Uniswap Labs just removed a number of DeFi assets from their interface (the one most of us use on a regular basis).

Let's dive into this decision and bit and understand a bit more about the numbers of the assets delisted.

A thread 🧵

Let's dive into this decision and bit and understand a bit more about the numbers of the assets delisted.

A thread 🧵

First off, let's be clear:

Uniswap *did not* delist these assets from trading.

Users can still trade the assets affected via contracts, decentralized interfaces, or aggregators. The liquidity still exists.

Uniswap as a protocol to list and swap assets remains decentralized.

Uniswap *did not* delist these assets from trading.

Users can still trade the assets affected via contracts, decentralized interfaces, or aggregators. The liquidity still exists.

Uniswap as a protocol to list and swap assets remains decentralized.

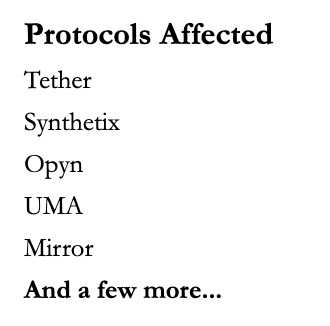

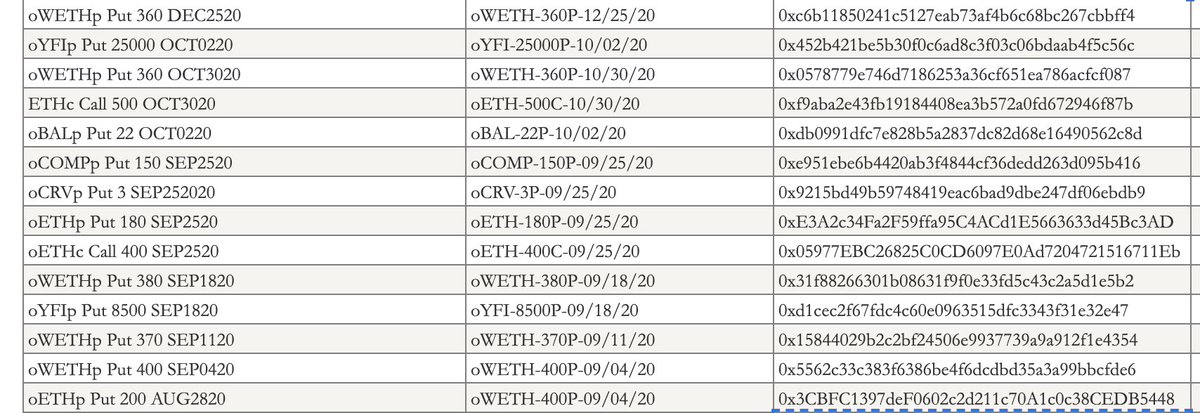

Below is a full list of assets affected.

Some, I've never heard of. Others are community and yield farmer favorites :). To name a notable few: sBTC, sDEFI, Opyn's option tokens, and Mirror Assets.

Check them out 👇

Some, I've never heard of. Others are community and yield farmer favorites :). To name a notable few: sBTC, sDEFI, Opyn's option tokens, and Mirror Assets.

Check them out 👇

As I was writing this thread, the community already went to work deploying ways to get around this issue.

Here's a token list (h/t @bantg) with the restricted assets.

There's a ton of alternative interfaces!

Here's a token list (h/t @bantg) with the restricted assets.

There's a ton of alternative interfaces!

https://twitter.com/bantg/status/1418716653945331713

Now, on to some numbers. Volume for the restricted assets is unlikely to drop to zero, though let's gauge the potential impacts on Uniswap if these assets were entirely untradable.

👇

👇

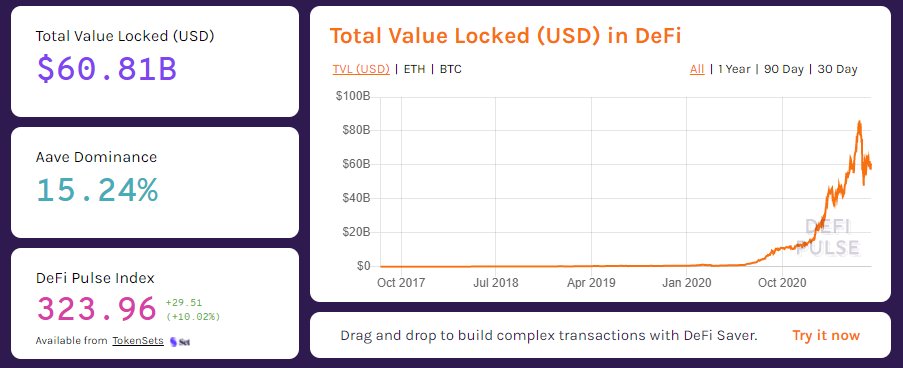

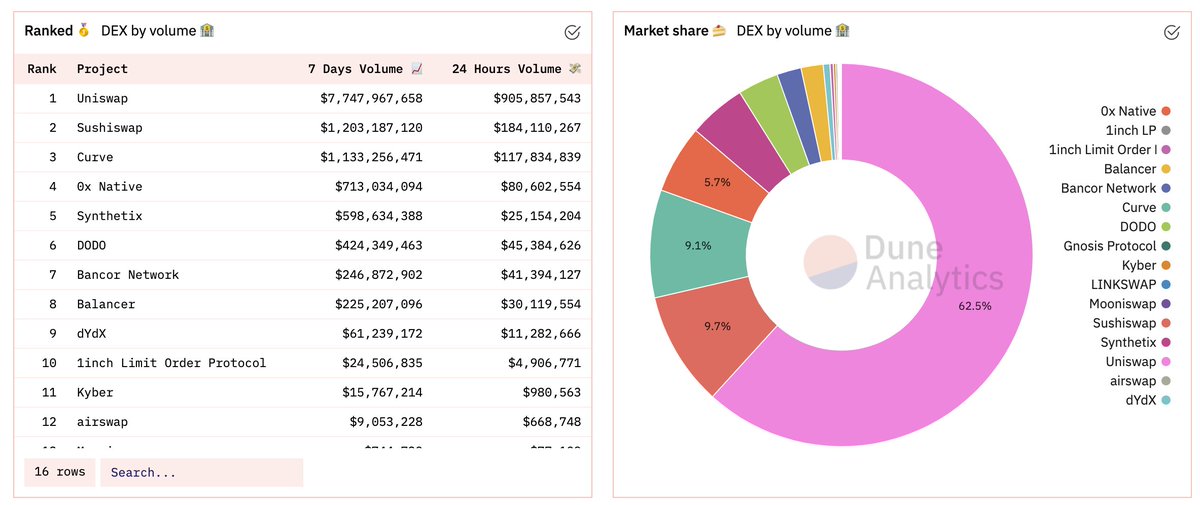

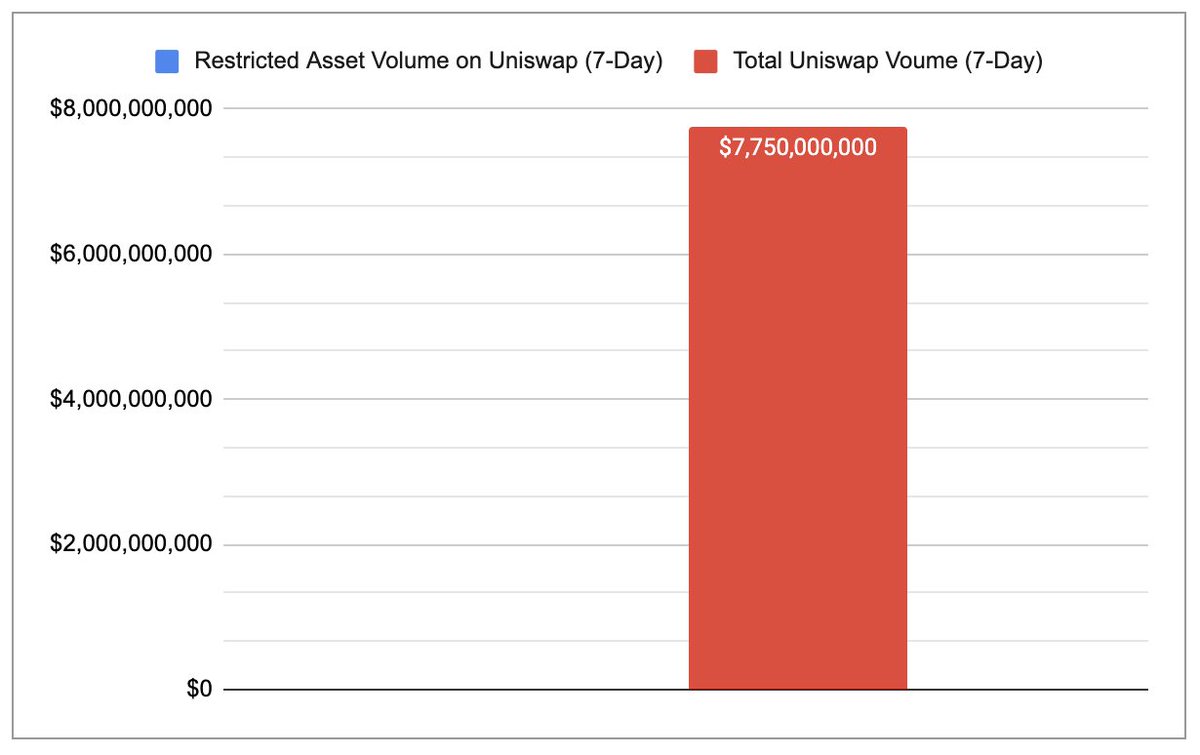

Uniswap (across v2 and v3) did $7.75b volume in the past seven days.

So how much of those billions in volume was for trades in the assets removed from the Uniswap frontend?

So how much of those billions in volume was for trades in the assets removed from the Uniswap frontend?

Per my quick analysis on Uniswap info data, the assets delisted accounted for a GRAND total of $5.9 million worth of volume over the past seven days.

Literally 0.076% of Uniswap's 7-day volume.

It's a rounding error.

Literally 0.076% of Uniswap's 7-day volume.

It's a rounding error.

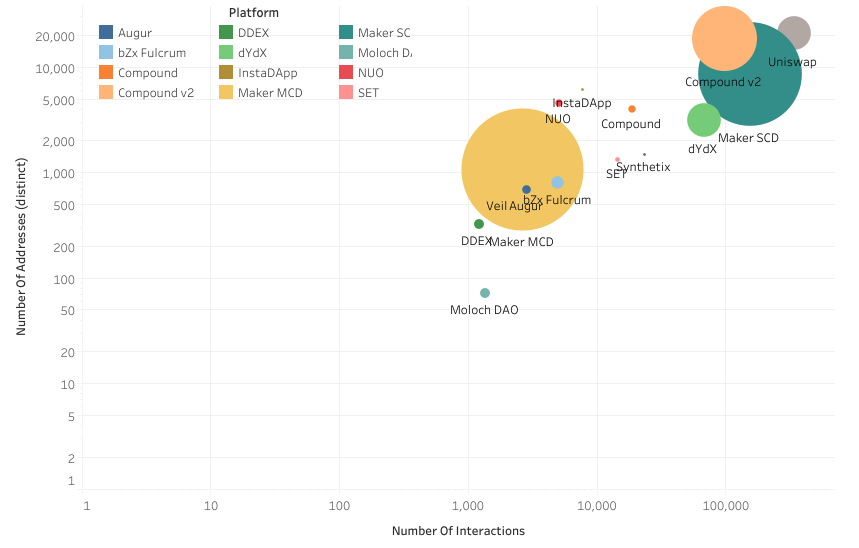

Interesting how a number of the assets delisted are long expired or trade on Balancer, etc.

Seems like they were trying to send a v strong message about not directly supped restricted assets.

~40 out of the 129 assets are currently nonfunctional. A supermajority don't trade.

Seems like they were trying to send a v strong message about not directly supped restricted assets.

~40 out of the 129 assets are currently nonfunctional. A supermajority don't trade.

Increasingly, I think you're going to see AMMs increasingly used as a base.

Perpetual Protocol, for instance, is using v3's AMM design for their perpetual futures. Future options protocols could have derivs settle physically on-chain via v3 ranges.

lambert-guillaume.medium.com/uniswap-v3-lp-…

Perpetual Protocol, for instance, is using v3's AMM design for their perpetual futures. Future options protocols could have derivs settle physically on-chain via v3 ranges.

lambert-guillaume.medium.com/uniswap-v3-lp-…

The world needs decentralized interfaces.

Wouldn't it have been bad if all non-power user DeFi traders woke up one day and the Uniswap Labs interface was gone w/ no alternatives?

This is a wake-up call! Bookmark the decentralized interfaces. Make them lindy. (h/t @anjan_vinod)

Wouldn't it have been bad if all non-power user DeFi traders woke up one day and the Uniswap Labs interface was gone w/ no alternatives?

This is a wake-up call! Bookmark the decentralized interfaces. Make them lindy. (h/t @anjan_vinod)

• • •

Missing some Tweet in this thread? You can try to

force a refresh