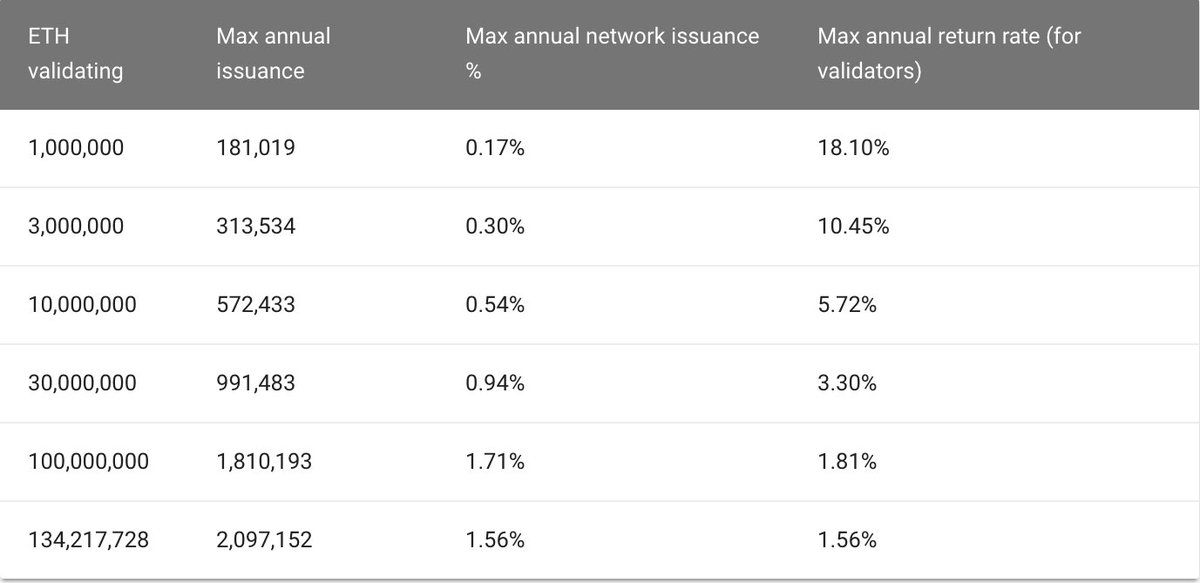

“POS isn’t secure”

PoS, although less-tested, remains unbelievably hard to attack

Validators in proof of stake are financially aligned with the good of the protocol

It is also extraordinarily expensive with many variables that you have to consider

PoS, although less-tested, remains unbelievably hard to attack

Validators in proof of stake are financially aligned with the good of the protocol

It is also extraordinarily expensive with many variables that you have to consider

“Regulation is bad for crypto”

We all knew the day would come for crypto to be recognized on a global scale

Regulations including environmental policies, anti-money laundering procedures, and all else lay out the grounds for a #bitcoin ETF for millions of investors

We all knew the day would come for crypto to be recognized on a global scale

Regulations including environmental policies, anti-money laundering procedures, and all else lay out the grounds for a #bitcoin ETF for millions of investors

“Crypto can be hacked”

The #Bitcoin network is backed by proven mathematics

It would require an astronomical amount of computing power for an attack

Many of our very gov agencies use the same cryptographic hash functions that the $BTC network relies on today for communications

The #Bitcoin network is backed by proven mathematics

It would require an astronomical amount of computing power for an attack

Many of our very gov agencies use the same cryptographic hash functions that the $BTC network relies on today for communications

“Tokens are securities”

Last week, a bipartisan bill was introduced to Congress hoping to clarify the role of digital assets in Securities law

The bill has a clear goal to bring regulatory clarity on tokens to make it attractive and easy for crypto investors

Last week, a bipartisan bill was introduced to Congress hoping to clarify the role of digital assets in Securities law

The bill has a clear goal to bring regulatory clarity on tokens to make it attractive and easy for crypto investors

“Crypto is too complex”

Email, with over 4.6B registered users, began as something for just academics

In 1971, it was created

It wasn’t until 1996, that some companies released an easy to use interface that it began to see every day adoption

This just like #Bitcoin

Email, with over 4.6B registered users, began as something for just academics

In 1971, it was created

It wasn’t until 1996, that some companies released an easy to use interface that it began to see every day adoption

This just like #Bitcoin

“Ethereum has an infinite supply”

With the changes that come about in EIP-1559, it is simply not true to argue that $ETH has an infinite supply anymore

Base fees introduce a variable fee that depends on congestion

Even at max, the $ETH supply is capped at 2% annual inflation

With the changes that come about in EIP-1559, it is simply not true to argue that $ETH has an infinite supply anymore

Base fees introduce a variable fee that depends on congestion

Even at max, the $ETH supply is capped at 2% annual inflation

“I just screenshotted this”

NFTs are far more than digital art, but this a concept many have yet to understand

These tokens offer a new level of freedom for digital property, across all platforms

The content represented on the NFT can then be commercialized on the wider market

NFTs are far more than digital art, but this a concept many have yet to understand

These tokens offer a new level of freedom for digital property, across all platforms

The content represented on the NFT can then be commercialized on the wider market

https://twitter.com/croissanteth/status/1414753778130169856

“Crypto can’t scale”

The open source nature of crypto means that it is a base layer to build on top of

Thousands of apps have been created for the sole purpose of scaling $ETH & $BTC

Eventually, it is entirely possible these solutions bring them to 10,000+ TPS

Enjoy! 🥐

The open source nature of crypto means that it is a base layer to build on top of

Thousands of apps have been created for the sole purpose of scaling $ETH & $BTC

Eventually, it is entirely possible these solutions bring them to 10,000+ TPS

Enjoy! 🥐

• • •

Missing some Tweet in this thread? You can try to

force a refresh